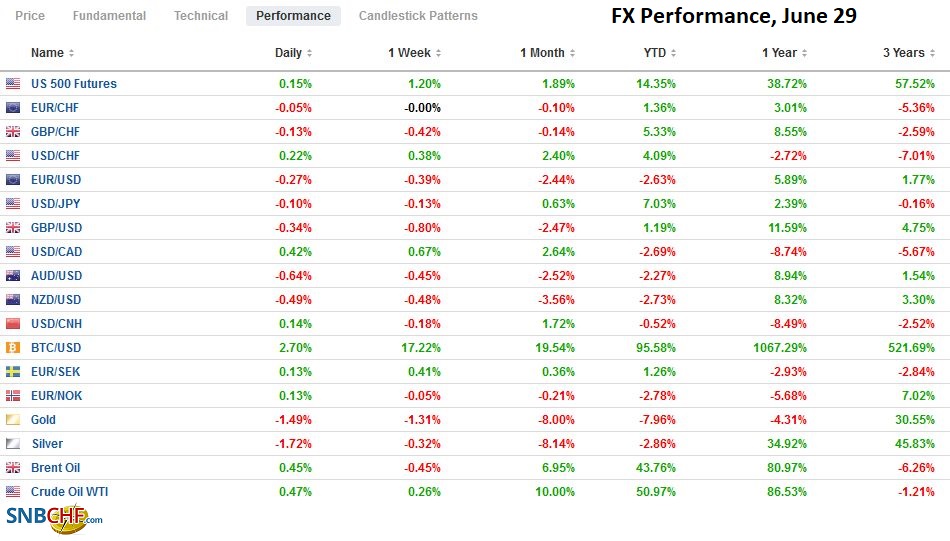

Swiss FrancThe Euro has fallen by 0.03% to 1.0959 |

EUR/CHF and USD/CHF, June 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

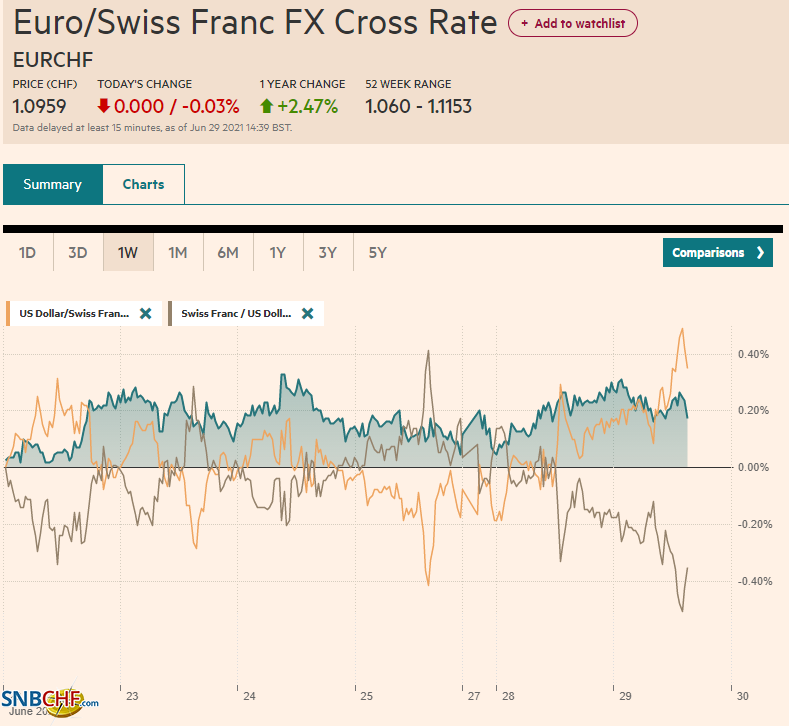

FX RatesOverview: Fear that the new mutation of the covid virus will slow the global recovery has sent ripples across the global capital markets. The foreign exchange market has the clearest reaction, and the dollar is bid. The dollar-bloc and Norwegian krone lead the currencies lower, while the yen is actually posting minor gains against the greenback. The JP Morgan Emerging Market Currency Index is off for the third consecutive session. The MSCI Asia Pacific Index snapped a five-day advance, and US futures are trading off. Europe’s Dow Jones Stoxx 600 is proving resilient, and its small gains are being led by financials, materials, and energy. The US 10-year yield is little changed, around 1.48%, while European yields have edged narrowly mixed, with the periphery doing better than the core. Gold has approached last week’s lows near $1766. August WTI is trading around $2 below yesterday’s high (~$74.45) after reversing lower yesterday. There is talk that OPEC+ could boost output by 500k-1 mln barrels a day. Hot rolled steel in the US reached a new record high yesterday and is up about 80% year-to-date. Copper is lower for the fourth consecutive session, and China’s iron ore futures snapped a four-day advance. The US Department of Agriculture survey reported a deterioration of the US winter wheat crop. Drought conditions and fears that it may extend are underpinning grain prices. |

FX Performance, June 29 |

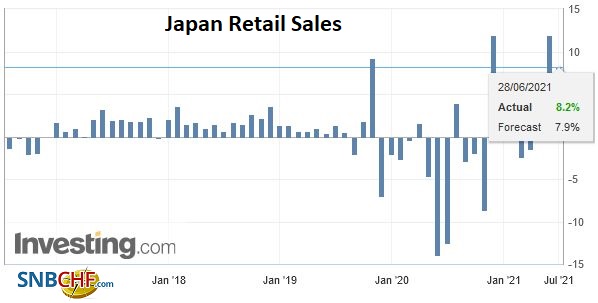

JapanJapanese May retail sales fell by 0.4%, a little less than expected after April’s 4.5% slide. Separately, Japan reported that its labor market deteriorated in May. Unemployment rose to 3.0% from 2.8%. Unemployment peaked last October at 3.1% and fell to 2.6% in March before rising again. The job-to-applicant ratio was steady at 1.09. Industrial production figures are due tomorrow, and a 2.1% month-over-month decline is expected, offsetting the bulk of April’s increase of 2.9%. Still, with extended states of emergency in Japan, investors have written on Q2. However, the Tankan Survey is expected to show confidence is growing for a recovery in H2. |

Japan Retail Sales YoY, May 2021(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

Asia Pacific

The US House of Representatives is making progress toward passing a series of bills that would later be reconciled with the Senate’s bill to bolster US competitiveness in the face of Chinese challenges. The Senate passed one bill that combined the work of several committees. The House is taking a piecemeal approach. With strong bipartisan support, the House approved measures that would fund the National Science Foundation and the Department of Energy’s new initiatives. A couple of bills are under consideration. The House also wants to fund a new agency focused on developing technology.

The US dollar slipped to a five-day low against the yen near JPY110.45 in Asia and recovered to almost JPY110.80 in early European turnover. There is a $465 mln option at JPY110.85 that expires today. Support is seen in the JPY110.25-JPY110.40.

Nearly half of Australia’s population is under lockdown, which is taking a toll on the Australian dollar. At the end of last week, it was probing $0.7600. It is not at a five-day low near $0.7525. The 200-day moving average (~$0.7565) may now offer resistance. The year’s low was set on June 21 near $0.7475, and that seems to be the next target.

The US dollar edged slightly higher (~0.03%) higher against the Chinese yuan. It fell in the last three sessions last week to settle near CNY6.4562. It is now changing hands around CNY6.4585. The PBOC set the dollar’s reference rate at CNY6.4567, tight against expectations for CNY6.4570. Quarter-end pressures in the money market are evident as the seven-day repo rate surges by 23 bp to 2.52%, the highest since the end of last month. Note that July 1 is a public holiday in China.

Europe

Nationwide estimates that UK house prices rose by 0.7% this month for a 13.4% year-over-year rise, which is the most since late 2004. Mortgage approvals increased in May. The temporary tax break begins being phased out tomorrow and will completely wind down at the end of Q3. Consumer credit in May rose by GBP300 mln, in line with expectations, offsetting the GBP200 mln decline in April.

Eurozone consumer and business confidence rose in June. Economic confidence rose to its highest level in more than 20 years. It was led by optimism in services but was also evident in retail trade and construction. Meanwhile, attention is turning back to CPI. Spain was the first of the large EMU members to report. June CPI rose by 0.4%, leaving the year-over-year pace unchanged at 2.4%. German states are reporting as well, and there seems to be some scope for a larger than initially projected decline in the national figure, which is out shortly. The national harmonized rate was projected to slip to 2.1% from 2.4%. The aggregate figure for the eurozone is due tomorrow, and it is expected to dip below the 2% level since in May, and the core rate may slip below 1.0%. However, the base effect does not peak until later in the summer.

Amid the political crisis, Sweden’s Riksbank meets on Thursday. It is expected to leave rates steady as the economy gradually recovers. The central bank may lift its growth forecast from the 3.7% seen in April. Still, around 40% in a recent Bloomberg poll see the central bank pointing to higher rates by the end of 2023, its forecasting period. Following the resignation of Prime Minister Lofven yesterday, the situation is very fluid as parties scramble to form a new coalition within the existing parliament. An announcement of who will get the first chance to do so could be made later today. If this fails four times, the parliament would be dissolved to new elections. With the national election scheduled for September 2022, few want to have an election now. After the 2018 elections, it took three attempts and more than four months to set up the government.

The euro eased to five-day lows and tested the $1.1900 level, which holds an expiring option for about 470 mln euros. The (61.8%) retracement of the rally from the June 21 low near $1.1850 is found just below $1.1900. Although last week’s high for the euro was near $1.1975, resistance now is seen in the $1.1930-$1.1940 area.

Sterling recorded a low near $1.3785 on June 21 and recovered to $1.40 before falling out of favor again. It fell to a six-day low today, around $1.3835. It found a bid in early European turnover. The nearby cap is seen around $1.3880.

America

The US reports houses prices today. Another increase is expected in the April series. The Conference Board June consumer confidence figures are also reported today. These are not typically market movers, and the focus is on employment. The ADP estimate is due tomorrow, and the median forecast in Bloomberg’s survey is looking for a 550k increase after 978k in May. Weekly initial jobless claims out on Thursday, and recall the four-week moving average ticked up for the first time since April. The national June figure is released on Friday, and the median guesstimate is for a 700k increase. Canada report April GDP figures tomorrow. A 0.8% contraction is expected after Q1 ended on a solid note, with March GDP rising by 1.1%. The economic calendars of Brazil and Mexico are light.

It is a light week for US debt sales. Yesterday’s three- and six-month bill auctions were strongly received. The government raised $111 bln while there were bids for more than three times the amount. The bill shortage problem is expected to continue next month when the debt ceiling issue needs to be resolved. Today, Treasury sells four and eight-week bills.

The US dollar closed firmly against the Canadian dollar yesterday and is extending the gains today. The greenback bottomed last week near CAD1.2250 and reached almost CAD1.2385 today. A move above CAD1.2400 would target the June 21 high a little below CAD1.2500. A close below CAD1.2320 would boost the chance that a US dollar high is in place.

The Mexican peso continues to consolidate within last Friday’s range (~MXN19.7050-MXN19.9065). The dollar has remained below BRL5.0 for the past four sessions. Sentiment among asset managers remains strong, and dollar bounce is still likely to be sold.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF,Featured,inflation,Japan,newsletter,Sweden,USD/CHF