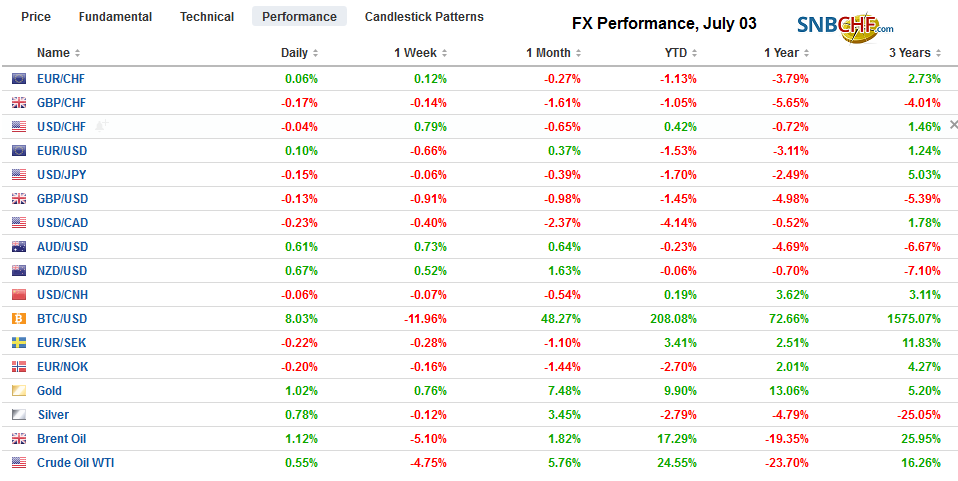

Swiss FrancThe Euro has fallen by 0.05% at 1.112 |

EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy’s benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy’s two-year is breaking more convincingly below zero. The nomination of Lagarde to replace Draghi is seen as likely continuing the course. Equity markets are mixed with most large markets in the Asia Pacific region weakening, while Europe’s Dow Jones Stoxx 600 edging higher to extend the advance into the fifth consecutive session and moving with spitting distance of the year’s high set in April. US shares are trading with a firmer bias in Europe. The dollar is edging slightly higher, though the yen is extending yesterday’s gains, and lower than expected inflation (15.72% vs. 18.7%) in Turkey is spurring speculation of a rate cut and the dollar found support in front of TRY5.60. US markets close early today ahead of tomorrow’s holiday. |

FX Performance, July 03 |

Asia PacificThe Australian dollar remains resilient in the RBA rate cut and expectations of a follow-up cut in Q4. The PMI services and composite reading warn of further economic weakness. May building approvals were stronger than expected, and the April series was revised higher to show a smaller drop (-3.4% vs. -4.7%). Australia reported a record monthly trade surplus of A$5.745 bln in May up from A$4.82 bln in April (from an initial A$4.87). Iron ore shipments rose nearly 13% on the month, including a 12.7% increase to China and shipments to Japan jumped 34.3% in May. Coal exports rose 5.2%, led by a 21.6% surge to South Korea and an 11.6% increase to China. The Bank of Japan has expressed concern about the flatness of its yields curve and today tweaked its bond-buying plans for July. It reduced the amount of 3-5-year bonds it buys and the 10-25-year bonds while increasing the amount of 1-3-year bonds it will purchases. Separately, speculation that Japan could increase its restrictions on exports to South Korea and some cited this as a reason for losses among Japan’s technology shares. |

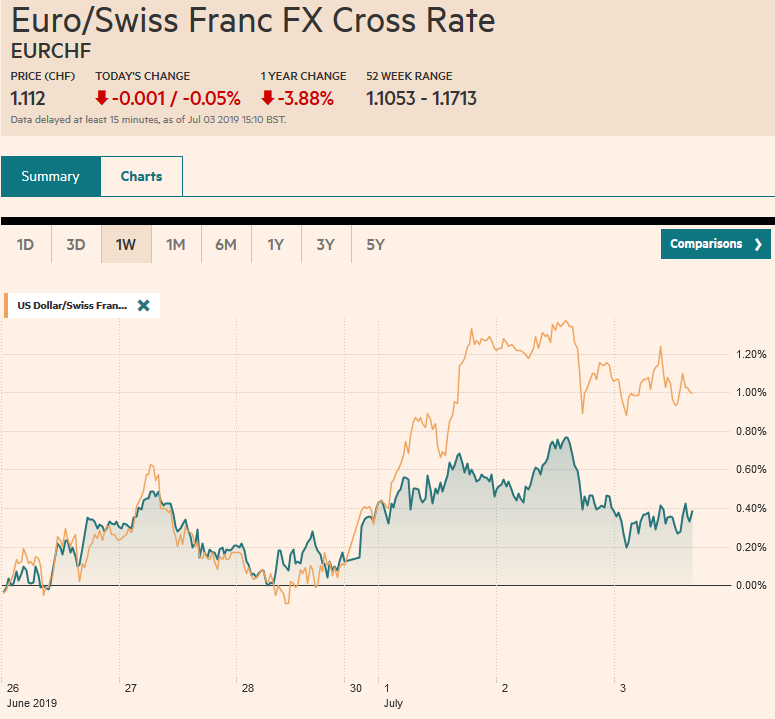

China Caixin Services Purchasing Managers Index (PMI), Jun 2019(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

The US slapped a 400% tariff on steel from Vietnam. South Korea and Taiwan might have diverted steel to Vietnam and exported from there to circumvent US steel tariffs. Recall that US imports from Vietnam have soared as production moves out of China and with its weak currency, many US trade hawks have increased their scrutiny.

The dollar had gapped higher against the yen on Monday, filled the gap yesterday, and kept falling today. Geopolitical tensions are running high between the Gulf, the Russian nuclear submarine accident and US Vice President Pence interrupted schedule to abruptly return to Washington. The dollar held above the (61.8%) retracement of the five-day advance that ended Monday. A roughly $375 mln option at JPY107.70 that expires today is in play, and $2.3 bln JPY108.00 option that is also expiring may deter a stronger dollar recovery. The Australian dollar is pushing back above $0.7000. The intra-day technicals look stretched, and Monday’s high near $0.7035 may be too much to see today. The greenback tested a two-week high against the Chinese yuan near CNY6.90 and backed off in late dealers to finish below CNY6.88.

EuropeThe new configuration of top posts in the EU caught investors by surprise. Just like a “Roman Prussian” (as Draghi was called in some German press) and Junker surprised last time, Lagarde and von der Leyen were unexpected. The main takeaway for many participants is that Lagarde’s appointment is very much in line with policy continuity. The French were able to once again secure the ECB presidency. It is the second French national of the four ECB presidents. Merkel, as we have long argued, recognized German interest could be best defended from the EC Presidency rather than the ECB. Von der Leyen had previously been seen as one of the possible successors to Merkel as Chancellor. |

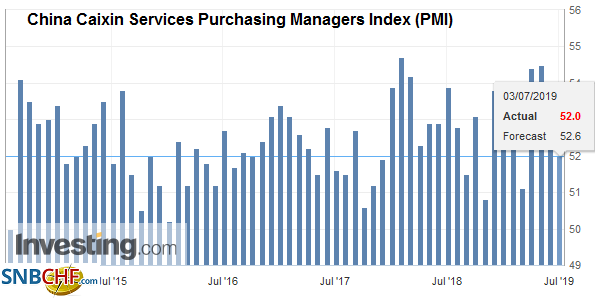

Eurozone Markit Composite Purchasing Managers Index (PMI), Jun 2019(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

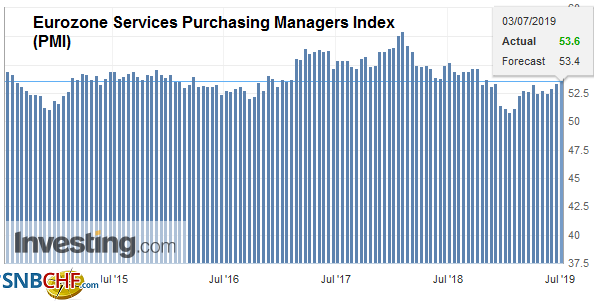

| The eurozone flash services and composite PMI were a little better than the flash readings suggested. The region’s service PMI rose to 53.6 from 53.4 flash and 52.9 in May. This is the highest since last October. |

Eurozone Services Purchasing Managers Index (PMI), Jun 2019(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

| The German service PMI was revised to 55.8 from 55.6 flash and is the strongest since last July. France’s service PMI was revised to 52.9 form 53.1 flash and 51.5 in May. Italy and Spain also saw improvements in the service PMI. The EMU composite PMI rose to 52.2 from 52.1 flash and 51.8 in May. Of note, the Italian composite edged back above 50 boom/bust level (to 50.1 from 49.9). |

Germany Services Purchasing Managers Index (PMI), June 2019(see more posts on Germany Services PMI, ) Source: investing.com - Click to enlarge |

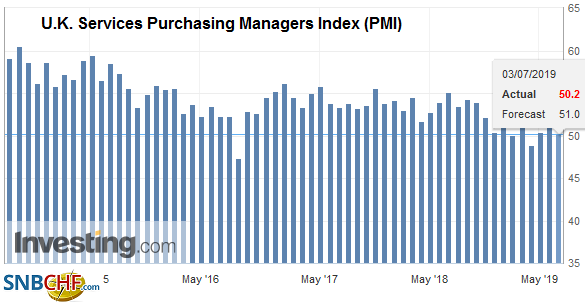

| The UK’s composite fell below 50 for the first time in three years.

Today’s report lends credence to ideas that the ECB meeting later this month may be too soon for the ECB to move, but a move before Draghi’s term expires at the end of October is still seen as likely, with the September meeting seen as most likely. In contrast, Sweden’s Riksbank maintained that it is still poised to hike rates before the end of the year. Meanwhile, BOE’s Carney struck a dovish note yesterday, which weighed on sterling. Carney emphasized the uncertainty surrounding Brexit and rising protectionism as threats. Playing into Brexit uncertainty, both Tory candidates have promised to jettison the backstop. This and strategies based on renegotiating the Withdrawal Agreement are raising the risk of a no-deal exit, which weighs on sterling. |

U.K. Services Purchasing Managers Index (PMI), June 2019(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

The euro is a narrow quarter-cent range below $1.13 in subdued turnover. There are around 5.6 bln euros in options between $1.1275 and $1.1320 that expire today. That could mark the range for the holiday-shortened US session. Sterling is lower for the third consecutive session. At the end of last week, it was testing $1.27 looked poised to break higher, but instead, it has been sold through $1.26 and is finding it difficult to resurface above there. The low since the flash crash on January 3 was recorded on June 18 near $1.25.

America

Trump will reportedly nominate Waller, who heads up research for the St. Louis Fed, and Shelton, who is the US executive director of the European Bank for Reconstruction and Development to the Federal Reserve Board. Waller is highly respected and broadly seen in the same light as St. Louis Fed President Bullard, the sole dissent in favor of an immediate cut at last month’s FOMC meeting. Shelton is seen to be a bit out of the mainstream, but also a dove. She has already been confirmed by the Senate for her current role so the confirmation hearings, while could be colorful, are not seen to be an insurmountable hurdle. Waller should easily be confirmed.

Cleveland Fed’s Mester aligned herself with the other wing at the Fed. She was skeptical of the immediate need to cut rates. Mester expects growth to slow but still be a solid 2%. While recognizing downside risks are increasing, she argued that cutting rates now would reinforce negative sentiment and encourage financial imbalances. She pushed back against calls from some of her colleagues that low inflation alone does not justify a cut.

The US reports a slew of data today after reporting better than expected auto sales yesterday. The main feature is the ADP private-sector jobs estimate. Last month it warned of the downside surprise in the official estimate. The median forecast on the Bloomberg survey was for a 140k increase after a lowly 27k in May. The US also reports May trade and durable goods and factory orders. The trade deficit is expected to have widened, and the durables and factory orders are being adversely impacted by Boeing’s problems. The non-manufacturing ISM and service PMI are also on tap. Canada’s May trade balance is expected to show a slight widening of the deficit, while the performance of non-oil exports will be closely watched. Canada reports its employment figures on Friday alongside the US.

The US dollar remains within Monday’s range against the Canadian dollar (~CAD1.3060-CAD1.3145). It is difficult to get excited within this range, which could persist for another day or two. The same is true of the dollar against the Mexican peso–Monday’s range continues to set the parameters (~MXN19.04-MXN19.22). After falling 4.8% yesterday, WTI for August delivery is stabilizing today above $56.00. Gold recovered smartly yesterday, amid the heightened geopolitical anxiety, and extended those gains in Asia to approach the high from last month near $1439 before consolidating a bit lower in Europe.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China Caixin Services PMI,ECB,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Services PMI,Federal Reserve,Germany Services PMI,newsletter,U.K. Services PMI,USD/CHF