Overview: The markets lack a clear direction today and await fresh incentives. After gaining almost 1% yesterday, the MSCI Asia Pacific Index slipped. Japan, Hong Kong, and Australia are among the few equity markets that rose. The Dow Jones Stoxx 600 is posting minor gains, while US futures are largely steady. The S&P 500 and NASDAQ have a five-day advancing streak in tow. The US 10-year yield reached a five-month high near 1.64% yesterday and extended to 1.67% before consolidating. European benchmark yields are 1-2 bp lower, including the UK Gilts, despite the strong inflation report. Asia Pacific yields mostly played catch-up to yesterday's rise in rates, but the Chinese benchmark slipped slightly back below 3%. The dollar is decidedly mixed. European currencies are softer, while the dollar-bloc currencies are posting small gains. Central and Eastern European currencies are also lower, while many Asian currencies are higher, as are the South African rand and Mexican peso. The JP Morgan Emerging Market Currency Index is little changed. It has been alternating between gains and losses since the middle of last week. Yesterday, it rose by almost 0.2%. Chinese officials reportedly are contemplating intervention to steady coal, while the LME opens an inquiry into copper and introduces some position rules and spread limits. Copper is trading lower for the third consecutive session. The 3.3 mln barrel build of US oil stocks estimated by API helped steady oil prices, and the November WTI contract is trading within this week's range (~$81.80-$83.90). Gold is trading firmly but inside yesterday's range (~$1763-$1785), and just below $1780 near midday in Europe.

Asia Pacific

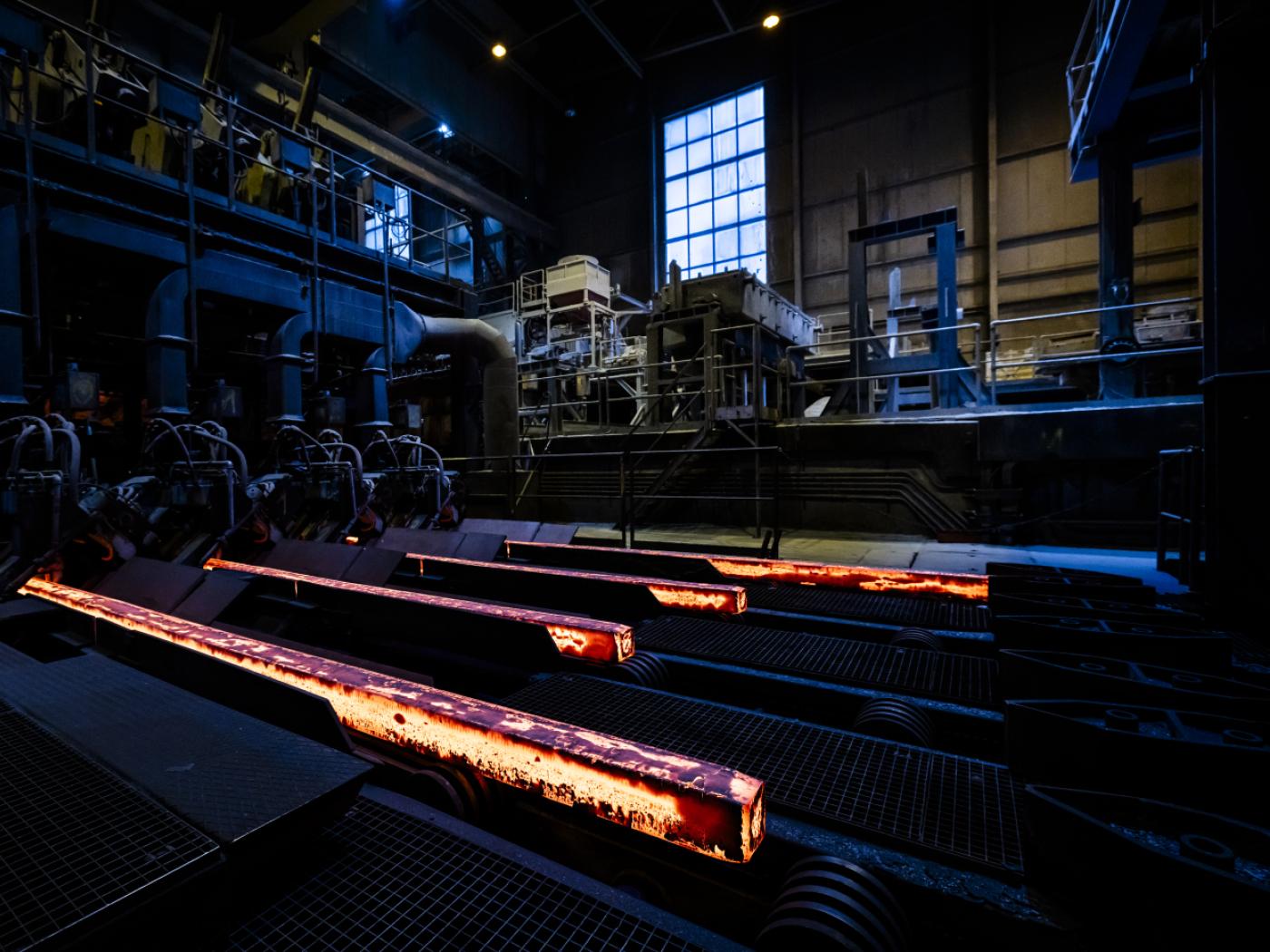

The strong seasonal pattern of Japan's trade remained intact as September's balance improved over August's (-JPY623 bln vs. -JPY637 bln). Exports and imports were stronger than expected. Exports rose 13.0% year-over-year in September, about half the pace seen in August. Exports were restrained by the disruption in the auto sector. Japan's auto shipments are off 40% from a year ago. Steel exports and sales of chip-making equipment to China offered some offset. Higher oil prices, and some observers cited the new iPhone as possibly boosting imports too.

China reported its first decline in house prices in six years. The fall was minor, but the direction, in light of the disruption in the property market, is notable. New house prices in 70 cities, excluding state-subsidized housing, eased by 0.08% last month. Existing house prices fell in about three-quarters of the cities. The slump in sales may be hiding an even larger decline in prices. According to some estimates, residential sales were off 17% last month, and existing home sales were off by nearly 65% in the first part of October. Separately, note that China completed its $4 bln dollar-denominated bond sales. There were four tranches (three years to 30 years), and at the short-end, China paid about six basis points above Treasuries and around 53 bp at the long-end.

Rising US yields seem to be the most compelling explanation of the greenback's rise against the yen to JPY114.70 earlier today, a new four-year high. It was sold back down to JPY114.30 in late Asian turnover before catching a new bid in early Europe. The JPY115.00 area is expected to be formidable resistance. The Australian dollar extended its recent gains and traded above $0.7500 for the first time in three months. Since the high was set, the Aussie has held support near $0.7480. Note that the upper Bollinger Band is by $0.7490, and the other momentum indicators are stretched. The PBOC set the dollar's reference rate at CNY6.4069 compared with the CNY6.4042 projection (Bloomberg survey). This was seen as a subtle protest of the yuan's strength, and the PBOC injected CNY100 bln into the money markets after providing CNY10 bln for the past nine sessions. The injection was linked to offsetting the drain created by tax payments and government bond sales. The dollar had fallen to almost CNY6.38 yesterday, its lowest level since June. It has been unable to resurface above CNY6.40 so far today.

Europe

There are two important developments from Germany today. First, as formal negotiations for a new government start in earnest, the Green's have come out strongly against certifying the Nord Stream 2 pipeline. The controversial pipeline has been completed and is waiting for the formal certification process to begin operating. German authorities and EU officials need to certify it. The German decision is not expected before January. Moscow has clearly indicated its preference and willingness to boost gas shipments beyond existing long-term contracts if the pipeline was operational. Second, citing personal reasons, Bundesbank President Weidmann will step down at the end of the year. He is widely regarded as among the more hawkish members of the ECB. The contest for his replacement has begun though it is typically a subtle campaign. Picking Wiedmann's successor may give a new chit to Scholz's effort to forge a coalition with the Greens and FDP.

The UK's CPI stabilized at elevated levels in September. CPIH, which includes owner-occupied costs, eased to 2.9% from 3.0%. Economists expected an unchanged figure. The month-over-month increase in CPI was 0.3%, slightly softer than the 0.4% projected. The core rate eased to 2.9% from 3.1%. The BOE has warned that the CPI could reach 4% by year-end. On the other hand, the RPI used to calculate the payout of inflation-linked bonds rose to 4.9% year-over-year from 4.8%, a new 10-year high. It was expected to have softened to 4.7%. Producer prices accelerated, even if not quite as much as expected. Input price rose 11.4% year-over-year after a revised 11.2% pace in August (initially 11%), while output prices accelerated to 6.7% from 6.0% (initially 5.9%). Separately, we note that the debate over next week's budget announcement by Chancellor Sunak has intensified. Meanwhile, the implied yield of the December 2021 short-sterling futures contract has eased for the second consecutive session. At slightly over 50 bp, it is 4.5 bp lower than Monday's close but 15 bp higher than last week's settlement.

The euro was turned back from almost $1.1670 yesterday could net sustain gains above $1.1650 today. So far, it is holding above yesterday's low, slightly below $1.1610. A 410 mln euro struck at $1.1600 expires today. The consolidative tone may persist through the North American session. That said, a close below $1.1600 would likely be seen as a signal that the modest upside correction has run its course. Sterling is also trading inside yesterday's range (~$1.3725-$1.3835). It was the first time since September 17 that sterling traded above $1.38, but it has not been able to sustain the move today. Support is seen in the $1.3740-$1.3760 area.

America

The US economic diary is light today. The main feature is the Fed's Beige Book out late in the session, and it typically does not move markets. Five Fed officials speak, including Quarles, whose terms ended as Vice-Chair of Supervision. His term as governor continues into the next decade but is expected to step down next year after his term as head of the Financial Stabilize Board is over at the end of this year. Meanwhile, the Democrat leaders appear to be still moving toward a vote on the large infrastructure efforts.

Canada reports September CPI figures today. The year-over-year pace is expected to have accelerated to 4.3% from 4.1% in August. However, the underlying core measures are expected to be little changed at elevated levels. The Bank of Canada meets next week (October 27). It will likely reduce its bond-buying further (to C$1 bln a week from C$2 bln). Since the last BoC meeting, the implied yield of the June 2022 BA futures has jumped from about 66 bp to 114 bp this past Monday before consolidating. Governor Macklem has acknowledged that price pressure may persist longer than initially anticipated but remains convinced they will likely prove temporary.

Since the last Bank of Canada meeting (September 10), the Canadian dollar appreciated about 2.75% against the US dollar. The US dollar fell to about CAD1.2310 yesterday before recovering to session highs near CAD1.2370. The CAD1.2300 area was the initial objective of the head and shoulders pattern we had been tracking. Today, the greenback is consolidating between CAD1.2335 and CAD1.2370. Mexico's economic calendar has been light recently, but it will pick up tomorrow with August retail sales (expected to have fallen for the third consecutive month). The peso is firm today after gaining about 0.8% yesterday, the fifth advance in the past six sessions. After peaking on October 12, a little above MXN20.90, the greenback has unwound this month's gains to approach MXN20.2150. The MXN20.25, where a $411 mln option expires today, corresponds to the (61.8%) retracement of the dollar's rally since the middle of last month. The next technical area of note is around MXN20.17, where the 200-day moving average is found.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Canada,China,Currency Movement,Featured,Germany,Japan,newsletter,U.K.