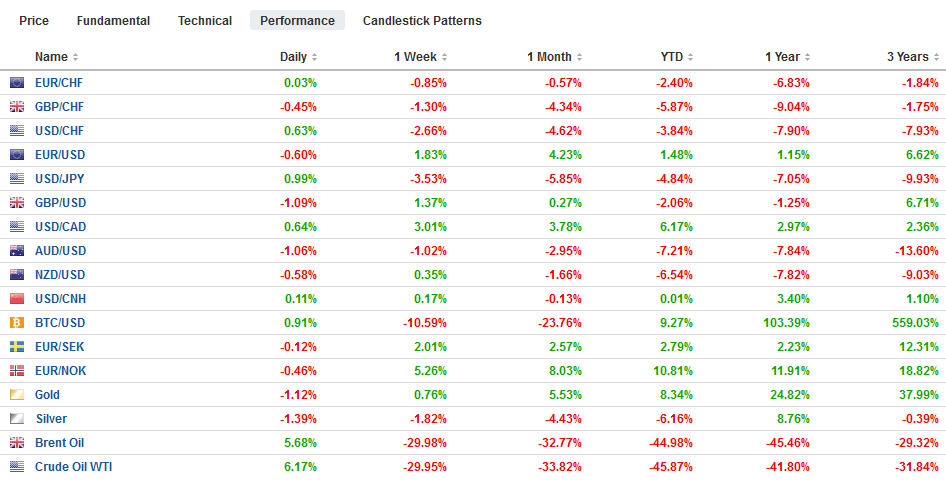

Swiss FrancThe Euro has risen by 0.09% to 1.0597 |

EUR/CHF and USD/CHF, March 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

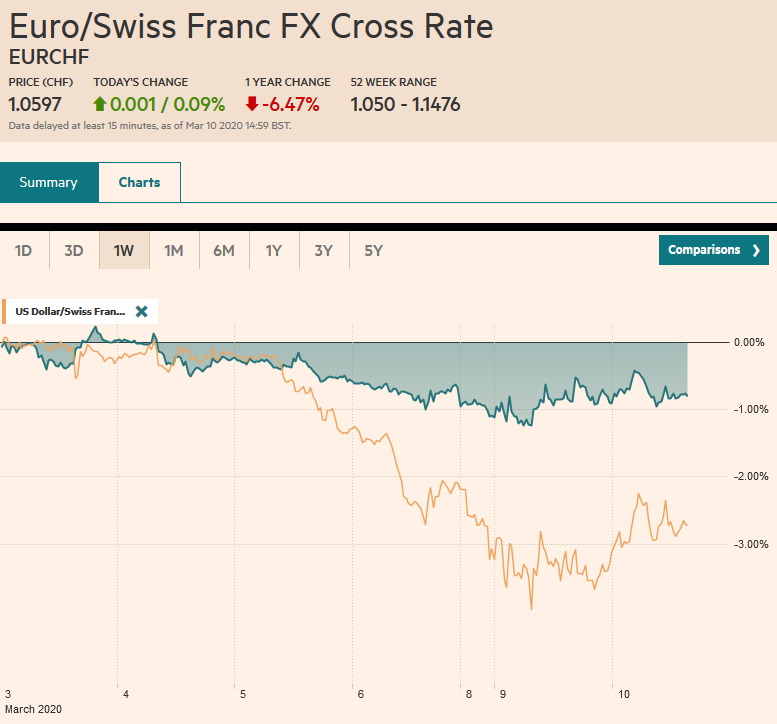

FX RatesOverview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump’s press conference today is expected to spell out in greater detail relief for households and businesses. Asia Pacific equities rallied, led by a 3% surge in Australia. Most markets gained 1%, though South Korea and Taiwan lagged behind. Europe’s Dow Jones Stoxx 600 is snapping a three-day 13.5% drop with around a 2% gain through the European morning. US shares are also higher, recouping around 3% of yesterday’s 7.6% fall. Bond yields have snapped back. Core European yields are 8-11 bp higher and the US 10-year yield is up 14 bp at about 68 bp. Italian bond yields that surged during the panic risk-off have come back 8-10 bp lower. The dollar is clawing back losses against most of the major currencies. The Norwegian krone and Canadian dollar have been helped by the bounce in oil prices. April WTI jumped 5% but pared early gains. It is up around 3.6% after falling more than 40% over the past four sessions. Gold is off by a little more than 1% (~$1662). |

FX Performance, March 10 |

Asia Pacific

Japan’s Diet is set to grant Prime Minister Abe the power to declare a national emergency. Abe, in turn, is pushing a fiscal package that will include about $4 bln for addressing the coronavirus as part of an o overall economic package of around $16 bln. At the same time, the BOJ has stepped up its ETF purchases, including JPY101 bln today (its fourth purchases this month), even though the pullback in the yen helped spur a recovery in Japanese shares earlier day. Separately, South Korea introduced a ban on short-selling.

China reported February CPI eased to 5.2% from 5.4% and PPI fell to minus 0.4% from 0.1%. Food prices rose nearly 22% from a year ago, led by the 135% increase in pork prices, added 1.3 percentage points to the annual CPI. The data was brushed aside as nearly irrelevant in the current context. Meanwhile, reports suggest that while manufacturers are increasing re-opening businesses, the cancelation of orders (domestic and foreign) and other disruptions may make for a slow and modest recovery.

Some observers thought they detected the BOJ’s hand in the market when the dollar fell sharply about 15 minutes before the US stock market open from around JPY102.30 to new multi-year lows near JPY101.20. While possible, it is more likely that it was simply the market’s newfound volatility. If it were to intervene during the North American session, protocol dictates that the US is asked. While it says nothing about Japan’s sovereignty, it would, if intervention is deemed necessary, prefer to intervene during its own time zone. If it asked, and the US turned it down, it would be awkward. If the US did not turn it down but did not intervene with it, it would be seen as disapproval and could undermine an operation that has historically enjoyed faint success at best.

The dollar’s lower opening yesterday created a small gap (~JPY104.93-JPY104.99) that was closed today as the dollar briefly poked above JPY105.00. Resistance extends toward JPY105.40, which represents the (38.2%) retracement objective of the slide since February 20-21 push above JPY112.00. Initial support is seen near JPY103.75. The Australian dollar is about a 30-40 point range around yesterday’s close (~$0.6585). It is consolidating after covering a nearly four-cent range yesterday (~$0.6300-$0.6700). For the fifth session, the US dollar remained in a CNY6.90-CNY6.95 range against the Chinese yuan.

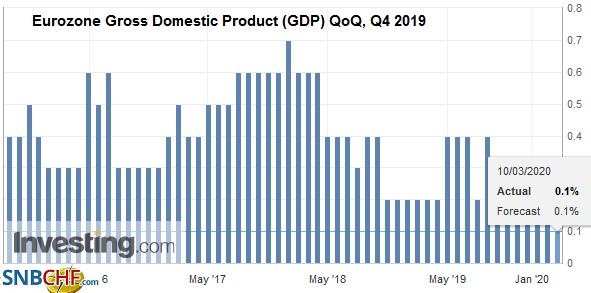

EuropeItaly has extended the lockdown to cover the entire country, limited movement until April 3. It follows a surge of cases and fatalities. The lockdown will be difficult to enforce, but the social distancing and testing seemed to have been pivotal in South Korea, which appears to have made great strides in containing the virus. France joined Germany in reporting a recovery in industrial output after a sharp drop in December. Yesterday Germany reported a 3% rise after December’s 3.5% fall was revised to only -2.2%. However, while Germany’s rise was almost twice what economists expected, France underwhelmed with a 1.2% gain instead of 1.8%. And the December revision was minor (-2.5% instead of -2.8%). The aggregate figure for the eurozone will be released a couple of hours before the ECB meeting concludes on March 12. Meanwhile, the first round of negotiations between the EU and Turkey were unable to resolve the border issue. At the end of last month, Turkey allowed/encouraged refugees to leave for Greece. The 2016 agreement under which Turkey would house the hundreds of thousands of refugees from Syria, Afghanistan, and elsewhere, for aid (6 bln euros) from the EU. The refugees and the border is one of the few elements of leverage Turkey has with the EU and insists on playing that card. |

Eurozone Gross Domestic Product (GDP) QoQ, Q4 2019(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

Rather than the BOJ, it could be that the Swiss National Bank is showing its hand. Sight deposits, reported yesterday for last week rose by almost CHF1.4 bln after little more than that the previous week. The euro has been trending lower against the Swiss franc. It has fallen in eight of the first ten weeks of 2020. With a lockdown in Italy directly impacting 16 mln people, Germany and France slapping export controls on medical supplies, like masks, record negative yields in Germany, and broad economic and financial stress, the perennial worries that EMU cannot survive are resurfacing. In mid-February, Italy’s 10-year premium over Germany was near 130 bp. It rose nearly 50 bp yesterday alone, after rising almost as much over the past three weeks. Italy is not alone. The Spanish premium over Germany has practically doubled as well to nearly 115 bp. Remember the argument in the media a couple of weeks ago that noted that if the risk of redenomination (dropping out of the eurozone), peripheral premiums over German Bunds could continue to narrow.

The euro is consolidating within yesterday’s broad (~$1.1285-$1.1495) range. A break of the $1.1300-$1.1325 area could spur a move toward $1.200-$1.1225. Ahead of tomorrow’s UK budget, sterling is trading softer. It peaked yesterday near $1.33 and eased to about $1.3020 today to meet the (38.2%) retracement objective of this month’s advance. The next retracement (50%) is near $1.2965.

America

The Trump administration has been criticized for a slow response with mixed messages but appears to be in the process of a midcourse correction. Trump indicated a payroll tax cut and “very substantial” relief for industry are being considered. Some help to hourly workers is also being contemplated. However, employee benefits in the US, or lack thereof, make government efforts challenging. A quarter of Amerian workers have not sick leave, and that includes half of the part-time workers. A third of private-sector employees have no medical benefits from their employers. A week ago, Treasury Secretary Mnuchin indicated a payroll tax cut was not under consideration, and yesterday sounded quite differently as he promised the administration would use all tools at its disposal.

With the circuit breakers for equities hit and speculation of a repeat of last week’s emergency 50 bp cut inter-meeting, the Federal Reserve bought some time by boosting the amount of liquidity it would provide via its repo operations. A couple overnight repos were oversubscribed though it did not result in a spike in rates. Previously, the Fed offered up to $100 bln in overnight repos and $20 bln for two-week term operations. The amounts have been increased to $150 bln and $45 bln, respectively. The reason it buys the Fed a few days is that on March 12, it is due to update the funding schedule. The adjustment means that the Fed can provide $285 bln of liquidity through its repo operations rather than $180 bln. As of the end of last week, the outstanding repos were for almost $180 bln. According to the CME’s model, the March fed funds futures contract is pricing in about near certainty (98%) chance of a 75 bp rate cut next week that would bring the target to 0.25%-0.50%.

Canada’s Finance Minister Morneau indicated that the Trudeau government was putting together a targeted fiscal response to the coronavirus. Mexico boosted its NDF hedging facility to $30 bln from $20 bln, and Banxico could auction the NDFs at any time.

The US dollar traded between roughly CAD1.3460 and CAD1.3765 yesterday and is consolidating in about a 50-point range on either side of CAD1.3650. As the North American session is about to begin, resistance near CAD1.3700 looks stronger than support around CAD1.36. The greenback traded between about MXN20.1050 and MXN21.1370 yesterday, boosted by the drop in oil prices and the powerful risk-off move. It settled near MXN20.7750 yesterday and eased a little below MXN20.30 today. The high nominal and real yields will attract carry-trades and asset managers again as markets stabilize, and this may help the peso regain its composure quicker than others. Note that the MXN20.33 area corresponds to roughly the halfway mark of the range since the February 20 low near MXN18.52.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of Japan,EUR/CHF,Eurozone Gross Domestic Product,intervention,Italy,Japan,newsletter,Swiss National Bank,USD/CHF