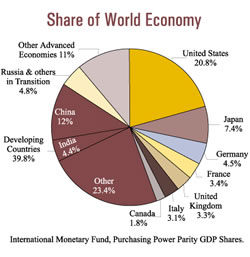

In our view the Swiss franc is not a pure Safe-Haven, but a "Safe Proxy for Global Economic Growth". Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals...

Read More »

Category Archive: 1.) CHF

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

Death of an FX punter

terriegym: Ive came back to my computer and Alpari have closed all my trades, loosing over $1000 off of my current balance, anyone got any idea what may have happened!!! they arent answering the phone!!

Read More »

Read More »

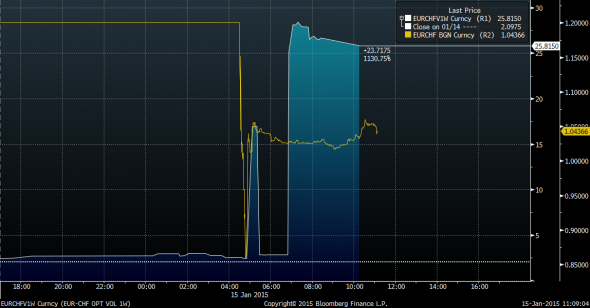

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

The SNB and the Russia/oil connection

A quick post to collate a few side theories on the reasons, justifications and consequences of the SNB move. Simon Derrick at BNY Mellon is first to point out that the euro floor/chf celing was leaving an open door to safe haven flows from Russia by ...

Read More »

Read More »

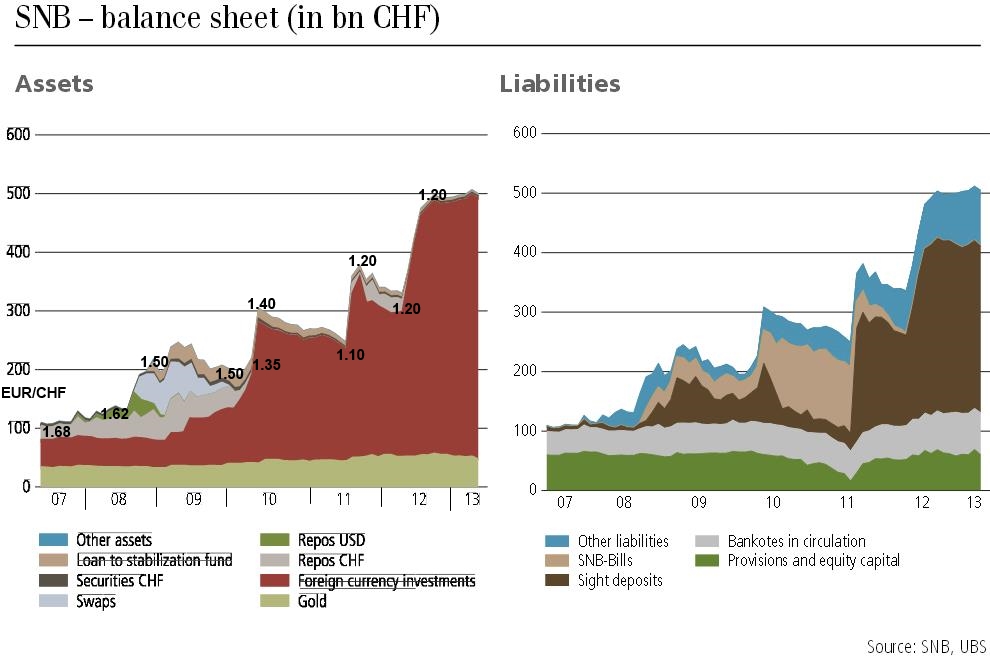

History of SNB Interventions

High inflows of around 400 billion francs between 2009 and 2012 in the Swiss balance of payments could only be countered with an increase in reserve assets and interventions by the Swiss National Bank. This number is far higher than the one seen during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF). We look at the detailed history of...

Read More »

Read More »

Sept 2014, George Dorgan at the CFA Society: Predicted End of EUR/CHF Peg

George Dorgan held a presentation at the CFA society in Zurich on September 1. The subjects of his speech were:

Reasons why the EUR/CHF exchange rate will fall under 1.20 once the deflationary pressures in Europe have ended

The missing link in the CFA program between its chapters on micro-economy, macro and currencies

Does history repeat? From Bretton Woods to Bretton Woods 2 and its slow end. Why the unexpected, the black swan happens more...

Read More »

Read More »

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »

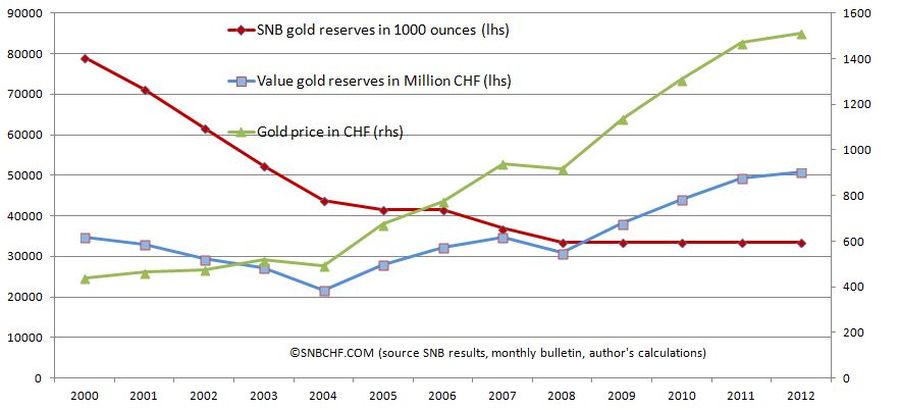

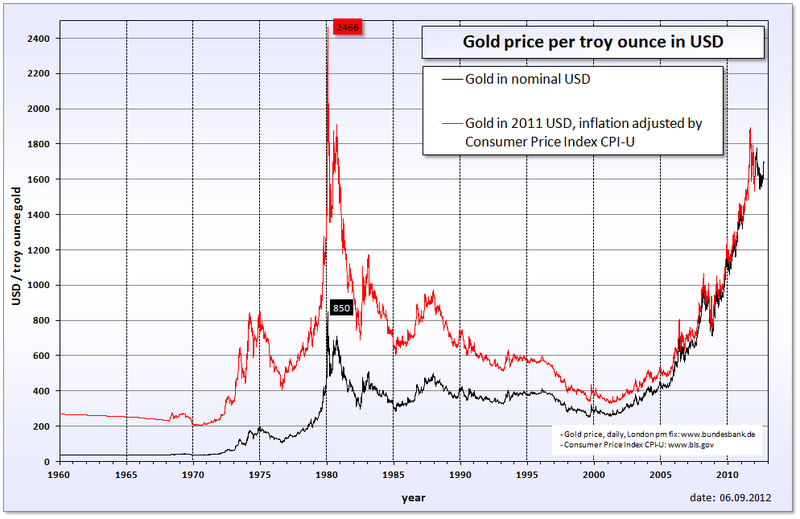

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

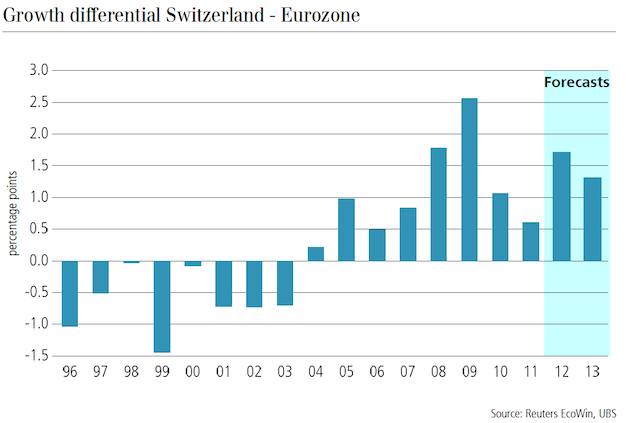

Swiss Franc History, from 2004 to 2009: The undervalued franc

A Critical History of the Swiss Franc: During the "global carry trade" period between 2004 and 2007, the euro strongly appreciated against the Swiss franc. Most astonishingly this happened, despite the fact that the Swiss GDP growth was on average 0.5% higher

Read More »

Read More »

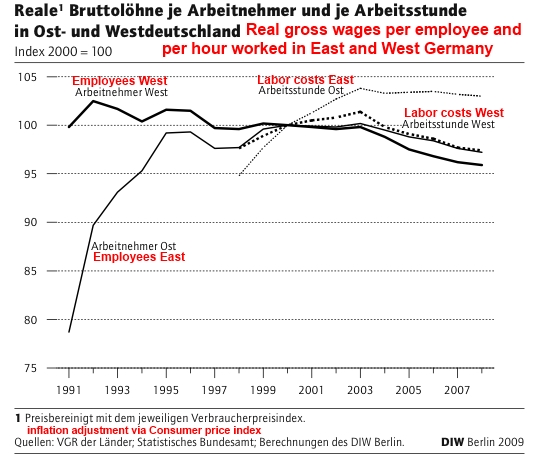

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »

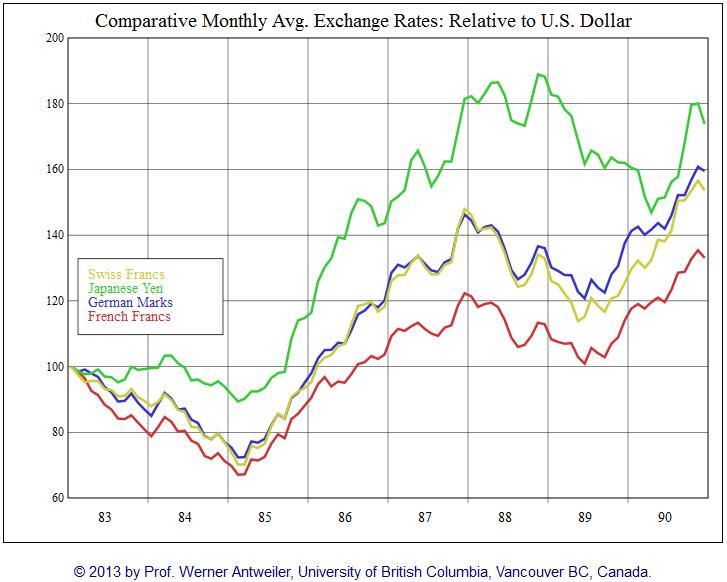

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

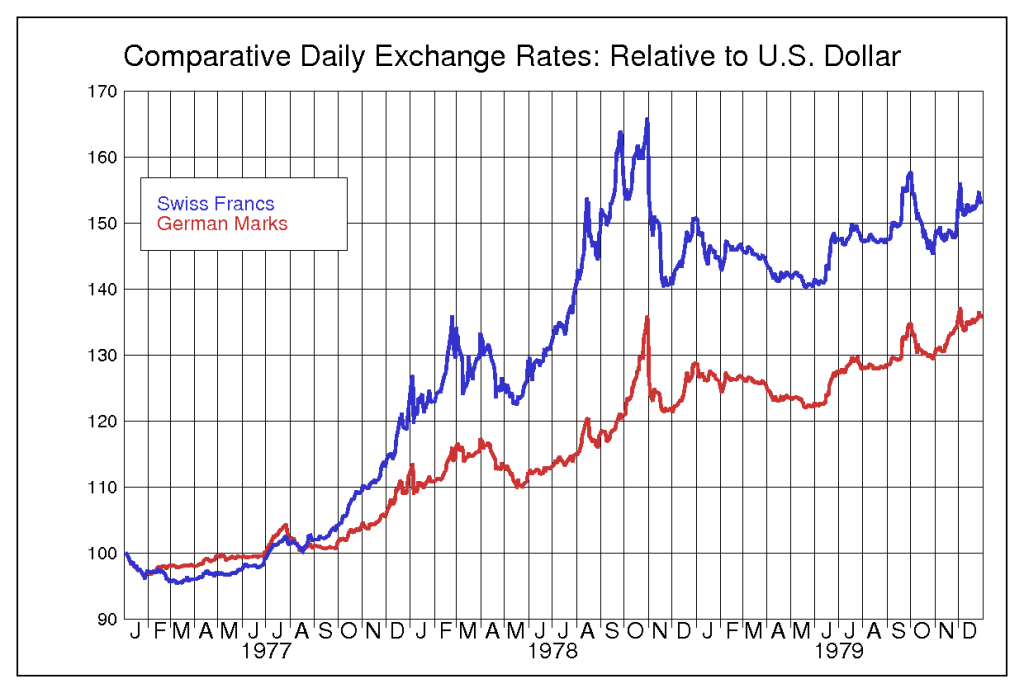

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

Swiss Franc History, 1970s: Due to US Stagflation CHF Strengthens Massively

We shows the massive appreciation of Swiss franc and German mark in the 1970s, the reasons were: stagflation and the wage-price spiral.

Read More »

Read More »