How (Not) to Win Friends and Influence People

Overview: There are two big themes in the capital markets today. The first is the ongoing push of the Chinese state into what was the private sector. Today’s actions involve breaking Ant’s lending arms into separate entities, with the state taking a stake. This weighed on Chinese shares and Hong Kong, where many are lists. On the other hand, Japanese markets extended their recent gains. The Nikkei, for example, is has fallen once in the past 10 sessions. South Korea and Australia’s markets rose, but the other major bourses in the region fell. On the other hand, there is, outside of Asia, an embracement of risk. Europe’s Dow Jones Stoxx 600 is snapping a three-day slide, while the US S&P 500 and Dow are poised to end their five-day drop and the Nasdaq, a three-day fall. Benchmark 10-year yields are narrowly mixed, leaving the US yield near 1.33%. In the foreign exchange markets, the Norwegian krone and Canadian dollar bid, while the sterling, the euro, and Swiss franc weaker. The yen is also sporting a soft profile. Among the emerging currencies, the liquid accessible currencies, led by the Russian ruble, Turkish lira, and South African rand, are the strongest. Of note, the dollar had finished last week at its lowest level against the Chinese yuan in nearly three months. The greenback recovered and is back above the lower end of the range found around CNY6.45. Gold is steady in the lower part of last week’s range. November WTI is testing the $70-level, which it has not closed above since the end of July. Iron ore prices are heavy, with the leading Chinese futures contract off for the 10th session in the past 11, during which time it has fallen almost 20%. Copper is up for a third session and is at its best level since early August. Aluminum is trading above $3000 for the first time in 13 years. The CRB Index eked out a small gain last week to extend its advance for the third consecutive week.

Asia Pacific

Reports indicate that last week’s call between Xi and Biden was instigated by the US frustrated by Beijing’s unwillingness to engage US officials in a substantive fashion. China rejects the US approach of de-linking issues, which identifies some areas of cooperation and other areas of intensive competition. Instead, Beijing insists that there must be respect for each other’s core concerns. Nevertheless, within 24-hours of the 90-minute call, the Biden administration let two things be known. First, a new investigation into Chinese trade practices, particularly how its subsidies harm the US economy, is being contemplated. It may indeed be launched, but it seems unrealistic to think that is the pressure that will make China capitulate. Second, reports indicate that the US may allow the representative office in Washington to include the name Taiwan and not just Taipei. No doubt Taiwan will approve of it, but to what end? What is achieved? Will Beijing stop harassing Taiwan by flying stories of fighter and jet planes into its airspace, or is it more likely that the fear of gradually losing Taiwan encourage Beijing to strike back?

On the other hand, a couple of other developments point in the other direction. Consider that when Fitch upgraded Taiwan’s debt at the end of last week, it made reference to Taiwan, China, in its press release. It raised eyebrows immediately. Fitch dismissed it as an administrative issue. Others linked it to last year’s decision by Beijing to grant Fitch approval as an independent credit agency. Taiwan, of course, expressed its regret, though it likely appreciated the upgrade at AA. Later this year, Taiwan is likely to lose an ally. Honduras is one of the few countries that formally recognize Taiwan. The opposition is pulling ahead in the polls, and former president Zelaya says that he wins, he will re-orient its policy toward China.

Ahead of the weekend, the dollar found support near JPY109.80, and after holding in early Asian turnover today, it bounced above JPY110.00. The gains were extended to JPY110.15 in the European morning. The upper end of the near-term range extends to about JPY110.45, above which it has not traded in nearly a month. The latest Commitment of Traders data showed the speculative market is still net short, about 62k yen futures contracts. They have not been long the yen since March. The Australian dollar initially slipped through last week’s lows (~$0.7345) before recovering to almost $0.7370. It takes a move above the $0.7390-$0.7400 area to lift the technical tone. In the futures market, the net speculative short position (~70.5k contracts) is the largest in three years and has been growing every week since the end of June. The dollar ended a three-day slide against the Chinese yuan that saw it settle before the weekend near CNY6.4445, its lowest level in three months. However, it snapped back today and has retired to the old range. The 0.16% gain of the dollar now (!CNY6.4545) is the most in nearly a month. The PBOC set the dollar’s reference rate at CNY6.4497, a little below the median projection in Bloomberg’s survey for CNY6.4502.

Europe

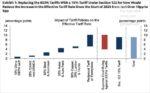

At the same time, the US appears to be willing to risk an escalation of tensions with China, it seems to think it is offering an olive branch to Europe. Recall that Trump’s steel and aluminum tariffs slapped on most of the world, including allies in Europe, on national security grounds. National security claims are given a wide berth at the WTO, and the berth is wide enough that other countries will likely find space for their protectionist measures as well. The US reportedly submitted an “initial offer” that combines a quota and tariff, though the thresholds were revealed. Ostensibly, the idea is to be taken up at the September 29 inaugural meeting of the US-EU Trade and Technology Council in Pittsburgh. If no agreement is reached by November 1, the EU has threatened to boost its retaliatory tariffs.

Russia is trying to hang American on its own petard. Moscow summoned the US envoy to complain about “election interference” by US tech giants, including Facebook, Twitter, and Google, for failing to remove content specifically requested by Russia’s media watchdog. The issue reveals the complications and nuances of an issue that may have appeared to be so straightforward. The problem is the SmartVoting app and identity are part of the opposition movement led by the imprisoned Navalny. To remove the content is to strengthen the forces of authoritarianism, but the basis for not removing the objectionable material at the media watchdog’s request does not seem right either and seems more subjective than an application of a general rule or principle.

The instant polls after last night’s German debate showed SPD’s Scholz, the winner. Scholz, who lost a leadership contest in the SPD in 2019, has emerged as its savior. A Bild poll before the debate showed the SPD leading the CDU 26%-20%. The Greens were at 15% and the FDP at 13%. Postal voting, which could account for as much as half the voted cast, has already begun. Scholz may loosen the purse strings a little, but he accepts the “black zero” of fiscal policy. Norway is at the polls today. The krone seems unperturbed by the likely change in government. Next week, the central bank is widely expected to be the first high-income country to raise rates since the outbreak of the pandemic.

Poor price action before the weekend saw follow-through euro selling to start the week. It recorded the session low (so far) just before the European market opened near $1.1775. The $1.1800 area that served as support last week is now resistance. The $1.1785 area corresponded to a (50%) retracement of the euro’s rally from the year’s low on August 20 (~$1.1665). The next retracement is a little below $1.1760. The speculative net long euro position rose last week in the futures market, but the bulls trimmed their gross long position. The rise of the net position was due to short-covering, where the speculators bought back 16.5k contracts previously sold. Sterling was pushed back from its pre-weekend attempt at $1.39. It briefly slipped below $1.38 today. A potential double top is in place, but it takes a break of last week’s low near $1.3725 to confirm it. It would project a test on the lows from the summer ($1.3575-$1.3600). In the futures market, speculators have their largest net short position since July 2020. In the most recent week, longs were cut, and shorts grew.

America

To argue as many do that the Fed’s bond purchases are depressing yields, financial repression, as it were, miss an important development. Even with tapering in the air, and price pressures elevated, the recent demand for Treasuries, including the 30-year bond auction ($24 bln that traded two basis points through the when-issued market). Dealers were left with the smallest share on record. The strong demand was evident last month, too, with dealers left with the lowest or next to the lowest share. The scar tissue from the 2013 taper tantrum appears to have left the market vulnerable to its opposite.

The quiet period ahead of next week’s FOMC meeting has begun, so no Fed speakers. This week’s auction schedule is limited to bills. A Bloomberg survey of primary dealers see a majority expect a formal tapering announcement in November and for it to actually begin in December. They see the tapering completed by the end of October 2022. Bloomberg economists see a slowing of $15 bln ($!0 bln in US Treasuries and $5 bln in Agency MBS). While we had anticipated a similar starting date, we anticipate a somewhat faster pace so that it is completed earlier. We think an earlier completion would maximize the Fed’s flexibility. Recall that seven of the 18 Fed officials thought a hike next year would be appropriate in June. The risk is that this number increase, and given the probable desire to have some time between the tapering and the first hike, finishing earlier would be preferable. Moreover, if part of the larger challenge is to normalize the use of the central bank’s balance sheet (QE), we suspect it has to be put back into the tool kit quicker and without so much fanfare.

The economic calendar starts the new week slowly. Today may be the quietest of the week. The US sees CPI tomorrow ahead of industrial production in the middle of the week and retail sales on Thursday. The September Empire and Philly Fed surveys will also be reported and are expected to stabilize alongside the University of Michigan’s consumer confidence. There are some preliminary signs that the surge in covid cases is slowing, but the US appears poised to fall to the lowest vaccination rate among high-income countries. Canada reports its August CPI in the middle of the week. The headline rate may rise, but the underlying core rates are expected to be steady. Canada goes to the polls next Monday. Mexico and Brazil’s economic calendars are light this week.

Falling stocks appeared to weigh on the Canadian dollar at the end of last week and offset what was a favorable employment report. The greenback rallied from the post-jobs low of roughly CAD1.2585 to almost CAD1.27. It is consolidating today, with a low bias for the US dollar, which is finding initial support near CAD1.2660. There is a $450 mln option at CAD1.2650 that expires today. In the futures market, speculators were net short the Canadian dollar for the second week, which is the first time that the net position has swung to the short side this year. The Mexican peso is going nowhere quickly, it seems. It remains within the range set on September 3 of about MXN19.8525-MXN19.9850. Speculators are the smallest net short peso position in the futures market (-17.5k contracts in three months. The gross long position jumped by 16.1k contracts, the most since May 2020.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,China,Currency Movement,EU,Featured,FOMC,Germany,newsletter,Russia,Trade