| The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. | |

| In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which more people need to realize just what absurd fantasy that would really mean). Since this being German consumers facing their fate, a third helpful facet of their persistent downturn-iness is how it can’t be the Fed.

Unlike America’s (fake) central bank, Europe’s (fake) central bank is still QE-ing. Rate hikes and balance sheet runoff remain a more distant future prospect to be done at a comparatively more incremental and determined pace. |

|

| Doves (read: chickens) are still in charge over there.

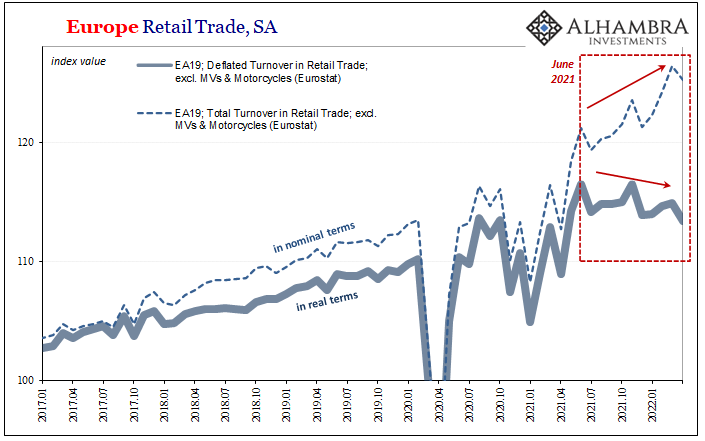

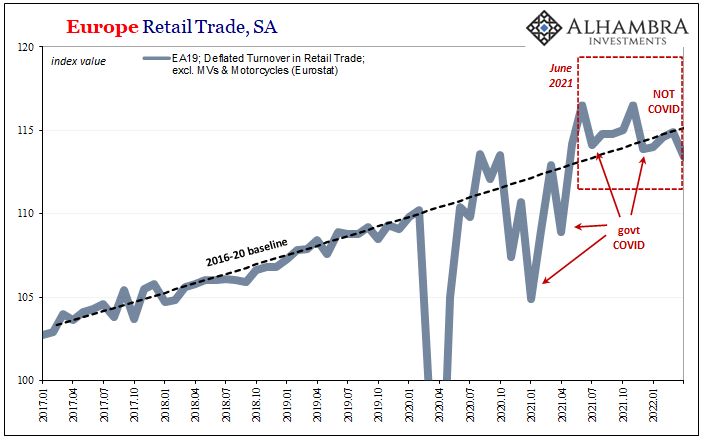

Today, Eurostat reports that, predictably, retail sales across all Europe sunk in April, too, brought down not just by the German cratering, though, also due to marked weakness pretty much everywhere. Not only that, it’s equally clear how and when this downturn came around. Supply shock downside, Euro$ #5 back to last June. |

|

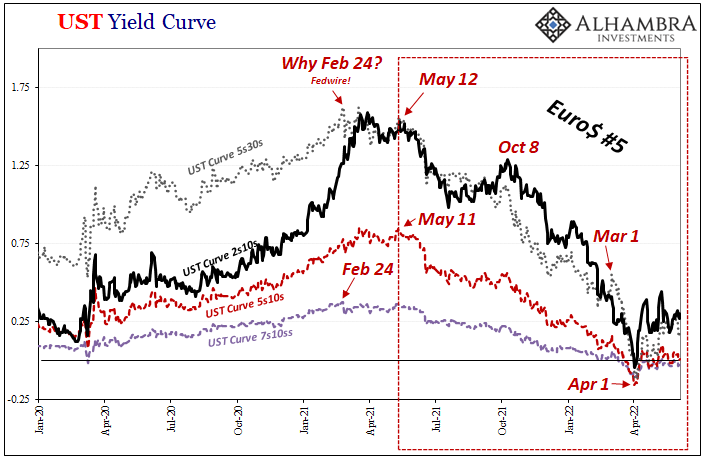

| This takes apart the interest rate excuse, too. Nominal rates have been moving up in Treasuries like those for European governments (though more the former), but that’s a more recent affair, primarily January 2022 and forward. Again, these weak accounts all date back to the middle of last year, as does Euro$ #5 instead of hawkishness in any degree.

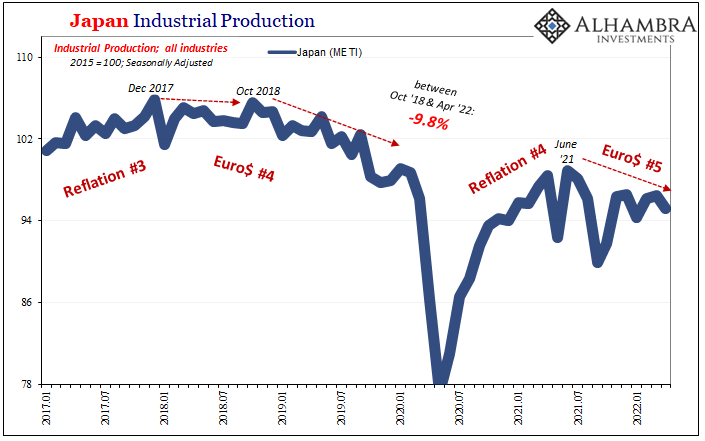

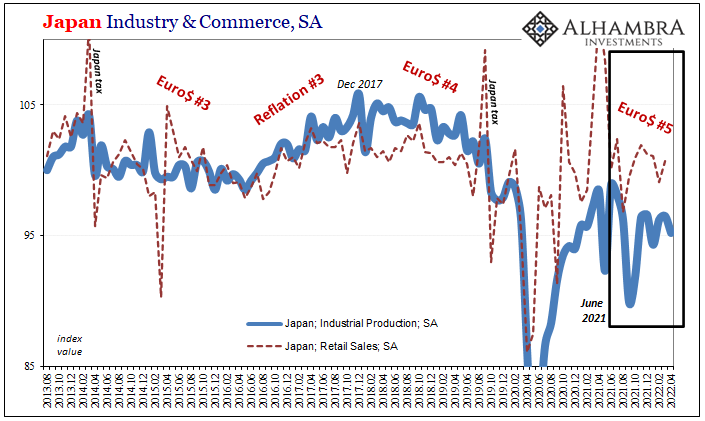

To take this examination one step further, we’ll stop in Japan. The Japanese (fake) central bank like Europe’s is still flowing with (Q)QE. When isn’t BoJ QQE? Bond rates in Japan have gone up much, much less than either USTs or bunds/OATS and sundry others, so we don’t have rates or lack of QE to blame here, either. |

|

| Japan has had the coronavirus like much of Europe, and the Japanese government has periodically (though far less stridently) intervened in social and economic life overreacting to the pandemic.

But, again, not in the more recent months. For instance, Japan IP fell by 1.3% m/m in April; it remains incredibly low, nowhere close to recovery, and going lower. Prior declines were, as per mainstream convention, simply dismissed as understandable COVID-measures (or supply shortages). Once freed from them, Japan’s economy was expected to pop up like a cork in the same way the same corona-free result has been expected everywhere else (including China). |

|

| Instead, like everywhere else (including China), Japan and Europe are left with the unmistakable signature of Euro$ #5. Pandemic. No Pandemic. Not rate hikes. Doesn’t matter interest rates. Just globally synchronized.

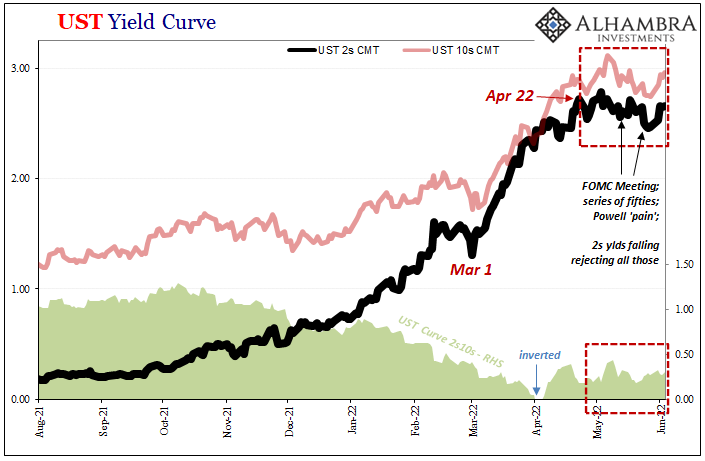

After today’s US employment report, yes, this includes the American part of that global economy. I believe that is why the normally Fed-over-aware 2-year note rate, importantly, has been almost completely ignoring the increasingly more hawkish noises from Powell (with President Phillips pulling his puppet strings) for the past six weeks to trade more in line – near exactly (see: below, stable 2s10s spread) – with longer-term notes (and bonds). This means inflation/growth prospects instead of non-money monetary policies, the rate hikes and ridiculous QT theater. |

|

| The noises of Euro$ #5 are only getting louder all over the world, and the excuses for it unlike this rolling downturn are running out. | |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,Bonds,consumer spending,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,federal-reserve,GDP,german bunds,Germany,industrial production,inflation,Japan,JGB,Markets,newsletter,rate hikes,Retail sales,U.S. Treasuries