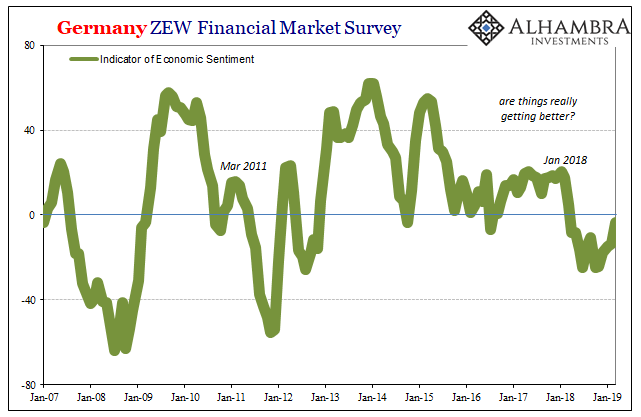

| According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

That’s up from -24.7 back in October, though sentiment had likewise improved at one point last year, too. In July, the number was also -24.7 rebounding to -10.6 in September before the real stuff began. |

Germany ZEW Financial Market Survey 2007-2019 |

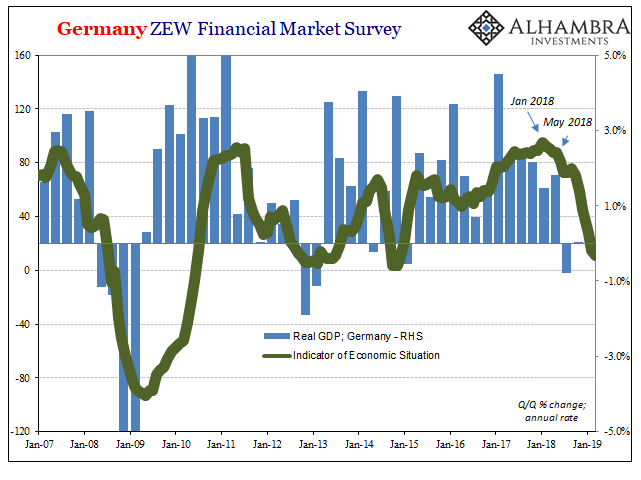

| With sentiment still underwater three months into 2019, ZEW’s separate estimates of the current economic situation in Germany are now firmly in recessionary territory. At 11.1, that’s the lowest in more than four years. Reaching 12.6 in September 2012, for example, just as Ben Bernanke was launching his second QE and the ECB’s Jean-Claude Trichet was trying to figure out the differences between OMP and SMP rescues (his replacement opting instead for LTRO’s) Germany was firmly gripped by its last declared recession. |

Germany ZEW Financial Market Survey 2007-2019 |

| Both sentiment as well as situation, Europe’s economic boom, what there might have been of one, clearly peaked around January 2018. The real skid, however, followed from April and May last year. The euro turning lower, meaning the dollar “rising”, in the first of those two months punctuated by the big market (collateral) break on May 29.

If the ZEW’s figures are close, and they have been a reasonable approximation for Germany overall, then real GDP growth in Q1 2019 will not have been growth – which would make three straight quarters without any. That’s a very long time for it to have been absent. This may or may not be recession, but that is quite beside the big picture. Just as May 29 had nothing to do with Italian populists, this German economic slump isn’t really about Germany. The US economy was supposed to be immune, the whole “decoupling” idea. Yet, though the American manufacturing sector isn’t so visibly distressed it is certainly following along regardless. |

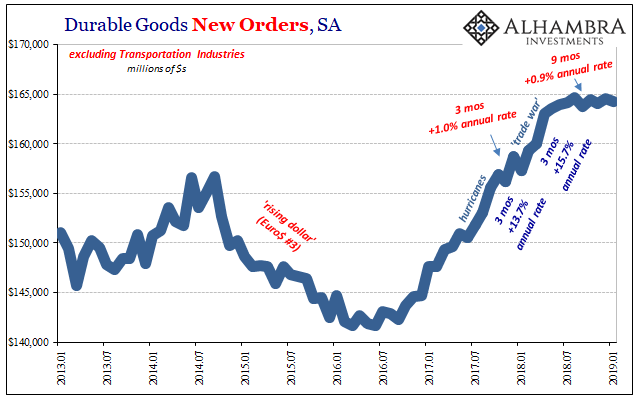

Durable Goods New Orders, SA 2013-2019 |

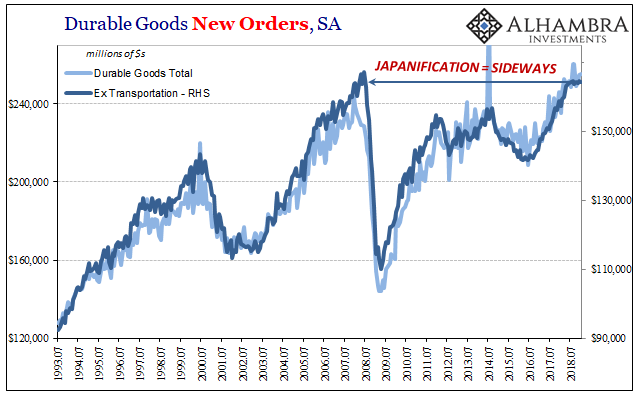

| The Census Bureau, getting closer to catching up on data, reported today that durable goods orders in January 2019 were flat for the ninth straight month. New orders for long-lived goods have been essentially stuck at the same level, indicating like Germany an industrial therefore consumer-led slump. It isn’t (yet) of the same magnitude as in Europe, it is, though, a very clear and lengthy slump nonetheless.

Whether we take account of just durable goods (excluding transportation) or the overall American factory sector (factory orders), the inflection dates to the very same as Germany (or China). Everything changed around April and May. |

All Manufacturing Industries New Orders, SA 2009-2019 |

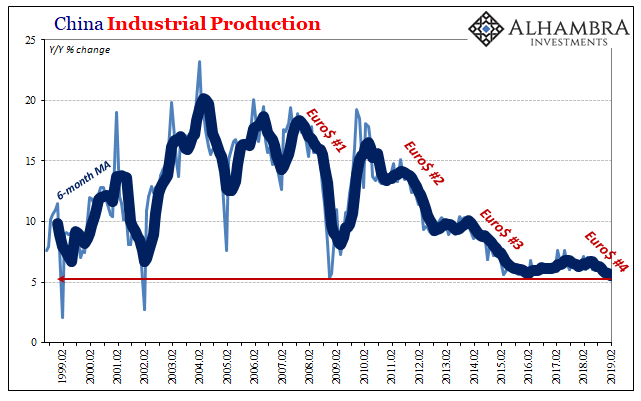

| By focusing on the narrow question of recession or no, we miss the more important pieces. The (global) economy occasionally looks like it could break out of its languishing malaise – but it never does. Instead, every time it appears set to really boom (by narrative) the whole thing is set back often in uniform timing if not always intensity.

Review all three prior Euro$ experiences, the harmony is what really sticks out – as it should. In the end, it doesn’t really matter if Germany is in recession but the US avoids it. Or the US catches a contraction and Germany merely another soft spell. What does is how the entire global system is pushed further away from recovery, however that might work out individually, squandering still more time stuck in a condition that isn’t expansion. |

China Industrial Production 1999-2019(see more posts on China Industrial Production, ) |

| In other words, what ends up happening is SIDEWAYS. Narrowing in on each of the upswings or downturns, and obsessing about the definitions and technical proportions of a recession, you might end up missing the important factors. Economists and central bankers have called this an expansion when it only adds up to sideways; Europe, US, and now China. Pretty much everywhere. |

Durable Goods New Orders, SA 1993-2018 |

| A globalized downturn here in 2019, continuing the one from 2018, pretty much nails the comparison. How many more of these, how much more time is required, before there is enough proof? If Japan is our model for all the dimensions of it, that’s not encouraging.

They’ve been going sideways for twenty-eight years, twenty-nine in some accounts. What stands out in Japan, too, are all those ups and downs along the way (below). Never too high, occasionally really low. How many recessions did Japan experience in those three decades? Trick question. It doesn’t make a difference however many you might come up with. The only thing that matters, especially for the global economy in 2019, is the next downturn. If it shows up before actual recovery, and all the evidence is pointing in that direction, we are conclusively stuck in SIDEWAYS. The worst possible economic case, the most dangerous social condition (outside of Japan). What these persistent downturns mean is a world without actual growth. That’s Japan. And now it’s everyone. |

Japan Industrial Production, SA 1978-2018(see more posts on Japan Industrial Production, ) |

Tags: China,China Industrial Production,currencies,downturn,durable goods,economy,factory orders,Federal Reserve/Monetary Policy,Germany,industry,Japan,Japan Industrial Production,manufacturing,Markets,newsletter,recession,ZEW