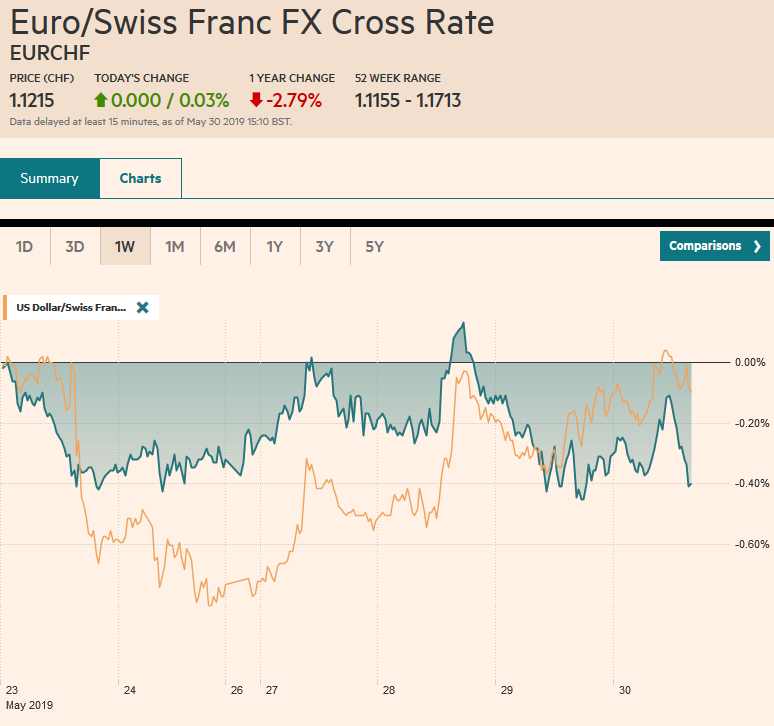

Swiss FrancThe Euro has risen by 0.03% at 1.1215 |

EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After significant moves in equities and interest rates, investors are taking a collective breath, waiting for fresh developments. A nervous calm has settled over the capital market. China, Japan, and Australian equities leaked lower, but other bourses in the region, including Korea and Taiwan posted modest gains, while Indonesian equities are still responding positively to the recent election. European equities are steady with the Dow Jones Stoxx 600 up about 0.3% in late morning turnover, led by energy and communication sectors. The S&P 500 gapped lower yesterday, and that gap (~2792.0-2801.6) is important from a technical point of view. Bond has stabilized too after large moves earlier this week. A 5-6 bp jump in Australia and New Zealand benchmark yields have not been duplicated in Europe, where most yields are up 1-2 bp. It still leaves the 10-year Bund yield at minus 16 bp, nearly twice JGB’s minus 8.5 bp yield. The US 10-year yield of 2.27% is just inside the fed funds target range (2.25%-2.50%). Meanwhile, the dollar is consolidating with a heavier bias against most of the major and emerging market currencies. The yen and the Swiss franc are also trading softer. The Chinese yuan, both onshore and off, firmed slightly. |

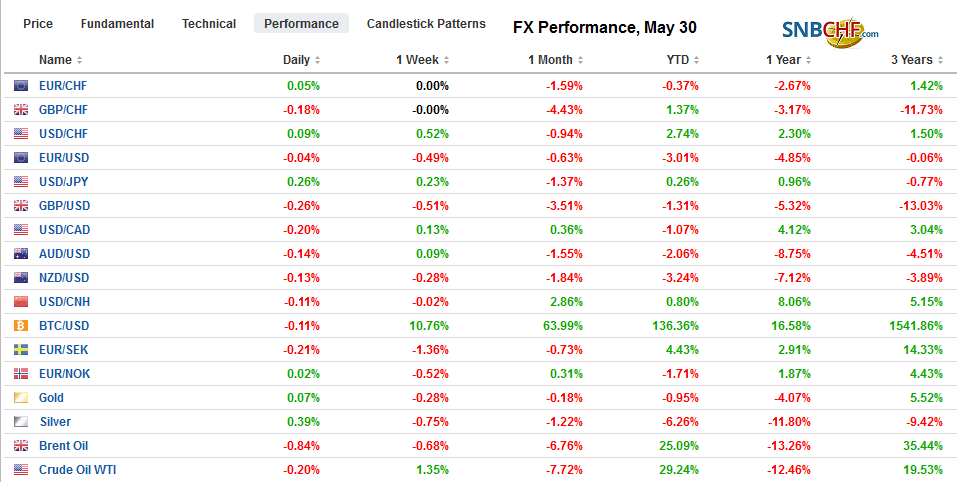

FX Performance, May 30 |

Asia Pacific

Macro developments were light in Asia. Japan’s weekly MOF flow report showed after a large buying spree of foreign bonds in the week ending May 17, Japanese investors took some profits last week. Foreigners were buyers of Japanese government bonds and kept the pattern of alternating weeks of buying and selling that has been intact since the middle of last month. Interest in equities was marginal: Japanese were small buyers and foreigners were small sellers. The rally in JGBs has many observers expecting the BOJ to use it as an opportunity to scale back buying further. The slide in equities, on the other hand, may see the BOJ be more active with its purchases.

Separately, Australia reported that the slide in building approvals in Q1 is spilling over into Q2. After a 15.5% plunge in March, many economists expected a bounce, but instead, a 4.7% decline was reported in April. The March drop was shaved to a 13.4% drop. On a year-over-year basis, building approvals have collapsed by 24.2%. The market is confident of a rate cut next week. It appears to be nearly 90% discounted.

If the US is not making much effort to lead a united front to force China to adopt better trade practices but is trying to have its way be demand, Chinese officials are taking a different tact. They may have begun getting a sense of how isolated China is on trade policy and is trying to find some common arguments. For example, it has struck out claiming the US is exaggerating “national security” claims. Of course, with steel and aluminum tariffs in place on national security grounds, America’s traditional allies chafe. The US threat to levy a 25% tariff on auto imports also for national security purposes does not set right. Reports suggest that China’s state-controlled media is recognizing that even many Americans are not happy with the US trade stance, and appear to be paying more attention to the different domestic voices.

The dollar recovered a bit against the yen yesterday after reaching a two-week low near JPY119.15. It has recovered further today, briefly poking through JPY109.80 in late Asian turnover. The dollar is approaching a crucial area. The 20-day moving average is just shy of JPY110, and the dollar has not closed above this moving average since it recorded the year’s high (~JPY112.40) on April 24. Then there is the JPY110.00 level itself. There is a $350 mln option struck there that expires today and a $2.2 bln option that will be cut tomorrow. Also in play today is a $1.3 bln options at JPY109.75. For the fifth consecutive session, the Australian dollar is knocking on the $0.6935 area. The 20-day moving average is a few ticks below $0.6940, and the Aussie has not closed above it since April 22. Intraday technicals suggest it could do so today as some shorts may cover as the rate is mostly discounted.

Europe

Investors are looking ahead of next week’s EMU May inflation report and the ECB meeting, where the staff will update the economic forecasts. The inflation news will not make for pleasant reading. France reported softer May CPI yesterday 1.1%, down from 1.5% in April. Spain matched suit today with a 0.9% year-over-year increase, down from 1.6% in April. The Easter holiday price increases are unwound, and energy prices eased.

One of the leading candidates to be the next Tory leader is Boris Johnson. He has been sued and must appear in court to defend himself against charges he lied during the campaign for the Brexit referendum in 2016. At the same time, a candidate that would take the UK out of the EU without an agreement is seen not only splitting the party but also risking national elections. There are some cabinet officials, like Foreign Minister Hunt who would rather delay that Oct 31 exit date than go to the polls, where the Tories have been handed three sharp defeats (parliament, local, and EU Parliament).

The euro is stuck in its trough; just above $1.1120 and below $1.1125. The $1.11 level held in late April and again this month. There is a 600 mln euro option that expires today and a 2.1 bln euro options that will be cut tomorrow. At the same time, there are options struck at $1.12 that will likely deter the upside. A roughly 710 mln euro option (to be cut today) and a 2.5 bln euro option (expires tomorrow) reinforce the cap. Sterling cannot distance itself much from the $1.26, which has been approached three times in a little more than a week. It needs to get above $1.2660-$1.2680 to stabilize the technical tone. An option for roughly GBP645 mln struck at $1.26 will be cut today. An option for less than half that amount at $1.2650 also expires today.

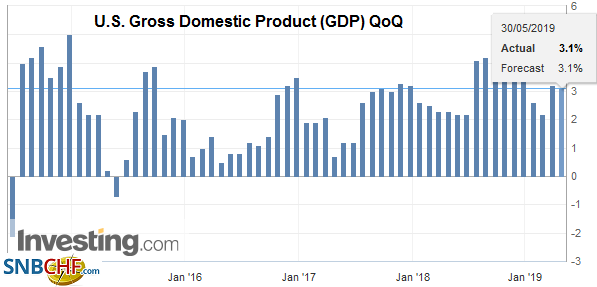

AmericaThe US economic calendar picks up today with the S&P 500 at 12-week lows. The first revision of Q1 GDP may see it shaved to 3.0% from 3.2% due primarily it appears to inventories (less of a build). The US also reports April goods trade and retail and wholesale inventories. These reports will impact forecasts for Q2 GDP, which have been shaved recently, with one large US bank warning of 1% annualized growth. Vice Chairman of the Federal Reserve Richard Clarida will speak to the Economic Club of New York today and will answer questions. Given the rally in bonds, the weaker data, while the Fed insists it is in a wait-and-see mode, some insight into Fed thinking is awaited. |

U.S. Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on U.S. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

The Bank of Canada left rates on hold yesterday as everyone expected. It seems more confident that the soft patch that the economy hit is only temporary. Reports suggest Prime Minister Trudeau of US Vice President Pence will be discussing the USMCA. The Canadian Prime Minister is expected to express concerns about the US backsliding on women’s rights. Mexico’s central bank cut its growth forecast (0.8%-1.1% from 1.1%-2.1%) and lifted its year-end inflation forecast to 3.7% from 3.4%, due to higher energy prices. Meanwhile, the first anti-corruption charges of AMLO’s term involves a PEMEX deal that threatens to implicate officials from the previous government. Lastly, Brazil reports May CPI, which is expected to have eased from 8.64% in April. However, it is also expected to report that the economy contracted in Q1 for the first time since 2016.

The US dollar closed above CAD1.35 yesterday for the first time since the very start of the year. However, the more stable risk-sentiment today has seen the greenback push back into the CAD1.34-handle. A break of CAD1.3480 may convince players that it was a false break. The dollar reversed lower against the Mexican peso after briefly poking through MXN19.29 yesterday. Follow-through selling has seen the dollar approach MXN19.10. Short-term participants are likely to take their cues from the equity market.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Brexit,EUR/CHF,newsletter,Trade,U.S. Gross Domestic Product,USD/CHF