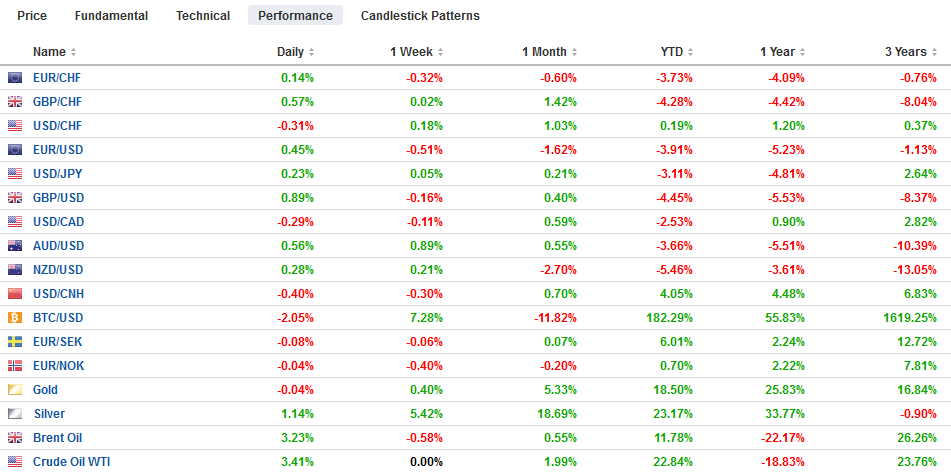

Swiss FrancThe Euro has risen by 0.09% to 1.0835 |

EUR/CHF and USD/CHF, September 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Risk appetites have been bolstered by three developments. The UK appears to have taken a tentative step away from leaving the EU without a deal. Hong Kong’s Chief Executive Lam has agreed to formally withdraw the controversial extradition measure that had been suspended. The eurozone service and composite showed improvement. Global equities are trading higher. The Hang Seng led the way with a nearly 4% gain. Nearly all the markets in the Asia Pacific region advanced but Australia. The Dow Jones Stoxx 600 gapped higher in Europe and is holding on to around a 1% advance in late European morning turnover, while US shares are trading firmer. The S&P 500 has chopped between roughly 2820 and 2950 over the past month and is poised to test the upper end of the range again. Benchmark bonds have lost the bid, and European yields are mostly two-four basis point higher. Italy, which is poised to get a new government, continues to outperform alongside Greece. Despite a two basis point gain, the US 10-year yield remains below 1.50%. The dollar is broadly lower against the major and emerging market currencies, with the Swiss franc and Japanese yen the notable exceptions. WTI is firmer after losing more than 2% in each of the past two sessions and gold, which tested $1550 yesterday is pulling back today. Last week’s low was near $1517, and support is expected around there again. |

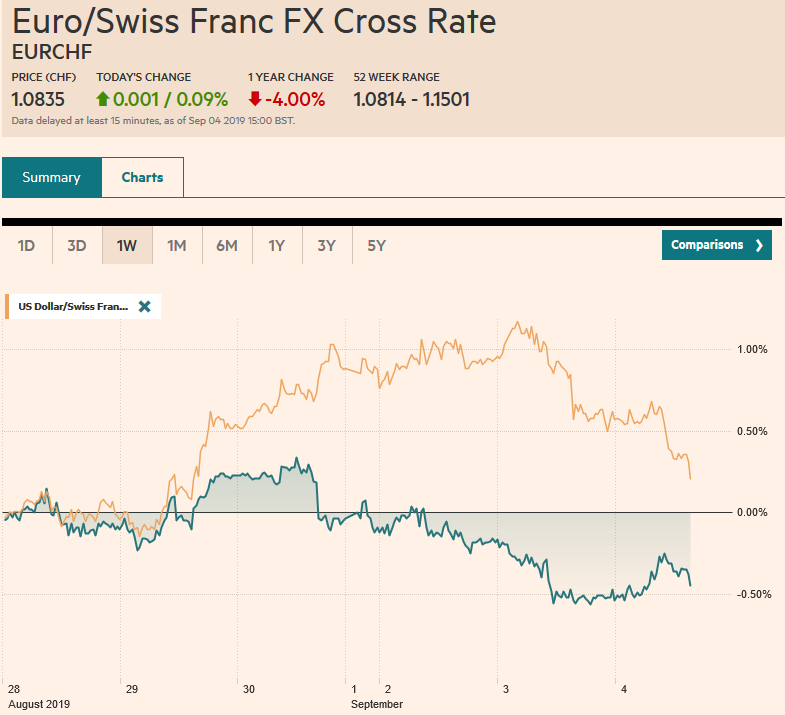

FX Performance, September 04 |

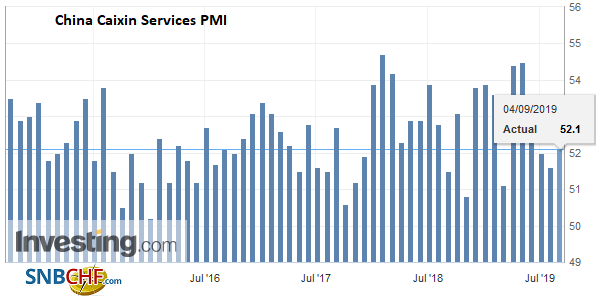

ChinaChinese officials drew a distinction between violent protests and peace demonstrations in Hong Kong yesterday. Although they supported the latter and condemned the former, they have not been above a wide variety of intimidation measures. Still, it is being left to HK officials to address the situation, and the Emergency Law left on the books from the UK, which seems like martial law, has been threatened. However, today, it was a small olive branch. Chief Executive Lam announced the formal withdrawal of the extradition bill that had sparked the initial protest. Previously, the bill had been suspended. While there was a favorable reaction by investors, it may not prove sufficient for the emboldened protesters, whose demands have grown to include universal suffrage. At the same time, concessions by Lam could split the demonstrations and draw away the more moderate wing. China’s Caixin services PMI rose to 52.1 from 51.6, and the composite rose to 51.6 from 50.9, gaining for the second consecutive month. The PBOC set the dollar’s reference level slightly above yesterday’s at CNY7.0878, though models were still anticipating something above CNY7.10. In the spot market, the dollar is near CNY7.1530, which is about 0.35% lower than yesterday and slightly below where it finished last week. Against the offshore yuan, the dollar is weaker for the second consecutive session and has converged with the onshore yuan. |

China Caixin Services PMI, August 2019(see more posts on China Caixin Services PMI, ) Source: Investing.com - Click to enlarge |

Australia’s Q2 GDP rose 0.5% quarter-over-quarter, in line with expectations. The year-over-year rate slowed to 1.4% from a revised 1.7% in Q1. However, taking some of the shine off was the poor August PMI. The service PMI returned to below the 50 boom/bust level after escaping it since April. The 49.1 reading was the lowest since February. The composite fell to 49.3 from 52.1. Both were revised slightly lower from the flash readings.

The Baltic Dry Index, a real-time average of the cost of shipping industrial commodities has risen to nine-year highs. Given the importance of Chinese demand, some are hoping that the increased cost of shipping is an early indication that the world’s second-largest economy is on the mend. However, even if the Chinese economy is recovering, for which there seems to be little evidence, and the full impact of the trade disruption caused by the tariff conflict with the US has not been fully absorbed, it does not explain the magnitude of the surge. The Baltic Dry Index bottomed in February as the bursting of the dam in Brazil that led to the reduction in Vale’s iron ore exports led to the culling of fleet capacity. The demand has returned, and the recent drop in prices is spurring more shipments. From the middle of July through the end of August, iron ore prices fell by 30%. The marginal increase in demand is finding fewer ships are available. It is not just the reduction of capacity earlier this year. More importantly, reports suggest that thousands of ships are being drydocked to be retro-fitted with emission scrubbers that will make the ships compliant with the new regulations regarding sulfur oxide emissions starting January 1. The new scrubbers will allow the ships to continue to burn cheap fuel.

The dollar is trading inside yesterday’s range against the yen (~JPY105.75-JPY106.40). Expiring options may check the upside today. There are $1.3 bln in options struck between JPY106.30 and JPY106.40. And if this was not a sufficient deterrent, there is another $1.4 bln of options between JPY106.50 and JPY106.60. The disappointing PMI data aside, the Australian dollar is seeing follow-through buying after posting an outside up day yesterday. It needs to rise above $0.6800-$0.6820, which capped the Aussie last month. That said, if it holds on to its gains, it will close above the 20-day moving average (~$0.6765) for the first time since the third week in July.

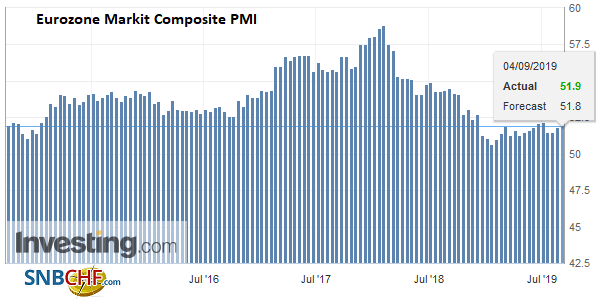

EurozoneThe Johnson government was a dealt a significant blow as 21 Tory MPs joined the opposition in a 328 to 301 vote to take the first step in forcing a request for a third extension of the exit from the EU until the end of January. Johnson seeks a snap election to be held prior to the EU summit on October 17 (October 14 seems preferred) the Tories do not have the power by itself to force the third national election in four years. The Tories lost its majority yesterday with a defection to the Liberal Democrats. Labour has been calling for elections for some time, but it is not clear how deep the feeling runs. Polls show Labour under Corbyn’s leadership continuing to trail behind the Conservatives. Those 21 Tory defectors lost the whip, as it is known, which means that they will not be able to run as Tory candidates in the election. If confirmed tomorrow, it would foster a deeper split in the party. Separately, Johnson’s suspension of Parliament was affirmed by a Scottish court today. The disappointing PMI readings (composite 50.2 from 50.7) add insult to injury but is overshadowed by political developments today. After several years of trading insults and barbs, the Democrat Party and the Five Star Movement have put aside their differences to block a common enemy in the nationalist League. The head of neither party will be Deputy Prime Minister unlike in the previous government. The markets have been recognizing the threat of a political and economic crisis were receding. The generic 10-year yield was near 1.50% in early August, and it is now below 55 bp. The generic two-year yield was near 34 bp at its peak early last month and now is nearly minus 30 bp. The five-year credit default, the cost of insurance against default has fallen from around 220 bp to 160 bp, and in the honeymoon phase of the new government, it can fall below 100 bp. |

Eurozone Markit Composite PMI, August 2019(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

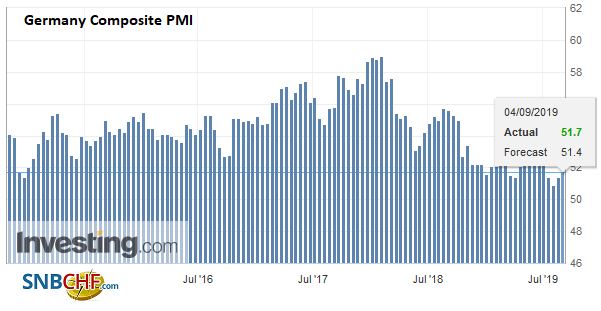

GermanyIronically, Italy’s composite August PMI disappointed in what otherwise was upbeat news today. Weighed down by a poor service PMI (50.6 vs. 51.7), Italy’s composite fell to 50.3 from 51.0. However, German and French reports saw upward revisions from the flash. French services and composite stand at their best levels since last November. The EMU aggregate services PMI rose to 53.5 from 53.2 in July, and the composite rose to 51.9 from 51.5. Both were slightly above the flash estimates. We have suggested that the worst of the soft patch may be behind Europe, though Brexit uncertainty and unresolved trade tensions remain potent threats. The euro recovered smartly yesterday after recording new two-year lows and left a hammer candlestick in its wake. Follow-through buying has lifted the single currency back above $1.10, where a 1.2 bln euro option struck that will expire today. Tomorrow, a 1.4 bln euro option at $1.1050 will be cut. Initial resistance is seen near $1.1020 and $1.1045. Sterling is also extending yesterday’s recovery. It is approaching Monday’s high near $1.2175, which is also a (61.8%) retracement of the leg down since the August 26 high (~$1.2310). It pushed above $1.2150 in the European morning, where a roughly GBP215 mln option has been struck that expires today. |

Germany Composite PMI, August 2019(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

United States

With the dismal manufacturing ISM/PMI reports and given the curve inversion, some economists have repeatedly called for a 50 bp rate cut. Yesterday, Bullard, the dissenting vote in favor of a cut in June, called for a 50 bp cut this month, while Rosengren, one of the two dissents last month, is still not convinced of the need for easier monetary policy. The Bloomberg model shows about a one-in-three chance (32.5%) of a 50 bp move. The CME’s model says almost 12% (11.9%) chance is discounted. Grant the two assumptions: First, the weighted average of fed funds is 2.13% until the Fed meets and delivers a cut on September 17. Second that it averages 1.88% for the remainder of the month. Then the average for the entire month is 2.02%. The September fed funds futures settled yesterday implying an average effective rate of 2.0075% this month. Next month’s meeting is on October 30. The market appears to be discounting almost a 25% chance of a 50 move, with a bias toward then rather than this month.

The US reports its July trade balance, where a preliminary report steals much of the thunder, and a slight reduction in the deficit is expected. The US also reports August auto sales. This private-sector report offers timely insight into consumer durable goods purchases. The Fed’s Beige Book in preparation for the September 17-18 FOMC meeting will be released late in the North American session.

The Bank of Canada meeting is much anticipated. The current policy setting is neutral, but some softer data, global trade disruptions, and risks emanating from the US have fanned expectations for an October rate cut. If the Bank of Canada leans against market expectations, Canadian interest rates will likely rise, and the Canadian dollar would likely rise. Yesterday, the Canadian dollar reached its lowest level since June 19 culminating a sell-off than began on July 19. US dollar support is seen in the CAD1.3280-CAD1.3300 area. A close below CAD1.3250 would fan ideas a greenback high may be in place.

The US dollar recorded an outside down day against the Mexican peso yesterday and settled below MXN20.00 for the first time in a week. Follow-through selling today pushed the greenback briefly below MXN19.76. This area corresponds to a (38.2%) retracement of the dollar’s rally that began on July 31, which was the last time it closed below MXN19.00. The peso is a proxy for emerging market currencies broadly, but also its high real and nominal rates attract carry-strategies.

Chile cut its overnight rate target by 50 bp to 2.0% following June. The earlier move caught the market by surprise. This one less so, but it is still seen as an aggressive move. Falling copper prices (around a two-year low), the slowing of the world economy and trade tensions, is exerting disinflationary pressures. The cut is not likely the last, but with the rate falling below inflation (August CPI due out on Friday and is expected to be 2.3% after 2.2% in July). The dollar has risen about 6.25% against the Chilean peso over the past two months.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Brexit,Chile,China Caixin Services PMI,Currency Movement,EMU,EUR/CHF and USD/CHF,Eurozone Markit Composite PMI,Germany Composite PMI,Hong Kong,newsletter