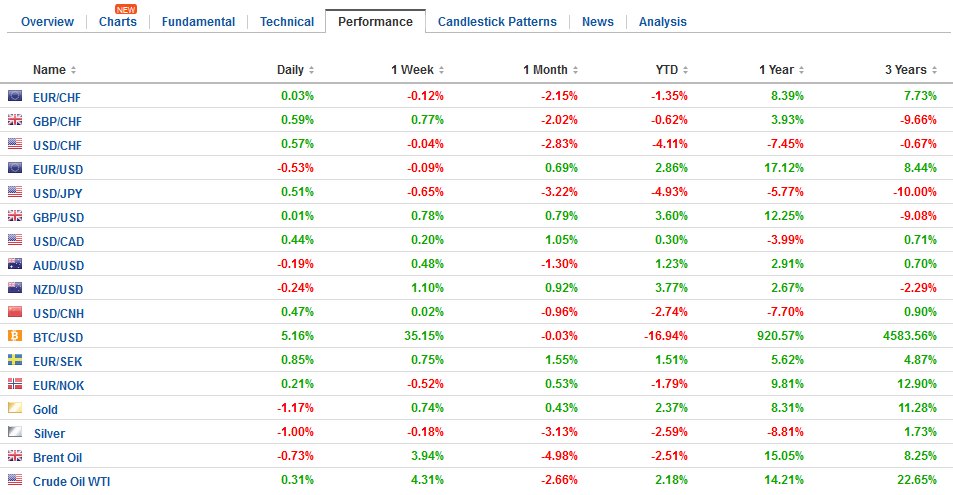

Swiss FrancThe Euro has risen by 0.13% to 1.154 CHF. |

EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

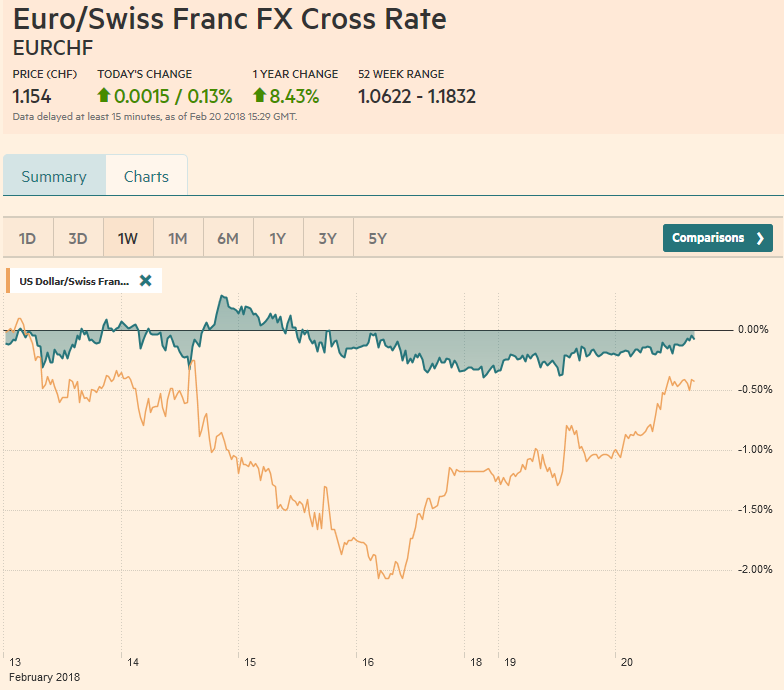

FX RatesThe dollar is finding better traction today, building on the upside reversal seen before the weekend. The news stream has been light and it seems like primarily an issue of positioning rather than a change in sentiment or the consensus narrative. The focus has shifted from monetary policy and idea that the ECB and BOJ are exiting their extraordinary monetary policy to return of the twin deficit problem in the US. One of the twins, the budget deficit occupies center stage in the US today. It is not so much the deficit as the paying for it. That is the US Treasury will raise a boat load of money today. It will issue $96 bln in three- and six-month bills, and $55 bln in a four-week cash management bill. It will also sell $28 bln of two-year notes. In the next two days it will raise another $80 bln in other note sales. |

FX Daily Rates, February 20 |

| The anticipation of this supply has pushed short-term rates higher, but it has yet to appear as a material force in the cross-currency basis swaps. The US debt market appears to have been building in a concession ahead of the new supply. The yield of the entire coupon curve is about three basis points higher. Global yields are mostly firmer. Sweden is a notable exception.

Despite one of the most aggressive monetary policies, strong growth and a large current account surplus, the Riksbank has been unable to create inflation. Today, Sweden reported a 0.8% decline in January CPI, which was a bit more than expected, and pushed the year-over-year rate to 1.6% from 1.7%. The market had expected a small increase. The underlying rates, which uses fixed mortgage interest rates, fell 0.9% (median in the Bloomberg survey was for a 0.7% decline) and the year-over-year rate eased to 1.7% from 1.9%. This is the slowest underlying rate since March 2017. The krona is the weakest of the major currencies today, losing 1.1% against the dollar and 0.6% against the euro. |

FX Performance, February 20 |

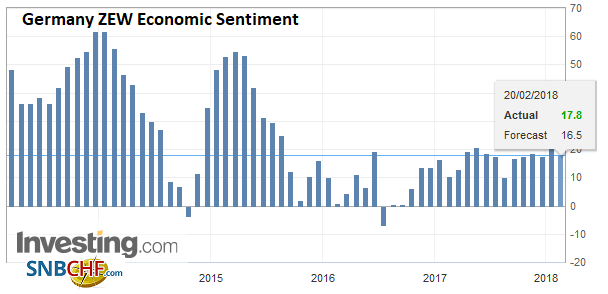

GermanyThe German ZEW survey slipped. The measure of the current situation eased to 92.3 from 95.2 and the expectations component fell to 17.8 from 20.4. On one hand, the German economy continues to motor along. |

Germany ZEW Economic Sentiment, Feb 2018(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

| On the other hand, political uncertainty lingers, and perhaps more importantly, the DAX fell almost 12% from January 23 peak to the low on February 9. The recovery so far has been rather flat, not event reaching a 38.2% retracement of the sudden drop. |

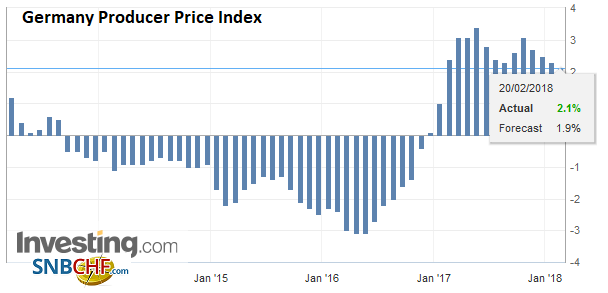

Germany Producer Price Index (PPI) YoY, Jan 2018(see more posts on Germany Producer Price Index, ) Source: Investing.com - Click to enlarge |

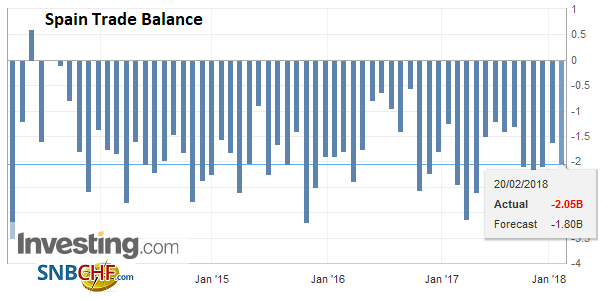

Spain |

Spain Trade Balance, Jan 2018(see more posts on Spain Trade Balance, ) Source: Investing.com - Click to enlarge |

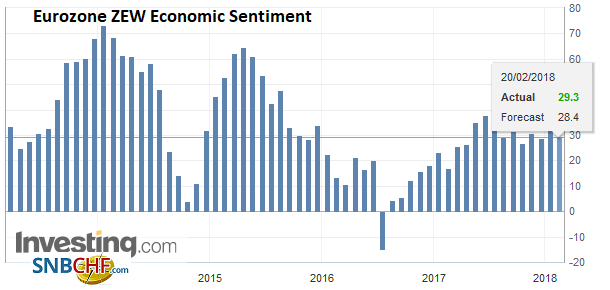

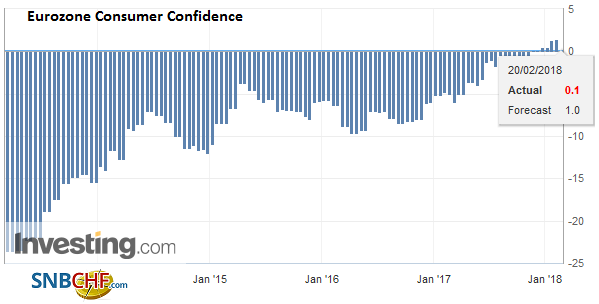

Eurozone |

Eurozone ZEW Economic Sentiment, Feb 2018(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

Eurozone Consumer Confidence, February 2018(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

The Australian dollar is slipping to a new four-day low. Support is seen in the $0.7855-$0.7880 band. The minutes from the RBA’s recent meeting failed provide new insight, and the Australian dollar’s weakness seems to be a function of the US dollar’s broader recovery. Inflation is expected to increase only gradually, and while household debt is elevated, low rates help prices and employment.

Indeed, the heavier tone in the European equity markets yesterday spilled over in to Asia. The MSCI Asia-Pacific Index ended a six-day rally to close nearly 0.9% lower. It recovered nearly 50% of its loss from late January before moving lower today. Of note, disappointing HSBC earnings seemed to cut short the recovery in the Hang Seng, which finished 0.8% lower. Foreigners were sellers of shares in the region.

European bourses have a heavier bias today, with the Dow Jones Stoxx off about 0.15% in late morning turnover. Financials and consumer staples are the largest drags, while industrials and energy are firm. The benchmark was off a little more than 0.75% this week. The S&P 500 is currently off about the same amount. With last week’s recovery, the S&P 500 retracement 61.8% of its slide. It finished last week just below that objective (~2743). We recognize this is an important area and one near which the bears may make a stand. Today’s price action, with the lower opening, is important to determine the near-term outlook.

The euro is pressuring another key chart point. The $1.2340 area corresponds to a retracement of the bounce from $1.2200 (Feb 9) to $1.2555 before the weekend. Below there, support is seen near $1.2285, nothing substantial until $1.22. A break of $1.2200 would suggest a more important high is in place for the euro and would warn of the likely push back toward $1.18 (on ideas of a double top). There is a 551 mln euro strike at $1.2365 that expires today.

The dollar is bouncing against the Japanese yen. It is moving higher for the third consecutive session. It is testing the JPY107.20 area, we highlighted as the initial objective. It can edge higher. There is a $1.3 bln strike at JPY107.50 that expires Thursday in NY. JPY108 is the next important chart area.

There are a number of sterling options that expire today that are near the money. Between $1.3985 and $1.4000, there are GBP540 mln set to expire. Between $1.3910 and $1.3915, there is another GBP537 mln set to be cut. Sterling fell to nearly $1.3930 in early European activity but rebounded to session highs near $1.4015 quickly before consolidating.

Graphs and additional information on Swiss Franc by the snbchf team.

Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Consumer Confidence,Eurozone ZEW Economic Sentiment,Germany Producer Price Index,Germany ZEW Economic Sentiment,newslettersent,Spain Trade Balance,SPY,USD/CHF