Monthly Archive: May 2022

Weekly Market Pulse: TANSTAAFL

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”.

Read More »

Read More »

The Fed Gets It Wrong on Money Velocity, Too

Money velocity's role in forcing up prices is misunderstood because today's monetary "authorities" fail to consider how new money is injected into the economy.

Read More »

Read More »

War in Ukraine – Week 11

Business trips are very different these days. It was a wonderful and intense week, but nothing beats coming back home with bags full of supplies!

Read More »

Read More »

Swiss seek cooperation with US on cyber security defence

Defence Minister Viola Amherd has held talks with United States government representatives on international security cooperation.

Read More »

Read More »

Herd on the Street

The casino has become complex and there are no easy answers or predictable paths.

The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict.

Read More »

Read More »

War, Sanctions, and Sanity: A Purely Hypothetical Inquiry

Dealing with specific geopolitical circumstances can be messy. We may disagree on the facts and on which sources are reliable, making it hard to make any headway in a discussion. This may be further compounded by extreme emotions we may have about that situation.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

Macro and Prices: Sentiment Swings Between Inflation and Recession

(On vacation for the rest of the month. Going to Portugal. Commentary will resume on June 1. Good luck to us all.) The market is a fickle mistress. The major central banks were judged to be behind the inflation curve.

Read More »

Read More »

Luna kollabiert innerhalb von wenigen Tagen

Der Cryptomarkt zeigte diese Woche wieder sein hässliches Gesicht. Die Preis-Volatilität hat in der Vergangenheit viele Investoren reich gemacht. Wer zum richtigen Zeitpunkt in einen Low Cap Altcoin investierte, konnte über Nacht Millionär werden.

Read More »

Read More »

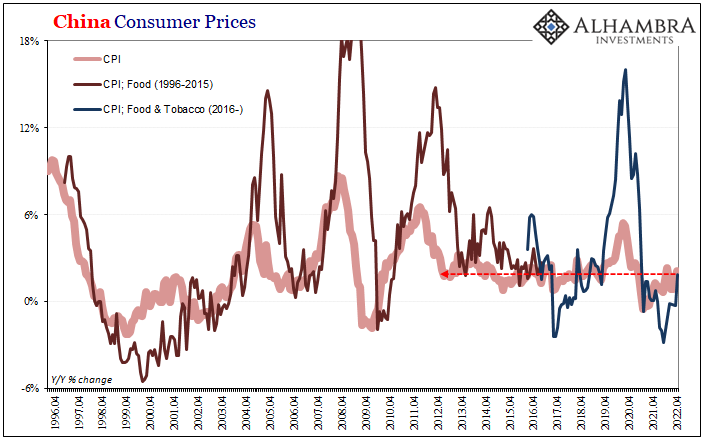

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

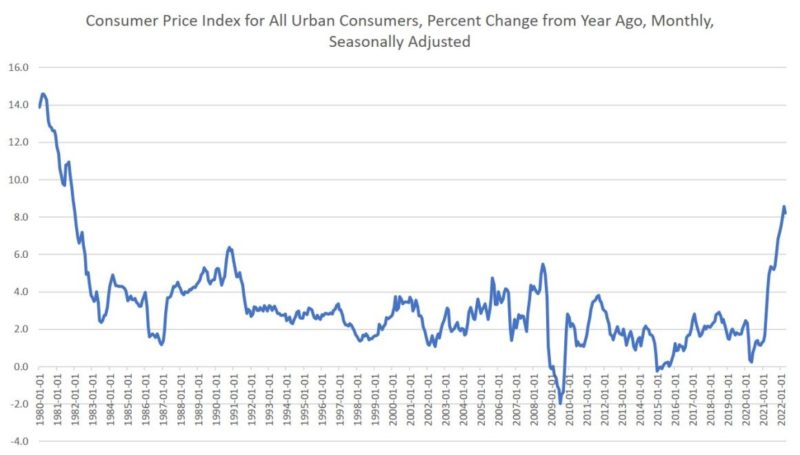

Real Wages Fall Again as Inflation Stays Near 40-Year Highs

Inflation is so high in America that we’re now supposed to believe that inflation is “moderating” if it doesn’t go above 8.5 percent. That, at least, was the message in much of the speculation yesterday around what April’s CPI inflation numbers would show.

Read More »

Read More »

Absurdist pop pioneer Yello wins Swiss music prize

The Swiss electronic duo Yello - Dieter Meier and Boris Blank – will receive the Grand Prix Music 2022, presented by the Federal Office of Culture and worth CHF100,000 ($100,400).

Read More »

Read More »

Sentiment Remains Fragile, and the Euro and Sterling can barely Sustain even Modest Upticks

Equities are recovering from dramatic losses. Today, the Nikkei, Hang Seng, and Kospi surged by more than 2%.

Read More »

Read More »

Swiss remain divided over 5G rollout

Swiss opinion over the expansion of the 5G telecommunications network is still split down the middle, according to the latest survey on the subject. The Swiss government is convinced that the new technology poses minimal health risks and is committed to the rapid erection of 7,500 5G antennae.

Read More »

Read More »

The War on Gold Ensures the Dollar’s Downfall

Last month was the 89th anniversary of one of America’s biggest blunders on her descent from honest, sound money into weaponized political money: Executive Order 6102. Signed on April 5, 1933, U.S. President Franklin Delano Roosevelt required all persons holding more than five ounces of gold to deliver their “gold coin, gold bullion, and gold certificates, now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the...

Read More »

Read More »

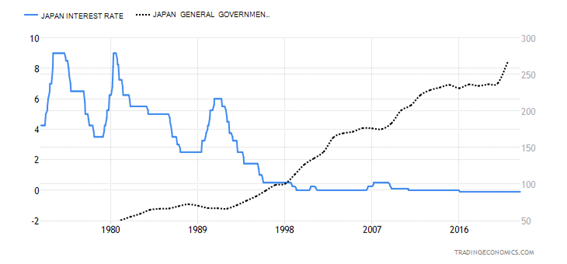

Stagflation Comes from Exorbitant Money Creation and Unhampered Government Spending

Too much government spending and loose monetary policy lead to rising prices combined with falling economic growth rates. All Keynesian roads lead to stagflation. It is the result of economic mismanagement. Again and again, the belief has been proven wrong that central bankers could guarantee the so-called price stability and that fiscal policy could prevent economic downturns.

Read More »

Read More »

Neither Confusing Nor Surprising: Q1’s Worst Productivity Ever, April Decline In Employed

Maybe last Friday’s pretty awful payroll report shouldn’t have been surprising; though, to be fair, just calling it awful will be surprising to most people. Confusion surrounds the figures for good reason, though there truly is no reason for the misunderstanding itself. Apart from Economists and “central bankers” who’d rather everyone look elsewhere for the real problem.

Read More »

Read More »

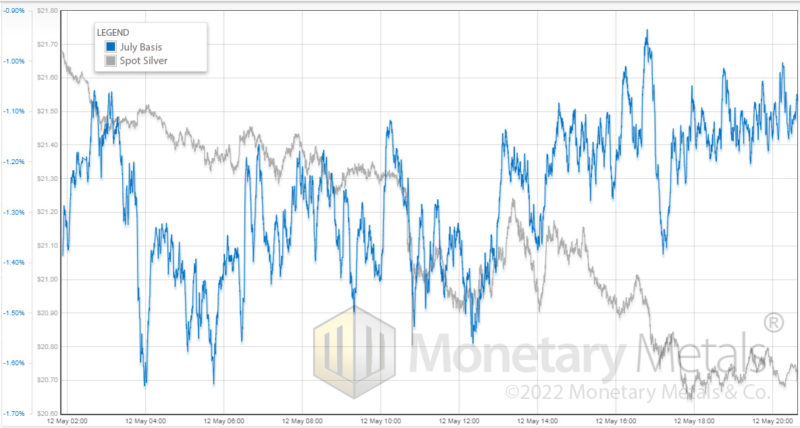

Is Gold Starting to Behave Itself?

2022-05-14

by Stephen Flood

2022-05-14

Read More »