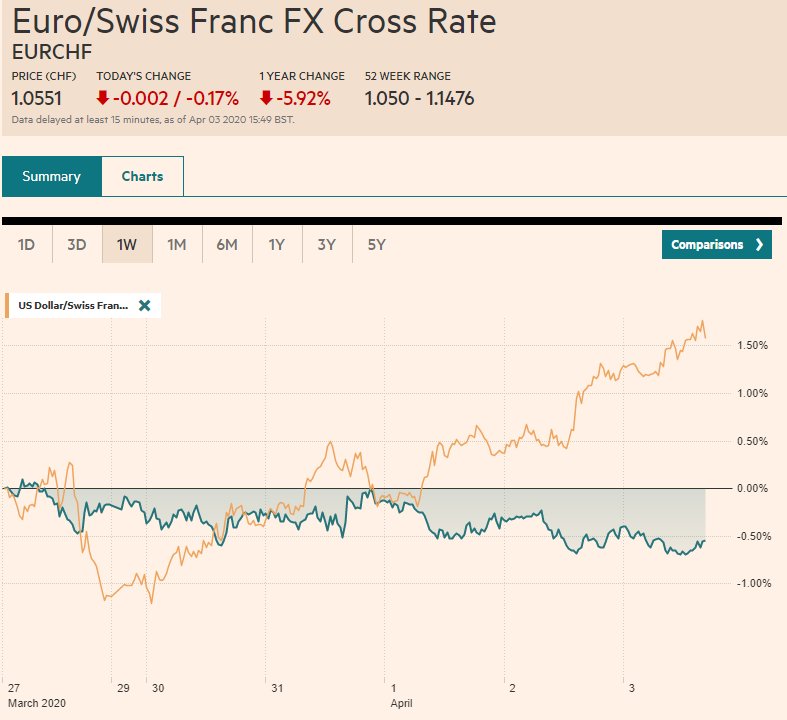

Swiss FrancThe Euro has fallen by 0.17% to 1.0551 |

EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equities are finishing the week on a soggy tone despite the 2%+ gains seen in the US yesterday. The extension of shutdowns, rising contagion and fatality rate, and imploding economies weigh on prices. In Asia, Korea and Indonesia bucked the trend to most minor gains. Europe is giving back yesterday’s gains, and the Dow Jones Stoxx 600 is nearly flat on the week. US shares are paring yesterday’s gains as well, Benchmark bond yields are little changed, though, at 60 bp, the US 10-year yield is about 13 bp lower on the week. European bond yields are mostly higher on the week, and most premiums over Germany have widened slightly, though not Italy. The dollar remains bid. It is higher against most of the world’s currencies heading into the weekend. Among the majors, only the Norwegian krone has gained on the greenback. The JP Morgan Emerging Market Currency Index is off by about 2.5% this week. Gold is consolidating after regaining the $1600 level yesterday. Near $1611, it is off about 1% on the week. Oil prices are consolidating yesterday’s surge. |

FX Performance, April 03 |

Asia Pacific

Like its manufacturing component, the Caixin services PMI rose to 43 from 26.5. The composite rose to 46.7 from 27.5. The below 50 reading means it is still contracting, albeit at a slower pace than previously. It is clear from several different measures that China’s economic and social activity is recovering. The extent of it is the question. China continues to take action to support the economy and today cut the required reserve ratio for small banks by one percentage point.

In Japan, Prime Minister Abe remains reluctant to call a state of emergency could do so early next week if confirmed cases continue to rise. Meanwhile, it is interesting to note that the final service and composite PMI showed small improvement from the flash readings. To wit: the services PMI is at 33.8 up from 32.7 in the preliminary reading and 46.8 in February. The composite PMI edged up to 36.2 from 35.8 flash estimate and 47.0 in February. Next week, the government is expected to finalize a fiscal package for over JPY500 trillion.

Australia’s services PMI deteriorated to 38.5 from the preliminary reading of 39.8 and 49.0 in February. The final composite stands at 39.4 from the 40.7 initial estimate and 49.0 in February. The RBA and the RBNZ have launched asset purchase programs, and the latter indicated it was accelerating its efforts.

After testing JPY107 yesterday, the dollar reversed higher and poked through JPY108 as it snapped a six-day decline. It is extending its recovery today to test the JPY108.50 area in the European morning. The $1.9 bln option JPY108.00 and the nearly $900 bln option at JPY108.35 that expire today do not seem particularly relevant. The week’s high was set on Monday near JPY108.75, which is also the (38.2%) retracement of the dollar’s losses from the March 25 high around JPY111.70. The next retracement (50%) is near JPY109.30. The Australian dollar rose for seven straight sessions through Monday and has fallen in the last four. Today’s losses are pushing it back below $0.6000. A break of $0.5945 could signal a move to $0.5780-$0.5860. Against the Chinese yuan, the dollar is virtually flat on the week.

Europe

The eurozone final services and composite PMI readings were atrocious, and IHS Markit suggested its surveys point to as much as a 10% annualized contraction in the regional GDP. Germany’s service PMI held up the best at 31.7. France and Spain were in the 20s (27.4 and 23.0, respectively), while Italy’s was at a stunning 17.4. The composite for both Germany and France were revised lower from the flash estimates to stand at 35.0 and 28.9 from 50.7 and 52.0 in February, respectively. Spains’ composite was practically halved to 26.7, while Italy’s crashed to 20.2 (form 50.7).

The pattern in the UK was broadly similar: the preliminary estimates showed reflected a marked slowdown, and the final estimate was even lower. The services PMI eased to 34.5 from 35.7 initially and 53.2 in February. The composite fell to 36.0 from 37.1 and 53.0 in February. Separately, the UK extended its support to medium-sized businesses, after already targeting small businesses.

The US premium over Germany for two-year money began the year near 220 bp. Yesterday it fell below 90 bp for the first time in 4.5 years. It was twice as high in late February. The three-month cross-basis swap was at a record high premium for the euro on March 27, near 25 bp. This week, it more than doubled to 57 bp. And still, the euro has fallen every session this week.

The euro had begun the week, extended last week’s gains to almost $1.1165. It has been under nearly constant pressure this week and was pushed briefly below $1.08 in the European morning. There is an option for almost 935 mln euros at $1.0750 that expires today. Resistance is seen in the $1.0850-$1.0860 area. At the end of last week and for most of this week, sterling was bumping against the $1.25 area. Ahead of the weekend, and in the face of the greenback’s underlying bid tone, the short-term market appears to have given up. It is now approaching the week’s low near $1.2245, and a break of that could initially target the $1.2075 area.

America

The monthly US job report typically is the most important economic report of the month for the world’s largest economy. However, this is not true now. The methodology of the report, conducting surveys of businesses and households in the week containing the 12th of the month, means that the report is particularly dated. We already know that roughly 10 mln Americans have filed for unemployment benefits for the first time over the past two weeks. This is equivalent to around 6.5% of the US workforce. And only in recent days have several other states ordered stay-at-home edicts (including Florida, Georgia, and Tennessee).

Our back-of-the-envelope calculation showed the hospitality sector broadly conceived accounts for about 14% of the economy and 10% of the workforce to give a rough approximation of what to begin expecting. That said, there is no reason to expect that all three data points: weekly initial jobless claims, household survey (unemployment rate), and establishment survey (non-farm payrolls) have to be in any kind of congruence in the short-run. The median forecast in the Bloomberg survey calls for a loss of 100k jobs, and there is talk of a decline twice that size.

Oil prices surged by around a third after President Trump tweeted about a possible agreement between Saudi Arabia and Russia to reduce output by 10 mln or even 15 mln barrels over an unspecified period (day? month?). The tweets were not confirmed, and as of April 1, the Saudis (and Iraq) has indicated they were boosting output. Although there are reasons to be skeptical, and the price of May WTI pulled back from a high near $27.40 to almost $24.00 before the close, the odds of something taking place are perceived to have risen. OPEC has invited other oil producers to a virtual meeting on Monday. Trump has rejected ideas that the US producers should participate in the production cuts. Still, May crude is bid, though below yesterday’s highs.

The Fed’s balance sheet jumped by about $560 bln in the week through Wednesday. It roughly matches the increase from the previous week. The two-week increase then of about $1.14 trillion is the fastest growth on record and no sign that investors took this as a negative development for the greenback. Separately, the Fed reported that foreign central banks have continued to sell Treasuries from the custody account in maintains. The nearly $24 bln liquidation was the fifth consecutive week of divestment and leaves the account with $2.87 trillion of Treasuries, which is the least in three years. The Fed’s repo lines, which will allow foreign central banks to repo their Treasury holdings with the Fed instead with commercial banks or selling them, will begin next week.

The dramatic bounce in equity prices has done little for the Canadian dollar. Since the end of last week, the US dollar has been climbing the 20-day moving average, which is found now near CAD1.4120. Yesterday’s high was near CAD1.43. In the European morning, the greenback is in the middle hovering around CAD1.42.Similarly, higher oil prices have not lessened the pressure on the Mexican peso. The dollar set new eight-day highs in Europe near MXN24.75. Above MXN25.00 looms the record high around MXN25.46. The peso reflects Mexico’s hardships, unconvincing policy response, and its role as a proxy for emerging market currencies more broadly.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Currency Movement,EUR/CHF and USD/CHF,federal-reserve,newsletter,OIL