Swiss FrancThe Euro has risen by 0.15% at 1.1386 |

EUR/CHF and USD/CHF, April 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan’s markets are closed all week, while China’s markets are closed from mid-week on for an extended holiday. The week has begun on a decidedly consolidative tone. Equity markets in Asia-Pacific were mixed. The Shanghai Composite fell for the third consecutive day and has moved lower five of the past six sessions. European equities are slightly firmer to start the week, and US shares are little changed. Benchmark 10-year yields are mostly one-two basis points firmer, but the yields in the European periphery of lower, one-two basis points lower, including Italy (BBB-rating affirmed by S&P with a negative outlook) and Spain (election will likely produce a center-left government that depends on support from a moderate party from Catalonia). The dollar appeared to be the victim of “buy the rumor-sell the fact” after the stronger than expected Q1 GDP estimate, and it continues to consolidate its recent gains with a mostly heavier bias. In emerging markets, the Turkish lira is weaker with the dollar nearing TRY6.0. The Korean won, which was sold every day last week has steadied today, though the tone remains vulnerable, after the surprise contraction in Q1 GDP. |

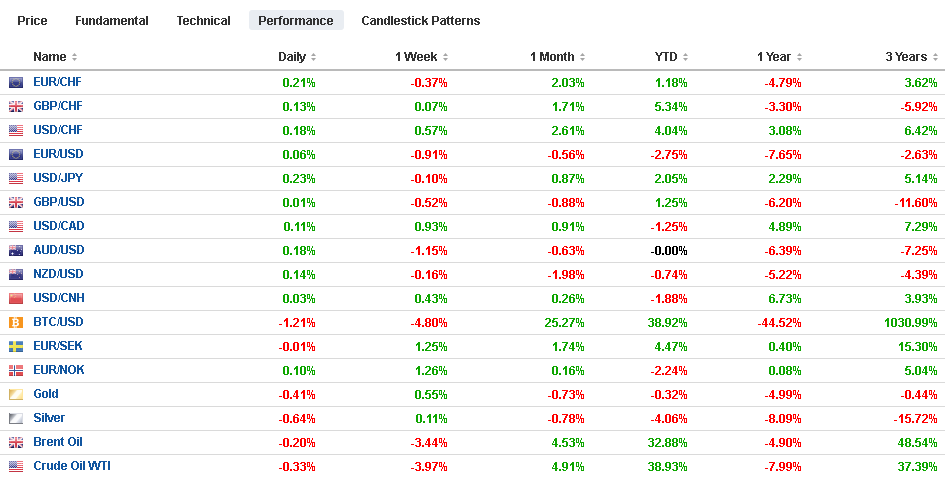

FX Performance, April 29 |

Asia Pacific

Japanese markets are closed through May 6 for an extended Golden Week holiday and the ascension of a new Emperor. Emperor Akihito is the first abdication in Japan in 202 years. The Crown Prince Naruhito will be the new Emperor. The absence of local liquidity may be reinforcing and encourage others to be sidelined if they can. Separately, it appears that Japan pushed back gently against US hopes for an “early harvest” by granting US farmers the same access that has been granted Europe and TPP members. Reports indicate that that the US offered no concessions, like phasing out levies on light trucks, auto, and parts as agreed under the TPP. Trump reportedly would like an agreement on some “low-hanging fruit” in time for his visit to Japan at the end of the next month. This does not seem particularly likely. Japan wants a comprehensive deal that will exempt them from auto tariffs that have been threatened. Japan will host the G20 meeting in June and the Upper House election is in July.

For the first time in a week, the dollar did not trade above JPY112.00. An option for about $645 mln struck there will roll off today. Without Tokyo markets, the range has been about a quarter of a yen above JPY111.55. The Australian dollar is trying to extend its recovery. Recall that last Thursday it was sold below $0.7000 but rebounded ahead of the close and rose further ahead of the weekend to about $0.7060. It seemed to signal this consolidative phase for the US dollar. The more important technical hurdle is seen from $0.7075-$0.7100. With a few exceptions, the dollar continues to be confined to a CNY6.70-CNY6.75 range against China’s yuan.

Europe

Spain went to the polls for the third time in four years. The Socialists will likely lead a center-left government that includes support from some regionalist parties, though it may take a little while to sort things out. The Socialists (~123 seats) and the populist-left Podemos (~43 seats) leaves them about 10 seats shy of a majority. There are two Catalan parties and one from Basque Country. Since 2015, Span has enjoyed among the strongest EMU economies. It is expected to have grown by 0.6% in Q1, matching the pace of each quarter in 2018. It will be reported on Tuesday.

S&P maintained its BBB rating on Italy. It is not surprising, but the risks remain. The negative outlook was maintained. Many talk and write as if Italy’s suffers fiscal excesses, but that is an old story and has not been true for many years. Its debt was accumulated before, and what it suffers from mostly now is the lack of growth. As long as growth is below the average interest rate, it pays Italy’s debt increases. Growth is very much in the news this week. After contracting in the last two quarters of last year, most are looking for a 0.1% gain in Q1 GDP, which will be reported on April 30. Disappointment will translate into larger deficit projections. Italy’s 10-year premium over Germany widened to two-month highs last week near 2.70%, and remember Germany’s 10-year yield is a little below zero.

Finally, there is something that can challenge Brexit for mindshare. Before the weekend, UK Chancellor Hammond was in China, a few days after the British government announced that it would allow Huawei to participate in non-core parts for the 5G infrastructure, and he was enthusiastically endorsing the Belt-Road Initiative as a”truly epic vision” as opposed to a vehicle to project a competing governance and value system. Even though this runs against US wishes and the recent EU statement, it is consistent with UK policy. Osborne, Hammond’s predecessor, sought to make the UK China’s best friend in the West.

The euro is holding in the upper half of the pre-weekend range. It has been mostly confined to $1.1140-$1.1170. There are 650 mln euros in an option at $1.1150 and another 870 mln euros at $1.1200; both expire today. Chart resistance is seen in the $1.1180-$1.1200 area, and a move above there would likely confirm a low is in place just ahead of $1.1100. Sterling has risen marginally through the pre-weekend high of a little more than $1.2940. Resistance is seen in the $1.2960-$1.2980, in front of the psychologically important $1.30. We suspect that North American participants may look to sell into the modest upticks.

America

The optics of Q1 US GDP (3.2% annualized pace) was better than the details. Consumption was halved to 1.2% from 2.5% in Q4 18, and the GDP deflator was also halved to 0.9% from 1.7%. Inventories and net exports (mostly because of a decline in imports) accounted for half of the growth. Nevertheless, the Fed’s assessment in March that the “economy slowed from its solid rate,” looks somewhat out of place. Today’s report of March personal income and consumption data will not tell us anything new and were contained in the pre-weekend report. However, the monthly PCE deflator and core deflator are important data points. Although there is some confusion over it, the Fed’s 2% target applies to the headline PCE deflator, not the core rate. As recently as January, the FOMC affirmed that it judged that an “inflation rate of 2%, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve statutory mandate.”

Canada reports its February monthly GDP estimate tomorrow. It is likely to be flat after a 0.3% expansion in January. The year-over-year rate is expected to slow to 1.4% from 1.6%. The contrast with the US is stark. The US dollar rallied CAD1.3520 in the middle of last week in response to the somewhat more neutral central bank comments. It pulled back toward CAD1.3450 before the weekend, but it is testing the CAD1.3470 area ahead of the North American open. In a move that began last week, oil prices continue to pare their recent gains and the mixed equities may not be helping.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,EUR/CHF,FX Daily,Italy,newsletter,Spain,USD/CHF