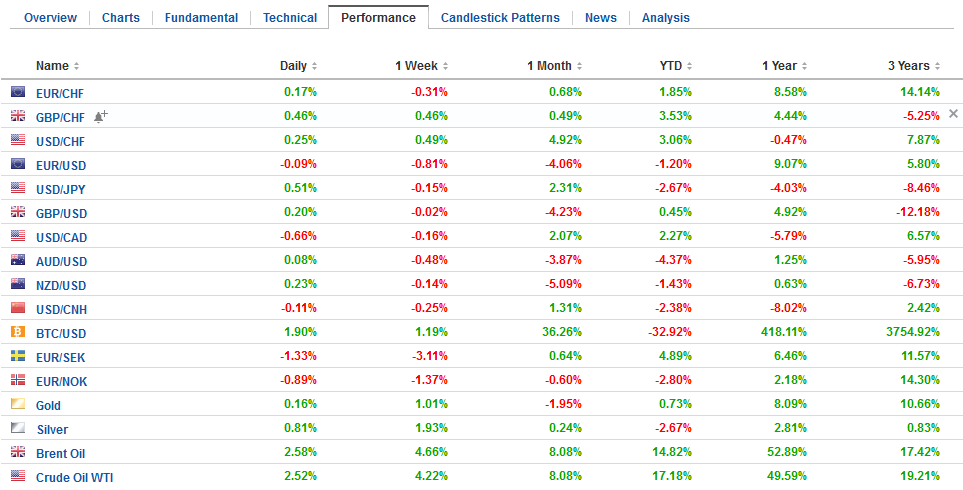

Swiss FrancThe Euro has risen by 0.29% to 1.1914 CHF. |

EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro’s losses. The euro dipped below $1.1825. The single currency is off a cent this week after falling nearly two last week. A 38.2% retracement of the euro’s gains since the beginning of last year is found a little above $1.1700 and represents the next important target. The dollar is drawing closer to the JPY110 cap that turned it back last. There is a $545 mln option struck there that expires today. The dollar is above its 200-day moving average against most of the major currencies, save the Japanese yen. It is found near JPY110.20. The high from early February is found near JPY110.50. |

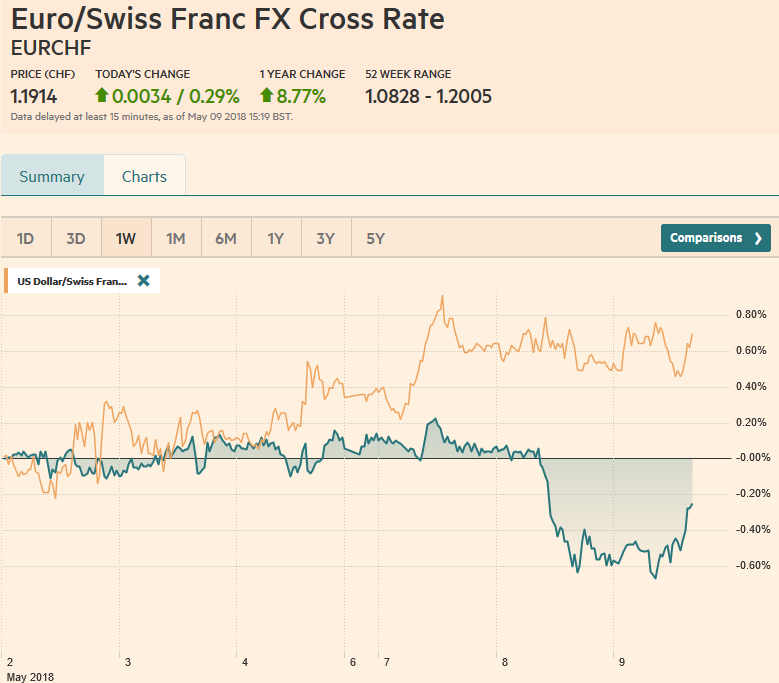

FX Daily Rates, May 09 |

| Sterling is weaker but the shelf carved in recent sessions around $1.3485 remains intact. There is a GBP222 mln option at $1.3525 that expires today. The $1.3560 area offers a nearby cap. The news flow is anything but good. The BRC reported a 4.2% drop in April same-store sales and a 3.1% decline overall, which is the largest since the time series began in 1995. A separate private survey showed business, especially in retail, with the weakest demand in four months. The Easter holiday, no doubt, skewed the data, but the signal is weak and that is consistent with the recent UK data.

On top of that, the House of Lords passed additional amendments to the government’s Withdrawal Bill. The House of Commons will likely unwind many if not most of the amendments, but likely not all, and this leaves the government’s ultimate position unclear with a little more than nine months before the exit. Cross rate demand for sterling may be helping it be a little resilient to the dollar. The euro has been sold from GBP0.8850 at the end of last week to GBP0.8750 today. Trendline support from the lows in the middle of last month is found just below there today, which also corresponds to a 50% retracement of that advance. It seems like it is at least partly a question of relative positioning, with the speculative market, judging from the futures activity, as of a week ago, still extremely long euros. |

FX Performance, May 09 |

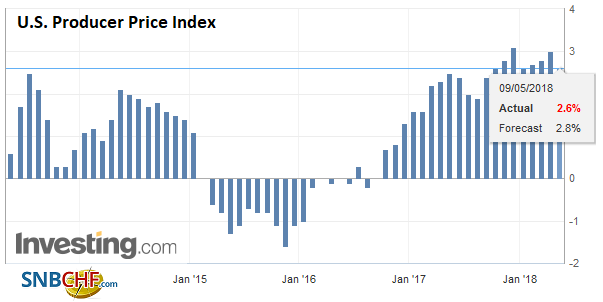

United StatesThe North American session has a light economic calendar. The main features are the April US PPI and Canada’s building permits. Owing to the base effect, a 0.2% increase in the headline and core rate as the median forecasts suggest, will translate into a softer year-over-year rate. It is unlikely to be much of a market mover and the signal from price pressures is still to the upside. Earlier this week, Canada reported softer than expected April housing starts. This would seem to have stolen whatever thunder may have been in the March permits data. |

U.S. Producer Price Index (PPI) YoY, May 2013 - 2018(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

The US decision to leave withdraw from the agreement with Iran was well telegraphed. A little more than 12 hours after the announcement, oil prices have recovered. Brent has rallied through $77 and WTI $71 before consolidating. Equity markets are mixed. China and Japan were the main drags on the MSCI Asia Pacific Index which was off about 0.35% and is the first decline of the week. However, MSCI Emerging Markets Index is faring better and is eking out a small gain, which would be the third in a row. The Dow Jones Stoxx 600 is up 0.2% in mid-morning turnover, as the advance is being extended for a fourth consecutive session.

The reimposition of US sanctions will be phased in over the next 90-180 days. The gamble is that the anticipated pain of the sanctions will drive Iran back to the bargaining table and allow for a more comprehensive agreement. Companies with existing Iranian business commitments have until early August and early November to comply. The first phase involves exposure to Iranian sovereign debt and currency, precious and industrial metals. The second phase focuses on the oil industry and significant action with the Iranian central bank.

Initial estimates suggest that the sanctions could impact 200k-300k barrels of oil a day of Iranian exports. The initial sanctions that were applied by a coalition, before 2015, saw Iranian oil sales cut by 1.0-1.5 mln barrels. When thinking of the companies that are impacted, think broadly and not just oil, infrastructure, and finance. For example, Boeing’s license to sell aircraft to Iran has been revoked. This could impact as much as $20 bln in orders.

The rise of dollar LIBOR rates that began in Q4 17 may have been driven by several factors, including Fed tightening, a surge of T-bill issuance, and unintended consequences of tax reform that impacts intra-company loans. If these are the main drivers, then after the market makes the adjustment the pressure on LIBOR should ease. Most recently, the US Treasury paid down nearly $125 bln of bills. Rate expectations have stabilized. Yesterday saw a 1.6 bp decline in the three-month benchmark. It does not sound like much, but it is the biggest decline in almost two years, and at 2.3525%, it is the lowest in a month. Some other unsecured funding rates, like commercial paper, have edged higher. The net result is a new re-convergence. This normalization is taking place at higher absolute interest rates.

Argentina has gone hat in hand back to the IMF. It reportedly seeks a $30 bln flexible line of credit after hiking rates to 40% and spending $5 bln of reserves failed to staunch the capital strike. At yesterday’s low, the Argentine peso had fallen 12% over the past eight sessions. The relationship between the IMF and Argentina has warmed, it has been anything but smooth and stable over the past couple of decades.

A flexible credit line is to be a precautionary facility for countries who have strong fundamentals and the IMF’s endorsement. Colombia, Mexico, and Poland are the only participants of the program, and none drew on the line. Poland exited theirs last year. The peso recouped some of its early losses in an hour or so before the announcement and then pushed back toward the lower end of the day range. While the IMF request may have broken the panic, it is not clear that a low place. Watch the ARS22.20-ARS23.20 range.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Libor,newslettersent,U.S. Producer Price Index,USD/CHF