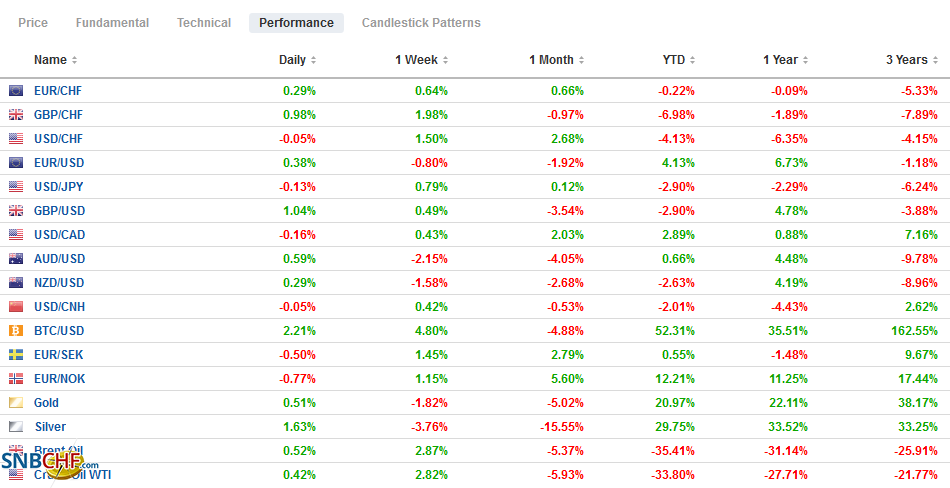

Swiss FrancThe Euro has risen by 0.23% to 1.0822 |

EUR/CHF and USD/CHF, September 28 Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Following the strong finish in the US before the weekend, global equities are paring last week’s slide. The MSCI Asia Pacific Index rose to for a second session. Markets in Japan, Taiwan, South Korea, and India rose by more than 1%. China and Australia were notable exceptions. Europe’s Dow Jones Stoxx 600 is gapped slightly higher and hasn’t looked back. Its 1.85% gain in the morning, if sustained, would be the largest advance since early August. US shares are also trading more than 1% better, pointing to a gap higher opening. Interest has been drained from the debt market, where the US 10-year is hovering around 67 bp, and European bond markets are narrowing mixed. The dollar is mostly softer against the majors. Sterling, which closed firmly end the end of last week, leads today’s move, rising more than a cent to test the $1.29 area. Emerging market currencies are mostly softer, and the JP Morgan Emerging Market Currency Index is off about 0.2% in what would be the sixth decline over the past seven sessions. Gold remains pinned near its recent lows near $1850, while November WTI is straddling the $40 a barrel level in quiet trading. |

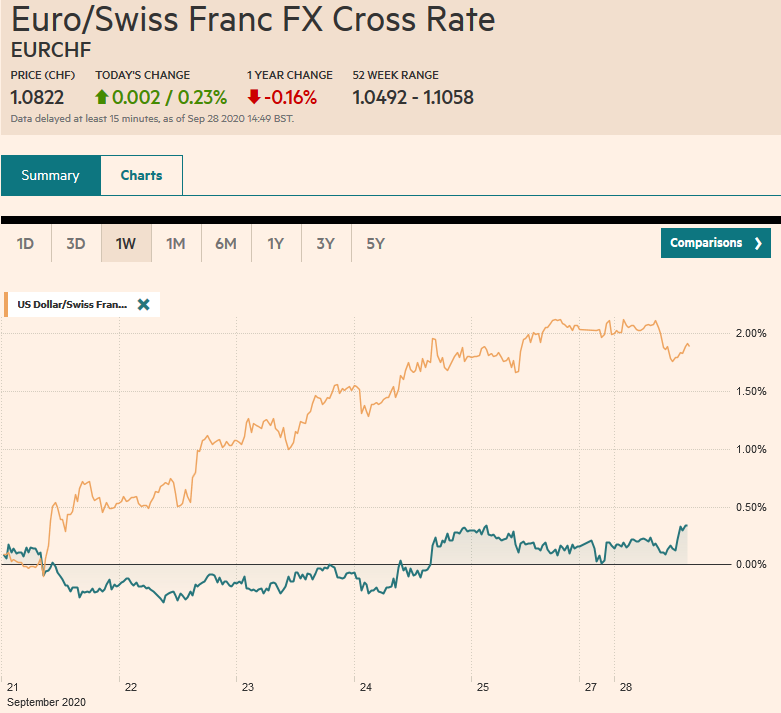

FX Performance, September 28 |

Asia Pacific

While US courts are stymying the Trump administration’s efforts to force a sale of TikTok and shut WeChat, it has taken a new step to undermine Beijing’s economic push. It is imposed export restrictions on its largest semiconductor fabrication company SMIC. It has been discussed for several weeks and is not a surprise. The US claims that there is an unacceptable risk that the chip military-end use, though the company denies it. Reports suggest Huawei bought a fifth of SMIC semiconductors, and Qualcomm uses SMIC fabrication for some of its chips. It impacts European producers such as ASML, which has been unable to obtain a license to exports to SMIC. There appears to be some discretion in the implementation, but this represents a new escalation in the US-China confrontation.

Separately, over the weekend, China’s reported that industrial profits in August rose 19% after a 19.1% gain in July. Through the first eight months of 2002, industrial profits in China are about 4.4% lower than a year ago. Mining and equipment manufacturing sectors stand out. The September PMIs are due out of the next couple of days. Note that Chinese markets are closed for about a week starting October 1.

There is some speculation that Japan’s Prime Minister Suga is considering calling an extraordinary Diet session at the end of October. This could delay earlier fiscal efforts. Suga’s strategy is still not clear. Some observers see an early election and then a supplemental budget. Japan reports August industrial production and retail sales this week ahead of the Tankan Survey.

The dollar has traded between about JPY105.25 and JPY105.70 so far today, which is just inside the range seen before the weekend. The intraday technicals suggest the consolidative tone may persist through the North American session. The Australian dollar is also confined to the pre-weekend range (~$0.7005-$0.7080). Some attribute the Aussie’s slightly firmer tone today to a local bank’s shift of its rate cut call from October to November. A quiet session today could see a little range extension higher. The PBOC set the dollar’s reference rate at CNY6.8252, a little lower than the bank models implied. As the quarter-end and the Golden Week holiday approaches, it threatens to inject volatility into Chinese money markets.

Europe

In yesterday’s referendum, Swiss voters soundly rejected the proposal to end the existing freedom of movement arrangements with the EU. Many other arrangements with the EU are linked to it, including some trade privileges. In 2014, a slight majority voted in favor of a similar proposal, and a compromise in the Swiss parliament was found that kept the freedom of movement intact. While a major disruption has been avoided, the focus will quickly shift back to the “institutional framework agreement” with the EU. Essentially it would mean that Switzerland automatically adopts EU rules unless it has specific objections. The Swiss often adopt EU rules to preserve market access. It is not so much about extraterritoriality (applying one’s laws outside of one’s country) as it is in the tragedy of being a small country next to a larger (by magnitudes) economic entity. Brexit represents an opposite strategy. Although the institutional framework agreement has been struck, it has not been validated by parliament, in which a majority seemed elusive. The question is whether the referendum changes the dynamics. We suspect not.

The last formal round of UK-EU trade talks ahead of next month’s summit is launched today. Some progress has been reported but trying to craft the text of an agreement still seems like a stretch. Meanwhile, domestic issues are prominent. First, parliament may seek to wrestle more power from the government over the pandemic. Second, BOE member Tenreyro seemed to play up negative rates even though Governor Bailey had appeared to play it down last week. The latest polls put Labour ahead of the Conservatives for the first time since Labour picked a new leader (Starmer) almost six months ago.

The euro has held the important $1.1600 area but has failed to inspire on the upside. It recorded the session highs so far in the European morning near $1.1650. The highs from the past two sessions are nearer $1.1685. The euro’s recent pullback has not deterred the speculators in the futures markets, where the net and gross long euro positions increased in the week through September 22. The gross long speculative position peaked in mid-August near 266k contracts. After the 16k contract increase in the last reporting period, it stood near 247k contracts. Sterling remains bid through the European morning. It is at a five-day high near $1.2900 and the next resistance is seen about $1.2930 and then $1.30. Part of this reflects sterling’s recovery against the euro. The single currency is at its lowest level in about three weeks, near GBP0.9045.

America

What is an eventful week in the US begins off slowly. The main feature today is the Dallas Fed’s manufacturing survey and the Fed’s Mester speaking at a webinar on economic equality. The highlight of the week is the September employment report at the end of the week. The presidential debate tomorrow night will draw attention even though the number of voters who declare they are undecided and the number who say they could be swayed by the debate are near historic lows, according to some surveys. On the fiscal front, some observers hold out the possibility that Treasury Secretary Mnuchin and House Speaker Pelosi can strike a last-minute agreement. Still, the odds seem to favor a move after the election. Meanwhile, PredictIt.Org participants collectively see about an 85% chance that the Supreme Court nominee Barrett will be confirmed before the election.

The highlight for Canada this week may be the July GDP report on Wednesday. While the US and Canada often report the job data on the same day, this week is not one of them. Canada will issue its September employment report next week. A vote on the government’s budget could happen as early as this week. Mexico’s data highlight for the week is today with the August trade and employment reports. Mexico enjoyed a record trade surplus in July, and while the August surplus may be smaller, it will remain near the record. The surplus appears to be more a function of a compression of imports than a surge of exports. Economists forecast Mexico’s unemployment rate to reach a new cyclical high near 5.6% (5.4% in July) from 2.9% at the end of last year and 2.94% in March.

The US dollar traded between about CAD1.3325 and CAD1.3420 on September 24 and remained within that range ahead of the weekend. It is still in that range today. Initial support now is near CAD1.3360, and a break would signal a test on the lower end of the recent range and possibly bolster confidence that a high is in place. The US dollar rose in four of last week’s five sessions against the Mexican peso for a 5.7% advance. Support is seen near MXN22.20 and then MXN22.00. Once spot stabilizes, we expect the 4.25%-4.30% yield on bills (cetes) to renew its pull. The stabilization of US equities may also ease the selling pressure on both the Canadian dollar and Mexican peso.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,Currency Movement,Featured,newsletter,Switzerland