Category Archive: 6b.) Debt and the Fallacies of Paper Money

The Capital Structure as a Mirror of the Bubble Era

As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences.

Read More »

Read More »

From Fake Boom to Real Bust

More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf.

Read More »

Read More »

Negative Rates: Rise of the Japanese Androids

One of the unspoken delights in life is the rich satisfaction that comes with bearing witness to the spectacular failure of an offensive and unjust system. This week served up a lavish plate of delicious appetizers with both a style and refinement that’s ordinarily reserved for a competitive speed eating contest. What a remarkable time to be alive.

Read More »

Read More »

Trade War Game On!

“Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee.

Read More »

Read More »

Short Term Market Signals

We reviewed the daily charts after yesterday’s close and noticed that the Russell 2000 Index, the NYA and transportation stocks all exhibited relative strength (the same holds actually for the DJIA), particularly vs. the FANG/NDX group. This is happening just as the SPX is battling with an extremely important trendline. As we pointed out before, relative strength in the RUT in particular served as a short term reversal signal ever since the...

Read More »

Read More »

GBEB Death Watch

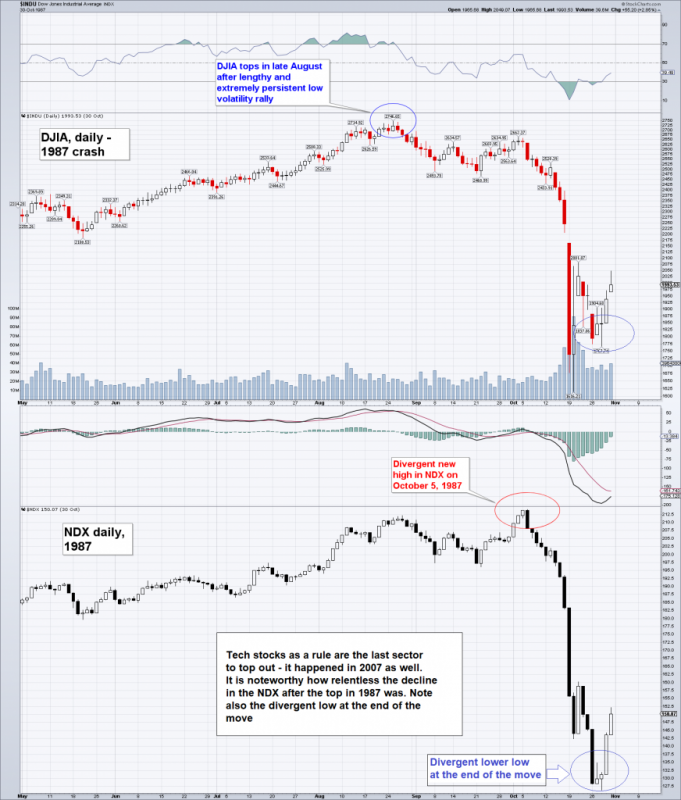

As our friend Dimitri Speck noted in his recent update, the chart pattern of the SPX continues to follow famous crash antecedents quite closely, but obviously not precisely. In particular, the decisive trendline break was rejected for the moment. If the market were to follow the 1987 analog with precision, it would already have crashed this week.

Read More »

Read More »

Trendline Broken: Similarities to 1929, 1987 and the Nikkei in 1990 Continue

In an article published in these pages in early March, I have discussed the similarities between the current chart pattern in the S&P 500 Index compared to the patterns that formed ahead of the crashes of 1929 and 1987, as well as the crash-like plunge in the Nikkei 225 Index in 1990. The following five similarities were decisive features of these crash patterns.

Read More »

Read More »

Slaves to Government Debt Paper

Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master”. While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but merely a small gesture of disloyalty.

Read More »

Read More »

What Fed Chair Powell Forgot to Mention

What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high.

Read More »

Read More »

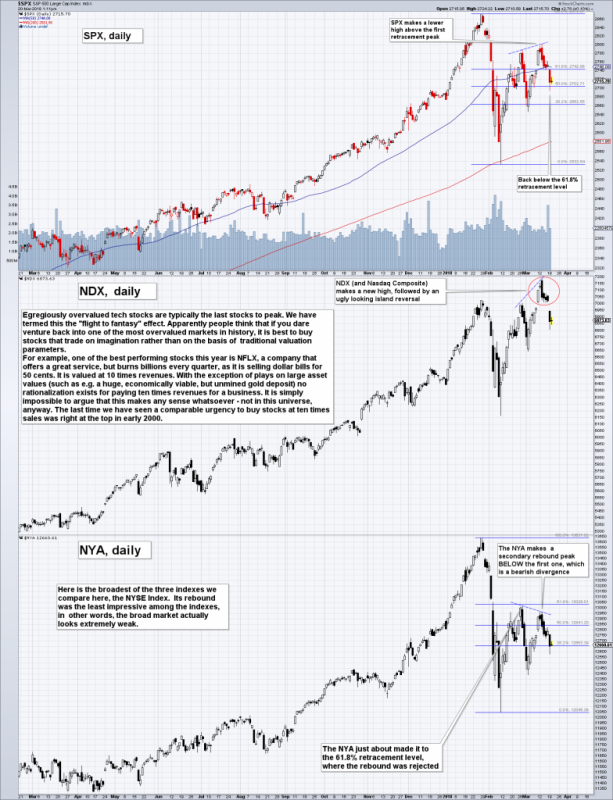

US Stock Market – How Bad Can It Get?

In view of the fact that the stock market action has gotten a bit out of hand again this week, we are providing a brief update of charts we have discussed in these pages over the past few weeks (see e.g. “The Flight to Fantasy”). We are doing this mainly because the probability that a low probability event will actually happen has increased somewhat in recent days.

Read More »

Read More »

Incrementum’s New Cryptocurrency Research Report

As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link).

Read More »

Read More »

US Stock Market – The Flight to Fantasy

The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based NYA (NYSE Composite Index).

Read More »

Read More »

Stock and Bond Markets – The Augustine of Hippo Plea

Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their existing exposure. Or more precisely: their investors would be saddled with staggering...

Read More »

Read More »

US Equities – Mixed Signals Battling it Out

Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator.

Read More »

Read More »

US Stock Market: Conspicuous Similarities with 1929, 1987 and Japan in 1990

There are good reasons to suspect that the bull market in US equities has been stretched to the limit. These include inter alia: high fundamental valuation levels, as e.g. illustrated by the Shiller P/E ratio (a.k.a. “CAPE”/ cyclically adjusted P/E); rising interest rates; and the maturity of the advance. Near the end of a bull market cycle there is always the question of when a decline will begin, and above all, how large will it be.

Read More »

Read More »

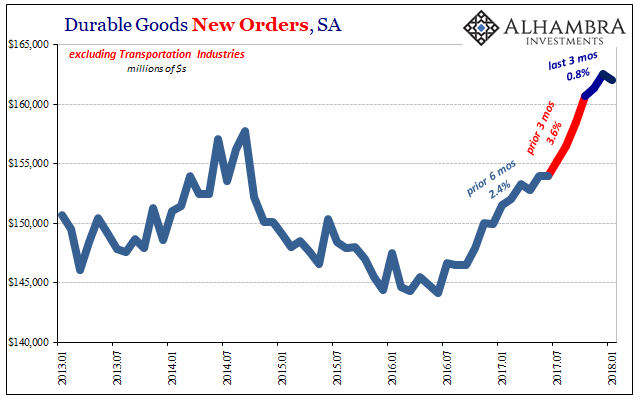

Durable and Capital Goods, Distortions Big And Small

New orders for durable goods, excluding transportation industries, rose 9.1% year-over-year (NSA) in January 2018. Shipments of the same were up 8.8%. These rates are in line with the acceleration that began in October 2017 coincident to the aftermath of hurricanes Harvey and Irma. In that way, they are somewhat misleading.

Read More »

Read More »

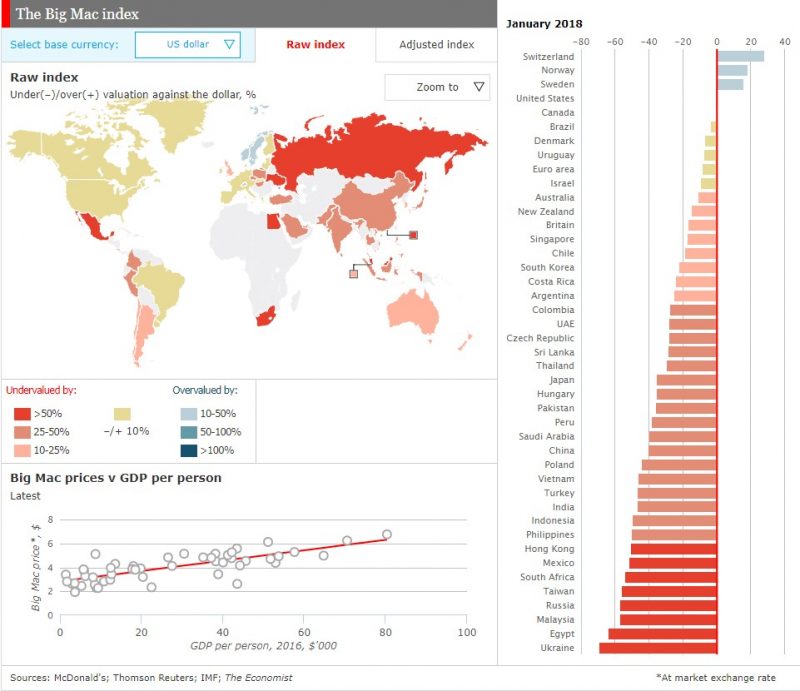

Purchasing Power Parity or Nominal Exchange Rates?

“An alternative exchange rate – the purchasing power parity (PPP) conversion factor – is preferred because it reflects differences in price levels for both tradable and non-tradable goods and services and therefore provides a more meaningful comparison of real output.” – the World Bank

Read More »

Read More »

Socialism and Capital Consumption

We have been promising to get back to the topic of capital destruction, which we put on hiatus for the last several weeks to make our case that the interest rate remains in a falling trend. Today, we have a different way of looking at capital destruction.

Read More »

Read More »