Category Archive: 5) Global Macro

What Happens When More QE Fails to Reverse the Recession?

The smart money is liquidating assets, paying off debt and moving capital into collateral that isn't impaired by debt or speculative valuations. The Federal Reserve's sudden return to "accommodative" dovishness in response to the stock market's swoon telegraphs its intent to fire up QE once the recession kicks into gear.

Read More »

Read More »

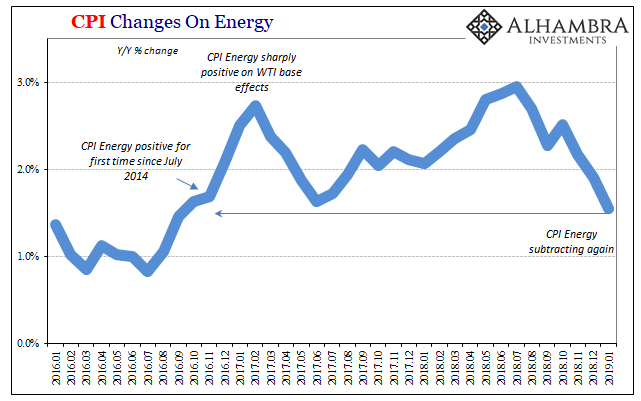

Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria.

Read More »

Read More »

SpokenTome Audiobooks: Charles Hugh Smith Episode 2

SpokenTome.Media’s Mark E. Jeftovic catches up with Charles Hugh Smith. Topics ranged from PropOrNot’s anonymous, unsourced hit piece on …pretty well everybody, to populism, Yellow Vests, so-called “Democratic Socialism” and a new unicorn farm called “MMT”. Since our last episode we’ve released three more CHS audiobooks.

Read More »

Read More »

How Islam in the West is changing | The Economist

Islamist terrorism has fractured relations between Islam and the West. Robert Guest, our foreign editor, explains how Western Muslims are gradually becoming more liberal. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook:...

Read More »

Read More »

What Caused the Recession of 2019-2021?

As I discussed in We're Overdue for a Sell-Everything/No-Fed-Rescue Recession, recessions have a proximate cause and a structural cause. The proximate cause is often a spike in energy costs (1973, 1990) or a financial crisis triggered by excesses of speculation and debt (2000 and 2008) or inflation (1980).

Read More »

Read More »

The search for new planets | The Economist

A new space telescope could discover thousands of planets. But will they support life? TESS may reveal the next clues to finding out. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow …

Read More »

Read More »

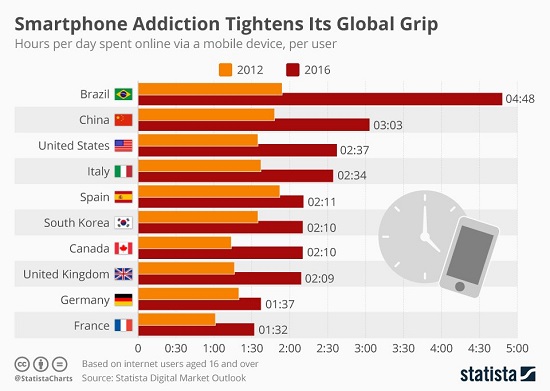

The Corporate Lemmings Who Rushed into Mobile/Social Media Ads Are Running off the Cliff

Given that corporations are run by people, and people are social animals that run in herds, it shouldn't surprise us that corporations follow the herd, too. Take the herd move to forming conglomerates in the go-go late 1960s: corporations suddenly started buying companies in completely different sectors in businesses they knew nothing about, because the herd was forming conglomerates--not because it made any business sense but because it was the...

Read More »

Read More »

Can free-cash handouts help society? | The Economist

In parts of California there are plans to give people no-strings-attached cash, whether they have a job or not. It’s hoped these trials could be the solution to a potentially jobless dystopian future. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

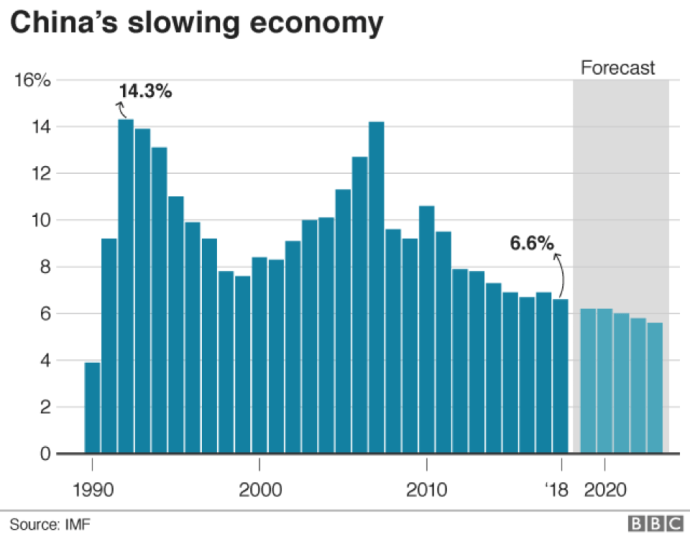

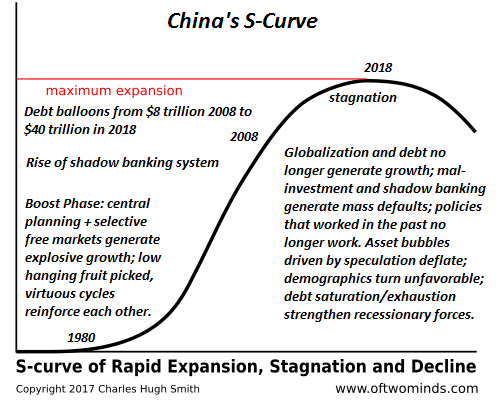

China: Harbinger of Global Economic Decline

The latest numbers released by China’s statistics bureau fueled widespread concerns about the outlook of the global economy, as the Asian superpower reported its slowest growth rate since 1990. The figures showed a 6.6% growth for 2018, confirming the view that the growth engine of the world economy is running out of steam.

Read More »

Read More »

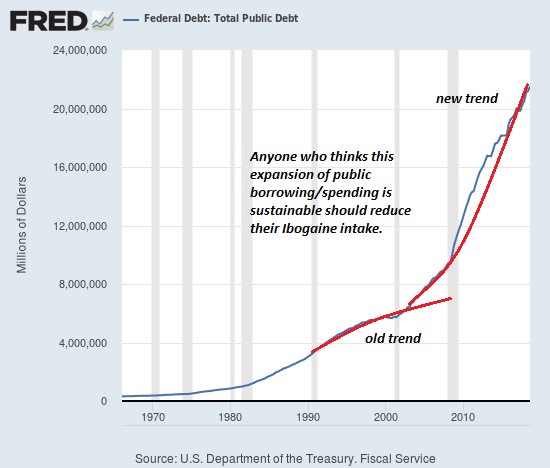

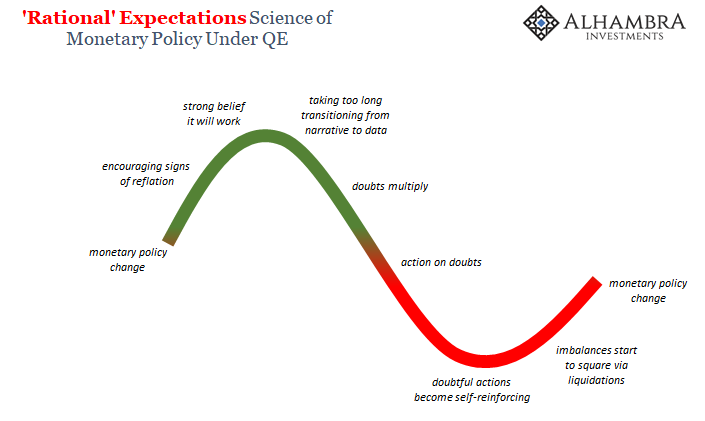

We’re Overdue for a Sell-Everything/No-Fed-Rescue Recession

We're way overdue for a sell-everything recession, one that the Fed will only make worse by pursuing its usual policies of lowering interest rates and goosing easy money. As I noted last week, central banks, like generals, always fight the last war--until the war is lost.

Read More »

Read More »

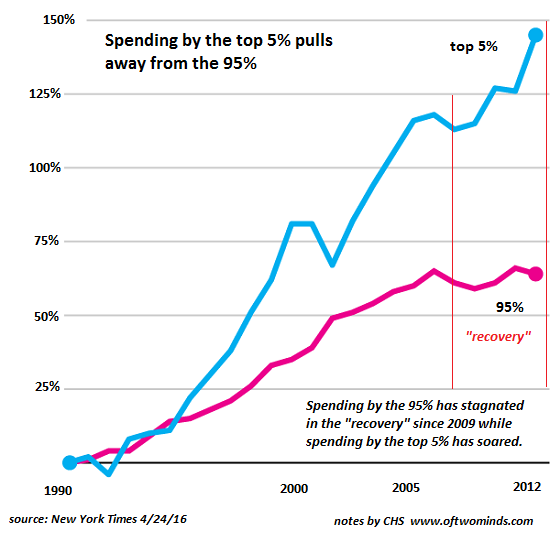

2019: The Three Trends That Matter

Look no further than Brexit in Britain, the yellow vests in France and the Deplorables in the U.S. for manifestations of a broken social contract and decaying social order. Among the many trends currently in play, Gordon Long and I discuss three that will matter as 2019 progresses: 2019 Themes (56 minutes).

Read More »

Read More »

Brace for Impact

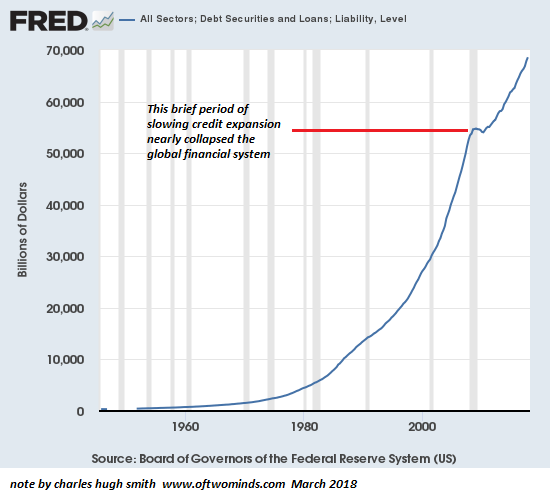

As credit-asset bubbles pop, the dominoes start falling. The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them.

Read More »

Read More »

More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic.

Read More »

Read More »

MACRO ANALYTICS – 02-07-19 – 2019 Themes w/ Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: http://charleshughsmith.blogspot.com/2019/02/2019-three-trends-that-matter.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all Macro Analytics/Gordon …

Read More »

Read More »

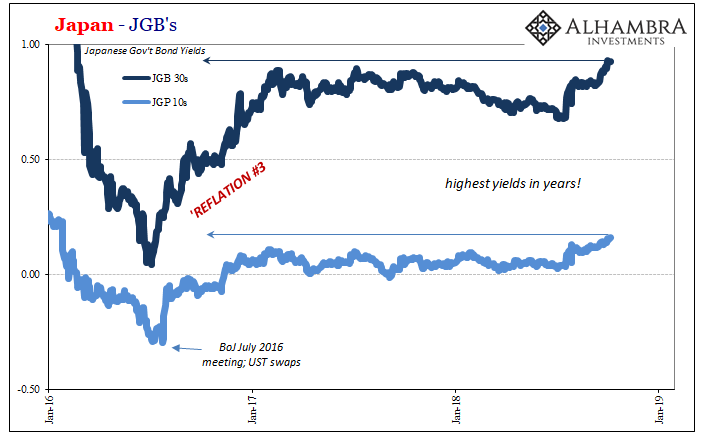

Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

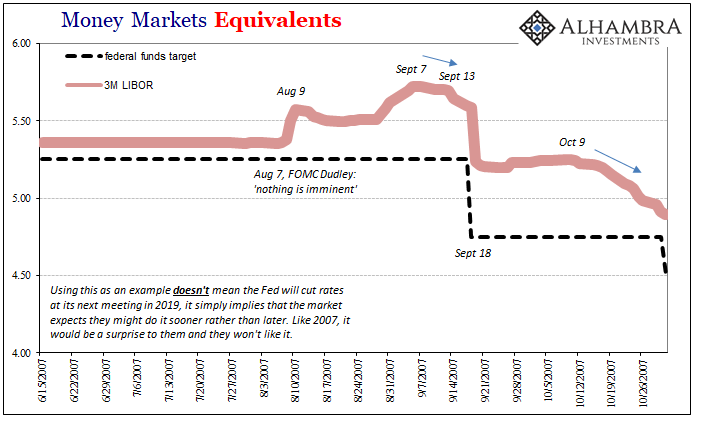

LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where).

Read More »

Read More »

The next global arms race? | The Economist

America and Russia have pulled out of the INF, a cold war-era weapons treaty. Why is this significant and what does this mean for global stability? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on …

Read More »

Read More »

China’s S-Curve of Expansion, Stagnation and Decline

All the policies that worked in the Boost Phase no longer work. Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what's known as the S-Curve. The dynamic isn't difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc.

Read More »

Read More »

US Manufacturing Questions

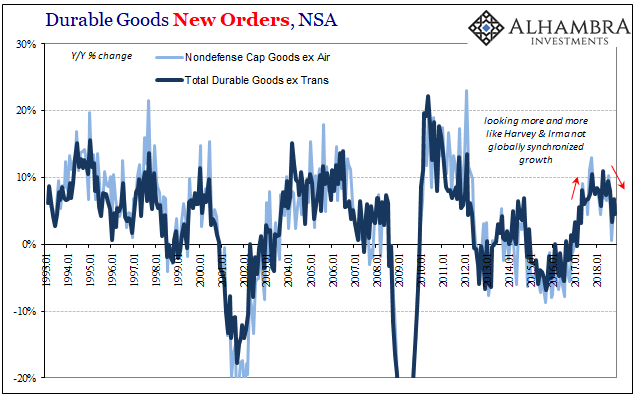

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

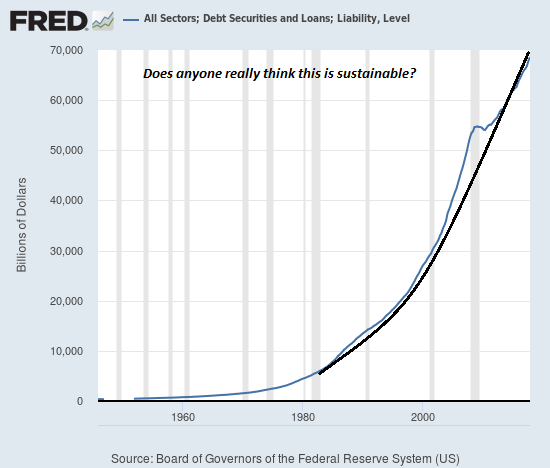

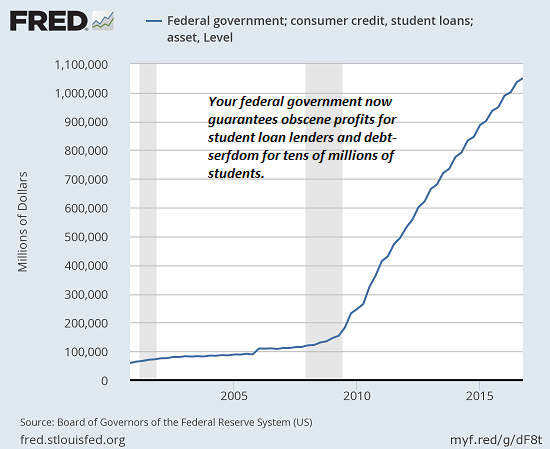

The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and...

Read More »

Read More »