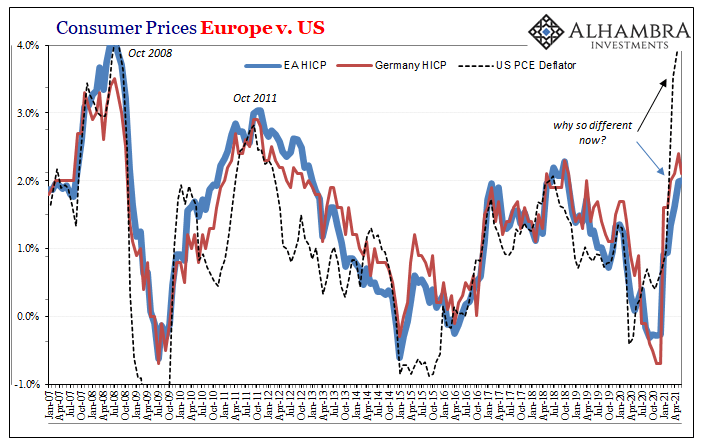

| Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years. Even using the European “harmonized” methodology (Harmonized Index of Consumer Prices, or HICP), inflation had reached 2.4% year-over-year which was the highest since 2012. |

Europe HICP and Germany HICP, Jan 2007 - May 2021 |

| These numbers, of course, pale in comparison to their American counterparts (most recently the PCE Deflator). That’s a big part of the problem. Despite big numbers in Europe, they are nowhere near as big as the US. Put another way: inflation figures which had been more harmonized than not for decades all of a sudden they are acting a bit too idiosyncratic for once.

That’s actually a red flag warning against inflation. |

Consumer Prices Europe vs US PCE Deflator, Jan 2007 - May 2021 |

| The German inflation estimates, like those for Europe overall, while higher than recent years haven’t actually been that much higher – just a tenth of a percent for Germany’s HICP. And now, according to flash June 2021 estimates, consumer prices may have cooled off a touch already. The annual change fell back to 2.1%, a “disappointing” (to the inflation narrative) 0.3% deceleration that wasn’t supposed to happen.

Because inflation is supposed to be a global phenomenon – it certainly has been for a very long time in consistently undershooting – these twists and turns while not unexpected to more honest observers they do confirm some hidden or even missing components that continue to undermine the inflation case. It’s these global factors that account for several key developments, most especially how Germany’s bund market didn’t seem to notice the “highest in almost a decade” HICP report. As skeptical as bunds have remained this year, on the surface it might appear as if there’s too much skepticism; and not just this year. Going back 2017 and 2018, low yields have remained much further below German inflation rates where once upon a time they were tied much closer together. In other words, by German account of German inflation German yields would be substantially higher; instead, they’ve come down to the low side and remained there regardless of German inflation, meaning it’s the missing global factors which must explain this difference. Germany managed to be a bit less deflationary, but the rest of the world did not as reflected in these lowest bond rates. |

Germany Federal Government Yields, 2007 - May 2021 |

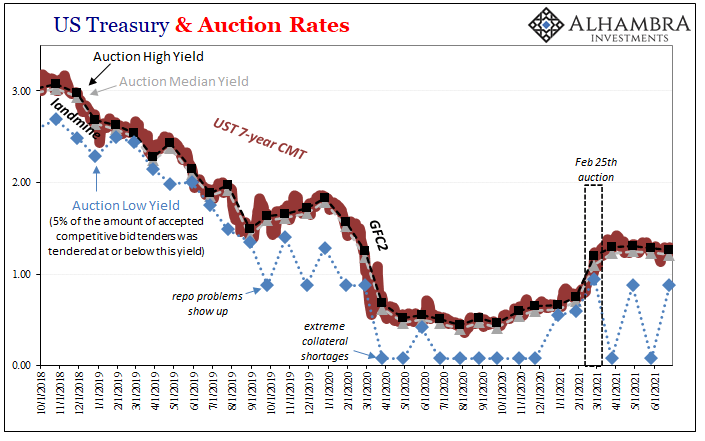

| The Treasury market is, in this sense, the farthest out of whack to inflation estimates. Or, put in the proper order, US inflation estimates are the farthest out of whack with global bond yields.

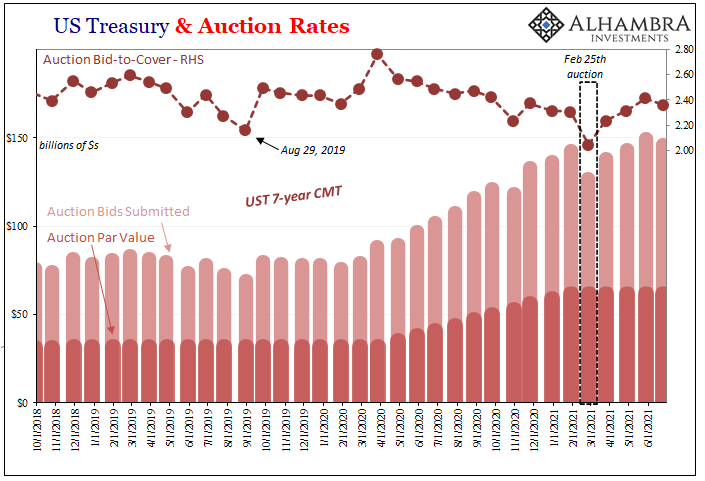

That’s really where we’re going with all this. American estimates are outliers and German a bit less so, both representing better outcomes not widely shared beyond idiosyncratic (and temporary) factors. That would mean the center of global bond yields, what’s keeping them down regardless of these outlier CPI’s and whatnot, are zeroed in on a global inflation center of gravity not picked up by most or any published indices. Bonds, on the other hand, remain rather fixed – especially going back to around February 25. That was the day, of course, following Fedwire (Feb 24) which produced the one event that initially had made it seem like the uniform global bond façade had finally cracked – that the Treasury market was about to give itself up to coming US inflationary excessiveness, breaking with other parts of the bond system. The 7-year UST auction rout. As it has turned out, however, now more than four months later that, too, ended up being a curious outlier and one that was totally anti-reflation as anything to date. Treasury finished up another 7-year auction just last week, another one without a hint of trouble or anything out of the ordinary. Only that single one. |

US Treasury and Auction Rates, Oct 2018 - June 2021 |

| Apart from the money-disrupted Feb 25 auction, the UST auctions all over the curve have been as detached from CPI’s and the PCE Deflator, too. Again, global factors; only in this case those global factors are a bit less concealed by virtue, ironically, of monetary disruption which snuck out on the 25th.

German bund yields way undershoot German HICP inflation, and US Treasury yields way, way undershoot PCE Deflator action, each being dragged down by a set of probabilities conditional to inflation never getting too much going. What might those look like? Looking at inflation from a national perspective, US yields, if they were national rather than international in nature, should be much, much higher given what’s being said about already sky high inflation numbers; German rates more than a little higher for the HICP and the like. But from the point of view of shadow global money, if represented by the dollar’s value, there’s the true center of gravity for inflation, economy, pretty much everything. |

US Treasury and Auction Rates, Oct 2018 - June 2021 |

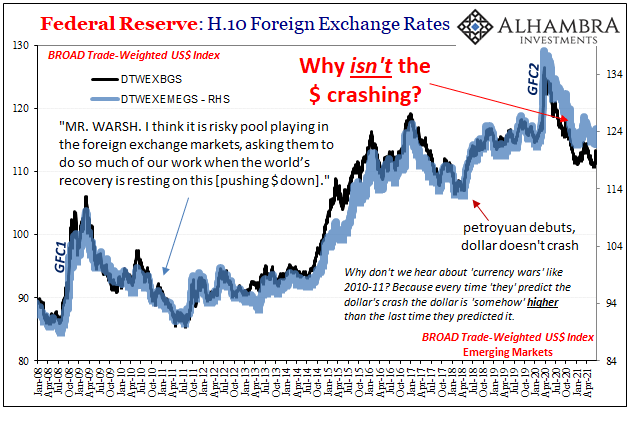

| There’s a bid for safe and liquid instruments that isn’t at all consistent with these inflation indices and their recent changes/accelerations. This would seem to have opened up a monetary discrepancy since inflation is a money thing first and foremost. But if the published inflation numbers were representative of anything meaningful, then we’d also expect not just higher rates globally but a much lower dollar exchange value.

Much lower. |

Federal Reserve: H.10 Foreign Exchange Rates, Jan 2008 - May 2021 |

| That exchange value, therefore, is easily connected to stubborn low global bond rates (high demand for safe, liquid instruments) which can only mean recent CPI’s and HICP’s must therefore not mean what everyone says they otherwise mean. The global inflationary center is more like the stubborn dollar therefore rates are being linked here rather than any inflationary outburst just now getting started.

Low yields/high dollar are telling you something a lot more meaningful about inflation (and growth prospects) than PCE Deflators and HICP’s. If the latter were illustrative of anything important, then yields and the dollar’s exchange value would reflect that. |

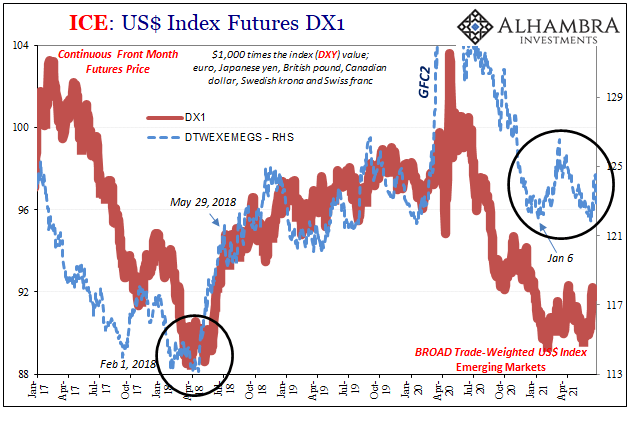

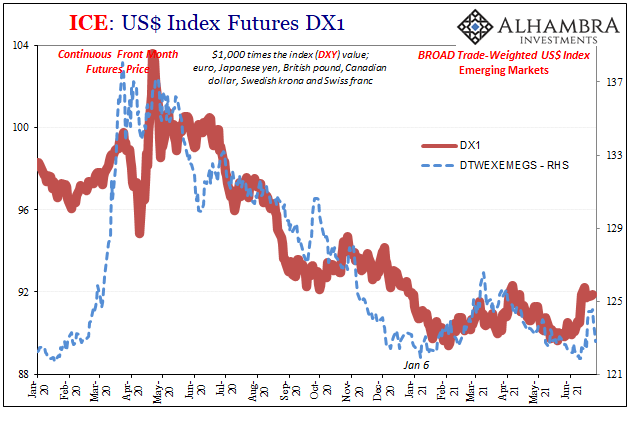

USD Trade Weighted DXY, Jan 2017 - May 2021 |

| There is, in the end, a great deal of consistency once you look at inflation from the proper monetary perspective. As much as everything was supposed to have been going right, from vaccines to reopening to consumer prices, it’s been the consistency suggesting quite the opposite that too much continues to be wrong which ties all these things together.

If US inflation was merely the start with global factors settling in the inflationary case, then the dollar would’ve been driven far lower already and UST yields coming in next still much higher. The dollar instead only went a bit lower and yields only slightly higher. The CPI, on the contrary, up by a lot. |

USD Trade Weighted DXY, Jan 2020 - June 2021 |

One of these things is not like the others…

In Germany, dollar down and German bund yields up by a lot if German HICP was being led upward by global inflation as suggested in the US CPI. Instead, same as Treasuries. It’s all backward because the global inflation factors remain firmly in the disinflationary camp; meaning dollar didn’t move so rates didn’t really, either. It only looks like Treasury rates and German bund yields are “too low” when in fact it is local inflation indices which are (temporarily) too high.

The inflation indices are the outliers. Balance of global factors must be not inflation.

Full story here Are you the author? Previous post See more for Next postTags: Bonds,CPI,currencies,Deflation,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,german bunds,Germany,hicp,inflation,Interest rates,Markets,money,newsletter,pce deflator,U.S. Treasuries,Yield Curve