Category Archive: 6b.) Acting Man

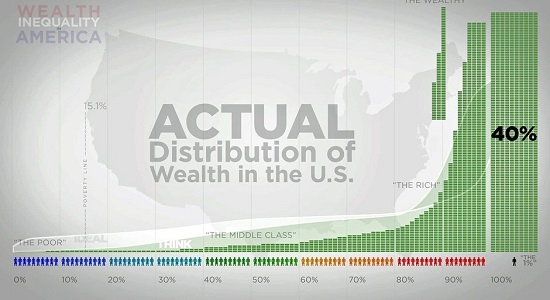

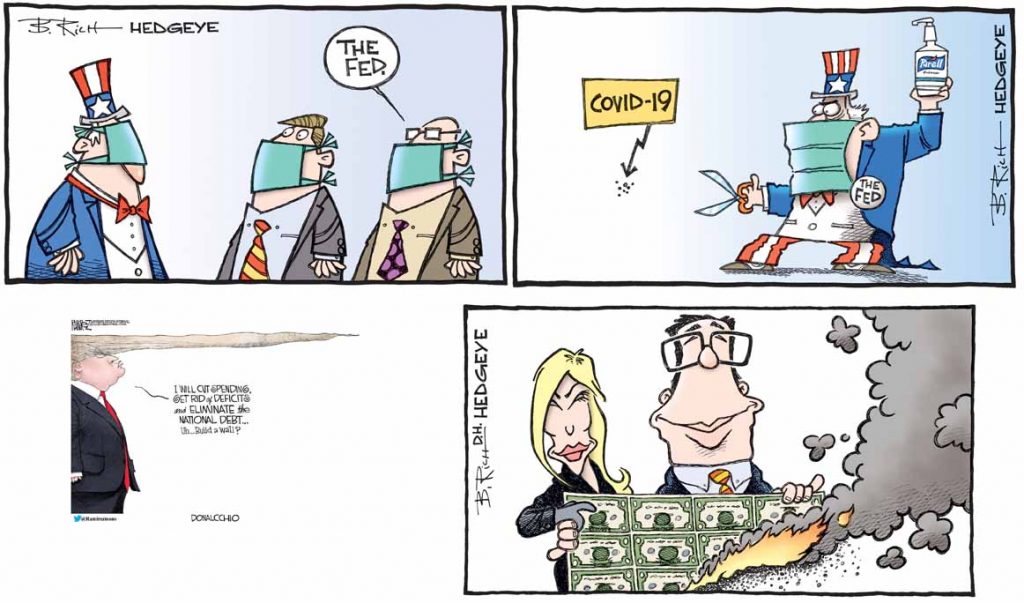

Central Banks = Welfare for the Wealthy

The fact that central banks provide welfare for the wealthy is now entering the mainstream. The fact that all central bank policies since 2008 have dramatically increased wealth and income inequality is now grudgingly being accepted as reality by mainstream economists and the financial media. The central banks' PR facade of noble omniscience on behalf of the great unwashed masses has cracked wide open.

Read More »

Read More »

The Idea that Overseas Manufacturing Jobs will Return to the US is Pure Fantasy

As we enter the final lap of the presidential race in the United States, as always, the two candidates will say just about anything to secure your vote. And of course the economy is a major topic of conversation. Loud calls for both higher wages and more jobs dominate the rhetoric. Naturally, Hillary Clinton and Donny Trump claim they can easily solve both of these problems. I can only laugh at their certitude. They are so wrong… and like true...

Read More »

Read More »

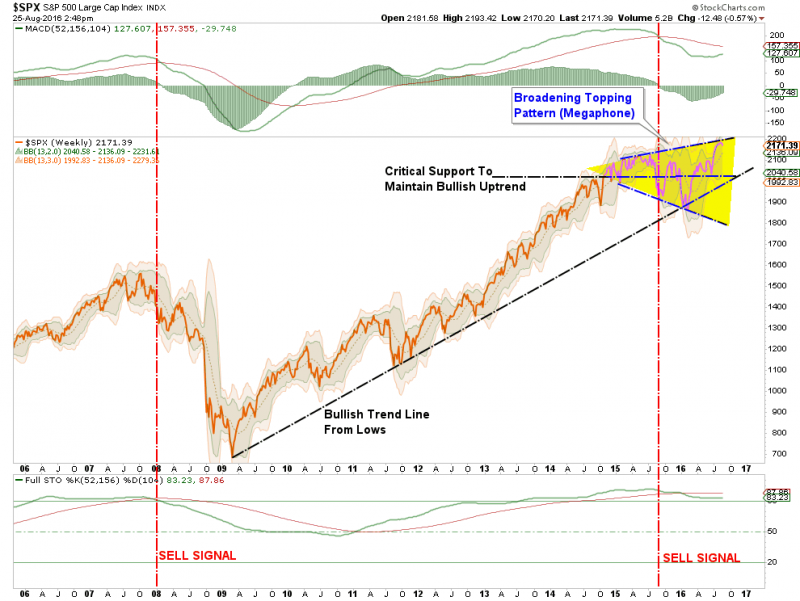

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »

Party Like It’s 1999

OUZILLY, France – The farther you get from the big city, or the international press… the closer you get to reality. The myth and claptrap disappears as distance shortens. Imagination gives way to fact. Gone is global warming, for instance. Instead, you find – as we did when we drove to Nova Scotia for a summer holiday in the 1990s – that it will be “75 degrees in Halifax again today… No relief in sight.”

Read More »

Read More »

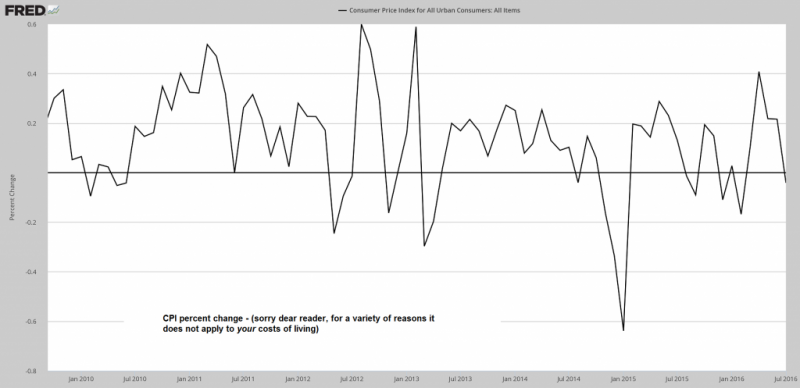

Yarns, Mysteries, and the CPI

Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. In reality, the CPI is so distorted and disfigured it doesn’t really tell us much that’s useful. Empirical experience and common sense are much better indicators of inflation and deflation. What’s more, you don’t have...

Read More »

Read More »

Should we Be Concerned About the Fall in Money Velocity?

A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959.

Read More »

Read More »

Does the UK Need Even More Stimulus?

“We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the economy, and the sooner the better,” — argues the...

Read More »

Read More »

The Deep State’s Catch-22

What happens if the Deep State pursues the usual pathological path of increasing repression? The system it feeds on decays and collapses. Catch-22 (from the 1961 novel set in World War II Catch-22) has several shades of meaning (bureaucratic absurdity, for example), but at heart it is a self-referential paradox: you must be insane to be excused from flying your mission, but requesting to be excused by reason of insanity proves you're sane.

Read More »

Read More »

Retail Snails

Second Half Recovery Dented by “Resurgent Consumer”. We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example.

Read More »

Read More »

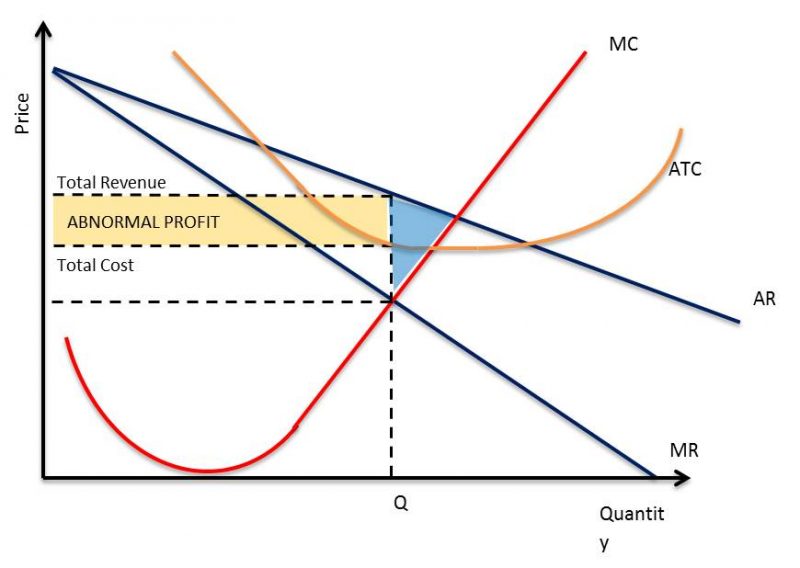

The Great Stock Market Swindle

Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven.

Read More »

Read More »

Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller.

Read More »

Read More »

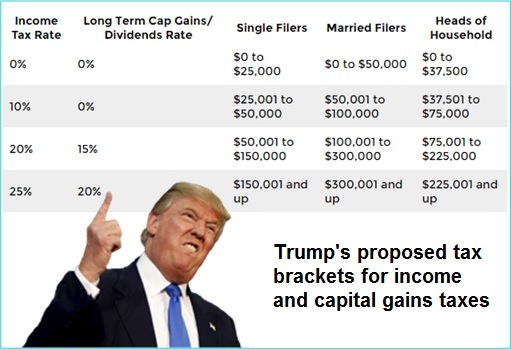

Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system.

Read More »

Read More »

Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame).

Read More »

Read More »

US Economy – Something is not Right

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong?

Read More »

Read More »

States Must Help Restore Sound Money in America

Control the money, and you control the people. Over the last hundred years, the federal government and the Federal Reserve, a privately owned bank cartel conceived of in secret, have waged a war on sound money in America. They’ve ended the free circulation of gold (and, for a time, criminalized its ownership), while imposing taxes on those who trade with it.

Read More »

Read More »

Trump is Right About Stocks

It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice.

Read More »

Read More »

Deflation Is Always Good for the Economy

“Experts” Assert that Inflation is an Agent of Economic Growth. For most experts, deflation, which they define as a general decline in prices of goods and services, is bad news since it generates expectations for a further decline in prices.

Read More »

Read More »

Jailing Banksters Will Not Resolve the Economic Crisis

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months).

Read More »

Read More »

Why Americans Get Poorer

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for...

Read More »

Read More »

Should the Government Give Us Infrastructure?

“Bad” Monopolies? An argument against absolutely free markets comes up often. What about so-called natural monopolies? So-called infrastructure projects (e.g. sewage plants) have high barriers to entry, and are a challenge to true competition.

Read More »

Read More »