Category Archive: 6b.) Debt and the Fallacies of Paper Money

Is a Rapid Advance in the Japanese Stock Market Imminent?

The Japanese stock market is quite unique: it would need to rally by approximately 80% to reach its former historical peak. What’s more, said peak was attained on the final trading day of 1989, more than 25 years ago. In short, Japanese stocks have been anything but a good investment in recent years.

Read More »

Read More »

How to Survive the Winter

One of the fringe benefits of living in a country that’s in dire need of a political, financial, and cultural reset, is the twisted amusement that comes with bearing witness to its unraveling. Day by day we’re greeted with escalating madness. Indeed, the great fiasco must be taken lightly, so as not to be demoralized by its enormity.

Read More »

Read More »

Marc Faber, Freedom of Speech & Capitalism

Political Correctness Hampers Honest Debate. What would the world be like today had Europeans never colonized Americas, Africa, the Middle East, Australia, New Zealand, and South Asia? Most of these societies would still not have discovered the wheel. It takes a huge amount of reality-avoidance and ineptitude for outsiders who travel there not to realize that a billion or more people in the Third World still wouldn’t have discovered the wheel.

Read More »

Read More »

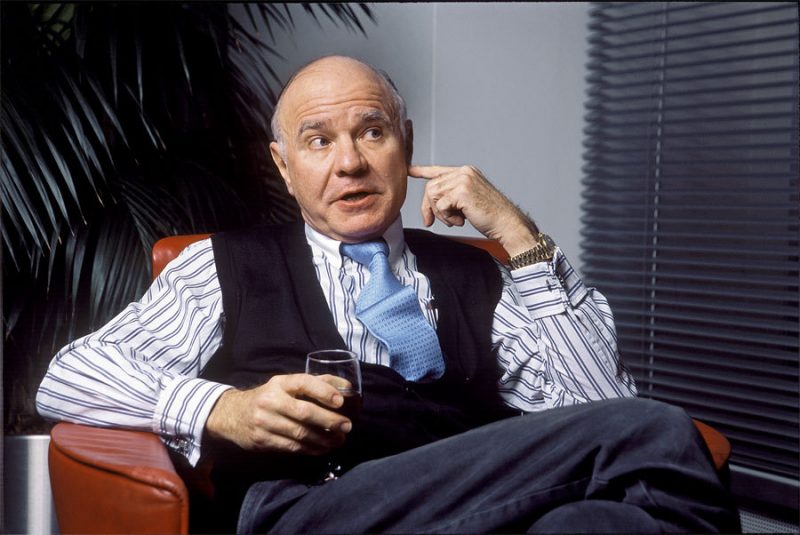

On the Marc Faber Controversy

By this time anyone reading this particular article on Acting Man will know about the controversy surrounding Marc Faber these last days, when a single paragraph of many from his October 2017 newsletter was published out of context.

Read More »

Read More »

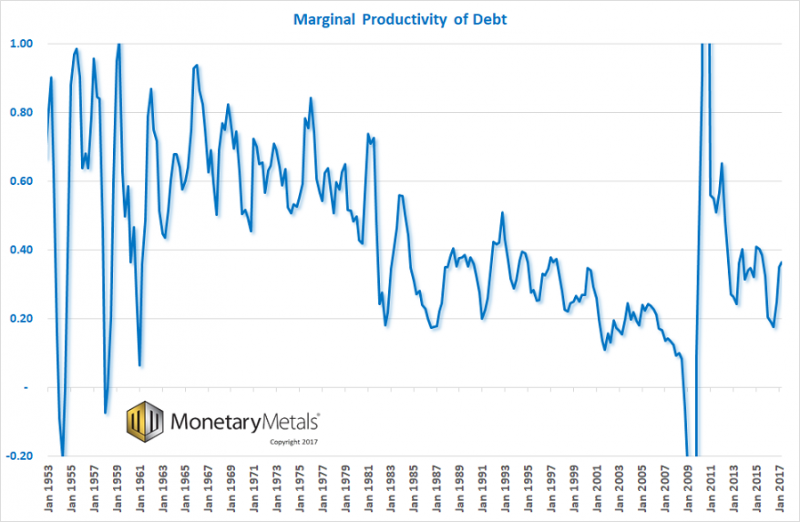

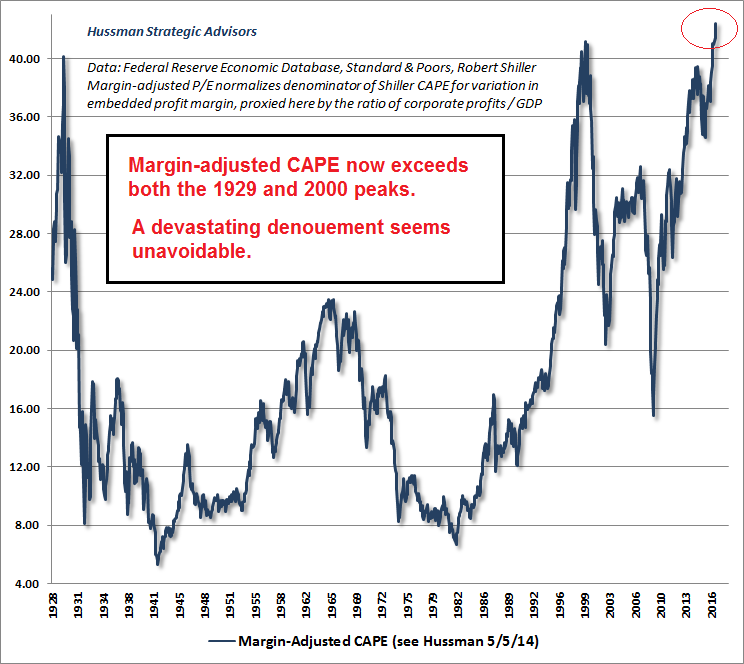

The Falling Productivity of Debt

Discounting the Present Value of Future Income. Last week, we discussed the ongoing fall of dividend, and especially earnings, yields. This Report is not a stock letter, and we make no stock market predictions. We talk about this phenomenon to make a different point. The discount rate has fallen to a very low level indeed.

Read More »

Read More »

The Donald Can’t Stop It

The Dow’s march onward and upward toward 30,000 continues without a pause. New all-time highs are notched practically every day. Despite Thursday’s 31-point pullback, the Dow is up over 15.5 percent year-to-date. What a remarkable time to be alive. President Donald Trump is pumped! As Commander in Chief, he believes he possesses divine powers. He can will the stock market higher – and he knows it.

Read More »

Read More »

Le déclin de la valeur travail

Le travail: toujours une valeur? Et a-t-il encore de la valeur? Le commerce et, d’une manière générale, les échanges transfrontaliers entre nations, ont considérablement amélioré nos conditions de vie. Mais, en fait, que ferait-on sans commerce ? En d’autres termes, s’il fallait tout réaliser soi-même sans faire appel à d’autres corps de métier, à d’autres entreprises et à d’autres nations dont la spécialité n’est guère disponible dans notre pays...

Read More »

Read More »

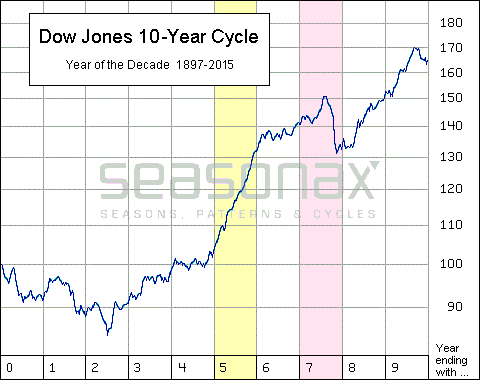

1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation. Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked the beginning of the GFC...

Read More »

Read More »

London House Prices Are Falling – Time to Buckle Up

London house prices fall in September: first time in eight years. High-end London property fell by 3.2% in year. House sales down by over a very large one-third. Global Real Estate Bubble Index – see table. Brexit, rising inflation and political uncertainty causing many buyers to back away from market. U.K. housing stock worth record £6.8 trillion, almost 1.5 times value of LSE and more than the value of all the gold in world.

Read More »

Read More »

Donald Trump: Warmonger-in-Chief

If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! This past week, the Donald has continued his bellicose talk with both veiled and explicit threats against purported American adversaries throughout the world.

Read More »

Read More »

Federal Reserve President Kashkari’s Masterful Distractions

The True Believer.How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard.

Read More »

Read More »

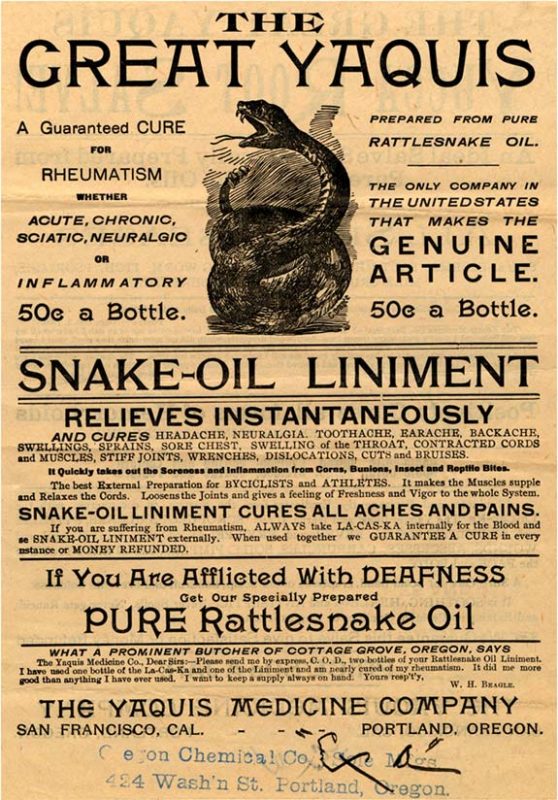

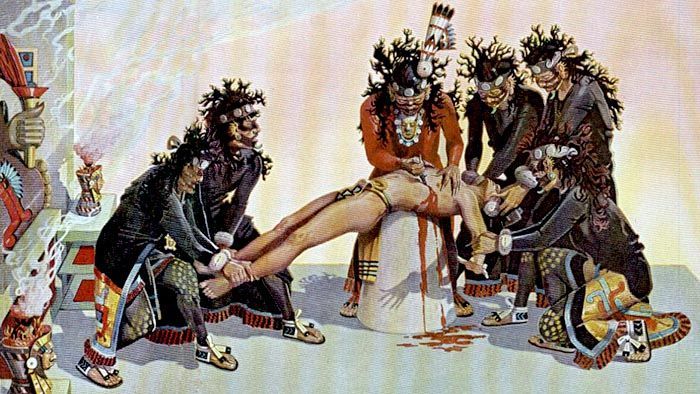

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »

India: The Genie of Lawlessness is out of the Bottle

Recapitulation (Part XVI, the Last). Since the announcement of demonetization of Indian currency on 8th November 2016, I have written a large number of articles. The issue is not so much that the Indian Prime Minister, Narendra Modi, is a tyrant and extremely simplistic in his thinking (which he is), or that demonetization and the new sales tax system were horribly ill-conceived (which they were). Time erases all tyrants from the map, and...

Read More »

Read More »

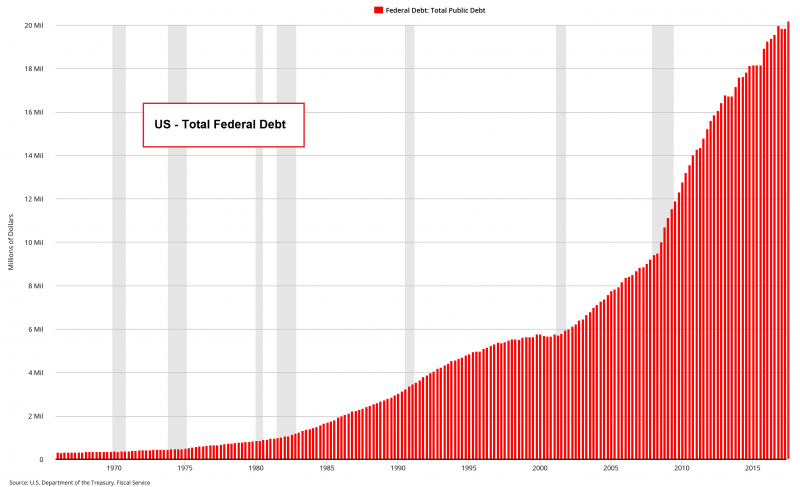

US Debt: To Hell In A Bucket

No-one Cares. “No one really cares about the U.S. federal debt,” remarked a colleague and Economic Prism reader earlier in the week. “You keep writing about it as if anyone gives a lick.” We could tell he was just warming up. So, we settled back into our chair and made ourselves comfortable.

Read More »

Read More »

21st Century Shoe-Shine Boys

Anecdotal Flags are Waved. “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

– Joseph Kennedy

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat...

Read More »

Read More »

The Government Debt Paradox: Pick Your Poison

“Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted.

Read More »

Read More »

Christopher Columbus and the Falsification of History

The Los Angeles City Council’s recent, crazed decision* to replace Christopher Columbus Day with one celebrating “indigenous peoples” can be traced to the falsification of history and denigration of European man which began in earnest in the 1960s throughout the educational establishment (from grade school through the universities), book publishing, and the print and electronic media.

Read More »

Read More »

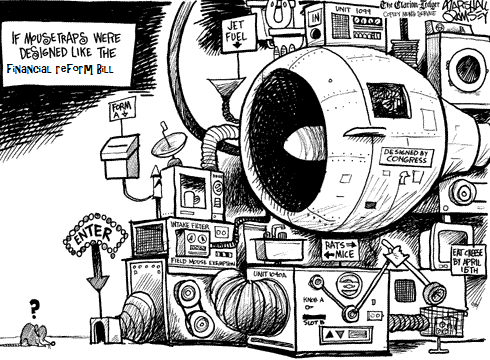

How to Make the Financial System Radically Safer

Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism.

Read More »

Read More »

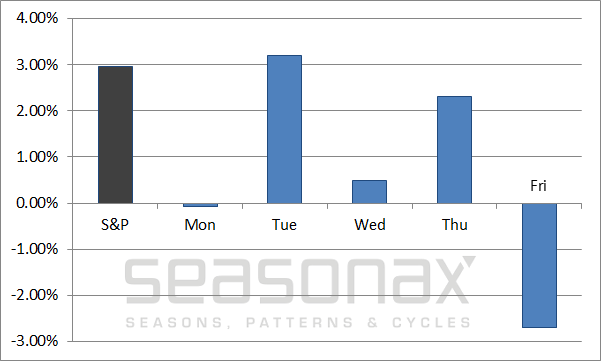

S&P 500 Index: A Single Day Beats the Entire Week!

Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods.

Read More »

Read More »