Category Archive: 6b.) Acting Man

Donald’s Electoral Struggle

Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign!

Read More »

Read More »

A Different Candidate?

French for Trump OUZILLY, France – There are two ways you can destroy a country: pull down its money or build up its military. Usually, they go hand in hand – one hand ruining the economic body, the other attacking the soul.

Read More »

Read More »

Why the Deep State Is Dumping Hillary

Join me in offering solutions by becoming a $1/month patron of this wild and crazy site via patreon.com.

Read More »

Read More »

Great Causes, a Sea of Debt and the 2017 Recession

NORMANDY, FRANCE – We continue our work with the bomb squad. Myth disposal is dangerous work: People love their myths more than they love life itself. They may kill for money. But they die for their religions, their governments, their clans… and their ideas.

Read More »

Read More »

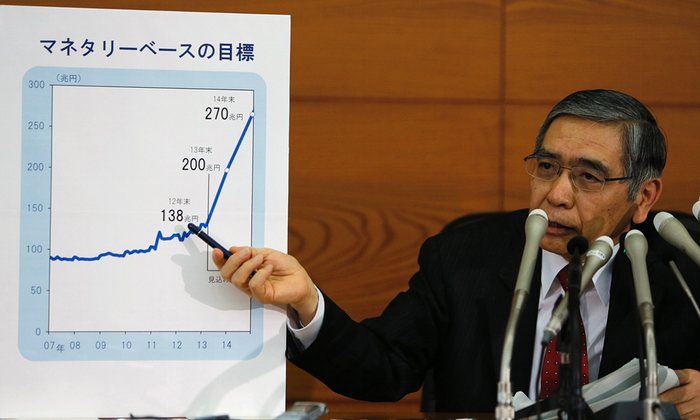

Don’t Bet on Deflation Lasting Forever

Japan’s stock market crashed in 1989. Since then, the no-luck Japanese have had sluggish growth, recession, and on-again/off-again deflation. For more than a quarter-century, the gears of Japan, Inc. have turned slowly. But will it last forever?

Read More »

Read More »

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »

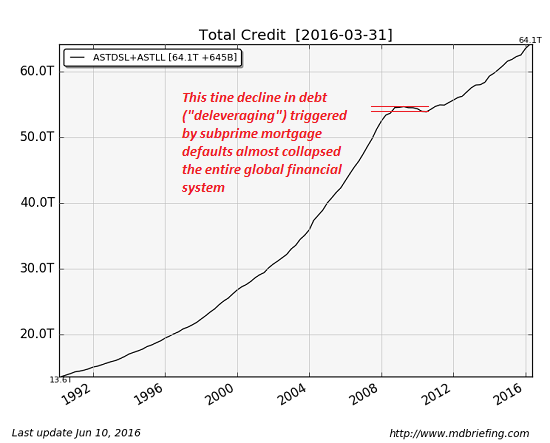

Why the Coming Wave of Defaults Will Be Devastating

In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by subprime mortgage defaults (a.k.a. deleveraging) very nearly collapsed not just the U.S. financial system but the entire global financial system.

Read More »

Read More »

Get Ready for a New Crisis – in Corporate Debt

OUZILLY, France – We’re going back to basics here at the Diary. We’re getting everyone on the same page… learning together… connecting the dots… trying to figure out what is going on. We made a breakthrough when we identified the source of so many of today’s bizarre and grotesque trends. It’s the money – the new post-1971 dollar. This new dollar is green. You can buy things with it.

Read More »

Read More »

Janet Yellen’s Shame

n honest capitalism, you do what you can to get other people to voluntarily give you money. This usually involves providing goods or services they think are worth the price. You may get a little wild and crazy from time to time, but you are always called to order by your customers.

Read More »

Read More »

The Donald Versus Killary: War or Peace?

War: A Warning from the Past. Although history does not exactly repeat itself, it does provide parallels and sometimes quite ominous ones. Such is the case with the current U.S. Presidential election and the one which occurred one hundred years earlier.

Read More »

Read More »

The Strikingly Weak ISM Purchasing Manager Indices

We are always paying close attention to the manufacturing sector, which is far more important to the US economy than is generally believed. The ISM index shows striking weakness.

Read More »

Read More »

Follow the Money

PARIS – It’s back to Europe. Back to school. Back to work. Let’s begin by bringing new readers into the discussion… and by reminding old readers (and ourselves) where we stand. US economic growth: average annual GDP growth over time spans ranging from 120 to 10 years (left hand side) and the 20 year moving average of annual GDP growth since 1967

Read More »

Read More »

How is Real Wealth Created?

An Abrupt Drop. Let’s turn back to our regular beat: the U.S. economy and its capital markets. We’ve been warning that the Fed would never make any substantial increase to interest rates. Not willingly, at least. Each time Fed chief Janet Yellen opens her mouth, out comes a hint that more rate hikes might be coming.

Read More »

Read More »

US Economy – Curious Pattern in ISM Readings

Head Fake Theory Confirmed? This is a brief update on our last overview of economic data. Although we briefly discussed employment as well, the overview was as usual mainly focused on manufacturing, which is the largest sector of the economy by gross output.

Read More »

Read More »

John Maynard Keynes’ General Theory Eighty Years Later

The “Scientific” Fig Leaf for Statism and Interventionism. To the economic and political detriment of the Western world and those economies beyond which have adopted its precepts, 2016 marks the eightieth anniversary of the publication of one of, if not, the most influential economics books ever penned, John Maynard Keynes’ The General Theory of Employment, Interest and Money.

Read More »

Read More »

Shrewd Financial Analysis in the Year 2016

“Markets make opinions,” says the old Wall Street adage. Perhaps what this means is that when stocks are going up, many consider the economy to be going great. Conversely, when stocks tank it must be because the economic sky is falling.

Read More »

Read More »

How Does It All End? Part II

Low Rates Forever, Nothing much is happening in the money world. The press reports that traders are hanging loose, wondering what dumb thing the Fed will do next. Rumor has it that it may decide to raise rates in September, or maybe November… or maybe not at all.

Read More »

Read More »

How Does It All End?

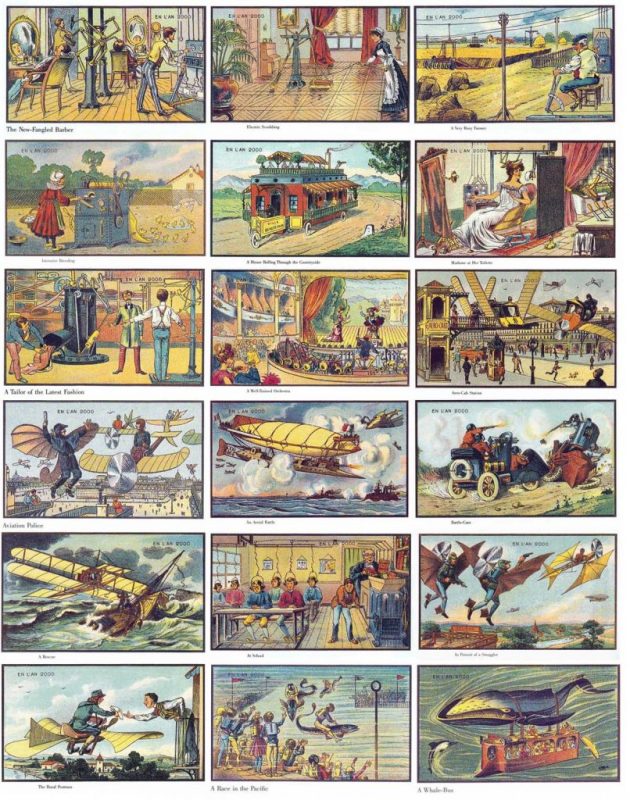

In 1900, a survey was done. “What do you see coming?” asked the pollsters. All of those people questioned forecast better times ahead. Machines were just making their debut, but already people saw their potential. You can see some of that optimism on display today in the Paris Metro. In the Montparnasse station is an illustration from the late 1800s of what the artist imagined for the next century.

Read More »

Read More »

US Presidential Election – How Reliable are the Polls?

Is Clinton’s Lead Over Trump as Large as Advertised? Once upon a time, political polls tended to be pretty accurate (there were occasional exceptions to this rule, but they were few and far between). Recently there have been a few notable misses though. One that comes to mind is the Brexit referendum.

Read More »

Read More »