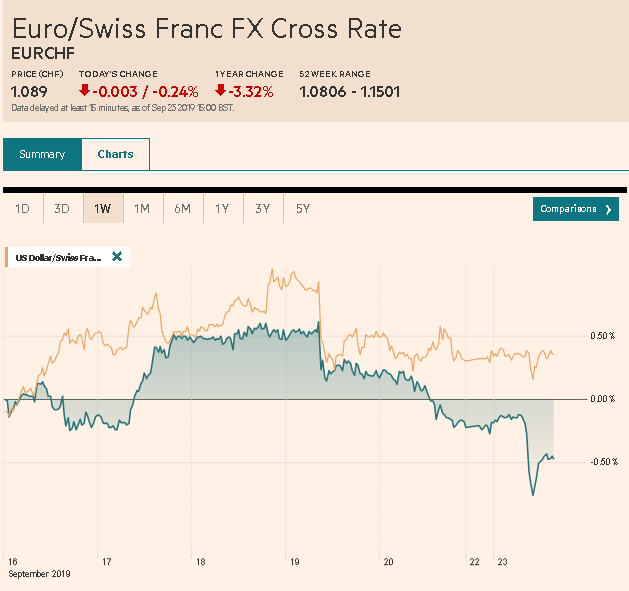

Swiss FrancThe Euro has fallen by 0.24% to 1.089 |

EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The critics who claim the ECB’s policy response was disproportionate got a rude shock today with the unexpected weakness revealed by the flash PMI. The euro looks to re-visit the lows set recently near $1.0925. Sentiment has also been eroded by the poor South Korean export figures. Asia Pacific equities moved lower, though Tokyo markets were closed. Indian equities, however, continue their pre-weekend surge. Investors are bidding up Indian shares (5% before the weekend and 3% today) on the back of the corporate tax cuts. Led by financials, materials, and information technology, Europe’s Dow Jones Stoxx 600 is off around 0.8% in late morning turnover. US shares are little changed. Bond yields in Europe are tumbling 5-8 basis points, while the US benchmark yields are off a few basis points to push back below 1.70%. The US dollar is narrowly mixed. The yen and Swiss franc have been joined by upticks the Australian and New Zealand dollars, while the complex of European currencies is heavier. Emerging market currencies are mostly heavier, though the Turkish lira’s 0.25% gain is the notable exception. Gold and oil are trading higher. |

FX Performance, September 23 |

Asia Pacific

South Korea reported that exports slumped 22% in the first 20-days of September. Exports to China are off by 30%, and shipments of semiconductor chips are off 40%. If there was a bright spot, it is that exports of chips for mobile devices rose 58%. Exports to the US fell 21%, though imports from the US rose 6.4%. Exports to Japan were off 14% while imports were down 17%. The takeaway is that investors can be more confident in a South Korean rate cut either in October or November and a recovery in regional trade is looking unlikely this year.

Australia’s flash manufacturing PMI fell to 49.4 from 50.9. It is the first reading below the 50 boom/bust level since the time series began in 2016. However, the services sector improved, and the PMI rose to 52.5 from 49.1 in August. This lifted the composite to 51.9 from 49.3. A week ago, the derivatives market was discounting almost a 1-in-4 chance of a cut at the next RBA meeting on October 1. The weak jobs data last week boosted the chances, and after today’s PMI reading, the OIS market appears to be discounting more than an 80% chance of a cut then.

The Chinese yuan fell by about 0.5% against the US dollar, its largest fall since early August. The PBOC’s reference rate for the dollar was little changed at CNY7.0734 and was a little lower for the dollar than the bank models suggests. The PBOC injected CNY100 bln in the banking system after draining CNY15 bln last week. Further injections this week are expected ahead of quarter-end and the October 1 holiday. Separately, Chinese news sources report that its delegation canceled visits to US farms before the weekend at the request of the US. It still seems mysterious and followed quickly on the heels of President Trump’s claim of no interest in a short-term agreement, which many suspect is part of his negotiation strategy.

The dollar is lower against the yen for the third consecutive session. It ran into offers near JPY107.80 in Asia without Tokyo participants. The greenback saw a 10-day low near JPY107.30 in early European turnover where a bid was found. Nearby resistance is seen near JPY107.60. There is an option for about $850 mln at JPY107.00 that expires today. Tomorrow there is a $1.1 bln option struck at JPY108.00 that will be cut. The Australian dollar is trying to snap its own three-day slide. It has held above the pre-weekend low near $0.6760. A close above $0.6780 could put it in favorable technical light for tomorrow.

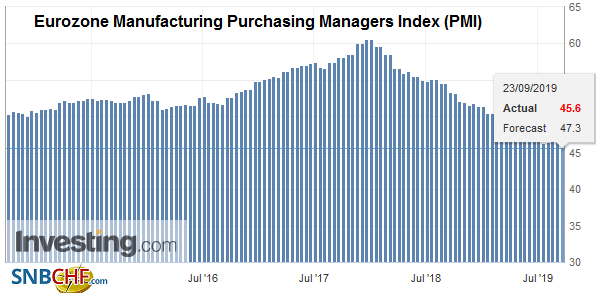

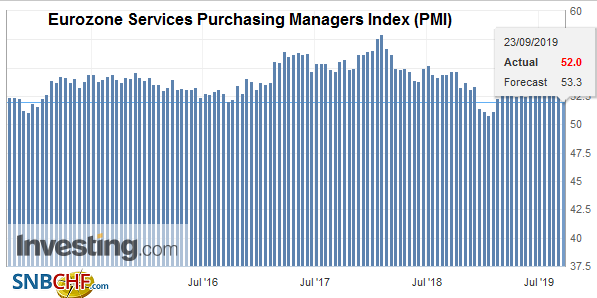

EuropeThe eurozone flash PMI dashed hope that the worst was past and supports those that were calling for bold ECB action. Just like South Korea exports show an Asia recovery remains elusive, the eurozone PMI warns that the downside risks are materializing. The German manufacturing PMI fell to 41.4 from 43.5 and the weakness cut into services, where the flash PMI fell to 52.5 from 54.8. The composite dropped to 49.1 from 51.7, much worse than expected. The French PMI also deteriorated. Manufacturing fell to 50.3 from 51.1 and services fell to 51.6 from 53.4. This pushed the composite reading to 51.3 from 52.9. |

Eurozone Manufacturing Purchasing Managers Index (PMI), September 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| For the eurozone as a whole, this means that the manufacturing PMI fell to 45.6 from 47 as the slump is extended and deepened. The service PMI eased to 52.0 from 53.5. The composite stands at 50.4, a new cyclical. It was at 51.9 in August and 54.1 in August 2018. The new orders component fell to 48.8 from 50.5. It is the weakest since June 2013. |

Eurozone Services Purchasing Managers Index (PMI), September 2019(see more posts on Eurozone Services Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

In the UK, the collapse of Thomas Cook has grabbed attention from Brexit. Labour Party members are expected to vote today on the party’s Brexit stance. While the Tories will campaign as the Leave Party and the Lib Dems the Remain Party, Labour’s position is less clear and arguably more about the process and ensuring voters have the final word. Prime Minister Johnson is expected to see if he can persuade any on the sidelines of the UN General Assembly.

The euro formed a cap near $1.1080 last week. Support near $1.0990 has given way today under the weight of the disappointing flash PMI. There seems little now to prevent a retest on the recent lows near $1.0925. A break of $1.09 would target $1.08. The $1.0990-$1.1000 may now serve as resistance. Sterling reversed lower before the weekend after pushing to $1.2580. It reached a low near $1.2420 in Asia. Resistance is seen in the $1.2460-$1.2480 band in North America. A break of $1.2390 would lend credence to our ideas that a high is in place.

AmericaToday will test the effectiveness of the Fed’s temporary inject of cash it the banking system via overnight repo operation. It is one thing to demonstrate control over the very short-end of the curve when what the ECB calls “autonomous factors” (activity that is not normally related to the conduct of monetary policy that affects the liquidity position credit institutions) had slackened. It is quite another thing to so under less favorable conditions. Despite the easing of repo rate and the average effective fed funds moving back into range, the bill auctions on September 19 saw lukewarm reception. Today the US Treasury sells $45 bln of three-month bills and $42 bln six-month bill. There will be around $120 bln in coupons sold ( including conventional and floating two-year notes, five, and seven-year notes, and more four and eight-week bills). |

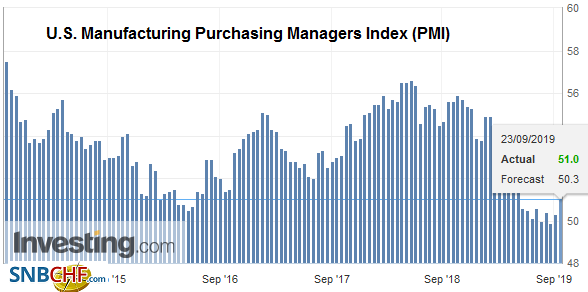

U.S. Manufacturing Purchasing Managers Index (PMI), September 2019(see more posts on U.S. Manufacturing Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

| Many observers continue to cling to ideas that the increase in the exemptions to tariffs by China and the US are signs of goodwill. They are not. The exemptions are attempts to minimize the domestic impact of the levies. US observers recognized this when China exempted US soy and pork from the tariffs. However, the US decision to grant Apple exemptions for some parts of the Mac Pro Computer is a similar gesture. Reports suggest 10 of 15 requests from the company to be excluded from the 25% tariff were granted at the end of last week. Two months ago this week, President Trump had indicated that Apple’s requests would be rejected, following its decision to shift Mac Book Pro production to China from Texas. The exemptions are based on the disruption that the tariff would impose. Is the product available outside of China? Would tariff cause severe economic harm to a US company or the US? |

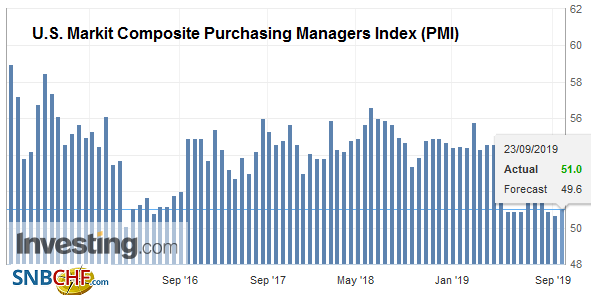

U.S. Markit Composite Purchasing Managers Index (PMI), September 2019 Source: investing.com - Click to enlarge |

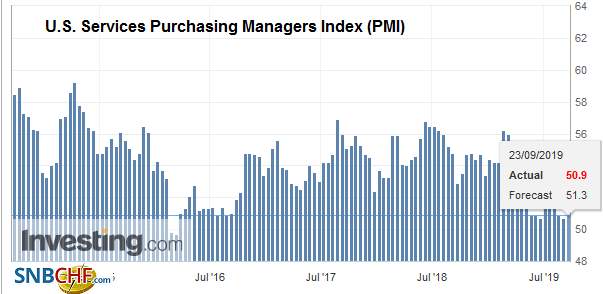

| Markit reports its flash PMIs for the US. The recent upside data surprises have led some to see the US economy as re-accelerating with the lagged help of lower market rates. Three Fed officials speak today: Williams, Daly, and Bullard. Bullard’s views are clear. He wanted to cut 50 bp. He is the main dove among the voting members. Daly is a centrist and often seems to follow the Fed’s leadership. Williams, the NY Fed President, can be expected to also support the Board of Governors, but his communication style is suspect, and the NY Fed had to take the unusual step of walking back his comments earlier this year. Mexico reports July retail sales. They are expected to have fallen for a second consecutive month. The central bank meets on September 26, and a 25 bp rate cut is expected. |

U.S. Services Purchasing Managers Index (PMI), September 2019 Source: investing.com - Click to enlarge |

The US dollar continues to test the cap near CAD1.33, which also houses the 200-day moving average. A break higher suggests immediate potential toward CAD1.3340 and the CAD1.3400. On the downside, support is seen near CAD1.3250. The dollar appears to be carving a shelf against the peso around MXN19.32. A move above MXN19.50 would lift the greenback’s tone, but MXN19.60 must be overcome confirm a low is in place. The Dollar Index has taken out last week’s highs, and the next target is the September 12 high near 99.10.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Currency Movement,EUR/CHF,Eurozone Manufacturing PMI,Eurozone Services Purchasing Managers Index,Mexico,newsletter,U.S. Manufacturing Purchasing Managers Index,USD/CHF