Overview: The dollar was aided yesterday by the hawkish FOMC minutes and the backing up of US rates. The greenback has stabilized today and is softer against all the G10 currencies. The stronger eurozone PMI masks divergence between Germany and France but keeps the recovery narrative intact. The dollar's broad gains pressured the yuan, and the PBOC's dollar reference rate was set at its highest since January.

Favorable guidance by Nvidia is helping lift US index futures today, especially the NASDAQ. Most Asia Pacific equity market rallied today, led by Japan and India. Chinese and Hong Kong indices over 1%, and South Korea and Australian indices eased. The Stoxx 600 in Europe is rising for the first time since Monday. Benchmark 10-year yields are little changed today. Of note, the 10-year JGB yield slipped back below 1.0%. Most European bonds are +/- less than a basis point but after yesterday's sell-off Gilts are better bid today. The 10-year US Treasury yield is off almost one basis point to near 4.41%. Gold is off for the third consecutive session. It approached $2355, slightly ahead of the 20-day moving average (~$2350). July WTI extended yesterday's loss and reached $76.85 before catching a bid and has bounced back to almost $78. It could be the first advance this week.

Asia Pacific

Japan and Australia's preliminary May PMIs will not change market views. The Japanese economy contracted more than expected in Q1 24 and growth in Q4 23 was revised away. However, the economy already appears to be recovering. The composite PMI did not warn of the economic downturn. With the exception of last November, Japan's composite PMI has been above the 50 boom/bust level since the end of 2022. The preliminary estimate saw the composite tick up to 52.4 from 52.3, as manufacturing rose back above 50, while services expanded at a slower rate. The Bank of Japan appears to be committed to gradually normalizing monetary policy, which will likely mean more rate hikes. The swap market is pricing a 10 bp hike in July and another 15 bp before the end of the year. Separately, the weekly portfolio flow data was highlighted by the nearly JPY2.2 trillion (~$14.1 bln) purchases of foreign bonds, the most this year. The minutes from the recent Reserve Bank of Australia meeting make it clear that central bank senses little urgency to cut interest rates, and the preliminary May PMI will not persuade them otherwise. The composite PMI was below 50 in H2 23 (except in September) but has been back above the threshold since February. In May it slowed to 52.6 from 53.0 as manufacturing was unchanged (49.6) and services slowed slightly to 53.1 from 53.6.

Rising US rates helped lift the greenback to almost JPY156.65 yesterday, a little short of last week's high (JPY156.75). It edged up to JPY156.90 and held above JPY156.55 so far today. The JPY157 area corresponds to the (61.8%) retracement of the dollar's decline from the multiyear high on April 29 (~JPY160.15). A move above there may target JPY158, but we expect the market to turn caution as that is where second bout of intervention (still unconfirmed) appears to have taken place. One-month implied volatility is still near 8.5%, the lower end of what it has been since mid-April, suggesting that another bout of intervention is not imminent. The Australian dollar punched through support near $0.6650 and fell by nearly another half cent, in its third losing session and posting its biggest loss in nearly six weeks (~0.85%). The 20-day moving average is slightly above $0.6600. The (38.2%) retracement of its rally from the year's low on April 19 (~$0.6365) is near $0.6580, which is also the low from last week. The losses were sufficient to turn the daily momentum indicators lower. Still, it has steadied today, mostly between $.06615 and $0.6630. The US dollar's broad strength and weakness of the yen warned of today's yuan weakness. The PBOC set the dollar's reference rate at a new high since January of CNY7.1098 (CNY7.1077 yesterday and CNY7.1020 last Thursday). The average projection in Bloomberg's survey was CNY7.2462 (CNY7.2372 yesterday and CNY7.2016 last Thursday). Against the offshore yuan, the dollar reached CNH7.2580. Last month's high was about CNH7.2830.

Europe

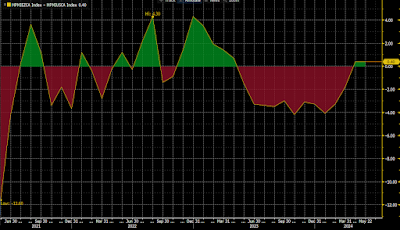

The flash eurozone PMI is consistent with the gradual recovery theme. The composite PMI has steadily improved since the 46.5 reading last October. It moved back above 50 in March, and the preliminary estimate puts it at 52.2 in May. It is the best level since May 23. Germany's PMI improved, but the manufacturing PMI remains below 50. In France, the composite slipped back below 50 to 49.1, as the services slowed (49.4 vs. 51.3), which offset the improvement in manufacturing (46.7 vs. 45.3). The ECB will not be deterred, and a June rate cut may be as close to a done deal as these things get. Even some of the noted hawks have endorsed a rate cut next month. The market leans strongly in favor of another cut toward the end of Q3 (70% chance of another cut discounted for September). During eurozone's recovery, the periphery appears to be performing better than core. The UK is in a more difficult position. After contracting in Q3 and Q4 23, the economy bounced back bigly in Q1 24, with a 0.6% expansion quarter-over-quarter. This overstates activity and growth maybe around half that pace in Q2. If this is going be borne out, the high-frequency economic data must slow. The preliminary May composite PMI ticked lower for the second time in three months, but at 52.8, it unwound April's gain. The market remains spooked by the firmer than expected CPI reading yesterday and does not have a cut fully discounted until November (though ~85% chance of September). A weak retail sales report tomorrow will likely help steady nerves. Lastly, and suffice it is to say now that news of a July 4 national election did not appear to impact activity.

The euro fell for the third consecutive session yesterday. It was not by much (~0.3%), though it is the largest single day decline this month. It fell to a marginally new seven-day low today slightly above $1.0810. It recovered to $1.0845 after the PMI. Nearby resistance is near $1.0855-60, and with the intraday momentum indicators stretched, this may be a sufficient cap. The euro's losses turned the over-extended daily momentum indicators. Several technical readings converge around $1.0785, including retracement of the rally from the mid-April low ($1.06). The 20- and 200-day moving averages also converge there. That area provided resistance on a closing basis earlier this month. Looking further out, the (61.8%) retracement is near $1.0715. Sterling performed best among the G10 currencies but was little better than flat against the dollar yesterday. It had rallied to $1.2760. It is holding above $1.27 for the second session. A close below $1.2680-$1.2700 would be the first sign that a top may be in place. The momentum indicators have not turned lower but given the strength of the dollar, we suspect that is the direction sterling is headed. A conservative target may be $1.2550-$1.2600.

America

After finding good bids below CAD1.36 in recent days, the greenback approached CAD1.37 yesterday amid the sell-off in US equities (risk-off) and debt (higher rates). The CAD1.37 area is where the trendline off the April and early May highs is found. It is holding so far today. A move above there boosts confidence that the greenback's losses since the mid-April high (~CAD1.3845) formed a corrective pattern. The next band of resistance is seen in the CAD1.3720-50 area. Support is seen around CAD1.3660. The Mexican peso fell for the second consecutive sessions, but its 0.15% loss was smallest in Latam yesterday. The dollar reached a three-day high slightly above MXN16.69 yesterday and has held slightly below it today. We continue to see a near-term test on MXN16.75 and then possibly MXN16.90. Concerns about the damage to crops from the floods may have weighed on the Brazilian real, which fell three times more than the peso. The sharp drop in copper prices (~5.5%), the largest in almost four years, amid reports of weaker Chinese demand, sapped the Chilean peso. It fell by 2.3%. Other industrial and precious metal prices were weaker.

Tags: #USD,Australia,Banxico,Currency Movement,EMU,Featured,Japan,Mexico,newsletter,PMI,U.K.,US