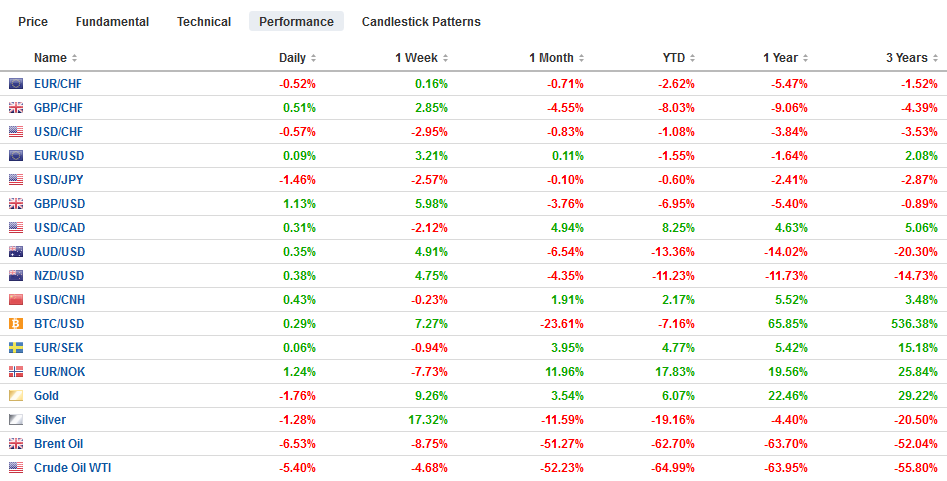

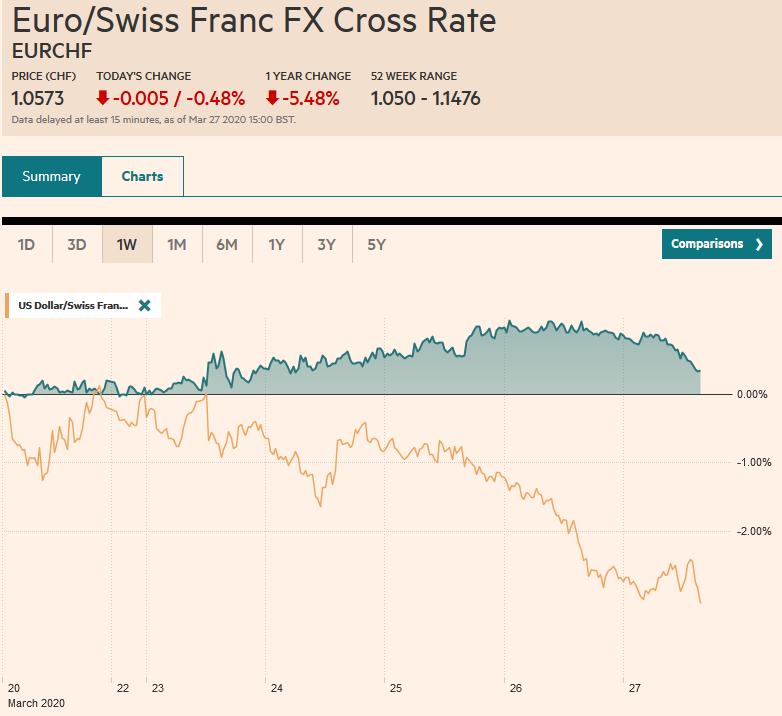

Swiss FrancThe Euro has fallen by 0.48% to 1.0573 |

EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Officials appear to have persuaded investors that they have put into place measures that will cushion the economic blow and ensure that the financial system continues to function. After seemingly goading officials into action, investors are choosing not to resist. Moreover, there is a recognition that many programs are scalable. Risk assets dipped initially yesterday and came roaring back. Good follow-through buying was seen in the Asia Pacific region. Australia and Taiwan were exceptions to the general move. Australia’s benchmark had begun off with around 2% gains before slumping and finished off more than 5%. European bourses are paring this week’s gains. The Dow Jones Stoxx 600 is down 2%, leaving it up around 6.8% on the week. The benchmark fell 2% last week. US shares are also more than 2% lower after the S&P 500 staged its biggest three-day advance in nearly a century. It was up 14% for the week coming into today after tumbling 15% last week. Core bond yields are softer in Europe by 2-3 bp, though the peripheral yields are a bit firmer after the ECB-induced decline that saw Greek bonds bought by officials and yields are off 90 bp this week. Italy, Spain, and Portugal’s 10-year yields are off 20-30 bp this week. The 10-year US Treasury yield is flat for the week with today’s seven basis point decline (to 78 bp). The dollar is paring this week’s decline. It is firmer today against all the major currencies, but the Japanese yen. The Norwegian krone is the strongest currency this week, recouping 11%, even after today 1.2% pullback. None of the major currencies rose less than 1.75% against the dollar this week. JP Morgan’s Emerging Market Currency Index is off about 0.5% today, but it snapping a five-week 11%+ slide with a 1.8% advance. Gold is trimming this week’s gains a bit, but its 8% rise is its largest weekly advance since 2008. Light sweet oil for May delivery is flat on the week coming into today, having given up the week’s gains with a 7.8% slide yesterday. |

FX Performance, March 27 |

Asia Pacific

With the help of US swap lines, the three-month cross-currency basis dollar-yen swaps snapped a nine-week drop and halved the dollar premium to about 41 bp this week, which is near the 200-day moving average. The dollar had stalled through mid-week near JPY111.60 before pulling back yesterday and today, reaching a six-day low today near JPY108.25. The surge in the yen is seen as a function of fiscal year-end related flows.

India’s central bank slashed the repo rate by 75 bp (to 4.40%) and cut the reverse repo rate by 90 bp (to 4.0%) ahead of next week’s meeting. It cut rates five times last year, and this is the first cut this year. Required reserves were cut by 100 bp (to 3%). The move reflects an escalation of India’s response to the crisis in which the country has been shut down. Yesterday, the government unveiled near measures of support worth an estimated INR1.7 trillion. The central bank estimates that its liquidity provision since last month’s review is worth about 3.2% of GDP.

The dollar found support near JPY108.25 in the Asian morning after settling yesterday near JPY109.60. It recovered to test JPY109 in the European morning but appears to be running out of steam. The expiring options today maybe helping to define the range. There is an option for $360 mln at JPY108.35 and a set at JPY109.50-JPY109.60 for a little more than $1.3 bln. The Australian dollar traded at a nine-day high near $0.6125 before encountering offers that push it back toward $0.6050 where bids re-emerged. Another push above $0.6125 could target $0.6200. For nearly two weeks, the dollar has been confined to CNY7.05 to CNY7.1250 range. The dollar is virtually flat against the yuan this week, and the PBOC has often set the reference rate for a slightly weaker dollar than the bank models implied.

Europe

The British government appeared to have completed its fiscal initiative with yesterday’s announcement of a support program for the self-employed. As many as 3.8 mln people will be eligible for up to GBP2500 a month for three months. The program may cost around GBP9 bln, and bring the cumulative price tag of the government’s initiatives to around GBP100 bln, according to some estimates.

VW became the latest auto producer to announced a halt in output. Both North American and European facilities are impacted. The company says it will cost about 2 bln euros a day. It noted that China’s sales are around half of pre-crisis levels, while sales outside of China are at a “standstill.”

While food supply chains are thought to be robust, the harvest in Europe will be adversely impacted. Reports suggest 200k French workers and 100k Italians are not available to help. Strawberries and asparagus, for example, are set to be rotting in Spain, Italy, and Southern France.

The three-month cross-currency basis swaps for the euro are now distorted in the opposite direction. Recently, the discount was the largest in several years, around 128 bp. Today the premium reached a record of a little more than 25 bp. In the spot market, the euro extended its gains to approach $1.1090, just nicking the 200-day moving average (~$1.1080). It has eased since the Asian morning and tested support near $1.10 in early Europe. Note that the $1.1065 area corresponds to a (50%) retracement of the losses since the $1.15 level tested on March 9. The next retracement (61.8%) objective is found around $1.1165. Sterling poked above $1.23 to meet its (50%) retracement objective of the decline since March 9. The next (61.8%) retracement target is around $1.2515. The three-month cross-currency basis swaps for sterling reached an extreme discount of a little more than 100 bp on March 17. It set what appears to be setting a record premium above 25 bp.

America

Today, the US House of Representatives is expected to approve the $2 trillion initiative approved by the Senate. Many suspects that an additional package will be sought later in the year. The market has seemed to focus on the to-and-fro of the progress of the US fiscal plans. The next debate already appears to be gathering momentum, and it is over how soon the shutdowns can end. The White House ha unveiled a county rating system, but some local authorities who orders the restrictions are unlikely to defer to national authorities from local medical officials.

We are not the only ones who have grown more concerned about the outlook for Mexico. Late yesterday, S&P cut the sovereign rating one notch to BBB and maintained a negative outlook. This matches Fitch’s assessment, which has a stable outlook. That leaves Moody’s at the outlier. It gives Mexico an A3 rating, which is equivalent to A-. The outlook is negative. Separately, both Mexico and Brazil are stepping up efforts to control the spread of the virus after having been reluctant to do so.

The US reports February personal income and consumption figures. The data is too old to capture the economic shutdown but may give a hint. The University of Michigan’s final March consumer confidence report will be released, and further deterioration is expected. The market took the record jump in weekly initial jobless claims that were reported yesterday in stride. It was more than the median forecasts, but it was widely anticipated to be a horrible number, and it was.

Although Canadian banks do not appear to have drawn on the official swap lines, the Canadian dollar is snapping a four-week, nearly 8.5% slide. It is up almost 2% this week. The US dollar is found support near CAD1.40, having reached roughly CAD1.47 on March 19. A move now above CAD1.4150 could spur a near-term move toward CAD1.4250. Besides, the US dollar’s broad direction and risk-appetites, the US has indicated it may move troops to the border. This threatens to erupt into a source of tension between the two countries. The risk-off mood and the credit downgrade is weighing on the Mexican peso. The dollar found support near MXN22.85 and is around MXN23.30 as the North American session is about to begin. Initial resistance may be seen near MXN23.46 and then MXN23.85.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,cross currency basis swap,EUR/CHF,India,newsletter,USD/CHF