Paul Tudor Jones recently voiced concerns that rising U.S. deficits and debt and increasing interest rates could lead to a fiscal crisis. His perspective reflects the long-standing fear that sustained borrowing will trigger inflation, raise interest rates, and eventually overwhelm the government’s ability to manage its debt obligations. In short, his thesis is that interest rates will rise as the Government goes broke. However, a closer look at historical precedent and current fiscal dynamics suggests these concerns are overstated. Contrary to Jones’ warnings, the U.S. economy has structural strengths that make an imminent fiscal collapse unlikely.

Paul Tudor Jones' warnings are not unusual, but like James Grant's views, they are not well supported by longer-term data. The chart below shows the long-term view of short and long-bond interest rates, inflation, and GDP.

The Fundamentals Of Interest Rates

Interest rates rose during three previous periods in history.

- During the economic/inflationary spike in the early 1860s

- The “Golden Age” from 1900-1929 saw inflation rise as economic growth resulted from the Industrial Revolution.

- The most recent period was the prolonged manufacturing cycle in the 1950s and 1960s. That cycle followed the end of WWII when the U.S. was the global manufacturing epicenter.

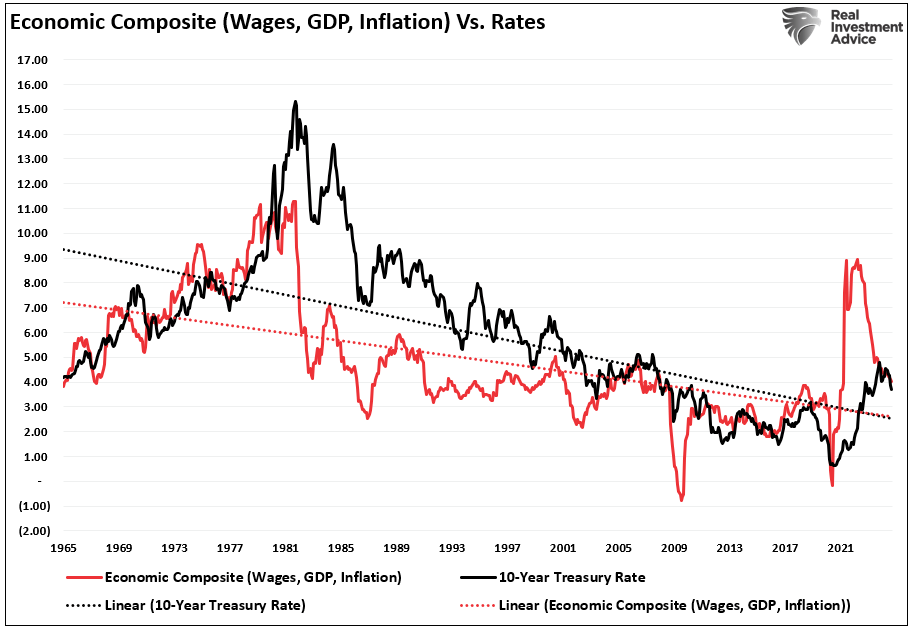

The current surge in inflation, and ultimately interest rates, was not a function of organic economic growth. It was a stimulus-driven surge in the supply/demand equation following the pandemic-driven shutdown. As those monetary and fiscal inflows reverse, that support will fade. In the future, we must understand the factors that drive rates over time: economic growth, wages, and inflation. Visually, we can create a composite index of GDP, wages, and inflation versus interest rates.

As can be seen visually, the correlation between the economic composite and rates is high. The long-term trend lines suggest normalization of the economy and rates at 2.5%, assuming no recession.

However, Jones's primary argument for not owning debt has nothing to do with the actual drivers of interest rates.

Debt and Interest Rates: A Complex, Nonlinear Relationship

Paul Tudor Jones argues that higher debt will increase interest rates and create unsustainable borrowing costs. In the interview, he repeated the "debt bears" mantra: the U.S. will eventually go bankrupt. However, his concerns overlook several critical economic realities.

First, the U.S. is a sovereign issuer of the world’s reserve currency. As such, the U.S. government cannot run out of money in a manner that a business or individual can. Debt rollovers, global demand for Treasuries, and flexible monetary policy all work to prevent a fiscal collapse. I am not suggesting that rising deficits and debt levels are NOT challenging. As we will explain momentarily, debt impedes economic growth. However, rising debt and deficit levels do not make bankruptcy inevitable.

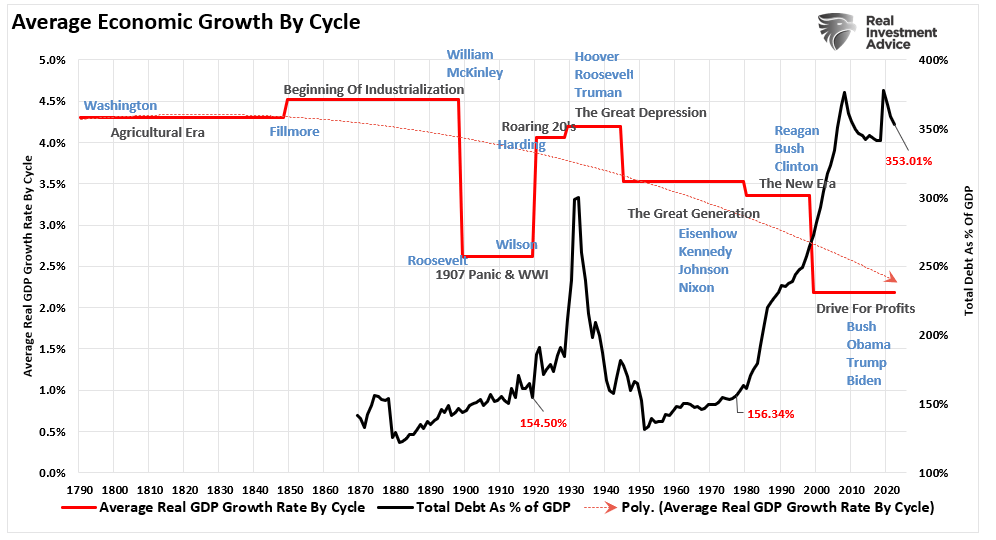

Secondly, rising government debt has not correlated with higher interest rates over the past few decades. Since 1980, total U.S. debt as a share of GDP has surged from 156% to nearly 353%. However, economic growth and interest rates slowed during that period. Despite increasing debt, slower economic growth reflects the diversion of productive capital into non-productive debt service. In other words, debt is "deflationary" as it retards economic prosperity.

Lastly, the U.S. is not alone in this current cycle. Major economies like Germany, Switzerland, and Japan have successfully issued long-term debt at near-zero or even negative interest rates. These cases demonstrate that investor demand for government bonds often outweighs concerns about debt levels, particularly when governments offer stability. The U.S. Treasury market is the most significant and liquid globally. That means there will likely continue to be a high demand for U.S. debt, even with increased debts and deficits. As countries seek high levels of safety and liquidity to store their fiscal reserves, the U.S. Treasury will remain the asset of choice.

Inflation Risks Remain Under Control

Jones’s concern about inflation resulting from high deficits overlooks the complex interplay of fiscal and monetary policy and structural economic factors. Inflation can indeed rise if government spending outpaces the economy’s productive capacity. However, recent inflationary pressures in the U.S. were driven largely by supply chain disruptions, energy shocks, and pandemic-related spending rather than chronic deficits.

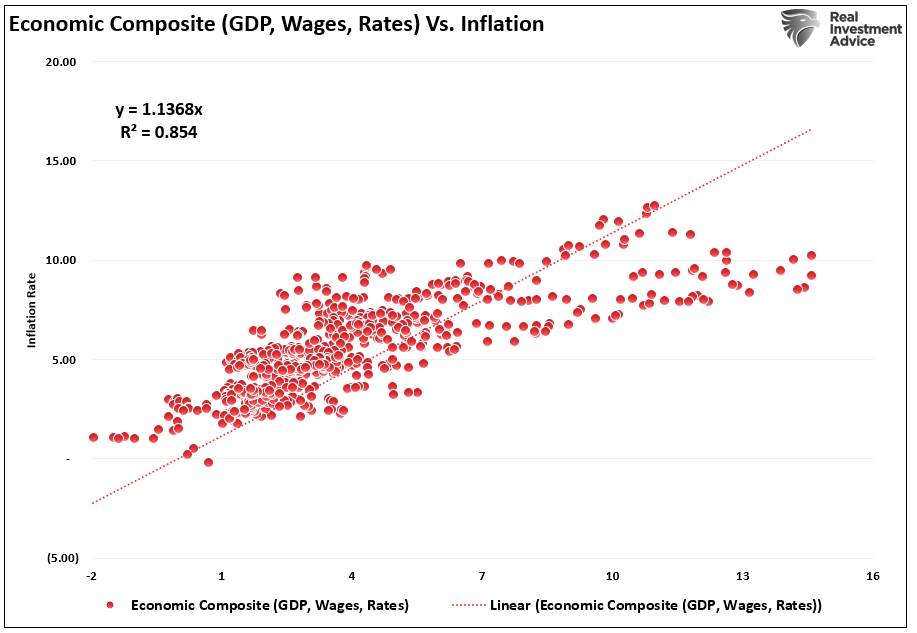

To understand inflation shock, we can remodel our economic composite above to represent the drivers of inflation. Wage growth provides consumers with more money to spend. As consumers spend more money, economic demand increases, increasing prices. As economic demand strengthens, borrowing costs increase to reflect stronger demand for loans, passed on through higher prices. Therefore, unsurprisingly, inflation has an 85% correlation to economic growth, rising wages, and higher rates.

The fallacy in Jones's argument should be evident. Interest rate increases, without a subsequent rise in economic growth and wages to support higher borrowing costs, slows economic activity. Slowing economic growth leads to increased unemployment, thereby reducing inflation and interest rates.

The Japan Experience

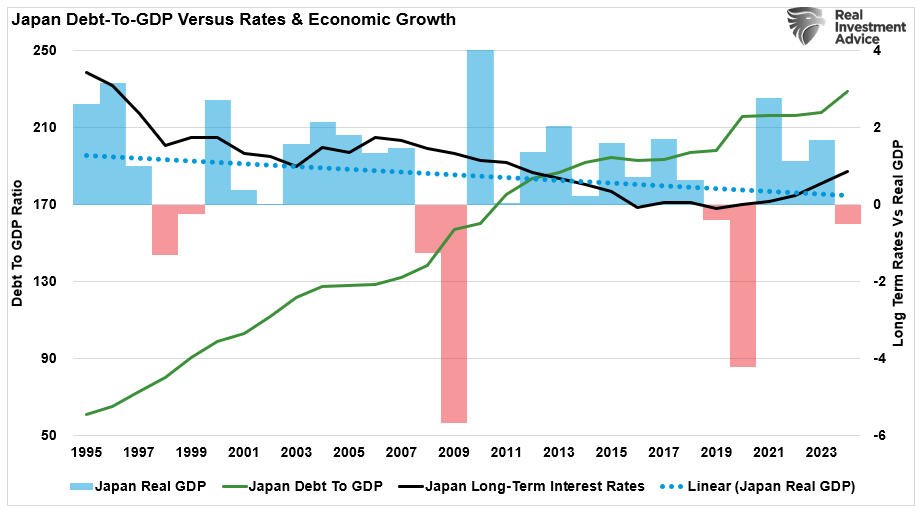

Furthermore, Jones' example of the "Japan experience" with debt fails to support his concerns. In Japan, high debt levels did not lead to runaway inflation or surging interest rates. Despite a 250% debt-to-GDP ratio, Japan faced persistent deflation and falling interest rates for the past 30 years. The debt problem was compounded by weak demand and an aging population. Those factors, when combined, suppressed inflationary pressures despite aggressive monetary easing

In advanced economies with robust institutions and stable financial systems, inflation risks from deficits are more manageable than Paul Tudor Jones suggests.

I am certainly not ignoring the current fiscal challenges. Those are undeniable, with the national debt nearing 120% of GDP and deficits projected to persist due to rising healthcare and Social Security costs. However, those levels suggest economic growth will weaken, inflation will ease, and interest rates will decline over time.

Debt Rollovers and Fiscal Sustainability

Contrary to Jones' assertion that debt will become unmanageable, debt rollovers are a standard practice for governments with large borrowing needs. The U.S. Treasury regularly issues new debt to refinance maturing obligations, spreading repayment costs over time. Historical data shows that even when debt levels rise temporarily, they can stabilize through economic growth, moderate inflation, and fiscal adjustments.

A research paper by Paul Goldsmith-Pinkham suggests that higher debt levels do not inherently raise fiscal costs. As long as real interest rates remain below the economy’s growth rate, governments can roll over debt without increasing the debt burden. This scenario has played out in the U.S. in recent years, with strong post-pandemic growth helping to offset the cost of higher borrowing.

Reality: The U.S. Is Unlikely to Face a Fiscal Crisis Anytime Soon

Jones’ prediction that rising debt will lead the U.S. toward financial ruin underestimates the resilience of the American economy and the tools available to policymakers. The U.S. enjoys several structural advantages—such as the global demand for Treasuries, the dollar’s reserve currency status, and the Federal Reserve’s ability to manage liquidity—that make a debt crisis highly unlikely. While rising deficits and interest rates present challenges, the U.S. has ample capacity to manage its debt sustainably, especially if economic growth remains near long-term trends.

However, given the impact of rising debt, increasing deficits, and demographic headwinds (the 3-D's), which retards economic prosperity over time, Central Banks will continue to suppress interest rates to keep borrowing costs down.

As with James Grant's analysis, the problem with Paul Tudor Jones' assumption that rates MUST go higher is three-fold:

- Central Banks will continue to buy bonds to maintain the current status quo but will become more aggressive buyers during the next recession. The Fed’s next QE program to offset the next economic downturn will likely be $6 trillion or more, pushing the 10-year yield towards zero.

- All interest rates are relative. The assumption that rates in the U.S. will move substantially higher is likely wrong. Higher yields on U.S. debt attract flows of capital from countries with low to negative yields, pushing rates lower in the U.S. Given the current push by Central Banks globally to suppress interest rates to keep nascent economic growth going, an eventual one percent yield on U.S. debt is not unrealistic.

- The budget deficit balloon. Given Washington’s lack of fiscal policy controls and promises of continued largesse, the budget deficit is set to swell above $2 Trillion in coming years. This will require more government bond issuance to fund future expenditures, which will be magnified during the next recessionary spat as tax revenue falls.

If you need a roadmap, refer to the chart of Japan above.

Historical evidence suggests that interest rates will be lower, not higher, unless the Government embarks on a massive infrastructure development program. Such would potentially revitalize the American economy and lead to higher rates, more substantial wages, and a prosperous society.

However, outside of that, the path of interest rates in the future remains lower.

The post Paul Tudor Jones: I Won’t Own Fixed Income appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Bear Market,Economics,Featured,Investing,Lance Roberts,newsletter,recession,S&P 500