Category Archive: 6b.) Debt and the Fallacies of Paper Money

Wreck the Halls

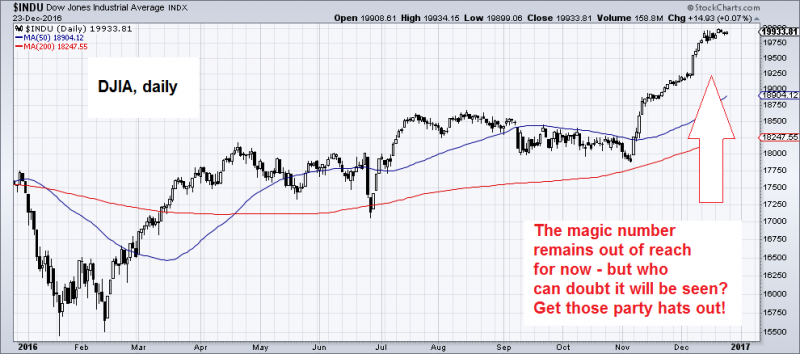

Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time.

Read More »

Read More »

Fake News? It’s All Fake!

BALTIMORE – In January of this year, the Empire Herald reported that a “meth-addled couple” had eaten a homeless man in New York City’s Central Park. Later, Now8News reported that a can of cookie dough had “exploded in a woman’s vagina”; the woman was alleged to be shoplifting.

Read More »

Read More »

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults. Last Wednesday Moody’s reported that mortgage arrears continue to rise across Australia, particularly in the mining states of WA & NT:

Read More »

Read More »

The Reign of Bubble Finance

Financialization Genius BALTIMORE – When we left you last time, we were in the middle of describing the crooked hind leg of crony capitalism. We used billionaire businessman Wilbur Ross – Donald Trump’s pick for the Department of Commerce – for illustration purposes. Not that there is anything wrong with Mr. Ross. He plays the game, just as everyone else does. He’s particularly good at it.

Read More »

Read More »

Has the Fed Turned “Hawkish?”

Juiced, Stimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath.

Read More »

Read More »

“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro's decision to follow Indian PM Modi's playbook and announce that the nation's largest denomination bill (100-Bolivars - worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called "mafias".

Read More »

Read More »

The Exiling of Risk

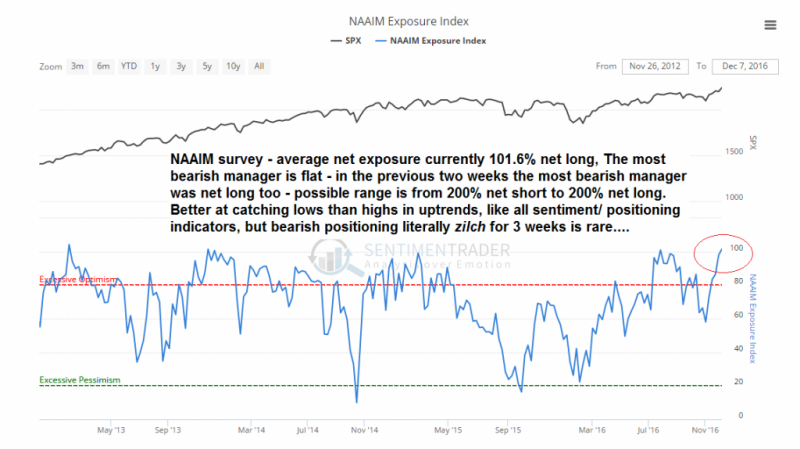

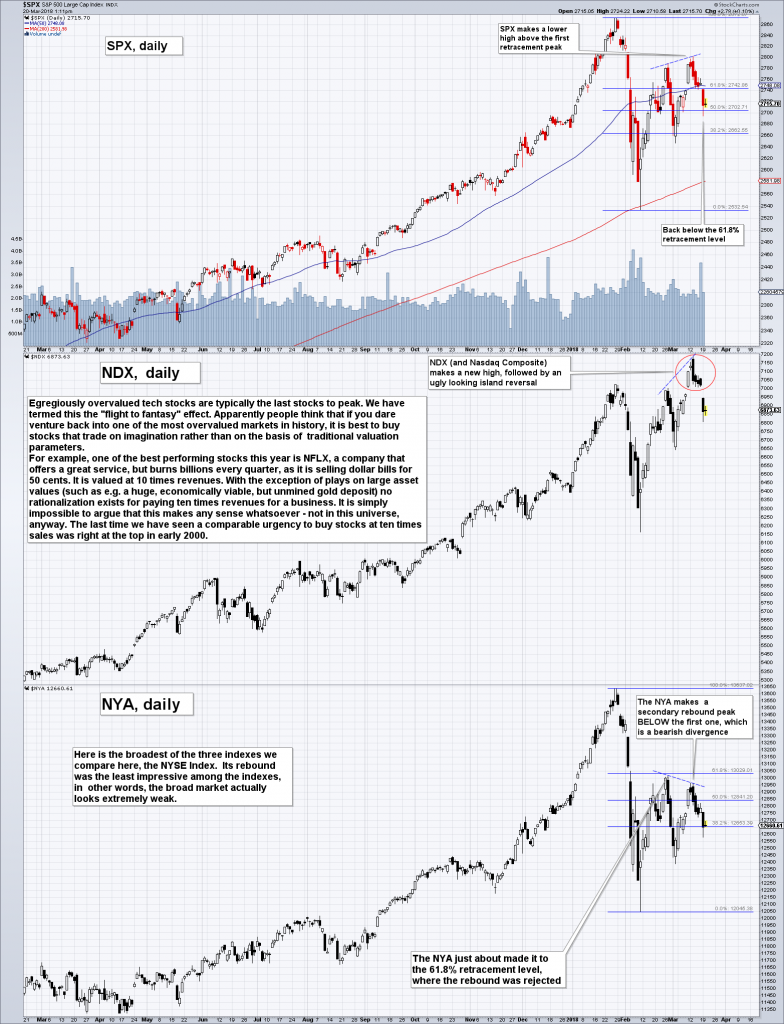

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index.

Read More »

Read More »

The Climate Changes Back – What Comes Next?

Last year’s El Nino phenomenon temporarily provided succor to climate alarmists, who were increasingly bothered by the “Great Pause” – the fact that the tiny amount of warming experienced since the last cooling cycle ended in the late 1970s had apparently stopped. Despite trace amounts of CO2 in the atmosphere continuing to climb, mother nature decided to disobey alarmist models and temperatures went sideways for about 20 years (or even longer,...

Read More »

Read More »

Smart Programs of Capital Destruction

These days everything must be smart. There are smart cities, smart grids, smart policies, smart TVs, smart cars, smart phones, smart watches, smart shoes, and smart glasses. There’s even something called smart underwear. Before long everything around us will be so smart we’ll no longer have to do one critically important thing. We’ll no longer have to think; smart algorithms will think for us. What’s more, the possibilities for not thinking are...

Read More »

Read More »

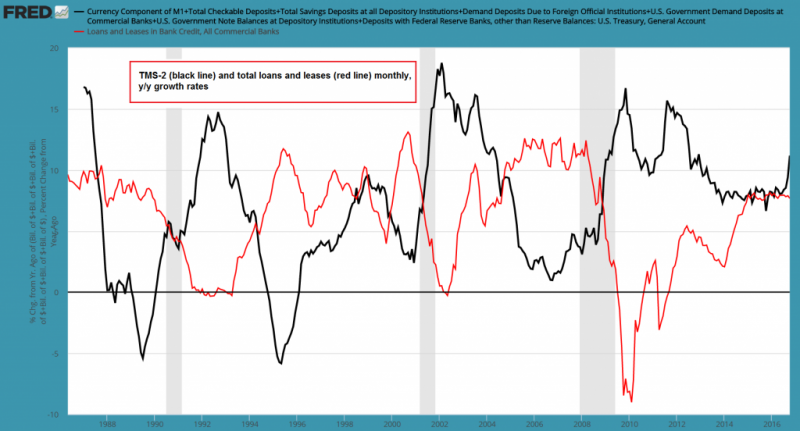

US True Money Supply Growth Jumps, Part 1: A Shift in Liabilities

The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is mortgage lending growth – at least until recently. Growth in mortgage loans is...

Read More »

Read More »

Attaining Self-Destruct Velocity

Some Monday mornings are better than others. Others are worse than some. For one Amazon employee, this past Monday morning was particularly bad. No doubt, the poor fellow would have been better off he’d called in sick to work. Such a simple decision would have saved him from extreme agony. But, unfortunately, he showed up at Amazon’s Seattle headquarters and put on a public and painful display of madness.

Read More »

Read More »

Fidel Castro and the American Empire

The death of the brutal Cuban Communist dictator Fidel Castro closes the door, in some respect, on another disastrous page in US foreign policy history. For all the denunciations and criticism of Castro from conservative elements and exiled Cubans, his despotic rule was the outcome of decades of American imperialism which began with President William McKinley’s infamous decision to wage war on hapless Spain in 1898.

Read More »

Read More »

Celebrating this Land of Absurdity

“Myths and legends die hard in America,” remarked Hunter S. Thompson in The Great Shark Hunt, nearly 40-years ago. These great myths and legends of America died long ago. Freedom. Liberty. Independence. Limited representative government. Sound money. Private property rights. All getting more and more replaced by regulation.

Read More »

Read More »

The Problem with Corporate Debt

There are actually two problems with corporate debt. One is that there is too much of it… the other is that a lot of it appears to be going sour. As a brief report at Marketwatch last week (widely ignored as far as we are aware) informs us.

Read More »

Read More »

Good Money and Bad Money

OUZILLY, France – Last week’s U.S. jobs report came in better than expected. Stocks rose to new records. As we laid out recently, a better jobs picture should lead the Fed to raise rates. This should cause canny investors to dump stocks.

Read More »

Read More »

Too Early for “Inflation Bets”?

After 35 years of waiting… so many false signals… so often deceived… so often disappointed… bond bears gathered on rooftops as though awaiting the Second Coming. Many times, investors have said to themselves, “This is it! This is the end of the Great Bull Market in Bonds!”

Read More »

Read More »

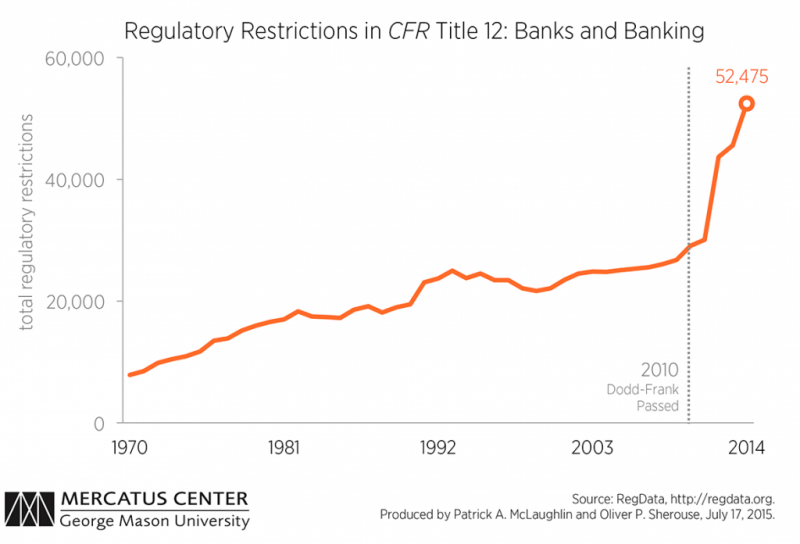

Putting an End to the Regulatory Industry

Corporate life in America these days is fraught with tedium. First the MBAs imposed their silly six sigma processes and reduced workers to mere widgets. Then the regulators went through and squashed out any fun that remained.

Read More »

Read More »

Two Types of Credit — One Leads to Booms and Busts

In the slump of a cycle, businesses that were thriving begin to experience difficulties or go under. They do so not because of firm-specific entrepreneurial errors but rather in tandem with whole sectors of the economy. People who were wealthy yesterday have become poor today. Factories that were busy yesterday are shut down today, and workers are out of jobs.

Read More »

Read More »