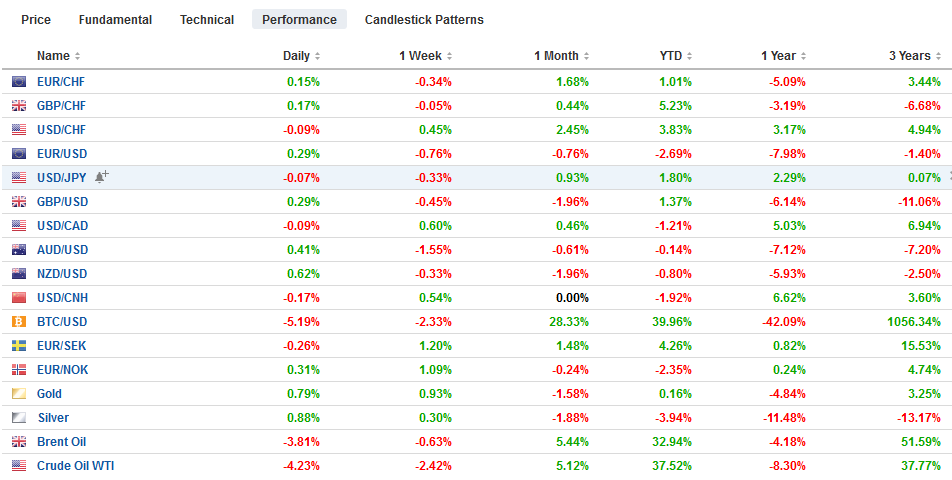

Swiss FrancThe Euro has risen by 0.14% at 1.1373 |

EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

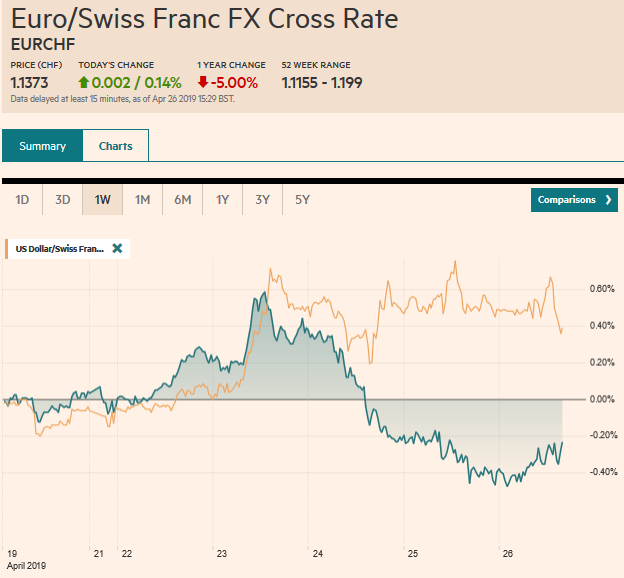

FX RatesOverview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe’s Dow Jones Stoxx 600 ended an eight-day advance with a two-day loss coming into today where it is a little softer. It has been alternating between weekly gains and losses for nine weeks. The S&P 500 has been consolidating after hitting record highs at midweek. It is about 0.75% for the week ahead of today’s session that features the first look at Q1 US GDP. Benchmark 10-year yields a little lower today. The US 10-year yield backed off from the 2.60% area tested last week and is off about seven basis points this week. Poor survey data earlier in the week have pushed the German 10-year Bund back below zero. Italian bonds are paring this week’s losses a little. The yield is still up seven basis points this week. S&P is expected to leave its sovereign rating unchanged at BBB. The price of oil continues to consolidate the gains scored earlier this week ostensibly on response to the US decision not to renew any of the exemptions for Iranian oil. Oil, though, has extended its advance for an eighth consecutive week. The price of oil has only fallen in three weeks so far this year. The dollar is little changed against the major currencies, where it is sporting a slightly heavier tone while emerging market currencies are mixed. The Turkish lira is softer but consolidating this week 2% decline. It the lira does finish lower, it will be the eighth consecutive session. It has fallen in 11 of the past 12 weeks. It is the Argentine peso that led the emerging market currencies to decline this week with a 7% drop before today’s local session. |

FX Performance, April 26 |

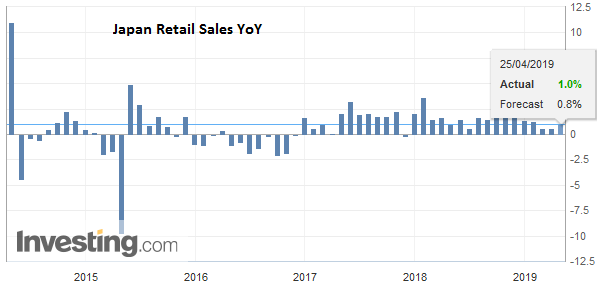

Asia PacificJapan is set to begin an extended 10-day holiday. The traditional Golden Week holiday has been extended, and Japanese markets will be closed the next two weeks to celebrate a new emperor and a new era. Ahead of the holiday, there was little economic cheer. Industrial output, which had been expected to be flat in March, fell 0.9%, offsetting in full the February gain of 0.7%. For the quarter as a while, industrial production fell 2.6%, which is the worst showing in almost five years. This report coupled with the unexpectedly large rise in unemployment (2.5% vs.2.3% in February) offset the better than expected retail sales (0.2% vs. expectations for a flat report and a doubling of the February increase from 0.2% to 0.4%) and strong housing starts (10% in March, nearly twice what economists expected). As we have suggested before, and the data reinforces it, the Japanese economy appears to have contracted in Q1. It would be the second quarterly contraction in the past three quarters. |

Japan Retail Sales YoY, March 2019(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

Many participants recall the flash crash on January 3 when the yen soared for apparently little reason and saw many other currencies sell off sharply. The lack of liquidity is commonly cited as the key factor, and with the long holiday, participants are again looking at the retail positioning in Tokyo, where the flash crash is thought to have emanated. We had expected the run-up to the holiday to weigh on the yen and the dollar recorded its highs for the year near JPY112.40 in the middle of the week. In the last couple of sessions, the yen has drifted higher amid position adjusting. Retail in Tokyo has a significant long yen position but also continues to be attracted to the high yield offered by Turkey and South Africa.

Japan’s Prime Minister Abe and Finance Minister Aso are in Washington ostensibly to talk trade. It appears Japan is willing to make concessions to the US granting it similar access to its agriculture market that it has given in the trade agreements with Europe and the TPP. It wants to be exempt from any auto tariffs the US may impose. While Aso has pushed against linking the trade agreement with a new pledge on currency intervention, it seems mostly semantics. While there is some long hanging fruit, the real effort to reduce the bilateral trade imbalance may take longer.

There are two talking points about China. First, the PBOC skipped its open market operations today. It said liquidity was sufficient though a CNY20 bln reverse repo matured today. The PBOC set the reference rate for the yuan-dollar exchange rate unchanged from yesterday (CNY6.7307). Some observers see it as a protest against further weakening. The dollar reached CNY6.75 yesterday, its strongest level since February 19. We suspect many are less convinced of the signal, and if it really is the PBOC’s intention, it will likely have to show its hand again next week. Second, President Xi addressed a Belt-Road conference promising to enact many of the reforms the US appears to be demanding in negotiations. This is seen as reinforcing expectations of a deal, perhaps as early as next month between the two largest economies. On the other hand, this is not the first time Xi has made such declaratory claims. The problem ultimately lies with the operational policy. And from another angle, it appears that China is moving in the desired direction, but slower than the US (and Europe) wish.

The dollar slipped below JPY111.40 yesterday to record its lowest level since April 11 and is consolidating in narrow ranges today near the 20-day moving average (~JPY111.70). Note that the 200-day moving average is near JPY111.50. The Australian dollar briefly traded below $0.7000 yesterday for the first time since early January but recovered late in the session and closed above it. It remains above $0.7000 today. The Australian dollar sometimes leads the other major currencies, so its recovery is flashing a near-term yellow light to US dollar bulls.

Europe

Spain goes to the polls this weekend. The Socialists are expected to be the largest party, but whether its possible coalition partners garner enough votes for a center-left government may be the crux of the matter. A key issue in this election cycle is Catalonian independence and how the two main secessionist parties, which have softened their rhetoric, perform may be critical to the center-left being able to forge a majority government. Meanwhile, the new right party, Vox, appears to be siphoning votes from the traditional right Popular Party.

Many economists and participants worry about Italy’s debt and bad loan burden. While we are cognizant of it, we see it as a chronic issue not acute. Moreover, the Italian bonds that have been bought under the ECB’s QE sit on the Bank of Italy’s books, and this has reduced Italy’s net debt (debt it owes other than to itself). It has among the most sophisticated debt managers who alas have much experience in this The government coalition illustrates the old adage that politics makes for strange bedfellows and despite a near constant tension, it is hanging together. League leader Salvini, who is a junior partner in the coalition seen his fortunes rise. He acts as the senior partner and the EU Parliament election are likely to validate it.

S&P will review its BBB rating for Italy today. The rating matches Fitch’s and is one notch above Moody’s assessment. It warned in October that a “material undershoot” in growth or a deterioration in its debt ratios, could spur a downgrade. Since then, investors have learned that the Italian economy contracted in Q4 18 (and Q3 18). Italy reports Q1 GDP next week. Economists expect another small contraction. Slower growth translates into a higher deficit to GDP ratio and impacts the debt to GDP ratio as well (without remedial action). A downgrade is a palpable possibility, but we suspect S&P will hold off.

The euro is little changed as it nurses this week’s drop. It slipped briefly below $1.1120, its lowest level since May 2017. Two large option strike may confine it ahead of the weekend. There is a 1.1 bln euro option that will be cut today at $1.11 and another 1.2 bln euros at $1.1160. Sterling was sold to almost $1.2865 and closed little change before hovering around in a tight range (less than 20 ticks) on either side of $1.29. With indications that the Withdrawal Bill will not re-submitted to Parliament next week, more are coming around to the idea that the UK will have to participate in EU Parliament elections. Next week sees local elections.

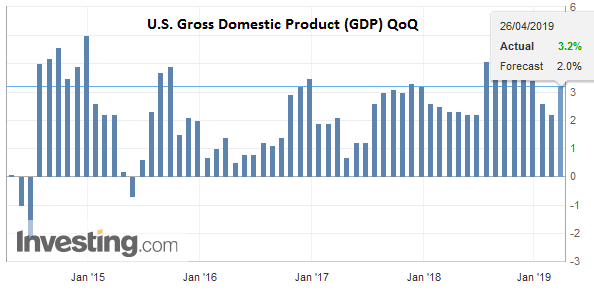

AmericaThe first quarter began miserably for the US, but steadily the data improved. Expectations have generally trended up, though not as much as the Atlanta Fed’s GDP tracker, which began the quarter near 0.3% and its last estimate is for 2.7%. Bloomberg economists revised up their estimate from 1.5% a week ago to 1.9% now while the survey Bloomberg conducts found a median forecast of 2.3%, just ahead of Q4 18’s 2.2% pace. Our own back-of-the-envelope calculation puts it around 2%. While there may be a knee-jerk reaction to the headline number, we suspect investors and policymakers are looking past Q1, so we do not expect lasting influence. That said, next week, EMU’s Q1 GDP will be reported, and the divergence theme, which underlies our constructive dollar outlook, is likely to be on full display. The FOMC’s statement next week is likely to recognize the subsiding of some of the domestic cross-currents, while the international headwinds remain. |

U.S. Gross Domestic Product (GDP) QoQ, Q1 2019(see more posts on U.S. Gross Domestic Product QoQ, ) Source: investing.com - Click to enlarge |

A slightly more dovish Bank of Canada has helped keep the Canadian dollar on the defensive. It is off about 0.75% this week (~CAD1.35) after a 0.5% loss last week. The greenback found support near CAD1.3470. There is a CAD1.35 option for about $510 mln that expires today. On a strong US GDP report, we suspect the US dollar can push toward CAD1.3520 or so before coming off ahead of the weekend. After rising toward our resistance near MXN19.20 yesterday, the dollar reversed lower to close a little above MXN19.00. Mexico is expected to report a larger March trade surplus. It would be the first back-to-back trade surpluses in a year. It also reports its economic activity for February and acceleration from January is expected.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,EUR/CHF,FX Daily,Italy,Japan,Japan Retail Sales,newsletter,Spain,U.S. Gross Domestic Product QoQ,USD/CHF