Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.

That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected. Realizing this is true does not cancel your vigilantism.

For two years now we’ve heard about how there are “too many” Treasuries. All the way back in December 2017 the federal government passed tax “reform” which was supposed to have been a different sort of stimulus than the all the same “stimulus” that the previous administration had also passed.

The only thing both parties could agree on was that it would bust the budget; as it did. With such an enormous increase in debt supply at auction, particularly T-bills, everyone said there was a brewing problem. Everyone.

And there was, just not the one they all thought.

Couple this very real supply imbalance with the Fed’s constant assurances that the labor market was ridiculously tight and how globally synchronized growth wasn’t just a bumper sticker slogan, there was no conceivable way interest rates would not have gone shooting up? The Bond Kings and Wall Street were certainly convinced.

Goldman Sachs underscored that fact by saying the Treasury is borrowing at record low rates, but couldn’t expect to do so indefinitely.

The Treasury’s need for more debt is inauspicious, given the recent surge in U.S. yields and a Federal Reserve that’s expected to begin a campaign to hike borrowing costs and withdraw liquidity.

“We expect rising interest rates and a rising debt level to lead to a meaningful increase in interest expense,” Goldman said.

These kinds of expectations were common during the era of inflation hysteria, the quote above taken from February 2018 at its height. And the reason it was a true hysteria was because, like any hysteria of any kind, the fallacy was widely believed and repeated despite lacking any tangible basis in fact. Inflation was forever a tomorrow phenomenon. Just like the deficit.

The inflation/deficit bogeyman.

Jay Powell kept referring to these which allowed him to perfect his ventriloquism; his lips didn’t move while his words kept coming out of Bill Gross’ mouth. The Fed Chair even went so far as to wade into the “too many” Treasuries story in order to outright lie as an attempted explanation for why signs of illiquidity were spreading openly in a way inflation wasn’t and never would.

|

I wrote in April 2018, just days before the dollar would begin to prove me right:

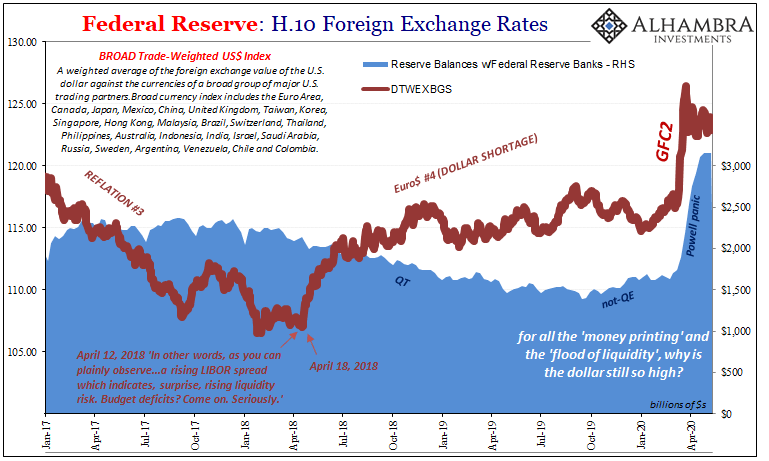

From the very beginning of “too many” Treasuries and inflation hysteria it was absolutely clear (if Jay Powell’s wasn’t your go-to source) there was rising liquidity risk – because the persistent dollar shortage was becoming an acute problem all over again (for the fourth time in a decade; Euro$ #4). Just six days after I wrote the above, the dollar exploded higher shocking all these same people who always couple irresponsible borrowing by the feds with the currency plummeting to zero. |

Federal Reserve: H.10 Foreign Exchange Rates, 2017-2020 |

| It’s not just that the Federal Reserve’s forecasts don’t matter, the central bank itself really doesn’t, either, which is the whole thing wrapped up in a nutshell. Aspiring Economists and Bond Kings like every Wall Street professional are all taught that the Fed is only what matters. That’s the error.

This point should have been driven all the way home at the end of 2018 (since it wasn’t but should have been, by 2008) when nominal yields had only pushed slightly higher and then started to plummet again to the shock and horror of Bond Kings and Jay Powell alike. Curves – like the rising dollar – had warned all year 2018 liquidity problems were becoming serious. Jay Powell said pay no attention to them. Guess which one the mainstream listened to? Here’s a clue from December 2018:

Why hadn’t “fresh debt” yet exerted “much pressure” on yields? Supply was going up, but so, too, obviously, had demand in defiance of Powell’s inflationary warning. Bond Kings had howled about the BOND ROUT!!!! the whole year by then, yet 3.25% was a conspicuously low high for the 10s. And now they were plummeting in yield again. What was it that would drive so many financial system participants into the safest, most liquid instruments on the planet? Safest and most liquid securities. A seemingly unending demand, regardless of supply, for what gets traded in the most liquid way conceivable. The continuing and then accelerating premium prices for those assets with the highest liquidity characteristics. Banks, most of all, willing to pay this skyrocketing liquidity premium at any cost to themselves. Hmmm. In what really has been the oddest twist, this very obvious conclusion was never even considered because of…bank reserves. The Fed’s balance sheet. |

UST Yield Curve, 2017-2020 |

| So, here we have the history of “too many” Treasuries over the last few years being thoroughly disproved in reality and more than that establishing, empirically, the very reasons why (the interest rate fallacy remains undefeated). The Fed’s level of bank reserves is immaterial to perceptions about monetary sufficiency in the actual monetary system.

Chastened by this, these people have learned their lesson on what really drives interest rates, the whole supply versus demand thing, right? LOL. No way. The cult never dies; BOND ROUT!!! is definitely, 100% guaranteed back on, this time for sure! Hot off the presses today:

Goldman Sachs strategists last week said more issuance adds to the case for higher rates and steeper curves. That’s not all, get this, these Wall Street strategists are now saying the Fed is going to need even more QE just to keep the BOND ROUT!!! from getting out of hand. Treasuries are going to require a yield cap that the Federal Reserve is supposed to supply. Because what Jay Powell has done recently, all those tantalizing bank reserves, there’s no freakin’ way it won’t work. Do you not see the trillions? |

TIPS Yields & Breaks, 2017-2020 |

| And yet, rates remain at historic lows and curves flattened so much as to be patently unlike them. Money and bonds in a state like we’ve never seen before. Ever. Demand for the safest, most liquid instruments continues to be unchallenged, though the federal government supply is giving demand its best shot. Again.

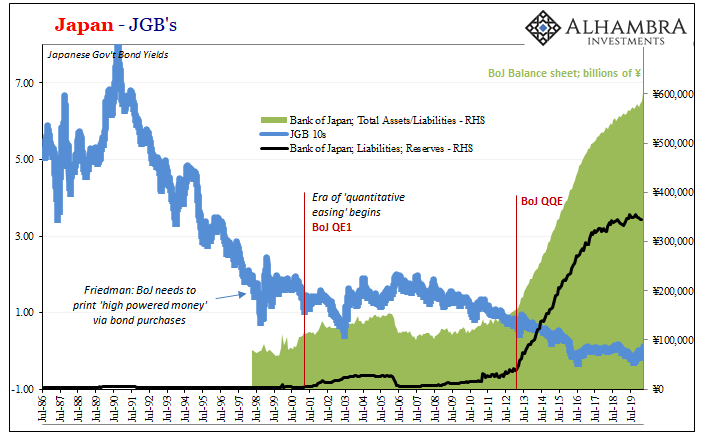

Hmmm. If your worldview begins with the central bank and its balance sheet, you’re doing it wrong. Economics, however, hasn’t taught anyone any other way of looking at the situation; that there can’t be any other way. Without a proper education there’s no means for people, even professionals and Bond Kings, to appropriately interpret the world around them. Even though all of this is really simple, highly intuitive stuff. The bond vigilantes aren’t an extinct species, they just realize the Fed’s a fraud and dollar shortage always wins because winning here means serious economic pain. And so long as the Fed remains a monetary fraud look to Japan, my friends, for the prior example of so much bond bull. |

Japan - JGB's 1986-2019 |

Full story here Are you the author? Previous post See more for Next post

Tags: bond yields,Bonds,currencies,demand,dollar shortage,economy,eurodollar system,Federal Reserve/Monetary Policy,FOMC,inflation,Interest rates,jay powell,Liquidity,Markets,newsletter,QE,supply,U.S. Treasuries