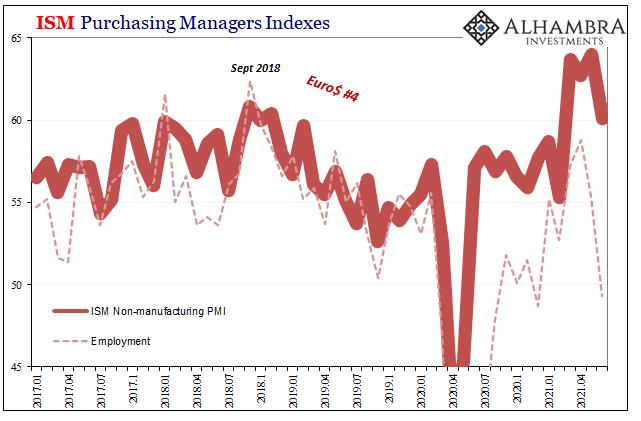

| Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Consistent with IHS Markit’s estimates as well as the ISM’s Manufacturing PMI released last week, there are growing (confirmed) concerns that early on in Q2 2021 that might have been the best we’re going to see. This possibility was raised that much more by the nasty little surprise contained within both sets of the ISM PMI’s, manufacturing and non-manufacturing alike. |

U.S. ISM Non-Manufacturing PMI, Employment, Jan 2017 - May 2021 |

| The subindex for employment is now under 50 for both! Neither is very far below the “magic” dividing line, yet each indicates widespread slowing in employment, wildly deviating from what is supposed to be a robust renewal. And it’s difficult to come out with a labor shortage from the way in which the ISM (or any PMI) gets tabulated (a very small number more responding that they are cutting workers than adding to payrolls). |

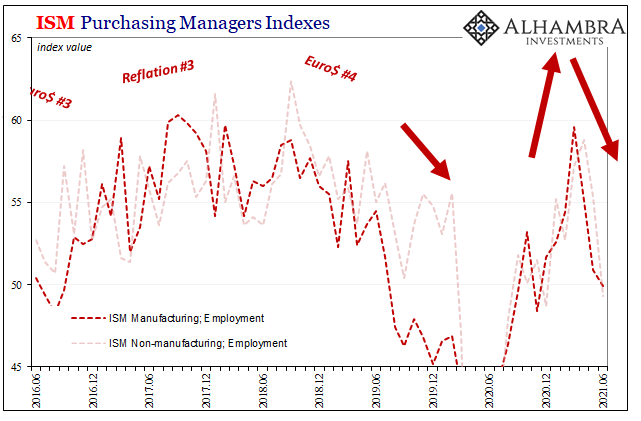

U.S. ISM Manufacturing and Non-Manufacturing, Employment, Jun 2016 - 2021 |

| Rather than a labor shortage, altogether the two ISM’s and especially their employment categories hint at a growing recovery shortage.

And it’s not just something to consider as an isolated case from second tier PMI data, either. As noted last week, underneath the glowing Establishment Survey (and all its massive seasonal smoothing) sits the Household Survey which was negative during the month of June – the same as the ISM’s Employment numbers. Not just June, though; the HH Survey tends to be noisy as are the ISM component surveys from time to time. But the pattern which has emerged in each is entirely consistent across manufacturing and services, ISM to at least one set of BLS employment data (above). There was a very clear but short run burst in general activity which boosted the labor market that over the past few months seems to have run out very quickly. This doesn’t mean recession on the horizon; much worse is that this is playing out as exactly the entirely predictable pattern of short run fireworks having no lasting impact. |

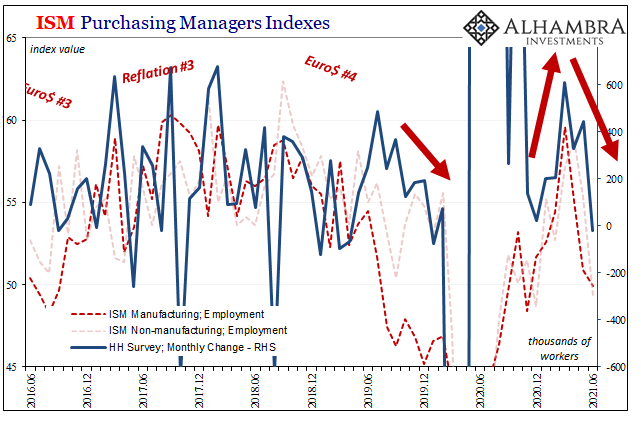

ISM Employment HH Survey, Jun 2016 - 2021 |

| Uncle Sam came in with huge checks, but then what?

For the second time now (last summer) we’re starting to see how that question is being answered. And the US situation was among the best in the world during this early 2021 burst, meaning that if American fortunes (especially in the goods economy) begin to change as the local sugar high wears off then what does the entire global economy really look like? Where does the world get any source of re-recovery momentum? Certainly not from China – even as, in Western mainstream imagination, it is the Chinese economy which is expected to save the day as it resoundingly recovers from last year. In reality, it’s not much different on that side of the Pacific from how it truly seems to be going over here. |

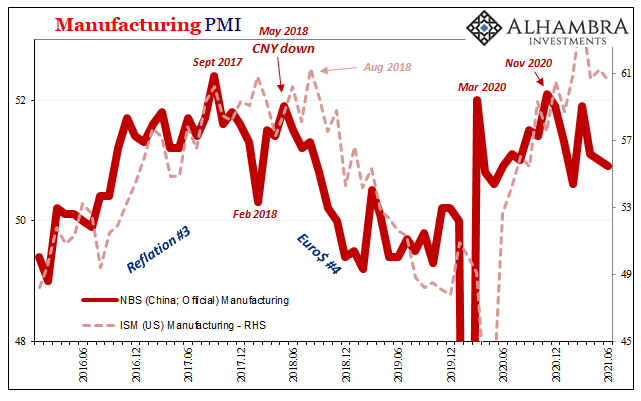

China ISM NBS Manufacturing and Non-Manufacturing, Jun 2010 - 2021 |

| In economic terms, there might be more (downside) convergence than otherwise imagined. It had been the Chinese economy reportedly doing well in early 2018 that had instead turned sour from the outset of that calendar year. And rather than the US economy “decoupling” as the conventional view on China quickly dissipated, by the end of 2018 the American system had joined the rest of the world – driven by Chinese weakness – in the growing downturn.

According to PMI figures as well as China’s Big 3 data, their most recent “recovery”, such that it was, peaked all the way back in November 2020. Since that time, momentum has increasingly been lost with acceleration dropping down to nothing or at best near nothing. This has alternately been ignored or blamed on government reactions to renewed COVID outbreaks (the latest in Guangdong). |

China ISM Manufacturing NBS, Jun 2016 - 2021 |

| However, the Chinese government (NBS) reported last week that its Non-manufacturing PMI had dropped all the way to 53.5 (among the lowest in the series). Then on Sunday night, private data provider Caixin said its China services PMI tanked; from 55.1 in May to just barely positive, 50.3, in June.

Together with its weak manufacturing reading of 51.3, the composite for last month dropped to just 50.6, further strengthening the case of a recovery having peaked all the way back before the end of last year. Rather than more coronavirus problems, the Chinese economy – and now maybe the US economy – are showing more consistent signs of a recovery problem. |

China ISM NBS Non-Manufacturing Caixin Composite, Jun 2016 - 2021 |

So soon after a huge economic contraction, there should only be unambiguous data all uniformly on the side of clear strength and momentum.

The expectation in the media, certainly, had months ago turned to inflation – as if 2018 never happened – all predicated on one mistake after another. This was based, had to be based on the idea that the government hadn’t just done what was necessary, it had risked doing too much if not way beyond too much (according to the hyperinflationists).

To reach this view, however, proponents had to dismiss and ignore, at least severely downplay, what really happened in 2020. An economy (globally!) that truly had been damaged to such a serious extent is not so easily covered or papered over by a bunch of haphazard spending programs (forget the global QE puppet shows); the two aren’t even close substitutes let alone near perfect ones.

Putting the cart (inflation) before the horses (economy and eurodollar, especially collateral among the latter), any idea of long-term economy damage was very deliberately cast aside in pursuit of the technocratic inflation dream – there’s no problem enough big government checks can’t solve!

Instead, it’s becoming quite clear as 2021 goes on this just hasn’t been true. There have been temporary – dare I write “transitory” – effects from all that fiscal intervention (again, forget the global QE puppet shows which accomplished nothing), but then what?

More and more we are starting to see the contours of “then what” emerge and it isn’t even like past reflations let alone some unmistakably huge inflationary liftoff and recovery. This is how the bond market could quite literally skip two of the biggest inflation reports (in the US) in decades.

Those consumer price elements (deviations) belong to temporary factors which are already receding, exactly as had been expected by those not captured by QE-hysteria coupled to fiscal hatred each combined driving this second inflation hysteria from emotion (either for it, cheering government action, seeing inflation as confirmation that it worked; or, ironically, those diametrically opposed who “need” inflation especially out-of-control inflation to “prove” their criticisms).

It has been emotion (for a second time) rather than rational analysis which has been driving this panic. The economics (small “e”) has never really been there; just more transitory molehills to be made into inflationary mountains.

And that’s why the inflation case has never been anything better than an outlier. Mainstream financial sources have only made it seem otherwise, that there is some consensus; which has been largely true if only in terms of biased commentary. Where it actually matters, where trillions of dollars are on the line, it’s never really been anything else.

Hardly unexpected, it’s all proceeding as if predetermined (Euro$).

Full story here Are you the author? Previous post See more for Next postTags: Bonds,caixin,China,currencies,Deflation,economy,employment,Featured,Federal Reserve/Monetary Policy,household survey,inflation,ism manufacturing index,ism non manufacturing index,manufacturing,Markets,newsletter,services