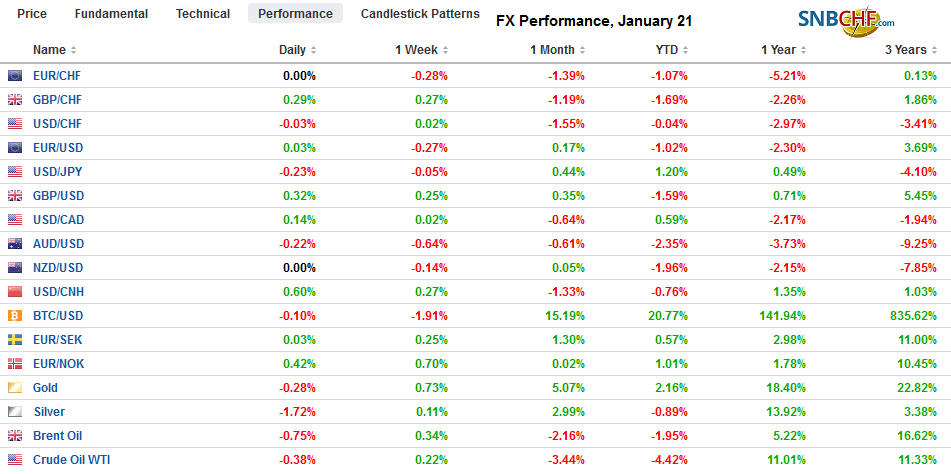

Swiss FrancThe Euro has risen by 0.05% to 1.0743 |

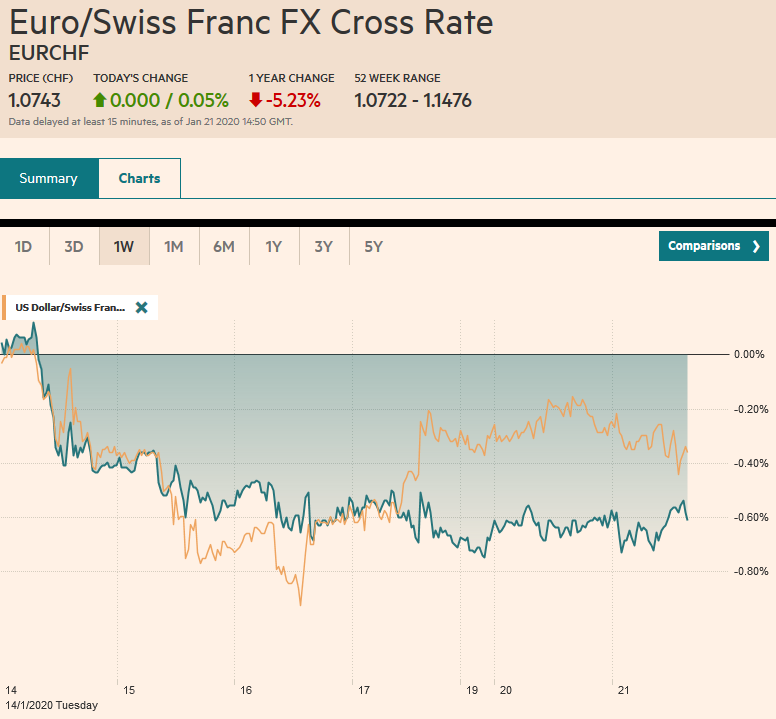

EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The spread of a new respiratory illness in China has spurred a wave of profit-taking in equities and risk assets more generally. All of the markets in the Asia Pacific region tumbled, with Hong Kong hit the hardest (-2.8%) after posting a key reversal yesterday. The sell-off continued in Europe. The Dow Jones Stoxx 600 is off about 0.8% in late morning turnover, led by consumer discretionary, materials, and energy. It is the biggest decline this month. US shares are trading heavily, with the S&P 500, about 0.5% lower in electronic turnover. Benchmark yields are lower in the Asia Pacific and core European countries, while Italy, Spain, and Portuguese yields are slightly higher. The dollar is mixed. With a better than expected employment report, sterling is the strongest of the majors followed by the Japanese yen. The dollar-bloc currencies and the Norwegian krone are nursing modest losses. Nearly all the emerging market currencies are lower. The JP Morgan Emerging Market Currency Index is lower for the fourth session in the past five. Gold is acting as a risk asset and is off about 0.3%. Oil is heavy, and the March WTI contract is off 1% and is slipping back below $58. |

FX Performance, January 21 |

Asia Pacific

As widely recognized, the Bank of Japan’s meeting concluded with no fresh action. However, the impression that officials will look through the economic wobble in Q4 and focus on the fiscal stimulus and the summer Olympics was reinforced by comments from Governor Kuroda. Growth forecasts for this fiscal year and the next were lifted by 0.2% to 0.8% and 0.9% respectively. CPI forecasts were shaved by 0.1% to 0.5% and 0.6% FY19 and FY20, respectively. Two governors dissented (Kataoka and Harada) against the decision to leave the yield curve target unchanged.

It is difficult to distinguish Hong Kong markets reaction to Moody’s decision to cut the Special Administrative Region’s rating to Aa3, which is the equivalent of an AA- rating by Fitch and S&P and fears of the new SARS-like virus in China. Consumer discretion, consumer staples, and real estate sectors fell 3% or more today. Fitch cut Hong Kong’s rating to AA from AA+ four months ago. S&P has maintained an AA+ rating. Moody’s expressed concern about the “slow” and “ineffective” government response to the demonstrations that began last April.

The gradual improvement in the semiconductor industry with knock-on implications for trade is seen in South Korea’s trade data covering the first 20 days of January. Semiconductor exports rose 8.7% year-over-year and are set to have increased for a month for the first time since late 2018. Overall exports fell by 0.2% in the first 20-day days of January, suggesting this is the best month in more than a year. Overall, exports to China were off 4.7% and to the US down 4.9%. Exports rose 5.6% to Japan.

The dollar was making little headway since poking above JPY110 a week ago. The unwinding of risk trades saw the dollar slip below JPY110 for the first time in three sessions. It found initial support near JPY109.90. There is an option for almost $510 mln struck there that expires today. The Australian dollar slipped to about $0.6845, its lowest in about a month, but has steadied and is back above $0.6850 in European turnover. A break of the $0.6840 area potentially would be a significant bearish technical development After reversing lower yesterday, the Chinese yuan continued to sell-off today. The 0.5% loss today appears to be the largest single-day decline since last August. The dollar bottomed yesterday near CNY6.84 and is now a little above CNY6.90.

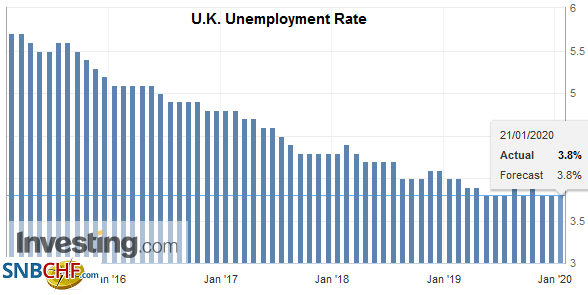

EuropeAfter a string of disappointing economic data, the UK surprised to the upside with its labor market report. The claimant count rose by 14.9k in December, matching the revised increase in November. Earnings and unemployment are reported with an extra month lag. Average earnings in November, including bonus payments, rose 3.2% in the three-month year-over-year measure, unchanged from October above the CPI (1.5% in November). Employment growth (also reported on the three-month year-over-year basis) jumped by 208k, the most in nearly a year, and twice what economists expected. Expectations for next week’s Bank of England meeting did not change much in response to the jobs data, which is understood to be a lagging indicator. Looking at the derivatives market, almost a 2/3 chance of a cut is discounted. Some participants may be waiting for the preliminary PMI readings at the end of the week before feeling comfortable with a rate cut. |

U.K. Unemployment Rate, November 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The recovery in German sentiment that began last year is being extended this year. The ZEW survey for January exceeded expectations. The assessment of the current situation improved to -9.5 from -19.9. It is the third monthly gain and the best reading since last July. The expectations component rose to 26.7 from 10.7 in December. It is also the third consecutive improvement, and it is the best since July 2015.

French President Macron and US President Trump struck a deal that avoids an escalation in the dispute over the digital tax Paris implemented. The US had threatened up 100% levies on $2.4 bln of French goods that US imports. The EU threatened to retaliate. The issue has been kicked down the road. The issue is, can there be a multilateral remedy? The EU’s previous attempt was blocked by Sweden, Finland, Denmark, and Ireland. The OECD is working toward a plan. However, at the same time, Italy is moving forward with its plans, and Prime Minister Johnson insists the UK adopt one too.

Johnson is expected to call for simultaneous fast-track talks between the UK and EU and the UK and the US. Johnson, Chancellor of the Exchequer Javid, and Bank of England Governor Carney have pushed hard against regulatory alignment with the EU after Brexit. An agreement like the one struck with Canada is the model. Johnson insists it is concluded by the end of this year. In the US, Trump has held out the promise of a big agreement that could lead to a 3-5-fold increase in trade. Lighthizer has said he would work toward a deal by the end of the summer.

The euro is in about a 10-tick range on either side of $1.11 today. Resistance in the $1.1115-$1.1125 may slow its recovery, and then there are the roughly 1.28 bln euros in expiring options ($1.1145-$1.1150) that may also deter stronger gains today. Support near $1.1080 frayed yesterday, but a convincing break below there would weaken the technical tone. The employment data helped sterling re-establish a foothold above $1.30, where an option for about GBP315 mln will expire today. There is another expiring option ($1.3040) for about GBP250 that also will be cut today. Resistance in the $1.3050-$1.3060 area may be a sufficient cap today.

America

There are no economic reports or Fed official speeches today. The US Senate impeachment trial opens today, but the impact on the capital markets and the economy remains minor at best. Canada report manufacturing sales today ahead of tomorrow CPI and central bank meeting. Governor Poloz has recognized the mixed nature of the recent data. The key issue going forward is whether the economy continues to moderate. The 11 primary dealers were queried by the Wall Street Journal. Six see the Bank of Canada on hold for the entire year, while five anticipate a cut in the spring. Mexico reports December unemployment figures. They are expected to be little changed.

The US dollar set a range against the Canadian dollar on January 9 of roughly CAD1.3025 and CAD1.3105. It has not been out of the range since then. It has built a base over the past two weeks in the CAD1.3030-CAD1.3045 range. It has not been above CAD1.3080. The technical indicators and risk-off sentiment seem to favor the US dollar’s upside. The market may be cautious ahead of tomorrow’s Bank of Canada meeting. The US dollar is about 0.35% higher against the Mexican peso, after being virtually flat yesterday. The greenback needs to re-establish a foothold above MXN18.80 to be anything of note. The technical indicators remain over-extended for the US dollar, but the large interest rate premium remains attractive. The Dollar Index was turned back from its 200-day moving average yesterday (~97.70). A break now of the 97.30-97.40 area would seem to confirm that a near-term high is in place.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Canada,China,Currency Movement,EUR/CHF,HK,newsletter,U.K.,U.K. Unemployment Rate,USD/CHF