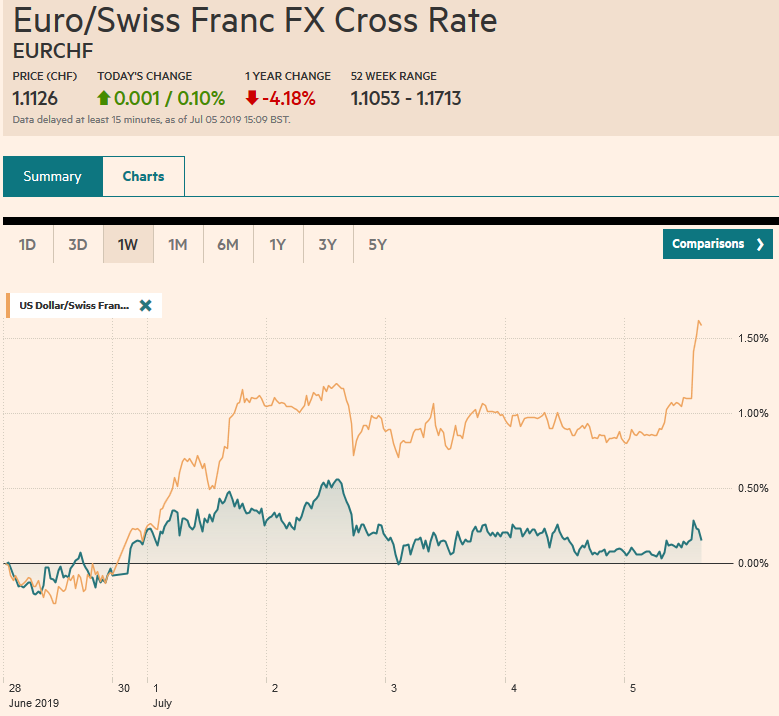

Swiss FrancThe Euro has risen by 0.10% at 1.1126 |

EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the weekend is squarely on the US employment data, where a second consecutive poor report will fan expectations for a large Fed cut to initiate an easing cycle. The large markets in Asia Pacific, including, China, Japan, Korea, Taiwan, and Australia edged higher. India and most of the smaller bourses slipped. After setting the year’s high yesterday, Europe’s Dow Jones Stoxx 600 is consolidating at slightly lower levels. European benchmark 10-year yields are little changed, though Italian bonds continue their recent outperformance. The US 10-year yield is little changed near 1.95%. The dollar is enjoying modest gains against all the major and most emerging market currencies today. Only the Canadian dollar and Australian dollar have thus far managed to escape a loss on the week, among the major currencies. Gold and oil are also trading lower. |

Asia Pacific

In the face of so much economic pessimism, it is noteworthy that household spending in Japan continues to fare better than economists expected. It rose 4% year-over-year in May It is the strongest in four years and was more than twice the increase economists forecast. It is the sixth consecutive year-over-year increase, which is the longest streak in seven years. Some observers concluding that consumption is strong enough to withstand the sales tax increase in October. However, maybe the glass is half empty rather than half full, and the strength of consumption now is bringing forward activity to beat the tax.

The US trade delegation is headed to China next week, but expectations for a breakthrough are low. Although talks have resumed the positions of the two countries has not changed. The press reports that China wants to know how Huawei will be treated before making new extensive soy purchases, and it continues to demand that all US tariffs must be removed to reach a deal, something the US will be loath to concede.

The dollar finished last week near JPY107.75. It is now straddling the JPY108 area, where a nearly $1 bln option is set to expire today and where the 20-day moving average is found. There is also an option for $1.8 bln at JPY107.75 that will also be cut today and an option for about $965 mln at JPY108.50 that expires. The Australian dollar reached a new three-month high yesterday just shy of $0.7050 and is little changed today, holding above $0.7015. There is an A$530 mln option at $0.7000 that rolls off today. The 20-day moving average is around $0.6950 and a close below that ahead of the weekend would likely signal a top is in place. The dollar edged slightly higher against the Chinese yuan earlier today to close about 0.15% higher on the week, ending a two-week slippage.

Europe

ECB President Draghi’s recent comments acknowledged that more stimulus will be required. The markets are anticipating a 10 bp rate cut before Draghi’s term ends on October 31, the same day, incidentally, that the UK is to leave the EU, and possibly a 20 bp cut before the end of the year. The nomination of Lagarde is seen as a continuation of the path that Draghi has led the ECB, well beyond former French national Trichet that was the president of the ECB before Draghi. The net impact has been to drive interest rates lower. Consider that the 10-year German Bund yields fell below the -40 bp deposit rate. The knock-on effect is well beyond EMU bonds, though Italy’s two-year yield is straddling zero. Dovish comments by BOE Governor Carney and poor PMI data helped push the 10-year UK Gilt yield is below the UK base rate for the first time since the Great Financial Crisis. Disappointing ADP jobs estimate and a disappointing service PMI saw the US 30-year yield is below the top of the fed funds target range.

Although some have been critical of the course of the ECB, the alternative is not clear. Consider today’s German factory orders report. Economists surveyed by Bloomberg forecast (median) that orders fell 0.2%. Instead, they slumped 2.2%, and the 8.6% year-over-year slide was the most since October 2009. The internals seemed to confirm that PMI reports showing that the domestic economy is actually doing better. Domestic factory orders rose by 0.7%. The lasting challenge is with foreign orders. They slumped 4.3%. The drop in foreign orders has two components. Eurozone orders fell 1.7 %, while non-European orders crashed 5.7%. Although Spain reported that May’s industrial output rose 0.3% rather than slump 0.5% as the median economist in the Bloomberg survey forecast, the conclusion by at least one central bank governor (Rehn from Finland) that the slowdown in the eurozone can no longer be thought of as temporary.

The euro has been unable to resurface above $1.13 since the middle of the week and is edging toward $1.1250 where a 625 mln euro option is struck that will be cut today. There is a set of options between $1.1295 and $1.13 for 1.5 bln euros that also expire today. A trendline off the late May and mid-June lows comes in near $1.1245 today, and a break warns of a test on $1.12 if not lower. For its part, sterling has been unable to resurface above $1.26 and has been sold to a new three-week low near $1.2550 and little stands in the way of a test of June’s five-month low a little ahead of $1.25. Below there is the flash crash low from January 3 near $1.2440.

AmericaUS jobs growth has slowed, and the real question is the magnitude, and there is a sense that last month’s 75k increase overstates the case. Nevertheless, consider that this year’s average through May stands is a little less than 165k, while in the first five months of last year, non-farm payrolls rose by an average of 230k a month. |

U.S. Nonfarm Payrolls, June 2019(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

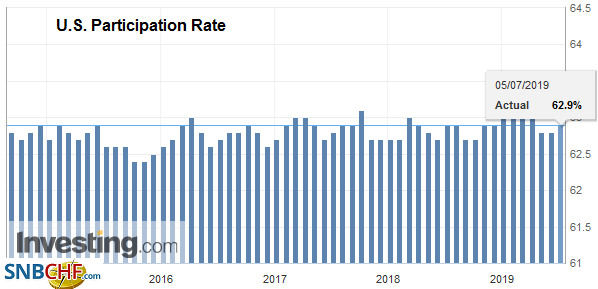

| Nevertheless, the lower average, coupled with a dip in the participation rate, |

U.S. Participation Rate, June 2019(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

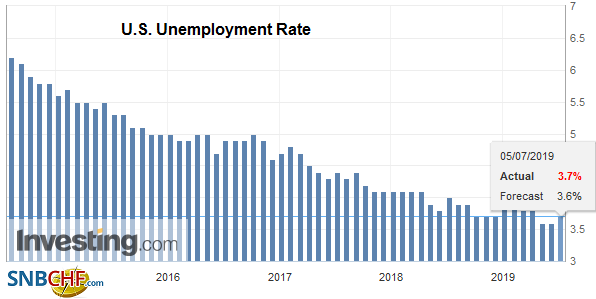

| has been sufficient to keep the unemployment rate at its lowest in a generation and average earnings growth near cyclical highs. |

U.S. Unemployment Rate, June 2019 Source: investing.com - Click to enlarge |

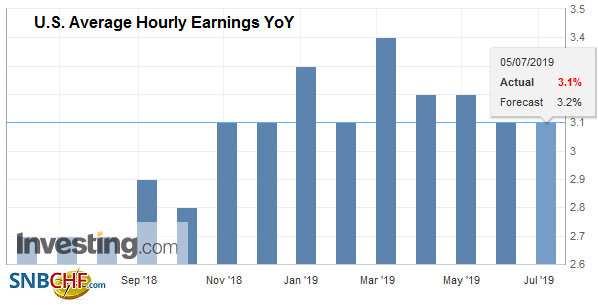

| Indeed, hourly earnings are expected to have increased in June by 0.3%, which would lift the year-over-year rate to 3.2% from 3.1% in May. That said, another weak report, say below 100k, would likely fan expectations for a 50 bp cut later this month. According to the CME’s calculations, there is slightly more than a 1-in-4 chance of a 50 bp move already discounted by the fed funds futures market. |

U.S. Average Hourly Earnings YoY, June 2019(see more posts on U.S. Average Hourly Earnings, ) Source: investing.com - Click to enlarge |

Canada also reports June employment today. Its jobs growth has accelerated this year. Consider that in the first five months of 2018, Canada lost about 1.5k jobs on average a month. This year, the average stands near 50k. And for the record, that includes about 38.5k new full-time positions a month, on average. For the sake of simplicity and brevity, assume Canada is a tenth of the size of the US. That would make Canada’s jobs growth this year roughly equivalent of the US creating half a million new jobs a month. That said, jobs growth is expected to have slowed to around 10k in June. Average hourly pay for permanent workers is likely to recover from the weakness seen in Q4 18 and January 2019. It peaked near 4% last May and fell to less than 1.5% in Q4 18. The median forecast is for a 2.7% pace in June, which would be the highest since last July.

Seemingly contrary to expectations of some reporters and analysts, Trump’s tweets on Wednesday, accusing Europe and China of a “big manipulation game” in the currency market failed to elicit a response. Trump seemed to go a bit further this time, as past verbal jousting has also received little reaction by investors or retaliatory. He said the US could match their actions or “be dummies who sit back.” Of course, Trump’s assessment is contrary to his own Treasury Department’s conclusions and nearly every reasonable economist, with the possible exception of those that work for him.

During the period when the Fed was buying long-term assets, it defended itself and was protected against accusations of currency manipulation. The use of monetary policy to pursue domestic goals must be acceptable. The distinction between currency and interest rate manipulation is not appreciated by market purists, but it is critical. Currency manipulation is a zero-sum game, which may be why Trump seems to be instinctively drawn to it, interest rate manipulation is not. The former takes others’ aggregate demand. The latter spurs demand. Like firing Mueller or demoting Powell, Trump’s verbal aggressiveness is not a prelude to action. That said, it is within the president’s authority to order intervention, but until he does, it may be best to assume he won’t. Also, the risk of escalation increases if other officials respond. Don’t be provoked, and there is no provocation.

The US dollar is consolidating in a tight range against the Canadian dollar after being sold to new lows for the year yesterday (~CAD1.3040). There is a roughly $560 mln option at CAD1.3050 that expires today. The employment data is key, but the technicals are stretched. The dollar was offered through MXN19.00 yesterday for the first time in about 2 1/2 weeks but finished just above it and has a slightly firmer bias today. It has not posted an advancing session yet this week. Mexico is expected to report softer CPI data next week, but the central bank, which meets next in the middle of August, is not likely to cut rates until later in Q4.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Canada,China,EUR/CHF,FX Daily,newsletter,Trade,U.S. Average Hourly Earnings,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate,USD/CHF