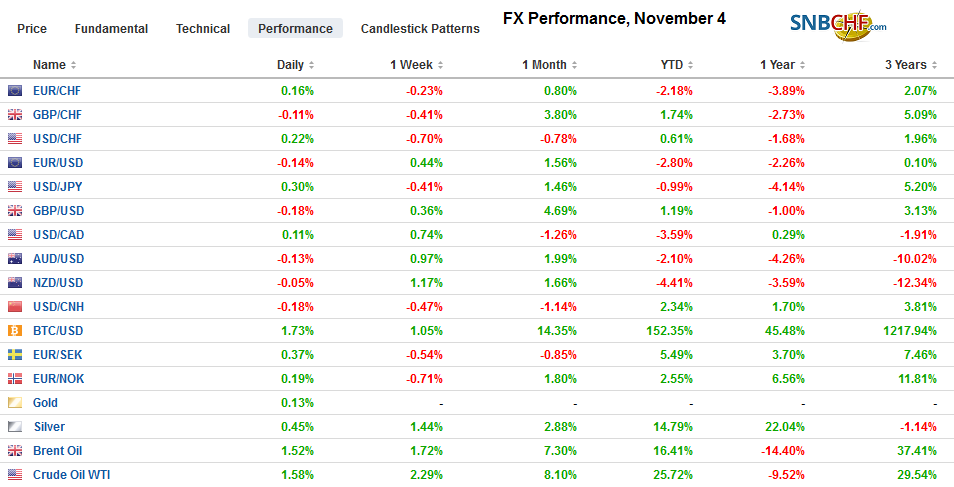

Swiss FrancThe Euro has risen by 0.16% to 1.1015 |

EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The regional benchmark advanced for the seventh session in the past eight and is approaching the year’s high. European shares extended their rally, and the Dow Jones Stoxx 600 has risen in nine of the previous 11 sessions. It is within spitting distance of last year’s high. US shares are also trading higher, and both the S&P 500 and NASDAQ set new records at the end of last week. Benchmark 10-year yields are mostly 2-4 bp higher, which puts the US Treasury yield near 1.75%. The dollar is mixed in mostly quiet turnover. The Antipodean and Swedish krone are leading the advancers, while the yen and Swiss franc are nursing small losses. Moody’s maintained its investment-grade rating for South Africa before the weekend, and the rand is taking comfort, leading the emerging market currencies higher. Gold is consolidating its foothold above $1500, and oil prices are little changed. |

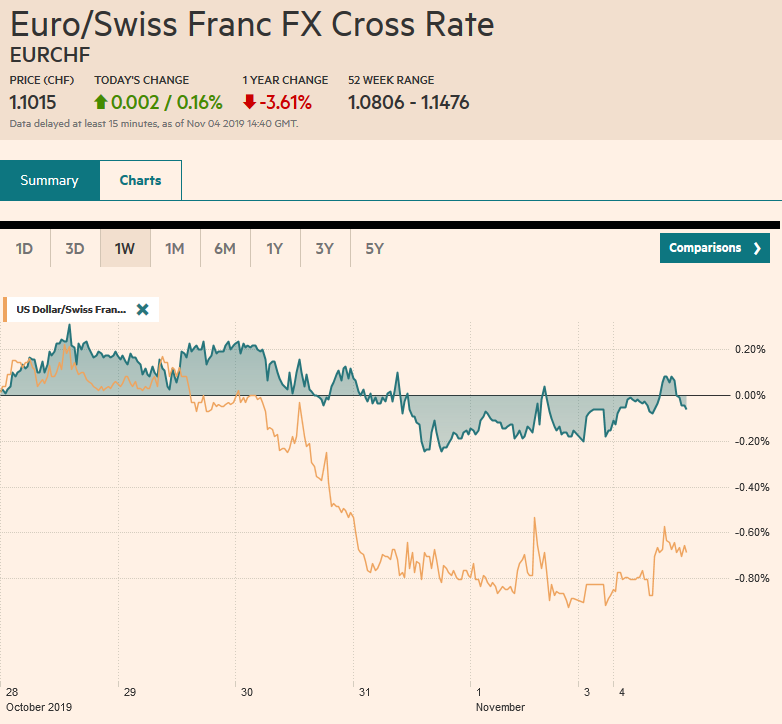

FX Performance, November 4 |

Asia Pacific

Chinese and US officials continue to sound optimistic about a near-term trade agreement. The essence of the deal is that in exchange for not taxing a range of consumer goods as they come into the US just in the middle of December, China will buy more US soy and livestock, which it needs as this week’s food component of CPI will show later this week. China has already maintained a stable yuan and has opened its financial services sector. US Commerce Secretary Ross indicated that licenses that will allow US companies to sell some product to Huawei will be granted soon. This had seemingly been agreed to several months ago.

The Abe government had signaled that it was prepared to offer some fiscal support if the sales tax sapped the economic momentum. The timing of the tax also corresponded to a disastrous typhoon. The Abe government is reportedly preparing a supplemental budget for as much as JPY5 trillion (~$45 bln) to be earmarked for disaster relief and flood protection.

Australia’s September retail sales rose by 0.2%, half of what economists expected. Retail sales have been fairly steady. The average through September was 0.2%, which matches last year’s average. When adjusted for inflation, retail sales fell 0.1% in Q3 after a 0.2% increase in Q2. Separately, in the region, we note that the Philippines central bank said its easing cycle was over. Malaysia reported weak exports (-6.8% year-over-year vs. expectations for a flat report after a 0.8% decline in August). Imports rose 2.4% following the 12.5% drop reported in August. It was the first increase since May.

The dollar had briefly dipped below JPY108 in the last two sessions but is holding above there today. The greenback has retraced (~38.2%) of the losses from last week’s high near JPY109.30, which is found near the 20-day moving average (~JPY108.40). Intraday support is seen initially near JPY108.20. The Australian dollar is firm just below last week’s high near $0.6930. An option for A$1 bln is struck at $0.6950 will expire today. The 200-day moving average, which has kept rallies in check since the end of last year, is found near $0.6955 today. The PBOC again set the dollar reference rate a little stronger than the models suggested. It is a subtle attempt to steady the yuan as the dollar approaches the 100-day moving average near CNY7.01. The dollar has fallen against the Korean won for seven of the past eight weeks and began the week at its lowest level since early July a little below KRW1160.

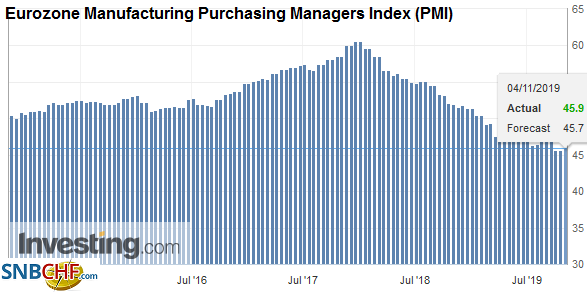

EuropeUpward revisions in German and French October manufacturing PMIs helped blunt the weakness in Spain and Italy. This translated into an uptick in the aggregate manufacturing PMI to a still lowly 45.9 from 45.7. |

Eurozone Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

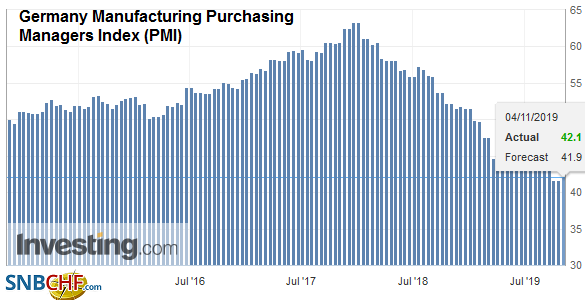

| The German flash reading of 41.9 from revised to 42.1 after 41.7 in September. The French manufacturing PMI rose to 50.7 from the flash report of 50.5 and September’s 50.1. Italy slipped to 47.7 from 47.8, and Spain deteriorated to 46.8 from 47.7. Note Spain goes to the polls this weekend. It is the fourth election in as many years. The surveys suggest the outcome will not be significantly different. The Socialists will be the largest party but has been unable to negotiate a coalition. |

Germany Manufacturing Purchasing Managers Index (PMI), October 2019(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Next month’s UK election is the key focus, and pre-election posturing and positioning dominate. The most important development may be Brexit Party Farage’s ultimatum to Prime Minister Johnson: he either abandons his withdrawal agreement or Brexit will not cooperate and instead field candidates that threaten to split the “leave” vote. There appear to be a sufficient number of three-way districts that could make a difference. Meanwhile, today, ahead of the suspension of Parliament for the campaign, a new Speaker will be selected.

Fitch maintained its BB- rating on Turkey, one notch above Moody’s (B1) and S&P (B+). It boosted the outlook to stable from negative and seemed optimistic, given its tone in July when it cut the rating. It cited progress in rebalancing and stabilizing the economy and played down the geopolitical risks on Turkey’s credit. Separately, Turkey’s central bank acknowledged for the first time last week that it was conducting swaps with non-bank financial institutions (taking dollars for lira) to provide funding for banks. Apparently, the central bank used a little known stock market mechanism rather than its own repo facility. The entire process not coincidentally lacks transparency and raises a concern about the true level of reserves. The latest reserve figures covered up until September 30, and the outstanding one-month or fewer swaps stood near $12.5 bln. Gross reserves are at almost $74 bln, which includes commercial bank deposits with the central bank required to be held against their dollar liabilities. Net reserves are thought to be a little less than half of the gross reserves. Turkey has around $120 bln of hard currency debt (roughly split between financial and non-financial institutions) maturing over the next year. Separately, Turkey reported October CPI moderated to 8.55% from 9.26% in September. The central bank does not meet until the middle of next month (December 12), and another rate cut looks likely (100-150 bp?).

The euro is in about a quarter of a cent range near its recent highs, just shy of $1.1180. Initial support is seen near $1.1150, and a nearly 810 mln euro option is struck at $1.1155 that expires today. The euro has not reacted much to press reports that quoted US Commerce Secretary Ross suggesting that a tariff on auto imports may not be necessary. A formal decision is expected in the next couple of weeks. Sterling was testing the $1.30 area before the weekend and is now nearer $1.29, where it is likely to find support. Following the better than expected manufacturing PMI at the end of last week, the UK reported an uptick in the construction PMI today (44.2 vs.43.3). We remain concerned that the election will not give a clear mandate to the Johnson, and the formation of a coalition may be challenging. The electorate remains divided on Brexit. The South Africa rand is the strongest of the emerging market currencies today. It has rallied about 1.6% after falling last week by 2.8%. Moody’s cut the outlook to negative from stable but kept the Baa3 rating (one notch into investment grade) while the other major rating agencies have it lower.

America

Perversely, it appears that the launch of formal impeachment proceedings may make the House approval of the new US-Canada-Mexico trade agreement more likely. House leader Pelosi reluctantly agreed to hold the vote to begin the impeachment inquiry proper, and she came out against the general drift of the Democratic presidential hopefuls, including medicare for all. Approval of the USMCA would be a success for the party moderates, who have sought greater enforcement of labor and environment protections provision and revisions to rules governing pharmaceuticals. Reports indicate progress has been secured, and a vote could take place over the next 4-5 weeks. The positioning at PredictIt.Org has not reflected these developments and has the odds 1-in-3. The recent peak was above 50% two months ago.

The US reports September durable goods orders and factory orders. The initial estimate of Q3 GDP steals whatever thunder it might have had. Tomorrow’s October non-manufacturing/service PMI/ISM are more important. While the US jobs data and the rise in new orders (though still below 50) commanded investors’ attention before the weekend, we continue to monitor potential warning signs that the consumer tired. Auto sales look to have fallen to six-month lows in October. Meanwhile, no fewer than nine Fed officials speak this week, beginning with San Francisco Fed President Daly today. While the bar to a December cut is understood to be high, we continue to expect two cuts next year, with the first one in Q1 20.

The US dollar fell to a three-day low near CAD1.3130 in a light Asian session, which is nearly meeting the (50%) retracement of last week’s Bank of Canada’s induced greenback rally. It has recovered in the European morning, and initial resistance is seen near CAD1.3180. The highlight of the week is Canada’s jobs report due on November 8. The US dollar tested resistance in the MXN19.25 area for the past three sessions but has given up on it with today’s push below MXB19.05. The dollar’s gains, which we had anticipated, have not alleviated the stretched technical tone. We continue to see risk-reward considerations arguing against chasing the dollar lower. The Dollar Index is slightly firmer in the pre-weekend range. Around the middle of October, it closed twice below the 200-day moving average before resurfacing above it. It is found near 97.45 today, and barring a stronger bounce, it would be the third session below it.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Brexit,Currency Movement,EUR/CHF,Eurozone Manufacturing PMI,FX Daily,Germany Manufacturing PMI,newsletter,South Africa,USD/CHF