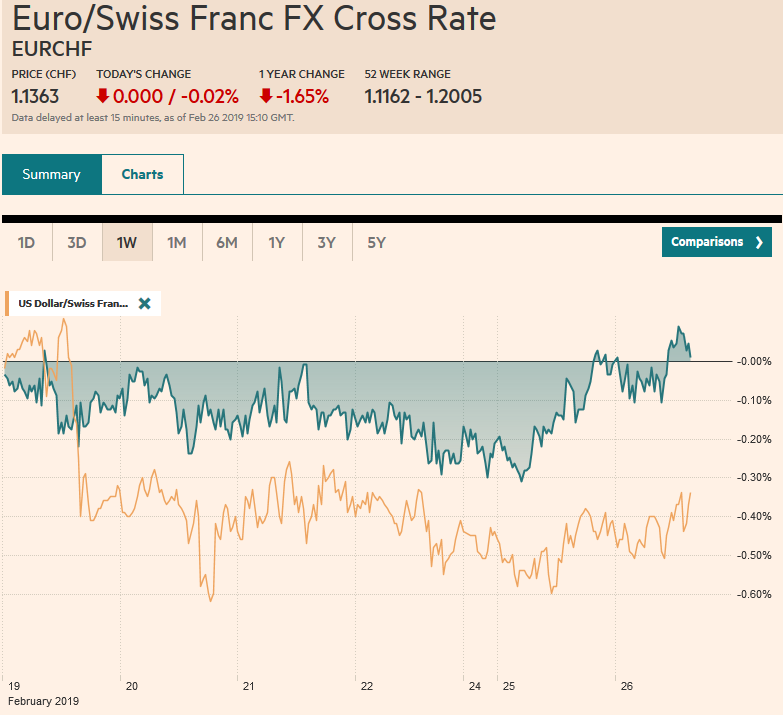

Swiss FrancThe Euro has fallen by 0.02% at 1.1363 |

EUR/CHF and USD/CHF, February 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The increased likelihood that Brexit is delayed and the possibility of a second referendum is helping lift sterling. As has been the case for most of the time since the June 2016 referendum, the prospects of a softer and/or later Brexit is understood as sterling positive. The other key focus is US-Chinese trade. The delay of the tariff escalation and the prospects for a deal helped lift equity markets yesterday, but profit-taking is cutting those gains today. The MSCI Asia Pacific Index ended a six-day advance today with nearly all the regional markets lower. The Dow Jones Stoxx 600 in Europe is giving back all of yesterday’s gains. US shares are trading lower in Europe, and the early call looks like a 0.25% lower for the S&P 500. Asia Pacific bonds reacted to higher rates in the US yesterday, but European bond yields are softer with the exception of UK Gilts. Outside of sterling, the yen and Swiss franc are firm as the use of funding is unwound on the margins. The dollar-bloc currencies and Scandis are lower. Oil prices are consolidating yesterday’s losses, which appear to have been sparked by a presidential tweet. |

FX Performance, February 26 |

Asia Pacific

The euphoric response to the extension of the tariff-freeze between the US and China was not sustained. Yesterday’s rally was exaggerated. The CSI 300, which was up 6% yesterday fell 1.2% today. The dramatic rise spooked officials. Today they warned an increase in unregulated margin debt. There are two other considerations. First, China’s Banking and Insurance Regulatory Commission (CBIRC) has called for 30% of new lending to be targeted to the private sector. Second, a Politburo meeting at the end of the week will reportedly focus on financial market reforms.

Economic reports from the region are mixed. Industrial output rose in Singapore by 0.9% in January, though the year-over-year pace slumped to -3.1% from +1.7% in December. In Taiwan, industrial production was 1.86% lower than a year ago, a bit worse than expected. The market had expected Hong Kong’s January exports to have fallen by 2.8% after December’s -5.8% year-over-year decline. Instead, they slipped 0.4%, the smallest decline in three months. Consumer confidence in South Korea rose for the fourth consecutive month in February. The takeaway is that weakness from the end of last year has carried over into 2019, but the stage appears to be being set for better economic traction in the coming months.

The dollar firmed to a marginal new high for the year against the yen yesterday near JPY111.25. It stopped a little shy of the high from December 26 and the 100-day moving average, both found near JPY111.40-JPY111.45. The dollar has found support on the pullback near JPY110.75 and yesterday’s low was around JPY110.60. There are three sets of expiring options to note today. The first is a $420 mln option at JPY110.70. The second is for $1.2 bln at JPY111.00. The third is JPY111.30 and JPY111.50 options for a total notional amount of $1.54 bln. The Australian dollar is pushing back after reaching about $0.7185 yesterday. We anticipated the recovery from the China embargo story that saw the Aussie drop hard last Thursday. We suggested selling into the corrective upticks that could run toward $0.7200. Expiring options are struck at $0.7200 and $0.7175 today (A$516 mln and A$782 mln, respectively). Initial support is seen near $0.7140 and then $0.7125. We note that India’s airstrike on a reported terrorist camp in Pakistan is weighing on the rupee. Note that these are two nuclear-armed powers using conventional weapons.

Europe

There is one story in Europe today and that is Brexit. The economic and events diary is otherwise sparse, and there have a few developments in the past 24 hours. First, Labour leader Corbyn as moved in line with his party’s platform and endorsed a call for a second referendum. Labour, like the Conservatives, were seeing defections and more have been threatened. Corbyn’s tact was arguably necessary to try to outflank his critics within the party. To be sure, even if the entire party were to vote for a second referendum it would not be sufficient to carry the day by itself, and there are thought to be around two dozen Labour MPs that would likely vote against a second referendum. If perchance, a second referendum would be agreed, depending on the options voters would have, it could be a way to overturn the 2016 referendum results. Such prospects would likely lift sterling.

Second, in order to try to maintain some control over her party, May is allowing the cabinet to discuss a postponement in Brexit from the end of next month. As recently as yesterday, reports indicated May was opposed to an extension and told Merkel as much. Initially, a couple month delay, until around the EU Parliament election at the end of May seemed possible, but subsequent signals from Brussels suggest that too short of a delay may not accomplish anything and a longer delay may be warranted.

Third, the Bank of England will step up its liquidity provisions to British banks over the next month. The BOE will provide Indexed Long-Term Repos on a weekly basis rather than monthly. Carney and others are emphasizing that the central bank will provide any and all liquidity that may be needed. Separately, Carney has signaled that the BOE has no intention to reduce its balance sheet until the base rate is at 1.50%. Currently, it sits at 0.75%.

Sterling is testing the $1.32 area. Last Thursday, it briefly dipped below $1.2970. The $1.32 area has blocked the upside earlier this year and last November. The penetration was deeper last October and November, reaching almost $1.33, but it proved equally unsustainable. We are looking at potential toward $1.34-$1.35 on a confirmation of a delay in Brexit. The euro has slumped to GBP0.8600, its lowest level in a bit more than 20 months. The next important technical target is around GBP0.8470-$0.8500. The euro is in a quarter-cent range mostly below $1.1370. It is trapped between large expiring options. At $1.1330-$1.1335 are options for 1.8 bln euros that will be cut today. There is another 1.5 bln euros struck $1.1390-$1.1400. That said, the intra-day technicals warn North American operators may try taking the single currency lower.

America

The US reports housing starts and permits, which expected to have remained soft in December. The Conference Board’s measure of consumer confidence will be reported today. It declined in the three months through January but is expected to have risen this month. The main feature though is Powell’s first leg of his congressional testimony. When testifying, Powell speaks for the Fed rather than himself, and this will allow the Fed to talk in a single voice even though there are of course a range of opinions and views. Powell will get pressed on the economic assessment and the balance sheet. What appears to many to be a sharp reversal in the Fed’s stance may also come under scrutiny. Perhaps some may point to the rally in stocks this year and wonder if the Fed did not over-react to the tightening of financial conditions at the end of last year. Powell has found the right tone for investors, apparently, with the patience and flexibility manta. No need to innovate today.

Mexico report December retail sales after yesterday’s slightly softer than expected Q4 GDP. There is more talk today that the central bank of Mexico could begin cutting rates in H2 19. It hiked rates four times last year including in December. The overnight rate stands at 8.25%.

Trump’s tweet about oil and the subsequent decline stole the wind from the Canadian dollar sails yesterday. The US dollar rose from near CAD1.3115 to almost CAD1.3200. There has been a little follow-through to nearly CAD1.3220. Resistance is seen in the CAD1.3230-CAD1.3250 area. The Mexican peso is little changed on the day near the middle of yesterday’s range. The Dollar Index is slipped through last week lows to test the 96.25 area. The next immediate target is 96.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD. $EUR,$CNY,$JPY,EUR/CHF,MXN,newsletter,USD/CHF