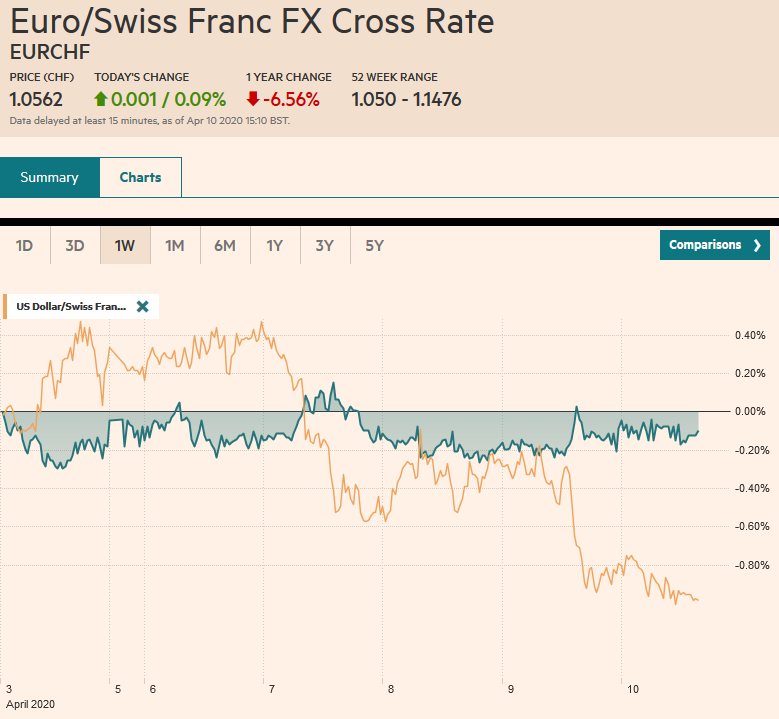

Swiss FrancThe Euro has risen by 0.09% to 1.0562 |

EUR/CHF and USD/CHF, April 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

Most of the financial centers in Europe and North America are closed today for the Good Friday holiday. Many markets in Europe will also be closed on Monday. Here is a summary of key developments.

- Many markets in the Asia Pacific regions were also closed. Most that were open advanced, including Japan, Taiwan, South Korea, and Thailand. China’s Shanghai Composite fell 1% and Malaysia, which saw its credit outlook cut to negative by Fitch, where equities fell a little less than 1%.

- The US dollar slightly lower against all the major currencies, led by roughly a 0.25% gain in the Scandis. The New Zealand dollar was the weakest in the G10, barely able to stay in positive territory. For the week as a whole, all the G10 currencies, but the yen gained at least 1% against the greenback. The Australian dollar was the leader, gaining 5.8%. The Norwegian krone and New Zealand dollar both appreciated by more than 3%. Around $1.0940, the euro rose about 1.3% this week, and near $1.2475, sterling gained almost 1.7%. At CAD1.3950, the US dollar fell roughly 1.8% against the Canadian dollar this week.

- OPEC+ struck an agreement that reduces output by 10-12 mln barrels a day in May and June. In H2 20, the reduction is eased to 8 mln barrels and then 6 mln bpd in 2021. There are a few reasons why oil did not rally when the announcement was made. First, the cuts are seen to be too small to address what is projected to be 25-35 mln bpd in excess. Second, as much as 5 mln bpd are expected from the G20 later today. OPEC+ wants the US to go beyond the reduction that lower prices and higher storage costs are already forcing. That said, Baker Hughes estimates that the US oil rig count fell by more than 10% last week, meaning that around a quarter of US oil rigs have been decommissioned. Third, Mexico refuses to cut its oil output, and in fact, AMLO wants Pemex to boost production this year. It is one of the cornerstones of AMLO’s domestic agenda. Pemex’s production has been falling for several years.

- The Eurogroup of EMU finance ministers struck a deal yesterday that will need the approval of the heads of state, which could be given next week. The agreement is for around 540 bln euros. The centerpiece (~240 bln euros) is a line of credit worth up to 2% of a member’s GDP at the European Stabilization Mechanism (ESM), with the only condition that the funds are used to Covid-19 related expenses. Another 200 bln euros is designated for the European Investment Bank for business loans. An employment guarantee fund is seeded with 100 bln euros and appears to offer some scope for mutualization. Like the OPEC+ outcome, the Eurogroup results disappoint those that wanted a more significant effort, given the magnitude of the disruption. Although some argued (as they did a decade ago) that the absence of a new collective debt instrument would mark the end of the European project, the push and pull and fits and starts that characterize Europe’s evolution look set to continue.

- The UK Treasury and the Federal Reserve announced bold actions yesterday. The UK Treasury indicated it would accept significant excess spending by departments in the near-term. Its over-draft facility is usually around GBP350 mln but swelled to GBP20 bln in the 2008-2009 crisis. It will be funded by the Bank of England. This is partly a cash-flow issue, but many see it as monetization of the debt. The Fed’s actions also blur fiscal and monetary policy. The Fed announced launched a new facility to buy local government debt and provided details about the purchases debt of small and medium-sized businesses. It also expanded the funding for two existing facilities. There are nine in all now, and each is funded by the US Treasury. The recent fiscal bill (CARES) included roughly $455 bln that Treasury will use to see these special purpose vehicles that will buy the various assets, which going forward will include bonds that have recently lost their investment-grade status. The Treasury’s funds are not needed to make the purchases but to protect the central bank from losses that these purchases may generate.

- Separately, the Federal Reserve announced it would further reduce the amount of Treasuries and mortgage-back-securities it is buying. Unlike asset purchases in the Great Finacial Crisis, the current purchases were aimed at stabilizing the markets. The Fed had reduced the daily amount of Treasury gradually from the $70 bln a day at the outset to $50 bln last week and $30 bln going forward. It is reducing its MBS purchases to $15 bln a day, down from $25.

- Usage of the Fed swap lines with foreign central banks was drawn to the tune of about $105.5 bln last week, down slightly from the previous week. The total outstanding was little changed just below $400 bln. The Bank of Japan, followed by the European Central Bank and the Bank of England, were the largest users, but ten central banks in all used the swap facility, including Mexico, South Korea, and Singapore. India and Indonesia are reportedly are in talks for swap lines with the Fed as well. The Fed’s repo facility for central banks is open, and although there is some interest, it was not used. The Federal Reserve’s custody holdings of US Treasuries for foreign central banks fell by $21.6 bln for the sixth consecutive weekly decline. Over these six weeks, the average weekly liquidation was about $25.8 bln.

- The highlights of the high-frequency data include another surge in US weekly initial jobless claims. It brings the three-week surge to nearly 17 mln, and the dramatic rise is not over. Backlogs have been reported, and some states have only recently imposed lockdowns. Canada reported a 1.1 mln job losses last month, which was more than twice what economists had projected. Job losses were concentrated in services, and over half of the losses were part-time positions. The number of hours worked fell sharply and is consistent with a sharp economic contraction. Germany reported a 650k (~40%) jump in the number of people in the shortened-work program, for which the government subsidies wages. Lastly, China reported a dramatic rise in aggregate financing last month. The CNY5.15 trillion (~$732 bln), was well above expectations and could be a record amount.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of England,EUR/CHF,Europe,federal-reserve,newsletter,OIL,OPEC,USD/CHF