Category Archive: 1.) CHF

Pound to Swiss Franc exchange rates remain docile despite yesterday’s UK political developments

Movement for the Pound to Swiss Franc pair limited. Pound to Swiss franc exchange rates have remained relatively rangebound this week, despite yesterday’s political developments inside the UK. Whilst the GBP/CHF pair is historically less volatile than GBP/EUR for an example, a range of only two cents movement over the past month is testament to the current market uncertainty.

Read More »

Read More »

Pound to Swiss Franc forecast: Will GBP/CHF rates fall below 1.20?

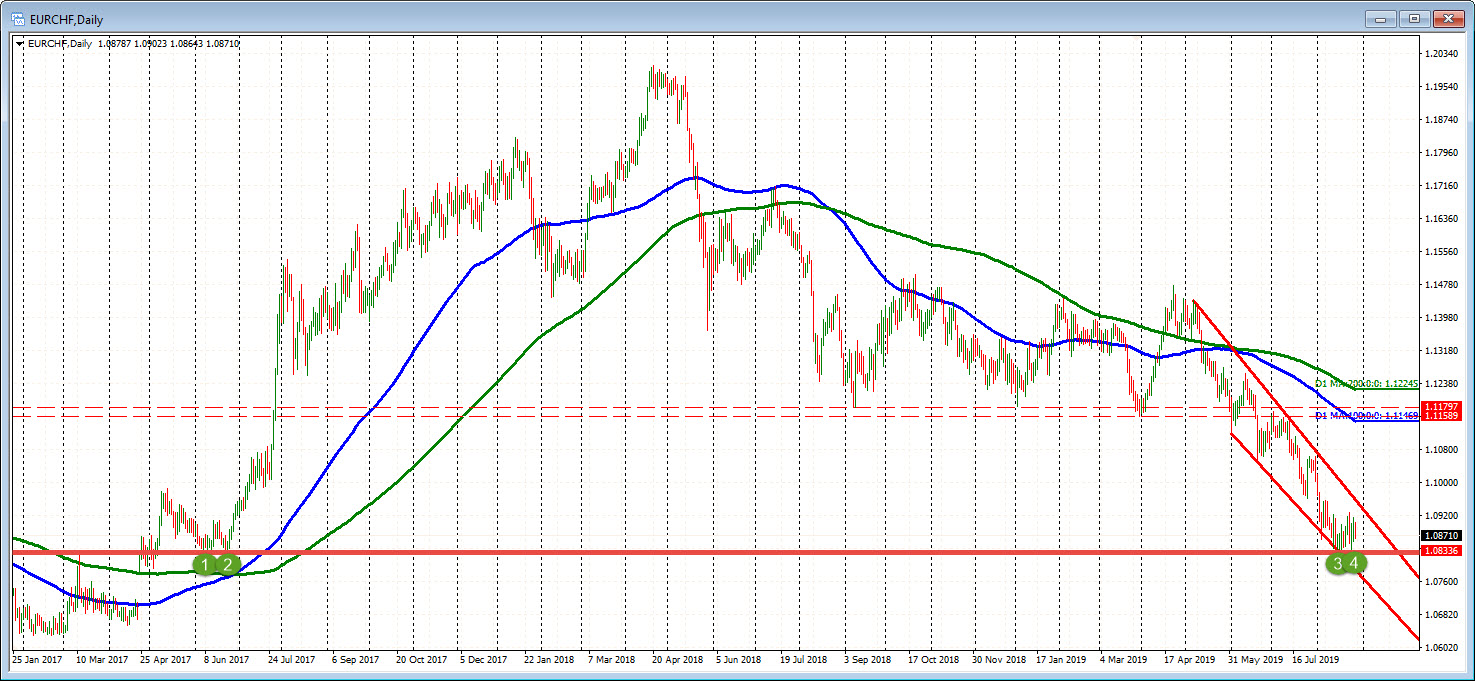

The pound to Swiss Franc exchange rate has been on steady decline since May when it peaked at 1.3397. Since then, it has fallen to 1.2245 as Brexit uncertainties continue to weigh on sterling, with the market feeling the prospect of a no-deal Brexit has increased. The franc has also risen in value owing to its status as a safe haven currency, and the continued fears over the global economy.

Read More »

Read More »

Alumni Top Tips: Jonathan Watson

In this video, alumnus Jonathan Watson - Business Economics class of 2016 - shares his top tips for students and recent graduates.

Find out about the alumni community here: mmu.ac.uk/alumni

Read More »

Read More »

Swiss Franc at 5 month highs vs the Pound

Tory leadership debate does little to help the pound. Sterling has remained under a lot of pressure against a number of currencies including vs the Swiss franc. The Tory leadership race is now down to 5 candidates after former Brexit secretary Dominic Raab only managed to get 30 votes. This was short of the required 33 to progress to the next round.

Read More »

Read More »

Pound to Swiss Franc forecast: Brexit limbo hurting Sterling

Political uncertainty & Brexit cause sterling weakness. The pound’s value is being predominantly dictated by Brexit. Over the past month sterling has gradually declined in value against the Swiss franc. There is potential for further falls for the pound due to the lack of clarity surrounding Brexit and the leadership battle for the new Conservative leader.

Read More »

Read More »

Pound to Swiss franc forecast: Brexit to continue to drive pound to swiss franc exchange rates

Since the start of the year the general trend for pound to swiss franc exchange rates has seen the pound strengthen. GBP/CHF mid-market levels started the year in the 1.23s and now are trading in the 1.30s. The pound strengthened as UK Prime Minister Theresa May extended Article50 by 6 months, which means the UK will not leave the EU without a deal.

Read More »

Read More »

Brexit to drive pound to Swiss franc exchange rates

Yesterday the PM’s deputy David Liddington confirmed that the UK will be taking part in European elections, therefore in my view the cross-party talks between Theresa May and Jeremy Corbyn are over. If the Prime Minister thought that they would be able to come to an agreement in the upcoming days Mr Liddington would not have made the announcement yesterday.

Read More »

Read More »

Pound to Swiss franc forecast – Brexit impasse means a fragile pound

Brexit Limbo. At present Theresa May is in talks with Jeremy Corbyn in order to try and come up with a mutually acceptable deal to put to Brussels. The problem is May can’t even get a deal that is acceptable within her own party let alone Labour as well. Her deal has been rejected three times and Brussels are stone walling us on the Irish border.

Read More »

Read More »

Pound hits best rate to buy Swiss francs in 6 weeks

The pound is now trading close to a 6 week high to against the Swiss franc which has come as welcome news to the Swiss central bank. Swiss policy makers appear to favour a weaker currency as they aim to control low inflation. Inflation in Switzerland has remained below 1% for quite a while even though interest rates have remained in a negative territory.

Read More »

Read More »

Pound to Swiss Franc rates: UK housing price growth hits 6 year low

We have seen a fairly stagnant market following the Brexit extension until 31st October. Although a key factor on GBP/CHF economic date releases will now gain back some of their impact. Yesterday saw the ease of House Price Growth data and figures dropped to a six year low. The average house price of across the UK grew by 0.6%, but property prices in the capital fell by 3.8%.

Read More »

Read More »

What happens next on GBP/CHF exchange rates?

The pound to Swiss franc exchange rate has been rather volatile, oscillating in a tight range between 1.2942 and 1.3336 in the last month. There is an expectation that we could see the pound losing further ground with the market bracing for worse news in the future for sterling.

Read More »

Read More »

Pound to Swiss Franc forecast: Will the GBP/CHF rate drop below 1.30?

There is a very strong likelihood that the pound to Swiss franc exchange rate might slip should Theresa May find herself in trickier waters ahead as she attempts to negotiate an extension on the Brexit deadline this week. Pound to Swiss franc exchange rates could easily slip below 1.30, particularly since the Franc is a safe haven currency that can strengthen in times of economic uncertainty.

Read More »

Read More »

GBP to CHF weakness after no majority for alternative Brexit

The pound to Swiss franc exchange rate still struggles to push higher amidst global uncertainty and the pressing issue of Brexit. The Swiss franc maintains the higher ground with its safe haven status amidst concerns of a global slowdown, the effects of which are already being seen across China and the EU.

Read More »

Read More »

Pound to Swiss Franc Forecast – Will GBP/CHF rates rise or fall on Brexit?

The Brexit date of 29th March has been delayed to the 12th April or the 22nd May as the EU provide a lifeline to the UK to help them avoid a no-deal scenario. This has helped the pound to rise and has provided some of the best rates to buy Swiss Francs in many months.

Read More »

Read More »

Pound falls against the Swiss franc owing to third meaningful vote uncertainty

The pound has once again felt the impact of the uncertainty caused by Brexit and the pound has fallen against the Swiss franc during yesterday afternoon’s trading session. We are now just over a week away from when the UK is due to leave the European Union and the latest update is that the EU will allow an extension until the end of June if Theresa May can get her deal backed in the next few days.

Read More »

Read More »

Pound to Swiss Franc Forecast: GBP/CHF rate hits near 1-year high

It is now very close to the best time to buy Swiss Francs with pounds since May 2018. The stronger pound and a reduced global risk appetite has seen the move on the GBP/CHF pairing. This is presenting a much improved opportunity to buy Swiss Francs with pounds. Any client wishing to buy or sell on this pairing might benefit from a quick review with our team to best understand what is next, and the potential outcomes.

Read More »

Read More »

GBP/CHF exchange rates: A good start to the year, but what next for Brexit?

Since the start of the year GBP/CHF exchange rates have increased from 1.2377 to 1.3212 at the time of writing this report. To put this into monetary value, a client that converts £200,000 into CHF could now achieve an additional 16,700 Swiss Francs.

Read More »

Read More »

GBP to CHF rate hovers over 1.32 awaiting new Brexit Developments

The pound has rallied higher against the Swiss Franc with rates for the GBP/CHF pair now sitting over 1.32. Pound to Swiss Franc exchange rates have been lifted on the back of some optimism over Brexit, that a deal will be reached between Britain and the EU. The markets are awaiting developments over the contentious Irish backstop which could pave the way forward for a deal.

Read More »

Read More »

Strong Trade Balance Data Supports the Franc

The Swiss Franc has been boosted during early morning trading as investors find the latest Trade Balance data supportive of the economy, with the Trade Balance data coming in showing a surplus of CHF3bn. The strength of the Swiss economy is its exports; in watches, chocolate and specialized industrial engineering.

Read More »

Read More »

Mark Carney Steadies GBP/CHF Rates on Global Viewpoint

The pound to Swiss franc exchange rate has been steadied following comments from Mark Carney during a briefing on the global economy at the Barbican centre in London yesterday. I was fortunate to be in attendance and was struck by Carney’s confident manner, although he highlighted some major risks ahead which would be key for GBP/CHF rates.

Read More »

Read More »