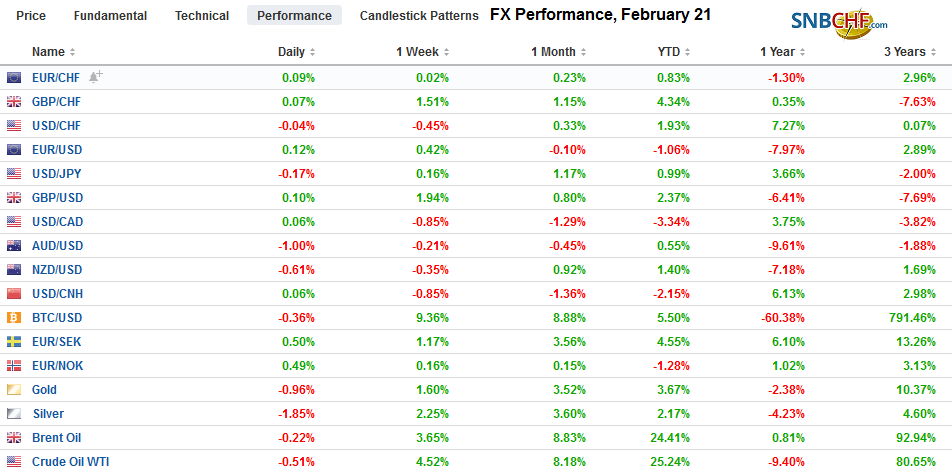

Swiss FrancThe Euro has risen by 0.04% at 1.1347 |

EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is firm against most major and emerging market currencies. There is more optimism on US-Chinese trade as a series of understandings are drafted, and an extension past March 1 of the tariff freeze is reportedly in the works. Mixed economic data and a call from a local bank for two rate cuts this year did not have as much impact on the Australian dollar as reports suggesting that Dalian, where 2% of Australia coal goes, has blocked imports to which is seen as a protest to Australia’s ban of Huawei, It is the weakest currency today, off more than 0.75%, straddling $0.7100 after hovering around $0.7200. A little improvement in the flash eurozone PMI failed to push the euro out of its recent narrow trading ranges. Some positive Brexit sentiment appears to be creeping in and helping stabilize sterling as the market absorbed Fitch’s decision to put the country’s AA rating on negative watch. Global equities are narrowing mixed. In Asia, China and Korea traded off, while most of the other market edged higher. In Europe, the Dow Jones Stoxx 600 is little changed in the morning and continued to flirt with the 200-day moving average. Soft data in Asia saw Japanese and Australian yields slip, and while peripheral European yields followed, core yields are one-two basis points firmer. Iron ore and gold prices are softer. Oil prices are little changed, putting at risk the six-day advance. |

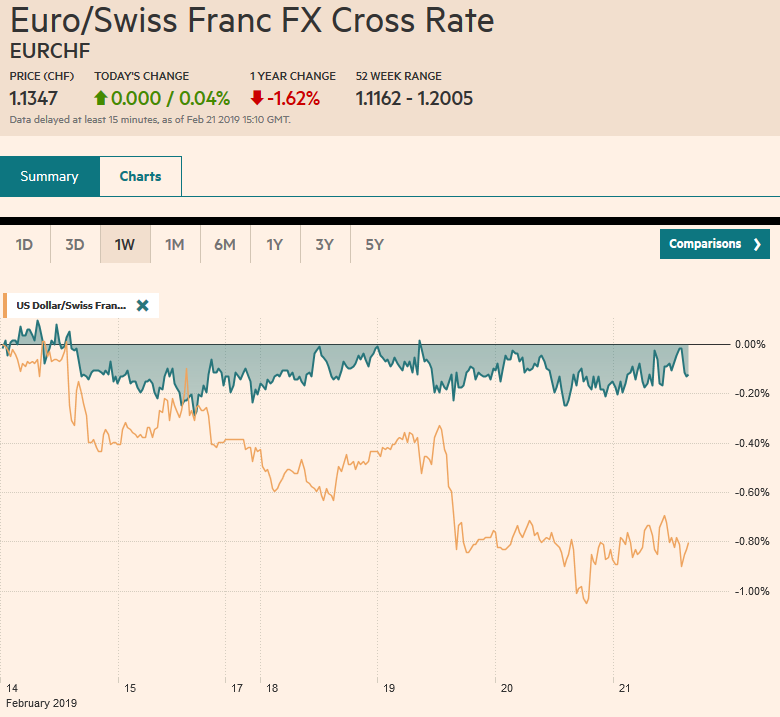

FX Performance, February 21 |

Asia Pacific

Australia is very much in focus today. The flash PMI was poor. The manufacturing PMI eased to 53.1 from 53.9, but the real shock was the dramatic weakness in the service PMI, which is often seen as more a reflection of the domestic economy that trade. It fell to 49.3 from 51.0. This report was followed by favorable jobs data. The economy grew more than twice as many jobs as expected (almost 40k). Of these, more than 65k were full-time jobs, the most since June 2017. The participation rate ticked up but the unemployment rate was steady at 5.0%. The Australian dollar came under pressure when a local bank forecast two rate hikes this year. However, the Aussie recovered fully but then was hit anew on reports that one port (Dalian) has banned Australian coal. The full details are not known or if this is a wider action.

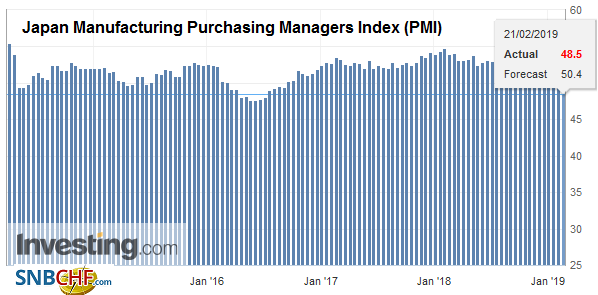

| Japan’s PMI disappointed. The flash manufacturing PMI fell to 48.5 from 50.3. It is the second sharp drop after finishing last year at 53.6. It is the first contraction (sub-50) reading in 2.5 years. Both new orders and backlog fell. The All-Industries Index, which is seen as a rough proxy for GDP fell 0.4% in December (twice the decline that was expected) after a 0.5% decline in November. |

Japan Manufacturing Purchasing Managers Index (PMI), February 2019(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

South Korea’s first 20-day trade data for February is instructive because it reveals the ongoing disruption in trade, especially with China and smartphones. South Korea’s imports were off 17.3% year-over-year, but exports were off 9.1%. Exports to China fell by 13.6%. Exports of semiconductor chips fell by a little more than a quarter. Korean shares, along with China, were among the worst performers in Asia today.

The dollar remains confined to the narrow ranges against the yen that have dominated this week. The greenback has traded between roughly JPY110.40 and JPY111 this week. Today it is in a 15 tick range on either side of JPY110.75. In contrast, the Australian dollar has a wide range today. It traded on both sides of yesterday’s range and is trading below yesterday’s low (~$0.7140). It is hovering around $0.7100 in the European morning, where an A$565 mln option expires later today. A convincing break of the $0.7050 area would complete a potential bearish chart pattern (head and shoulders top) whose measuring objective is near $0.6800.

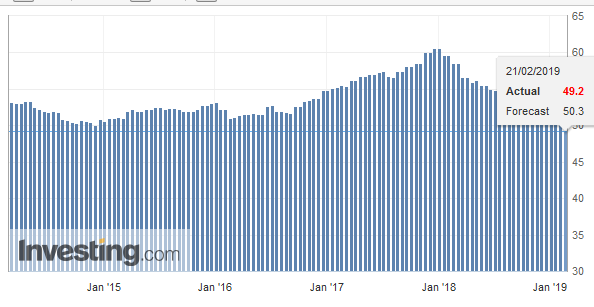

EuropeThe flash PMI readings are mixed in Europe, but the beginnings of a recovery may be hinted with today’s report. Germany’s service sector was strong at 55.1 from 53.0, but the manufacturing sector continued to erode (47.6 from 49.7). The composite rose to 52.7 from 52.1. France showed improvement in both manufacturing (51.4 vs. 51.2) and service (49.8 vs. 47.8). The composite recovered from 48.2 but at 49.9, did not quite back to expansion mode (above 50). The German manufacturing sector is more exposed to China and may also still be adversely impacted by the changes in the auto sector, though that seems to be fading. |

Eurozone Manufacturing Purchasing Managers Index (PMI), February 2019(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

There are several Brexit developments to be aware of today. First, late yesterday, Fitch put the UK’s AA rating on negative watch due to uncertainty over Brexit and the risks of a disruptive no-deal exit. Sterling initially softened in response. The rise in 10-year Gilt yields today are in line with the US and Germany. Second, and more importantly, new wording around the backstop may be being hammered out, according to reports. Brexit Secretary Barclay and the Attorney General Cox are in Brussels today with proposed changes that ostensibly would be acceptable to Parliament. The Spanish foreign minister appeared to confirm that this is in the works. Still, many European officials do not seem convinced that this will satisfy the House of Commons, which is likely to vote again next week. Third, reports suggest that as many as 15 government officials may vote against May’s bill next week. It would likely cost a minister their job, but if 15 defect, it will be more difficult to exert party discipline, which in any event seems at a low ebb given the reports of cabinet in-fighting.

The euro has re-entered the $1.13-$1.15 trading range after pushing lower last week. However, it has not been able to move above its 20-day moving average (~$1.1365), which is just shy of the .50% retracement of this month’s decline (~$1.1375). There is an option that will be cut today at $1.1365 for about 665 mln euros. There are nearly 3 bln euros in options at $1.1400-05 that also expire today and 1.2 bln euro s at $1.13. The record from the recent ECB meeting is still on tap today, and although we know the meeting’s outcome was dovish, the intraday technicals seem to favor a firmer euro. Sterling is firm within yesterday’s range. It is likely to remain rangebound until news from Brussel talks is reported, perhaps later today. There is an option for about GBP210 mln at $1.3055 that expires today, which is very much in play presently.

America

Yesterday’s FOMC meetings confirmed the shift in the Fed’s posture. It was spooked by the incredibly market volatility and the sharp slowdown overseas. Investors learned that nearly all Fed officials are on-board with ending the balance sheet reduction before the end of the year. The exact modalities still need to be worked out, like will the unwind taper like the purchases, And if the balance sheet will be Treasuries over time, will the Fed sell MBS and roll into Treasuries (aggressive) or will it simply maturing MBS proceeds into Treasuries (which also raises questions of maturities). At the same time, it is important to recognize that the Fed kept a mild tightening bias. The discussions where over under what conditions would the Fed resume hikes. There did not seem to be a discussion of cuts.

The US-China trade talks look most likely to be extended past March 1. Reports suggest progress is being made and several memorandums of understanding (MOU) are being crafted. China’s Liu He will reportedly meet with President Trump tomorrow after this week’s talks. The political climate in the US is such that Trump’s critics are not concerned that he will push for too strong of a deal but rather that he will claim victory for a deal that does not address the deeper structural issues. That said, it seems unrealistic to expect a trade agreement to be the last word on the multi-faceted competition.

The US reports a slew of economic data today. We suggest the February readings, which include the Philly Fed d survey, weekly jobless claims, and the flash Markit PMI are the most important. A mixed picture is likely to emerge and the soft patch in the US economy that looks to have begun in Q4 18 appears to have carried into Q1 19, aided by the government shutdown and the bitter cold. Durable goods orders for December will allow economists to fine-tune Q4 GDP forecasts, while the January Leading Economic Indicators and existing homes sales may firm. The Fed’s Bostic speaks today, but his views are well known. Canada reports wholesale trade, which is not typically a market-mover ahead of tomorrow’s retail sales, where the headline is expected to have fallen for the second consecutive month in December. Minutes from Mexico’s recent central bank meeting are also on tap today.

The US dollar found support near CAD1.3150 yesterday. It is slightly firmer today as the Canadian dollar appears to be dragged lower in sympathy with the sell-off in the other dollar-bloc currencies. The five and 20-day moving averages converge a little above CAD1.3210, and a close above there would help stabilize the tone. The dollar continues to consolidate against the Mexican peso though at higher levels. This week’s range is roughly MXN19.124 to MXN19.300. The Dollar Index is in a 25 tick range today. Support is near 96.25 and resistance near 96.75. It is still difficult to see a near-term breakout.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,EUR/CHF,EUR/GBP,Eurozone Manufacturing PMI,Japan Manufacturing PMI,MXN,newsletter,USD/CHF