Category Archive: 5) Global Macro

Sell in May, Come Back in October (outdated)

The U.S. economy regularly improves between October and March. This year the improvement was a bit earlier thanks to QE3. By March the economy already weakened according to the latest ISM PMIs.

Read More »

Read More »

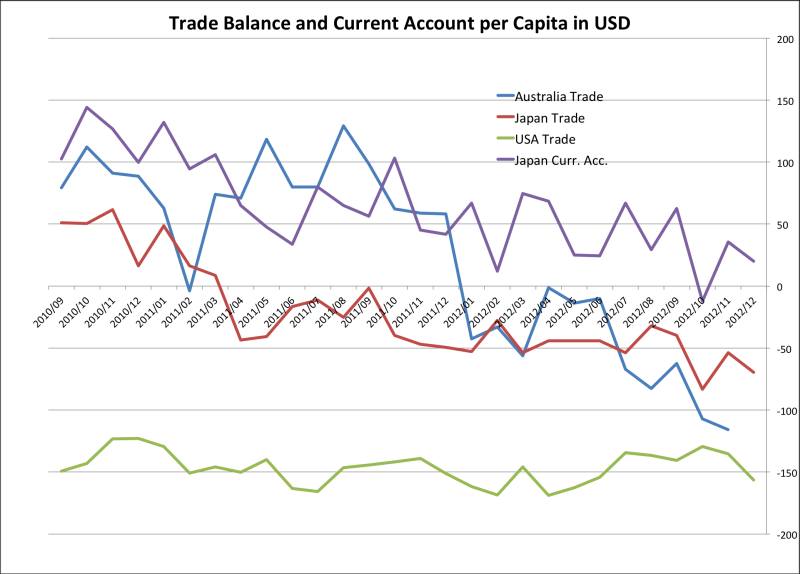

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

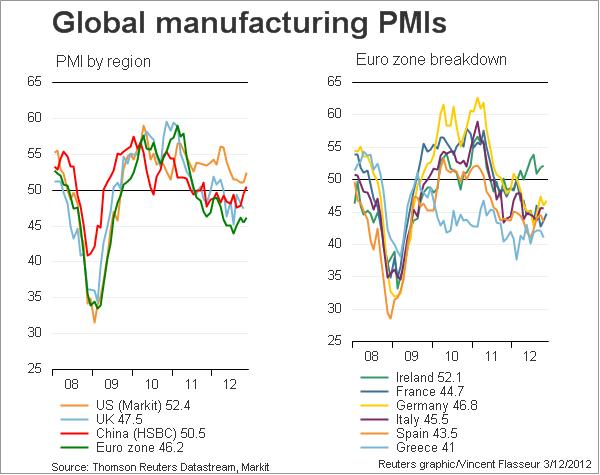

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

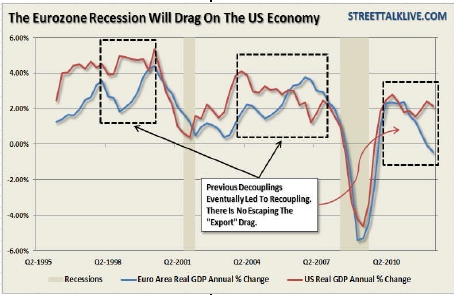

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »

2012 Posts on Global Macro

Debt, the Financial Cycle Determinant between 2011 and 2017

Between 2011 and 2017, the reduction of debt , the hunt on the rich and investment into countries with low debt will become the main rational expectation and the determinant of the next financial cycle.

Read More »

Read More »

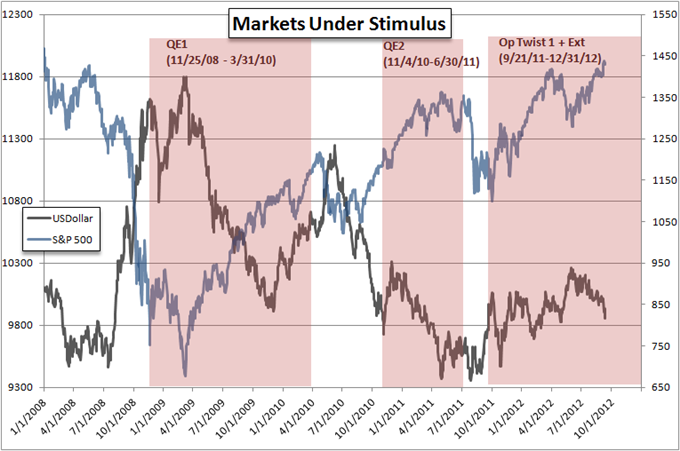

Quantitative Easing, Gold and the Swiss Franc

The main drivers of demand for Swiss francs are the euro crisis, but even more, the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and of Quantitative Easing. This will push down the dollar, and safe-havens like the CHF, gold or the Japanese Yen up. … Continue reading »

Read More »

Read More »

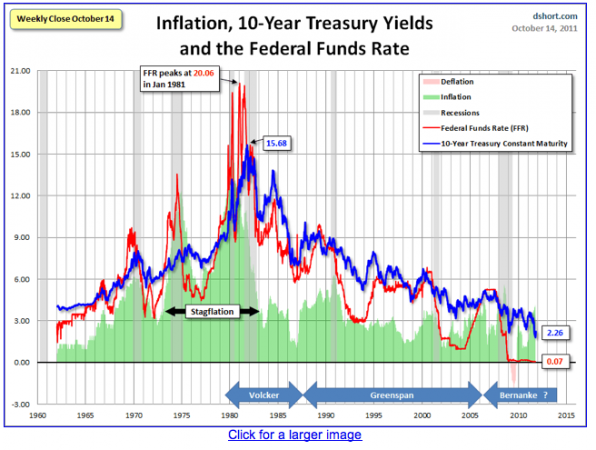

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

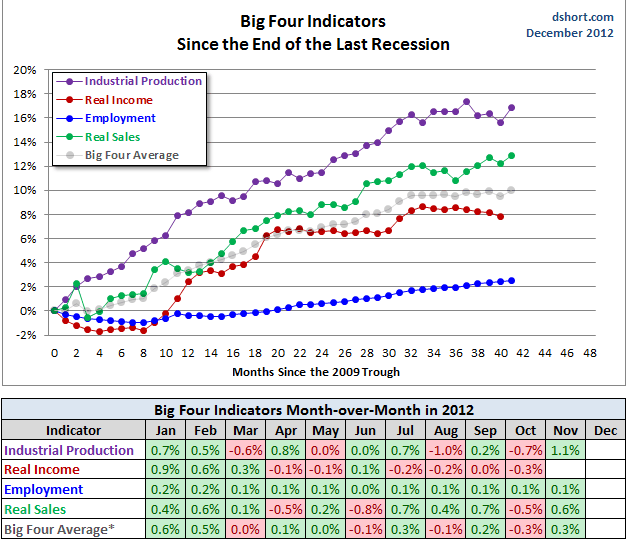

Main US Economic Indicators

The four best “recession” indicators, in form of coincident economic indicators, can be seen at Doug Short/Advisor Perspectives Update September 2013 Update December 21th, 2012 We observe the following: US indicators point upwards, when the rest of the world is slowing. After capital left many emerging markets and Europe, this capital helps the United States …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

Die Wiederwahl Obamas bedeutet nichts Gutes für die Schweiz

Barack Obama war und ist der präferierte Kandidat vieler Schweizer. Obama scheint der Mann von Welt zu sein, während vom konservativen Mitt Romney eher feindselige Politik gegen Russland, China und Iran zu erwarten ist. Daher sind die Neutralität- und Frieden-liebenden Schweizer eher auf Obamas Seite. Aber auch wirtschaftspolitisch scheinen viele Eidgenossen Obama zu mögen. …

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

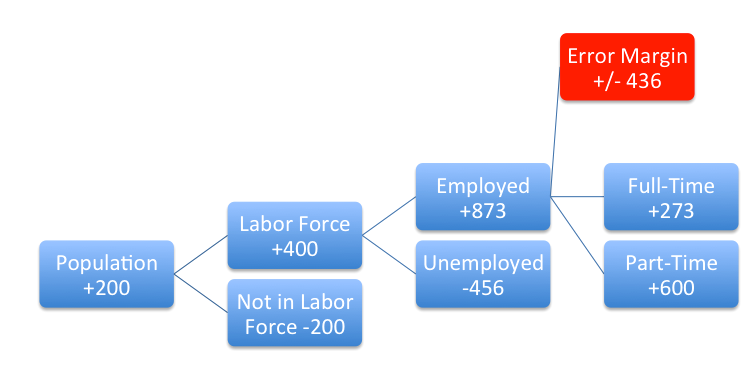

Again Flawed Data for Jobs

Some ten days ago, we examined in detail why the monthly job data was no conspiracy as Jack Welch maintained, but simply flawed. Similarly as David Rosenberg we said that the way the BLS obtains data for the household survey was error-prone. Gluskin Sheff’s David Rosenberg That the 7.8 percent jobless rate takes it to the …

Read More »

Read More »

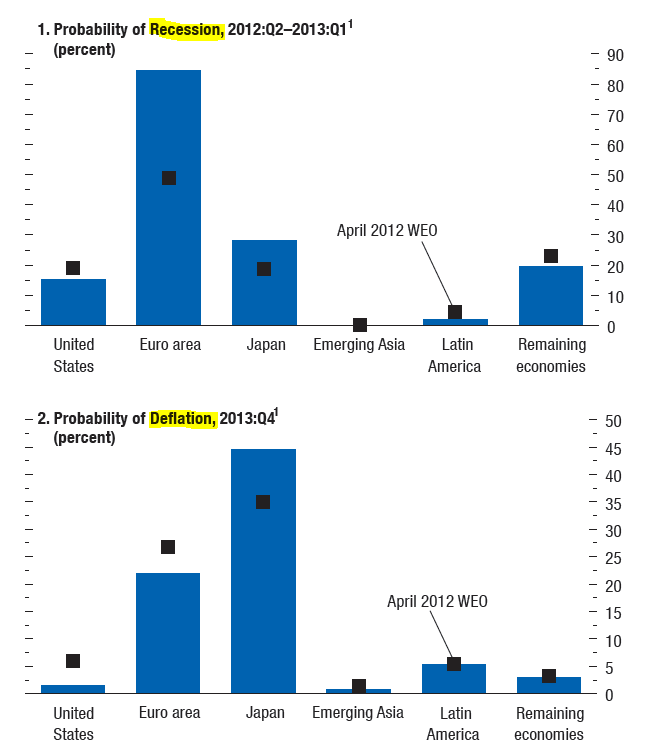

IMF World Economic Outlook

Alexander Gloy is founder and president of Lighthouse Investment Management The IMF’s (International Monetary Fund) “World Economic Outlook”, a slim 250-page piece, came out. Some excerpts: Substantial reductions in estimated output (GDP) growth for 2013 for all major countries: Unemployment in the Euro-Area (“EA”) is now expected to rise above the level …

Read More »

Read More »

Conspiracy? Why the Jobs Report Was not Cooked, but simply Flawed

Conspiracy ? Huge Differences Between the Payrolls Report and the Household Survey based on the extracts of Robert Oak, Noslaves.com and his blog on Economic Populist It’s a conspiracy! The BLS is trying to swing the election! They’re cookin’ de books! By now you’ve seen the claims, accusations and mumblings by the pundits, press, twitter and blogosphere. So …

Read More »

Read More »

The “Beautiful” De-Leveraging

A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn’t dramatic. It doesn’t produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That’s a beautiful...

Read More »

Read More »

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »