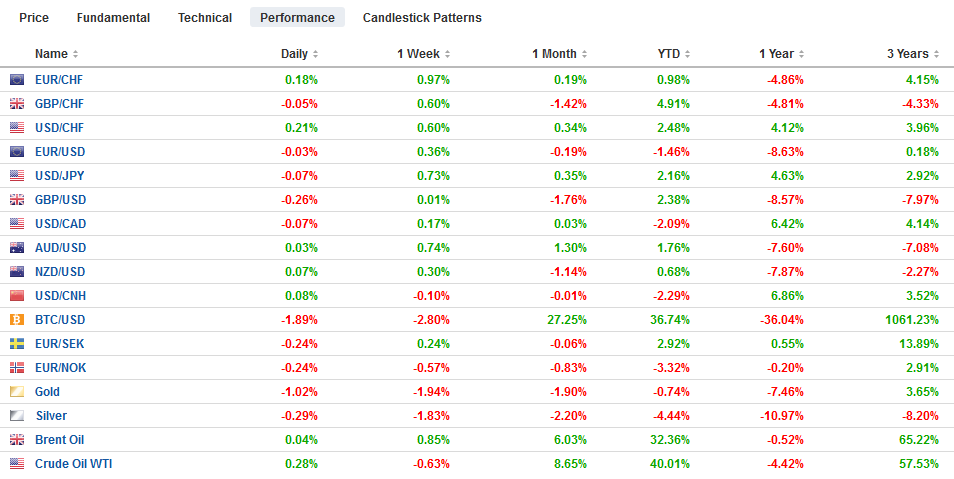

Swiss FrancThe Euro has risen by 0.14% at 1.1366 |

EUR/CHF and USD/CHF, April 16(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

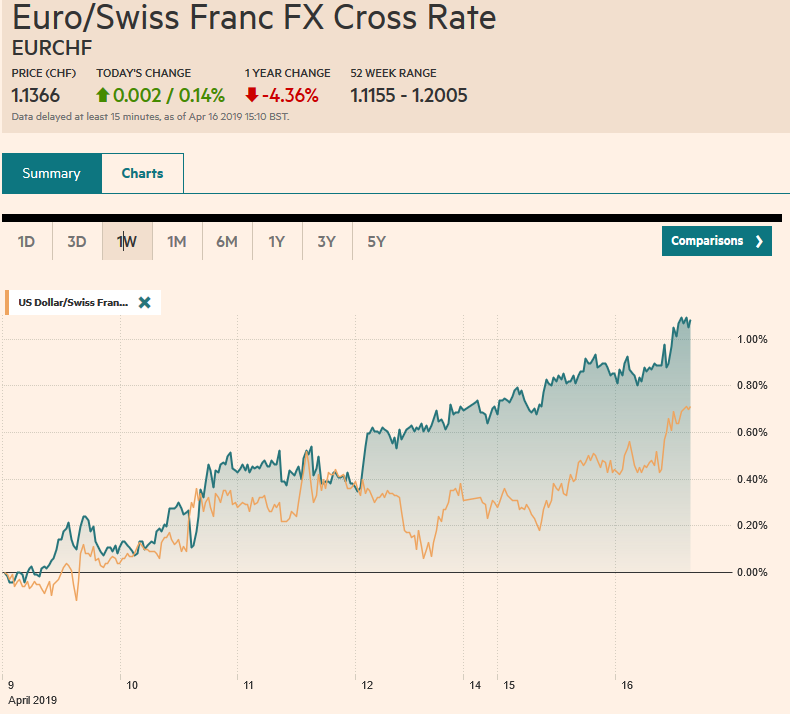

FX RatesOverview: Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with the Dow Jones Stoxx 600 moving higher for the fifth consecutive session. US shares are trading higher and the S&P 500 is edging closer to the record high set last September near 2941. Benchmark 10-year yields are mostly firmer. In Europe, Italy is an exception, as it bonds trade like risk assets, and Antipodean bond yields also slipped. The 10-year Germany Bund yield bottomed last month near minus 10 bp and is near seven basis points now. The 10 bp yield mark is an important threshold. The dollar is mostly a little firmer against the major currencies. The dollar-bloc currencies and sterling are the heaviest, while yen is firmer with the help of cross-rate demand. Narrow ranges prevail. |

FX Performance, April 16 |

Asia Pacific

The minutes from the Reserve Bank of Australia’s recent meeting showed that scenarios under which the central bank could cut rates were discussed, but officials indicated that the bar to a cut was still high. There was not, they concluded, a compelling case of a near-term adjustment. The minutes are part of the gradual shift toward a more dovish posture. Falling house prices are crimping consumption, but the labor market remains strong, with the unemployment rate at eight-year lows. In the scenario of a rate cut, the RBA identified a reversal of the labor market’s strength. Australia publishes March employment data first this Thursday in Sydney. Given the minutes, the market is more likely to sell the Australian dollar on disappointment than buy on a strong report. Australia lost 7.3k full-time positions in February.

China will report March industrial output, retail sales, and fixed asset investment figures tomorrow in Beijing, alongside Q1 GDP. Economists expected sequential improvement in the March series, but GDP may slow a touch from the 6.4% year-over-year pace since in Q4 18. The OECD revised down its growth forecast for the world’s second-largest economy to 6.2% this year and 6.0% next year.

Reports indicate that the US wants China to shift some of its retaliatory tariffs away from agriculture so the Trump Administration can claim a victory for American farmers ahead of the 2020 campaign. Some suggest China could shift some of the tariffs to make it easier to fulfill its pledge to boost its agricultural purchases to $30 bln more on top of the pre-trade war levels. Reports also indicate China is reviewing non-tariff barriers to agriculture trade and specifically is reviewing its anti-dumping and anti-subsidy measures against distillers’ dried grains (used for animal feed).

US-Japan trade talks began in Washington yesterday. If the US would have remained in the Trans-Pacific Partnership both NAFTA and US-Japanese trade ties would have been modernized and no need for these talks. At the same time, it is important to recognize that the TPP and what the US called USMCA is treaties and require Congressional approval. The talks with China, Japan, and the EU are executive agreements. No Congressional approval is necessary. Yet just like Trump has reversed many of Obama’s executive decisions, these trade agreements may not survive Trump’s successor.

The Australian dollar approached $0.7200 but has backed off. It has not closed above there for a little more than two months. There is an option stuck there for about A$555 mln that expires today and reinforces this resistance area. We have been looking for it to top out near there. Support is seen in the $0.7100-$0.7120 area. Meanwhile, the dollar continues to probe the JPY112 area. It finished the North American session above there for the past two sessions, but barely. There are no significant nearby expiring options today, but there is a $1.1 bln strike at JPY112 that will be cut tomorrow. Outside of the March 20-21 around the ECB and FOMC meetings, yuan has been flat in narrow ranges since the beginning of last month. The dollar has rarely traded below CNY6.70 or above CNY6.74.

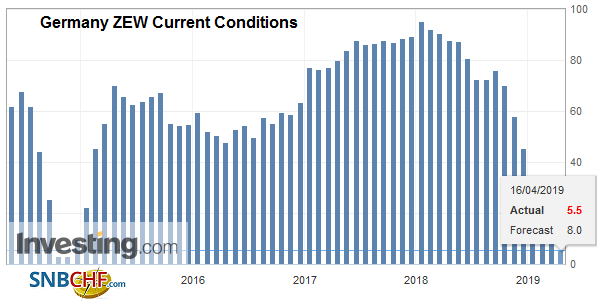

GermanyAlthough we continue to suspect that the worst is behind the German economy, its recovery remains painfully slow. The ZEW investor survey does not appear to be helped much by the strong performance of German equities. The DAX is up 3.65% over the past month, making it one of the strongest among the major markets. The current assessment was halved to 5.5 from 11.1. The median forecast in the Bloomberg survey called for a gain (to 8.5). It is the seventh consecutive decline. Last April it stood at 87.9. On the other hand, the expectations component rose to 3.1 from 0.5. It is the sixth consecutive month of improvement. It stood at -24.7 last October and has steadily risen since. The flash PMI is due Thursday. The manufacturing PMI is expected to have edged up but most likely will remain below the 50 boom/bust level. The service PMI may slip, leaving the composite with a possible minor uptick. |

Germany ZEW Current Conditions YoY, April 2019(see more posts on Germany ZEW Current Conditions, ) Source: Investing.com - Click to enlarge |

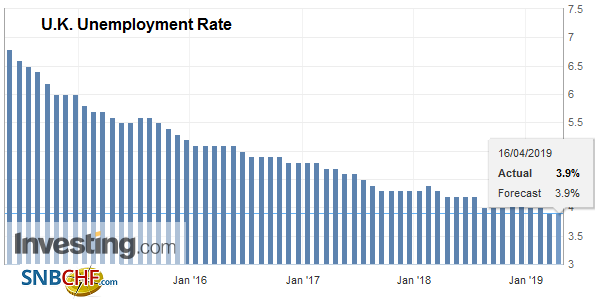

United KingdomThe UK’s employment data was in line with forecasts and had little impact on sterling, which is trading in a narrow range below $1.31. Employment rose 179k to a new record high. The unemployment rate was steady at 3.9%, its lowest level in nearly 45 years. Average earnings, excluding bonuses, rose 3.4%, which is near the best level since the Great Financial Crisis. The uncertainty surrounding Brexit is understood to keep monetary policy out of play. However, with earnings holding above inflation, we, like others, suspect that if it were not for Brexit, the BOE would be leaning toward a rate hike. Inflation figures will be released tomorrow. The UK reports several measures of CPI. They are all telling the same story, holding between 1.9% and 2.0%. The euro is struggling to maintain a foothold above $1.13. It tested support ar $1.1280 in the European morning and good bids emerged. Options may keep the euro penned in narrow ranges. The $1.1250 area on the downside houses options for 610 mln euros and 1.5 bln euros expiring today and tomorrow respectively. Tomorrow also sees a 1.4 bln euro option at $1.13 also expire. Trend line support drawn from the April 2 push to almost $1.1180 is found today near $1.1260. Sterling is trading inside yesterday’s range, which was inside last Friday’s range (~$1.3050-$1.3135). The 20-day moving average is near $1.3110 today and sterling has not closed above since March 27. Turkey reported better than expected February industrial output figures (1.3% vs. expectations of a 0.3% increase following a 1.0% gain in January is helping to stabilize the lira today after the dollar closed above TRY5.80 yesterday for the first time since last October. The technical indicators warn of the risk of a near-term short squeeze. |

U.K. Unemployment Rate YoY, February 2019(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

United States

|

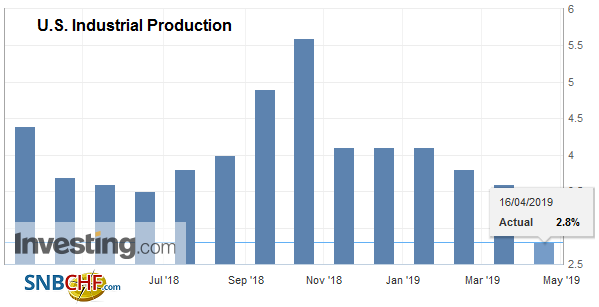

U.S. Industrial Production YoY, February 2019(see more posts on U.S. Industrial Production, ) Source: Investing.com - Click to enlarge |

Canada reports its international transaction for February and manufacturing sales. Neither tends to be market movers, even in the best of times. Trade and CPI figures will be released tomorrow, followed by retail sales on Thursday. Headline CPI will likely be lifted by food and energy, but the underlying measures are expected to be little changed. Canada has seen its trade balance deteriorate and the three-month moving average of C$3.7 bln deficit is the largest in at least 20 years. Retail sales are expected to have rebounded from January’s 0.3% decline.

The US dollar is threatening to break above the CAD1.34 level. It has not closed above there this month. The high from the second half of March was set near CAD1.3450. Intraday support is seen near CAD1.3340-CAD1.3360. After dipping below MXN18.75 ahead of the weekend, the greenback is clawing back. It rose to almost MXN18.90 yesterday and is edging a bit higher today. It has not traded above MXN19.0 for a week. We look for a test on the 20-day moving average near MXN19.05 in the coming days. The Dollar Index is firm near 97.00. The S&P 500 gapped higher ahead of last weekend. It entered the gap yesterday but did not close it. It is found between last Thursday’s high (~2893.4) and yesterday’s low (~2896.5). The S&P may gap higher again today. This gap is likely “normal” meaning that it is closed quickly. Still, the S&P 500 is approaching the record high set last September near 2941.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,EUR/CHF and USD/CHF,Germany ZEW Current Conditions,newsletter,Trade,U.K. Unemployment Rate,U.S. Industrial Production