Category Archive: 4) FX Trends

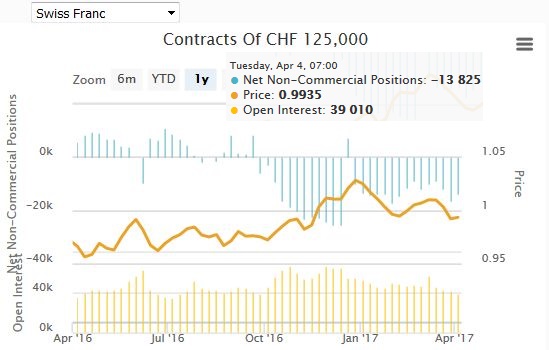

Weekly Speculative Positions (April 4 Data): Reduction in CHF Net Shorts

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. In the last week, finally they increased their Euro shorts again.... and reduced their CHF shorts.

Read More »

Read More »

FX Daily, April 10: Dollar Narrowly Mixed at Start of Holiday Week

The US dollar is narrowly mixed after a brief attempt in Asia to extend its pre-weekend gains fizzled, and a consolidative tone has emerged. The news stream is light and largely limited to the current Japanese account and the Sentix survey from Europe.

Read More »

Read More »

FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors' willingness to look past Q1 economic data.

Read More »

Read More »

FX Weekly Review, April 03-08: Dollar Recovery Can Continue, 10-year Yield Set to Rise

The US dollar appreciated against most of the major currencies last week. The Japanese yen was the chief exception. It rose about 0.5% as US yields remained heavy and equities were mostly softer. The Dollar Index did not fall in any session last week. It has had one losing session over the past nine, and that was the last day in March when the Dollar Index slipped less than 0.1%. It finished the week a bit above thee 61.8% retracement objective of...

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate.

Read More »

Read More »

FX Daily, April 05: Dialing it Up on Hump Day

he dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs.

Read More »

Read More »

Inclusion in SDR Does Not Spur Official Demand for the Yuan

China's share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves - valuation, portfolio decisions, and China's gradual inclusion in allocated reserves. The Swiss franc's as a reserve asset diminished, but the "other" category appeared robust.

Read More »

Read More »

Weekly Speculative Positions: Last Reduction of Euro Short Positions?

Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

FX Weekly Review, March 27 – 31: Euro breaks down against USD and CHF

Weak inflation figures in the euro zone let the common currency fall against both the dollar and the Swiss franc. Still last week, the Swiss Franc index had some losses against the US dollar index.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Five Keys to Understand Trump

The election of Donald Trump as the 45th President of the United States surprised many people, even seasoned political observers and astute investors. He failed to win the popular vote but did carry the electoral college, which is how the US elects its chief executive. His victory is a bit of a Rorshcach test, where people project the issues that allowed Trump to succeed, with different observers making different claims.

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

Cool Video: “Turn Around Tuesday” Call in Early Asia Yesterday

I had time this afternoon, as I prepare for my TMA presentation tomorrow night here in Hong Kong, to find my clip from yesterday on CNBC, where I suggested the risk of a dollar recovery after it lost downside momentum in North America on Monday.

Read More »

Read More »

Cool Video: Brexit, Europe and EU Challenges

Earlier today, I had the opportunity to discuss the outlook for sterling and the US dollar on Bloomberg TV with Rishaad Salamat and Haidi Lun. It is a momentous day with Article 50 of the Lisbon Treaty being formally triggered by UK Prime Minister May, nine months after what was, at least initially, a non-binding referendum.

Read More »

Read More »

FX Daily, March 28: Prospects for Turnaround Tuesday?

The slide in the US dollar and US interest rates faded in the North American session on Monday. US participants also had a fairly relaxed initial response to news that after years of complaining, the Republicans could not agree on an alternative to the Affordable Care Act.

Read More »

Read More »

Weekly Speculative Positions: Continued reduction of Euro Shorts

Another time speculators reduced their net Euro shorts after the less dovish ECB. But the net short of CHF nearly remains stable. This resulted in an appreciation of EUR/CHF.

Read More »

Read More »

FX Weekly Preview: After US Health Care, Now What?

The first quarter winds down. The dollar moved lower against all the major currencies. The best performer in the first three months of the year has been the Australian dollar's whose 5.8% rally includes last week's 1% drop. The worst performing major currency has been the Canadian dollar.

Read More »

Read More »