Category Archive: 6b.) Debt and the Fallacies of Paper Money

French Selection Ritual, Round Two

The nightmare of nightmares of the globalist elites and France’s political establishment has been avoided: as the polls had indicated, Emmanuel Macron and Marine Le Pen are moving on to the run-off election; Jean-Luc Mélenchon’s late surge in popularity did not suffice to make him a contender – it did however push the established Socialist Party deeper into the dustbin of history.

Read More »

Read More »

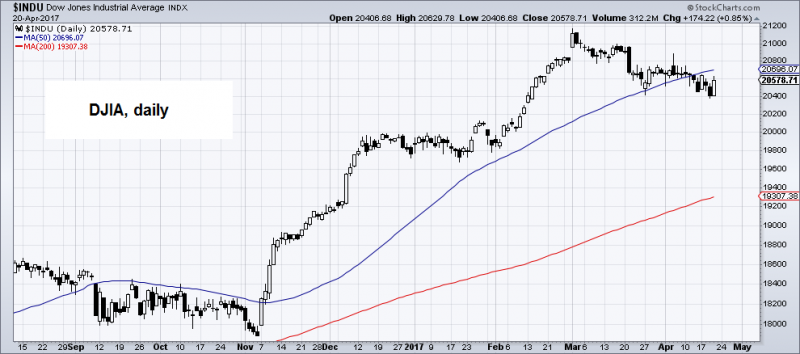

Central Banks Have a $13 Trillion Problem

GUALFIN, ARGENTINA – The Dow was down 118 points on Wednesday. It should have been down a lot more. Of course, markets know more than we do. And maybe this market knows something that makes sense of these high prices. What we see are reasons to sell, not reasons to buy.

Read More »

Read More »

Simple Math of Bank Horse-Puckey

We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights.

Read More »

Read More »

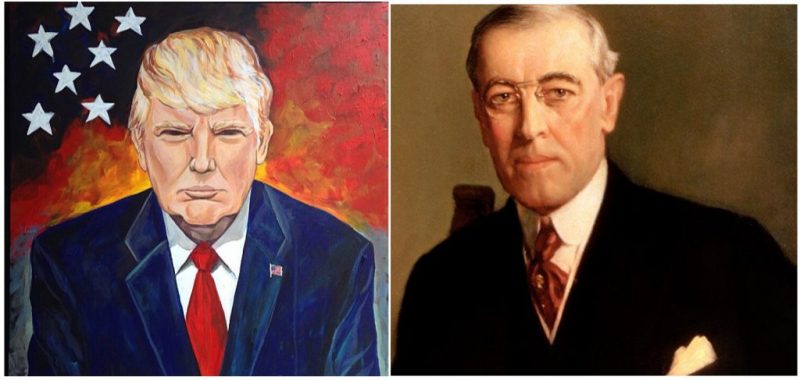

On the Commemoration of World War I: From Woodrow Wilson to Donald Trump

It is altogether fitting that the US attack on a Syrian airport, the dropping of a MOAB on defenseless Afghanistan, and the potential outbreak of nuclear war with North Korea have all come in the very month in which an American president led the nation on its road to empire one hundred years earlier.

Read More »

Read More »

India – Is Kashmir Gone?

Everything Gets Worse (Part XII) – Pakistan vs. India After 70 years of so-called independence, one has to be a professional victim not to look within oneself for the reasons for starvation, unnatural deaths, utter backwardness, drudgery, disease, and misery in India.

Read More »

Read More »

French Election – Bad Dream Intrusion

The French presidential election was temporarily relegated to the back-pages following the US strike on Syria, but a few days ago, the Economist Magazine returned to the topic, noting that a potential “nightmare option” has suddenly come into view. In recent months certainty had increased that once the election moved into its second round, it would be plain sailing for whichever establishment candidate Ms. Le Pen was going to face. That certainty...

Read More »

Read More »

Hell To Pay

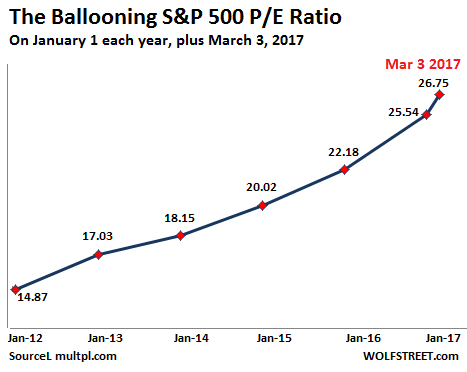

Economic nonsense comes a dime a dozen. For example, Federal Reserve Chair Janet Yellen “think(s) we have a healthy economy now.” She even told the University of Michigan’s Ford School of Public Policy so earlier this week. Does she know what she’s talking about?

Read More »

Read More »

The Cost of a Trump Presidency

Last Thursday’s wanton attack on a Syrian air field by the US and its bellicose actions toward North Korea have brought the real cost of candidate Trump’s landslide victory last November to the forefront. Unlike most laymen, accountants, and financial analysts, economists look at cost differently.

Read More »

Read More »

The American Empire and Economic Collapse

Despite widespread optimism among libertarians, classical liberals, non-interventionists, progressive peaceniks and everybody else opposed to the US Empire that some of its murderous reins may finally be pulled in with the election of Donald Trump, it appears that these hopes have now been dashed.

Read More »

Read More »

LIBOR Pains

If one searches for news on LIBOR (=London Interbank Offered Rate, i.e., the rate at which banks lend dollars to each other in the euro-dollar market), they are currently dominated by Deutsche Bank getting slapped with a total fine of $775 million for the part it played in manipulating the benchmark rate in collusion with other banks (fine for one count of wire fraud: US$150 m.; additional shakedown by US Justice Department: US$625 m., the price...

Read More »

Read More »

Price Inflation – The Ultimate Contrarian Bet

If there is one thing apparently no-one believes to be possible, it is a resurgence of consumer price inflation. Actually, we are not expecting it to happen either. If one compares various “inflation” data published by the government, it seems clear that the recent surge in headline inflation was largely an effect of the rally in oil prices from their early 2016 low.

Read More »

Read More »

March to Default

“May you live in interesting times,” says the ancient Chinese curse. No doubt about it, we live in interesting times. Hardly a day goes by that we’re not aghast and astounded by a series of grotesque caricatures of the world as at devolves towards vulgarity. Just this week, for instance, U.S. Representative Maxine Waters tweeted, “Get ready for impeachment.”

Read More »

Read More »

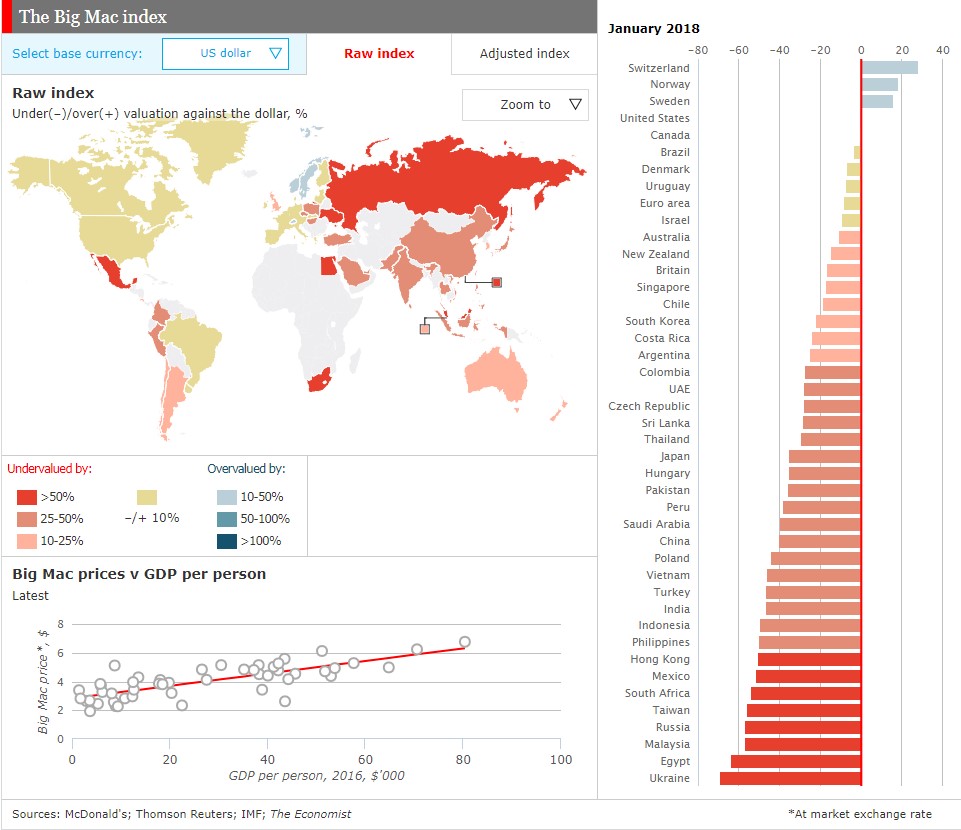

“People Need to Understand that their Biggest Asset is Individual Liberty” – an Interview with Claudio Grass

As election season is upon us in Europe and political and economic tensions are heating up, Claudio Grass notes that “the euro is the most artificial currency in history”, highlighting one of the most fundamental problems at the heart of the EU’s troubles. It is undeniable that public awareness is growing, and so is active opposition to ever greater centralization of political power.

Read More »

Read More »

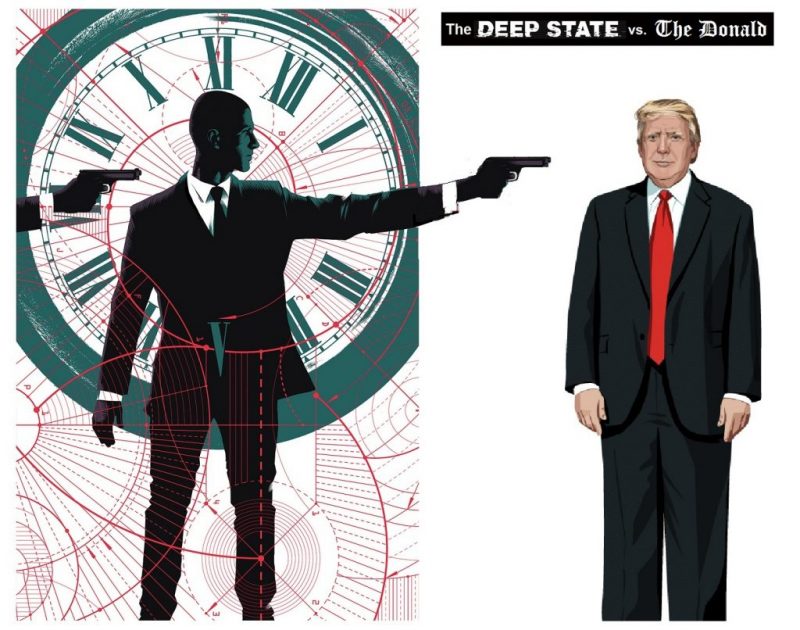

Welcome to Totalitarian America, President Trump!

If there had been any doubt that the land of the free and home of the brave is now a totalitarian society, the revelations that its Chief Executive Officer has been spied upon while campaigning for that office and during his brief tenure as president should now be allayed.

Read More »

Read More »

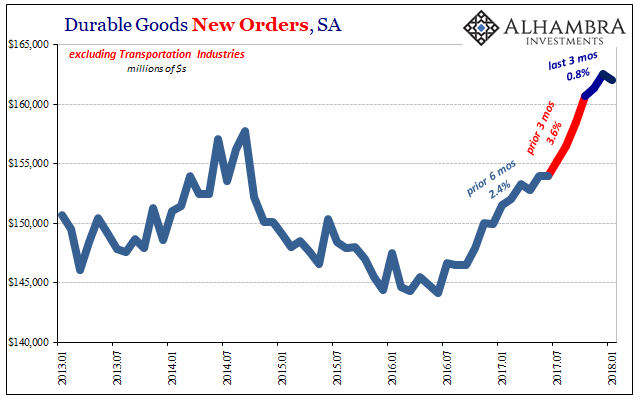

The Long Run Economics of Debt Based Stimulus

Something both unwanted and unexpected has tormented western economies in the 21st century. Gross domestic product (GDP) has moderated onward while government debt has spiked upward. Orthodox economists continue to be flummoxed by what has transpired.

Read More »

Read More »

Boosting Stock Market Returns With A Simple Trick

Trading methods based on statistics represent an unusual approach for many investors. Evaluation of a security’s fundamental merits is not of concern, even though it can of course be done additionally. Rather, the only important criterion consists of typical price patterns determined by statistical examination of past trends.

Read More »

Read More »

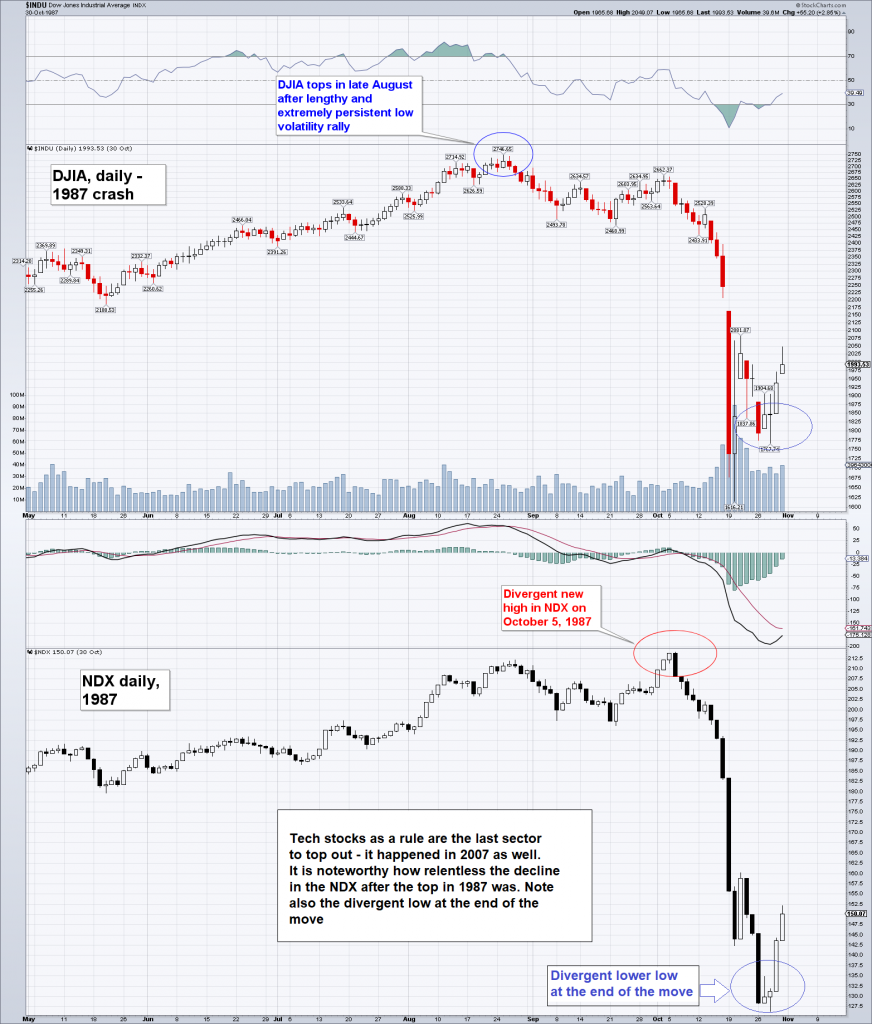

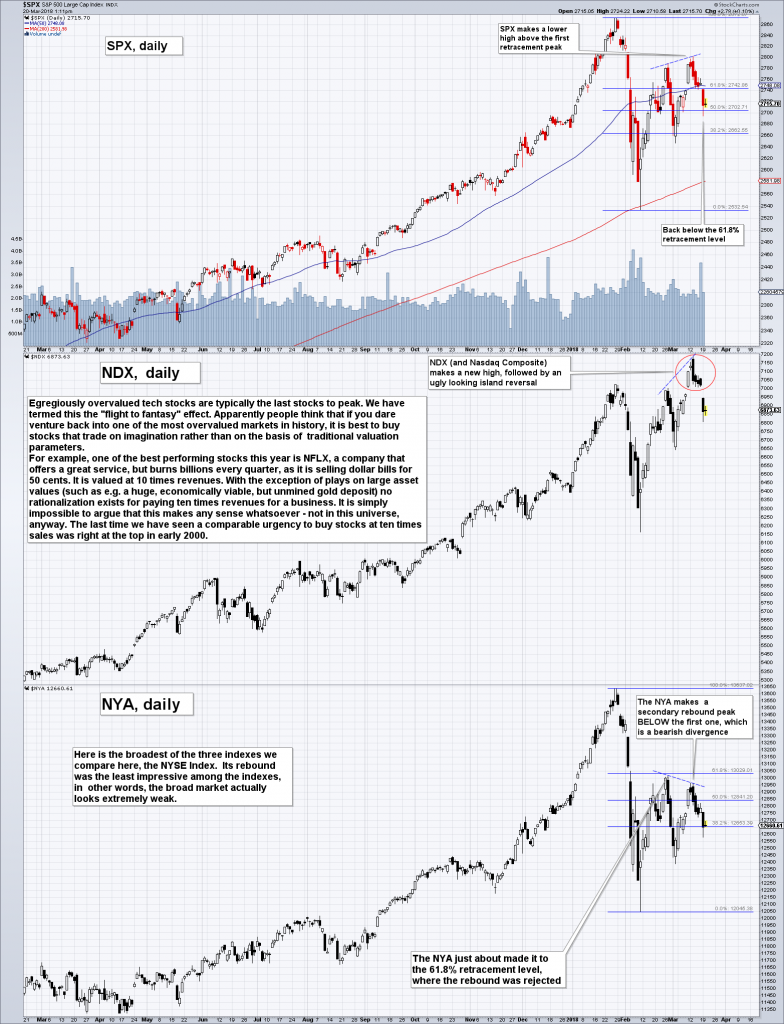

Speculative Blow-Offs in Stock Markets – Part 2

As noted in Part 1, historically, blow-patterns in stock markets share many characteristics. One of them is a shifting monetary backdrop, which becomes more hostile just as prices begin to rise at an accelerated pace, the other is the psychological backdrop to the move, which entails growing pressure on the remaining skeptics and helps investors to rationalize their exposure to overvalued markets.

Read More »

Read More »

Speculative Blow-Offs in Stock Markets – Part 1

Why is the stock market seemingly so utterly oblivious to the potential dangers and in some respects quite obvious fundamental problems the global economy faces? Why in particular does this happen at a time when valuations are already extremely stretched? Questions along these lines are raised increasingly often by our correspondents lately. One could be smug about it and say “it’s all technical”, but there is more to it than that. It may not be...

Read More »

Read More »

The Big Myth

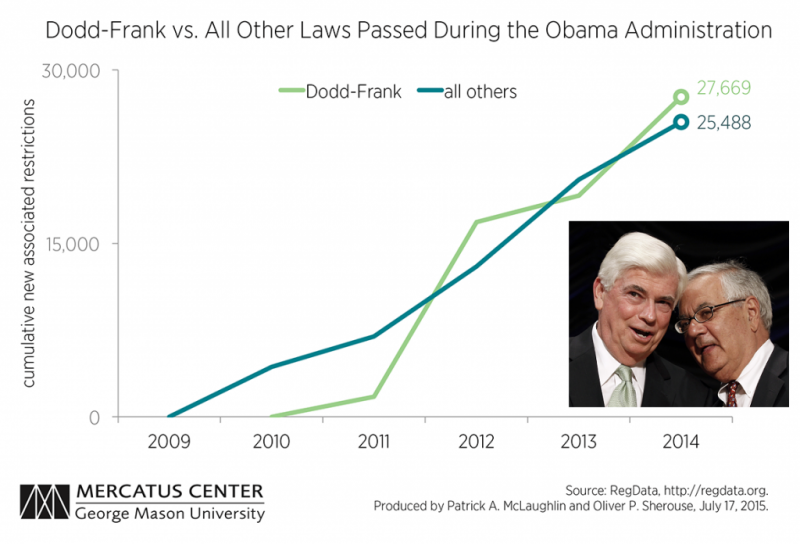

Don Watkins of the Ayn Rand Institute wrote an article, The Myth of Banking Deregulation, to debunk a lie. The lie is that bank regulation is good. That it helped stabilize the economy in the 1930’s. And that deregulation at the end of the century destabilized the economy and caused the crisis of 2008.

Read More »

Read More »

Farewell, Welfare State

The tweet was never sent and never received: “Lying Otto von Bismarck set us up for bankruptcy! What was he thinking? Sad!!” Instead, Mr. Trump said last weekend that, far from trying to curb the promises and cut the costs of the welfare state, he was nearly ready to unveil a plan to replace Obamacare with something better: a plan that would provide “insurance for everybody.”

Read More »

Read More »