Category Archive: 4) FX Trends

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, May 15: Softer Dollar and Yen to Start the Week

The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated.

Read More »

Read More »

Weekly Speculative Positions (as of May 09): Significant Position Adjustment in the Currency Futures

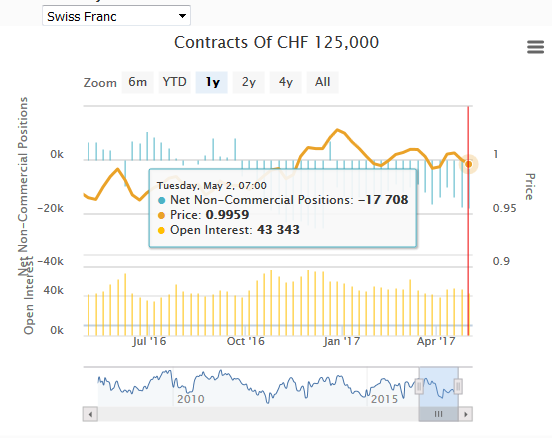

The net short CHF position has fallen from 17.7 short to 15,2K contracts short (against USD).

But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF.

Read More »

Read More »

Yen is the Weakest Currency in the World over the Past Month

Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate.

Read More »

Read More »

FX Weekly Preview: Two Known Unknowns

The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar.

Read More »

Read More »

FX Weekly Review, May 08-13: Euro rises far above 1.09 CHF, for how long?

The euro rose up to 1.0980. How long this momentum will last is still the question, given that it is driven by this political event and sustained by SNB interventions.

Read More »

Read More »

Great Graphic: Trade-Weighted Dollar

US TWI has appreciated a little since the end of Q1. The euro and sterling's strength are exceptions to the rule. The dollar has edged up against the currencies of the US top four trading partners here in Q2.

Read More »

Read More »

FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

The foreign exchange market is becalmed, and the major currencies are little changed. The US dollar is mixed, but mostly a little lower. Sterling is the weakest of the majors, off 0.3%, near $1.2850, having been rebuffed by offers in front of $1.30 several times. It has not recovered from the quarterly inflation report and Carney's press conference.

Read More »

Read More »

FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and construction output, and a sharp widening of the trade deficit.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, May 09: Dollar Firms amid Position Adjustments

The election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election.

Read More »

Read More »

Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

The net short CHF position has risen to 17K contracts (against USD). It was feast or famine in the adjustment of speculative positions in the currency futures market during the CFTC reporting period ending May 2. Speculators either made large adjustments or very small adjustments, and little in between.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

FX Weekly Preview: Dollar Drivers

US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea's national election are also important.

Read More »

Read More »

FX Weekly Review, May 01 – 06: Seasonal Patterns and Yen Crosses

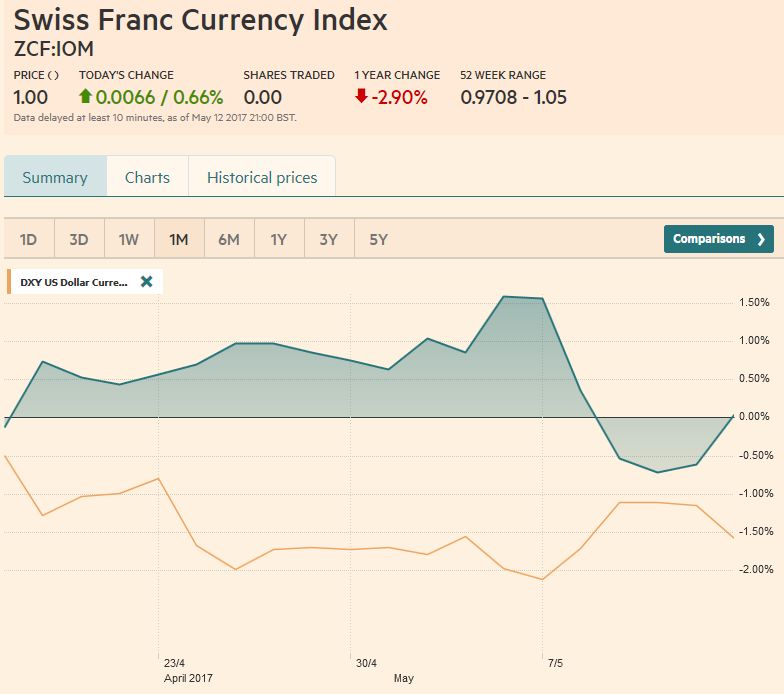

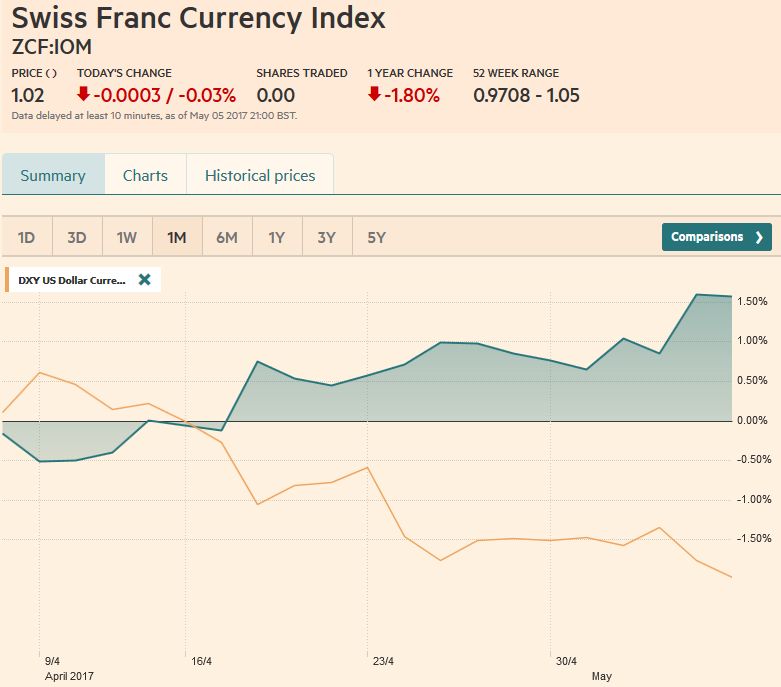

The Swiss Franc index gained 1.5% in the last month, the biggest part of it is from the last week. The trade-weighted indices the Fed tracks are updated monthly. The Bank of England calculates the effective exchange rate on a daily basis. It has not fallen since April 24.

Read More »

Read More »

Great Graphic: Gas and Oil

Steep falls in gasoline and oil prices. Large build in gasoline inventories and record refinery work shifted some surplus from oil to the products. OPEC is expected to roll over its output cuts, but non-OPEC may find it difficult and US output continues to rise.

Read More »

Read More »

April Jobs Won’t Change Minds

There is something for everyone in today's US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank's neutral stance next week.

Read More »

Read More »

FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

What is the Bank of Japan to Do?

Policy is on hold. There is several areas which the BOJ can adjust its forecast or forward guidance. BOJ is more likely to err on the side of caution.

Read More »

Read More »