|

After thinking about it all day, I’m still not quite sure this isn’t a joke; a high-brow commitment of utterly brilliant performance art, the kind of Four-D masterpiece of hilarious deception that Andy Kaufman would’ve gone nuts over. I mean, it has to be, right? I’m talking, of course, about Jackson Hole and Jay Powell’s reportedly genius masterstroke. There’s a lot that needs to be said about it, and I’ve already written countless times about the puppet show – including specifically symmetry. That’s really all the Chairman said today in Wyoming, the same thing that had been added to the monetary policy statement, and therefore their guiding mandates, all the way back in early May 2018. A long run average inflation target is no different than the medium-term inflation symmetry which first appeared in the official language at a pretty momentous time in recent history. |

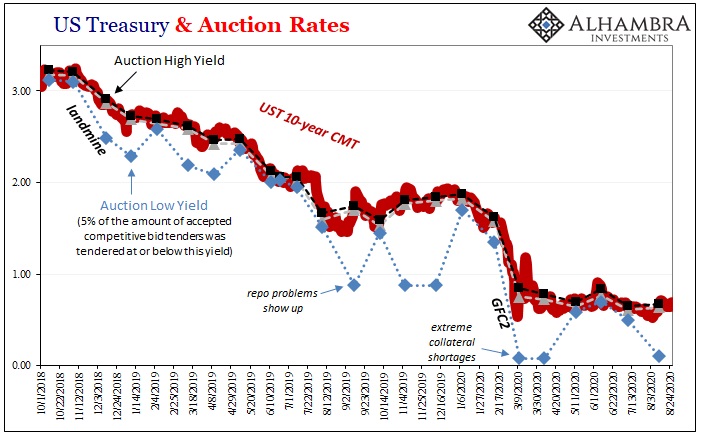

US Treasury and Auction Rates, Oct 2018 Aug 2020 |

| Within six weeks, not even two f-ing months, of making a big deal out of symmetry, by mid-June 2018 the eurodollar futures curve had inverted and rather than the economy sailing off into the inflationary acceleration symmetry was invented to invite, more and more markets and data revealed how the economy had already transitioned into the opening stages of globally synchronized downturn.

Four months after symmetry’s introduction, the landmine hit and it was quietly forgotten. They can make promises whatever they like, policymakers never deliver the smallest bit on any of them. |

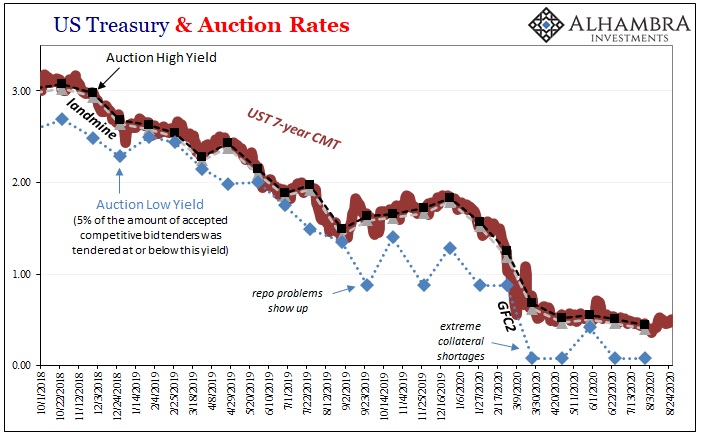

US Treasury and Auction Rates, Oct 2018 Aug 2020 |

|

And that’s why it necessitates these kinds of grand strategy reviews; successful policy doesn’t need any. The economy today in 2020 faces even greater challenges and we’re supposed to believe that, OK, now they’re going to be serious. In one respect, it’s a simple clash between jobless claims and Jay Powell’s mouth; or what specific words tumble out of it. Symmetry. Average inflation target. QE-cloud (that’s where central banks ditch all current pretense and simply start buying up the clouds passing over them in the sky, because at least that form of QE would be the first honest one). As I’ve written here, there’s even more to write about this utter stupidity and I’ve put together a good deal of it already today for publication tomorrow. |

US GDP Bank Reserves, 1988 - Aug 2020 |

Out of Jackson Hole, the puppet show nature of this ridiculous fantasy could not be more obvious. Here’s part of what I described in that regard:

It’s perfectly evident that they are really putting in the time and effort to show you how much time and effort they have put into this. Policymakers really want you to buy in to this fairy tale, which isn’t even a different story. I mean, look at that major, impressive stuff behind what that’s gone into…the same failed policy they created two years and almost four months ago. Forget all that, just look at those 15 community events, one huge conference with innumerable papers written up by all the right academics, and then 5 teams of working groups on top of everything else! How can you not be impressed? Results, bah. Monetary policy in this day and age is a ridiculous sales job, not the purview of an actual central banker working at an actual central bank. The policy itself no longer matters; the packaging it comes in does. If you aren’t distracted by the shiny wrapping, you realize what Powell’s saying is that after failing to hit the inflation target for over a decade he’s now going to let inflation run over the target none of them could hit because for more than a decade no one could hit their own target. But fifteen community events! |

|

|

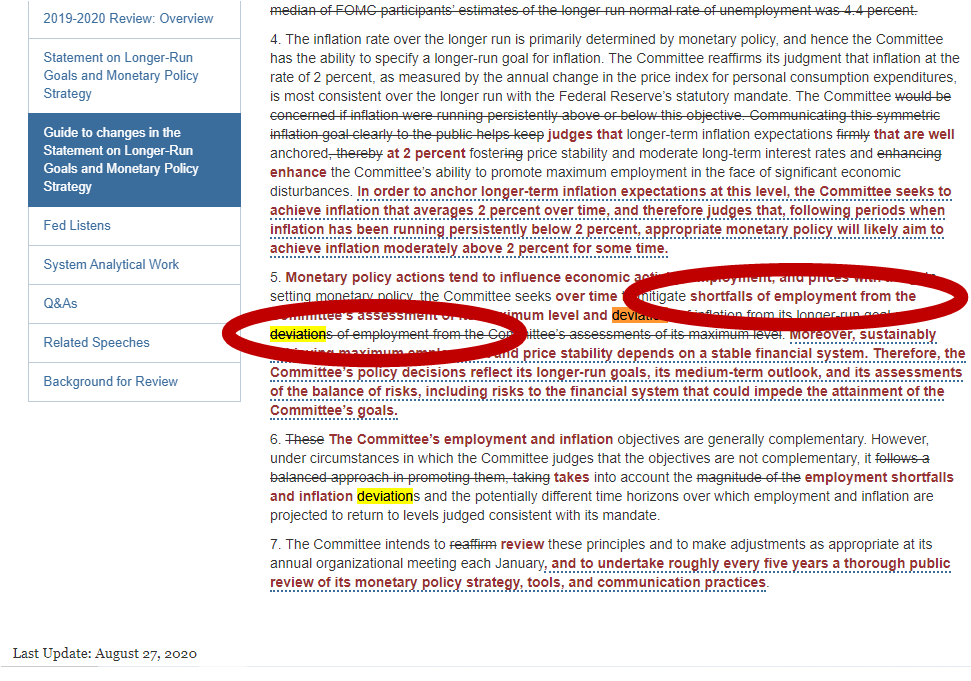

And it’s not about the target, either, not really. It’s what failing to meet it has represented for the realness in the real economy (above). Not the unemployment rate version; no, the inflation and bond “conundrum” of the 2010’s was always how the lack of inflation confirmed the lack of full recovery and therefore the destructive long run absence of actual growth. Believe it or not, that’s a good part of what this current “grand strategy” reassessment finally, finally admits. Not only is the absence of recovery implicit in this symmetry and average inflation targeting nonsense (they need to average out because they’d failed for so long), the strategy document also spells out the most important part of it all; what Keynes said about deflation and the labor market. I’ve highlighted it below (link to the original). |

Average Inflation Symmetry Shortfalls of Unemployment |

|

It used to be that monetary policy was guided in its dual mandate (inflation and employment) by “deviations of unemployment from the Committee’s assessments of its maximum level.” As you’ll notice, that part was stricken and, in its place, “shortfalls of employment” from the estimated maximum level were entered. What used to be in the framework was deviations, plural; which included the idea that employment could be “too much”, therefore requiring the Fed to raise rates (and other “tightening” hocus pocus) to cool off an overheated labor market. This would be a nonconformity from the maximum in the good direction, which, according to the Phillips Curve, can be inflationary. Now, there’s only the possibility of a “shortfall”, a single, specific kind of deviation. |

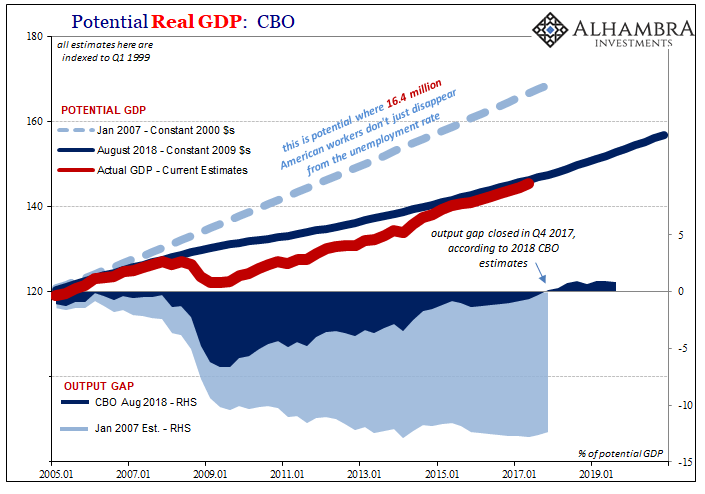

Potential Real GDP: CBO Output Gap, Jan 2005 - July 2020 |

| Why? Two words: the unemployment rate.

According to it over the last several years, going back to 2015, believe it or not, back when this main labor market ratio first tumbled underneath what had been calculated as “full employment”, the unemployment rate has totally confounded monetary policymakers. At every turn, year after year, they judged its decline as consistent with the deviation from the maximum I just described above; the good deviation, the inflationary kind. |

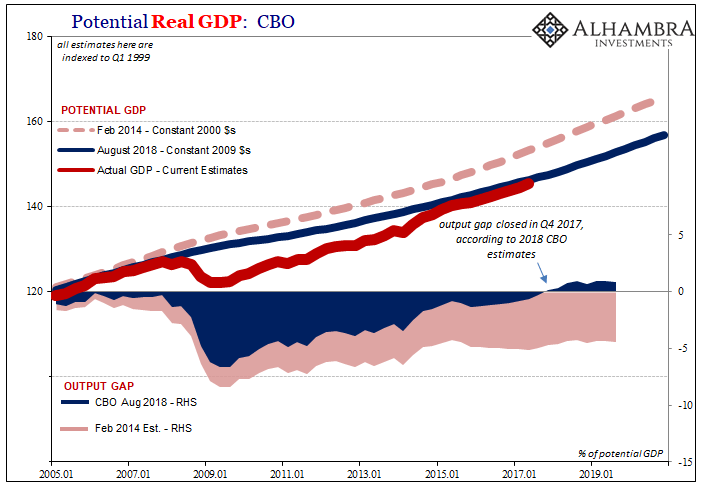

Potential Real GDP: CBO Output Gap, Feb 2014 - Aug 2018 |

| Yet, never once an inflationary burst nor the more important acceleration in growth we call a recovery. Because those things didn’t happen, the unemployment rate could only have been false. Yet, denial always persisted if for no other reason than CYA and convenience. |

Potential Real GDP: CBO Output Gap, Jan 2010 - Aug 2018 |

| It sure seems like, and it is heavily implied (because they’ll never just come out and state this) here, these charlatans have finally acknowledged how they’ve been misleading themselves, and you, for more than a decade about the real state of the labor market therefore the overall economy. |

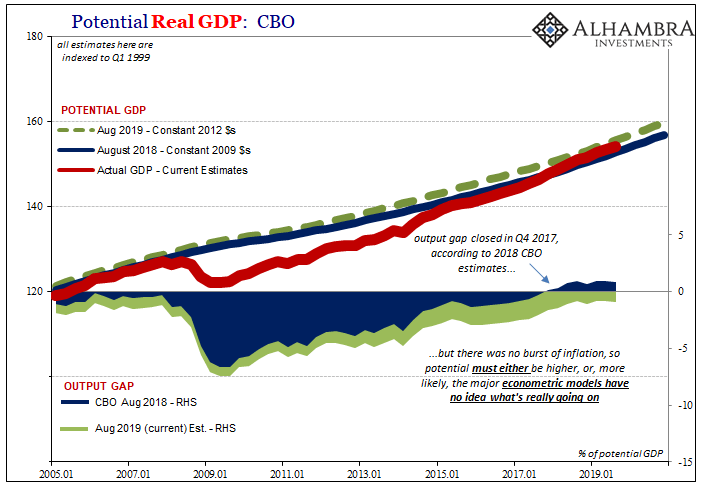

Potential Real GDP: CBO Output Gap, Aug 2018 - Aug 2019 |

| And this has implications in raw monetary policy terms, too, as we’re seeing right here; the very idea of “maximum level”, what we call potential and full employment. Also implicit in this new monetary policy framework is that, as I’ve shown for years, the economy must never have recovered from the Great “Recession” at any point; it’s been lagging every expectation for growth from the very beginning and that didn’t change in 2017, 2018, and certainly not since.

In short, there could only have been a continuous shortfall! |

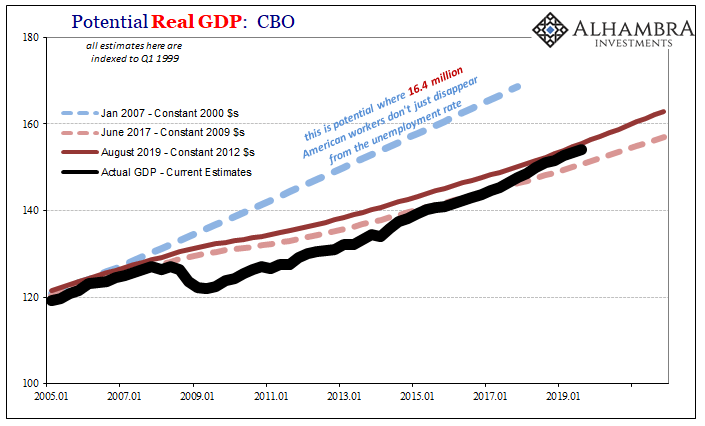

Potential Real GDP: CBO, Jan 2007 - Jun 2017 - Aug 2019 |

|

What Economists had done to delude themselves into believing that wasn’t the case is that they recalculated downward their idea of potential (including the R* version) to be more consistent with the unemployment rate; they literally fitted potential to it. But the more it deviated, the more it contradicted itself and this view the more it created problems – until in 2019 the 50-year low unemployment rate had shattered every idea about full employment being real. The CBO, like other mainstream models, actually had to push up calculations of potential to then “fit” the unemployment rate into it as it went lower, meaning they had to likewise admit there must’ve remained, there only could have been, still substantial slack in the economy; what I called the smoking gun which is now embedded within the Federal Reserve’s most sacred document. |

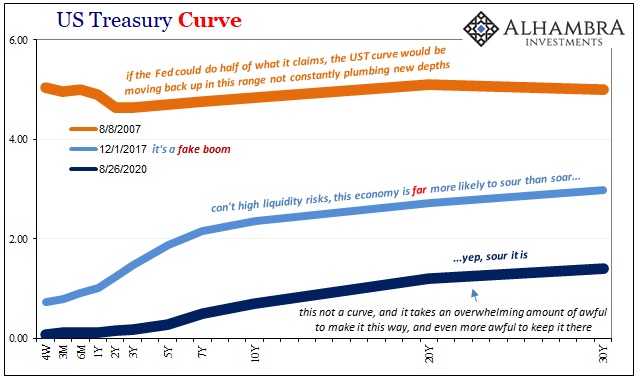

US Treasury Curve |

That’s why there’s now only “shortfall” deviation because the unemployment rate has been downgraded even to the Fed – unless it can be corroborated by something else, something inflationary (the same sort of deviation in the other mandate that they left in the document), it means squat.

Yeah, for the average person on Main Street this would’ve been highly useful to know sometime before today. After banging the drum for the unemployment rate view for years, and costing the world untold damages by doing so, all of a sudden they now want some proof; and rather than contrition, a public confession, this gets buried in heavily jargon-ed, unnecessarily complex policy statements.

Cowards, every single one. Destructive malfeasance. I truly wish this had been a joke.

As I write in that other column, these are not serious people and that is why I keep calling for them to be replaced. The zero lower bound was never a trap for the economy, it was always one for central bankers alone – because they have no idea what they are doing, and now, with symmetry being rerun from 2018 and one-sided deviations put into the strategy language, it’s obvious they don’t even have any ideas.

Full story here Are you the author? Previous post See more for Next postTags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,inflation,Jackson Hole,jay powell,Labor Market,Markets,Monetary Policy,newsletter,QE,recovery,unemployment rate,ZIRP