Category Archive: 1.) CHF

Warum ist der Schweizer Franken so stark?

Nehmen Sie an unserer kostenlosen wöchentlichen online Kaffeepause und Aktiendiskussion teil: https://www.eventbrite.ch/e/kaffeepause-okonomie-und-philosophie-tickets-149113349041?aff=video

Was hinter der Stärke des Schweizer Frankens steckt - Dr. Hermann Stern erklärt es in einem unserer Online Kaffeepause Aktien Gespräche.

Datum: 10. Februar 2022

Read More »

Read More »

Switzerland has frozen CHF7.5bn in assets under Russia sanctions

Switzerland has so far frozen some CHF7.5 billion ($8 billion) in funds and assets under sanctions against Russians to punish Moscow’s invasion of Ukraine.

Read More »

Read More »

Swiss franc highest against Euro since July 2015

On 19 November 2021, the Euro went below 1.05 Swiss francs, the lowest it has been since July 2015. The Swiss franc is viewed as a safe haven currency and tends to rise when markets are bearish. However, this week the shift in exchange rate may have had more to do with the situation in Euro zone than a shift to safety.

Read More »

Read More »

Understanding Minimum Wage Mandates: Empirical Studies Aren’t Enough

It is only through the increase in capital goods, i.e., through the enhancement and the expansion of the infrastructure, that labor can become more productive and earn a higher hourly wage.

Read More »

Read More »

Why is the Pound to Euro Rate Falling? Will it Continue?

U.K jobless claims were released in early morning trading today, much like many economic data releases the figures were posted at an earlier than usual 07:00, we normally would see a release such as this out at 09:30. The figures, as expected were not particularly great reading for the U.K economy however there was a slight surprise in the fact that the official unemployment rate came in at 3.9% as opposed to the 4.3% which had been expected.

Read More »

Read More »

Questions That Need Answering [feat. Jonathan Watson]

Guest Worship Leaders Austin and Lindsey Adamec from Jacksonville,FL. Jonathan Watson from Charleston Southern University helps us to understand The Trinity.

With THE BLOC Online you can join us every Thursday for 7pm!

—

Follow Austin and Lindsey Adamec:

https://www.youtube.com/channel/UCIHRWN8MV6uzP9yaLURmRDg

Subscribe to our channel to see more messages from THE BLOC:

https://www.youtube.com/channel/UCVEI...

Follow us on Instagram:...

Read More »

Read More »

Is capitalism broken? | Guy Standing, Izabella Kaminska, Jamie Whyte, and Steven King

Guy Standing, Jamie Whyte, Izabella Kaminska and Stephen King debate if we can save capitalism. Watch the full debate at https://iai.tv/video/is-capitalism-broken-democracy-reform?utm_source=YouTube&utm_medium=description It is just twenty-five years since Fukuyama’s claim, taken seriously at the time, that capitalism and liberal democracy had won, and represented the endpoint of cultural advance. Instead, after a decade of stagnation...

Read More »

Read More »

A More Connected American | Jonathan Watson | TEDxThunderRidgeHS

Very few Americans have the courage or motivation to live and work outside the USA. Americans need to be aware of cultural differences and teaching experiences outside the USA.

Jonathan Watson has been to 35 countries around four continents. His interests include reading, traveling, teaching, marketing, sales, and speaking. He wants to be the greatest speaker in the world. Jonathan wants to run a marathon on all seven continents of the world. He...

Read More »

Read More »

The power of money, the 2008 crash, and the next economic crisis | Izabella Kaminska

Is the economy rigged against the working class, and is a new crash inevitable? Izabella Kaminska lifts the lid on the world of finance Find more debates and talks at iai.tv After the financial crisis in 2008, tigher regulations were imposed to curb bankers’ behaviour. But 12 years on, are the regulators now serving the …

Read More »

Read More »

GBP to CHF Rate: Sterling Supported Against the Swiss Franc as Boris Johnson’s Health Improves

The GBP to CHF interbank exchange rate today has been ranging between 1.2017 and 1.2092. The pound looks supportive today on the back that Prime Minister Boris Johnson, is on the road to recovery from Covid-19.

Read More »

Read More »

GBPCHF Strengthens on News That COVID-19 Spread Appears to Be Slowing

The pound continued to strengthen against the Swiss franc yesterday following the news that the UK’s current lockdown situation appears to be slowing the spread of COVID-19, causing a 0.85% movement in GBPCHF exchange rates throughout the day.

Read More »

Read More »

Will CHF/GBP Be a Good Currency Pair for Investment in the Future?

Trade between the UK and Switzerland is robust these days and it’s not going to get any worse for a long time. Even with the economic turmoil resulting from Brexit, the trade between these two countries was set to stay strong due to the special deal signed by them in 2019. As the situation stands now, trade agreements are solid, so these business relationships should only strengthen.

Read More »

Read More »

Is greed good? | Brian Eno, Izabella Kaminska, Guy Standing, Mark Littlewood

Brian Eno, Izabella Kaminska, Guy Standing, and Mark Littlewood debate the value of greed. Watch the full debate at https://iai.tv/video/has-greed-got-the-better-of-us-consumer-culture?stage=Stage&utm_source=YouTube&utm_medium=description 150 years ago life was short and luxuries scarce. Fast forward to today and life is long and affluent. So why are we still unfulfilled? Is it human nature to be dissatisfied with our lot …

Read More »

Read More »

New 100 Swiss Franc Note Coming Soon

The note’s design is inspired by Switzerland’s tradition of humanitarianism, represented on the note by water. The note remains blue but is much smaller than the existing one, making it easier to fit into wallets.

Read More »

Read More »

Swiss National Bank Presents New 100-Franc Note

The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals.

Read More »

Read More »

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

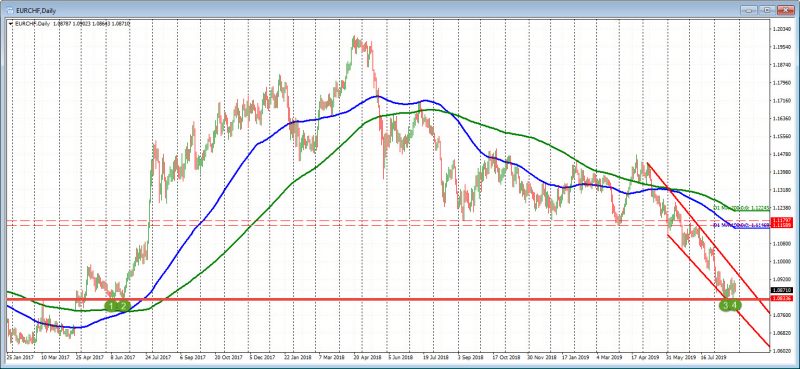

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank's Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits - plenty of jawboning going on here.

Read More »

Read More »

More SNB Maechler: Right now we still have plenty of room for forex intervention

Right now is still plenty of room for forex intervention. As to negative rates are working, SNB's Maechler says "absolutely". Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall.

Read More »

Read More »

Pound to Swiss Franc forecast: Investors flock to the CHF, will the Swiss National Bank curb demand for the Franc?

Sterling slides against the Swiss Franc as Brexit and the global economic outlook weigh on the Pound. The pound to Swiss franc exchange rate has fallen lower below 1.20 for the GBP vs CHF pair with interbank rates currently sitting at 1.189. The slide in the pound against the Swiss franc has presented those looking to sell Swiss francs with an opportunity to convert when compared to recent months.

Read More »

Read More »

Pressure returns on Swiss franc amid global uncertainty

One knock-on effect of the escalating trade war between the United States and China is that the Swiss franc is becoming more attractive for investors – putting pressure on the Swiss National Bank (SNB) to come to the defence of the safe haven currency. For much of July a euro bought at least CHF1.10.

Read More »

Read More »

Swiss Central Bank under Pressure as Franc Rises

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and typically rises when global risk perceptions rise.

Read More »

Read More »