We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way.

In January 2019, especially the past few days, there are so many examples of flighty birds. Here’s an especially obvious, egregious one from Atlanta Fed President Raphael Bostic. He was so damn positive at the end of October just three months ago he admitted it was giving him problems wordsmithing. Two and a half months, really.

The economy is in a good place. So good, in fact, that as I was sitting down to write this speech, I struggled to come up with sufficient variations on the word “strong.” Strong has many definitions that can describe physical prowess, the intensity of an odor or flavor, and, in physics, a type of force between particles. But one definition stands out to me as particularly apt to describe the economy at this moment: strong—able to withstand great force or pressure.

And now this week:

So grassroots intelligence from Main Street and messages from Wall Street indicate heightened uncertainty and concern about the economy. But the aggregate economic data continue to paint a robust picture. What is a policymaker to conclude from these mixed signals?

To me, the appropriate response is to be patient in adjusting the stance of policy and to wait for greater clarity about the direction of the economy and the risks to the outlook.

| So, maybe unable to withstand great force or pressure? You don’t go from strong to heightened uncertainty in a matter of weeks unless it wasn’t ever strong to begin with. Using the same dictionary as President Bostic, it tells me the antonym for “strong” is “weak.”

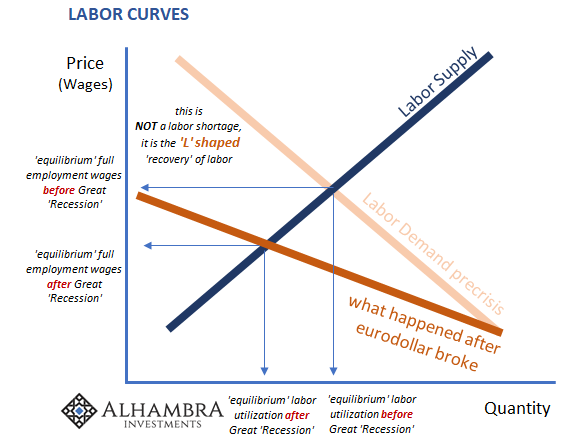

Memo to Economists: stop using the unemployment rate, this “aggregate economic data” point will let you down every time. Every time. It’s easy to try and ignore the participation problem, but there is no escaping the global “L.” But this isn’t really about that; or, more accurately, our desire is to use this more comprehensive and appropriate reading of the past in order to better analyze future prospects. The way in which the global economy is turning is a shocking surprise to those like Bostic who thought it was strong. Realizing it wasn’t, the nature and more so the speed of its deterioration isn’t at all unexpected. Leading the way forward, meaning downward, is China. The Chinese economy in 2017 was practically begged to be the centerpiece of globally synchronized growth. As 2018 rolled onward, it became increasingly clear it hadn’t and wasn’t ever going to. As each month flips on the calendar, there are only indications of bad things just ahead. |

Labor Curves |

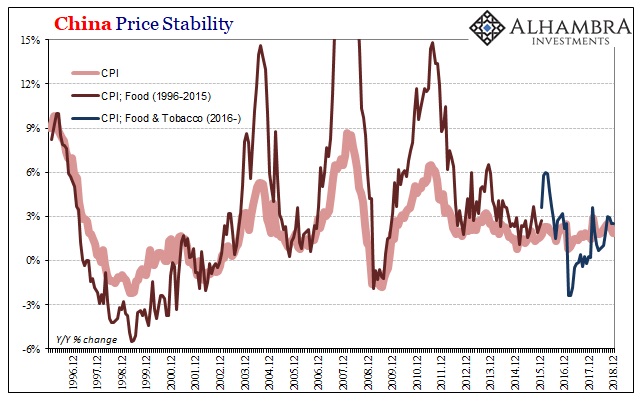

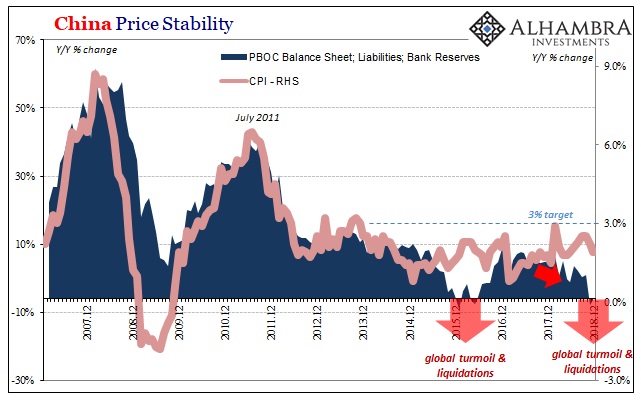

| Today, China’s CPI was reported to have fallen below 2% again in December 2018. This despite a relatively high (for recent times) rate of food inflation. In the West, consumer prices overall are pushed around by oil. In the East, by food. Thus, given 2.5% in food price inflation a 1.9% headline (down from 2.2% in November, and 2.5% in October) is somewhat concerning.

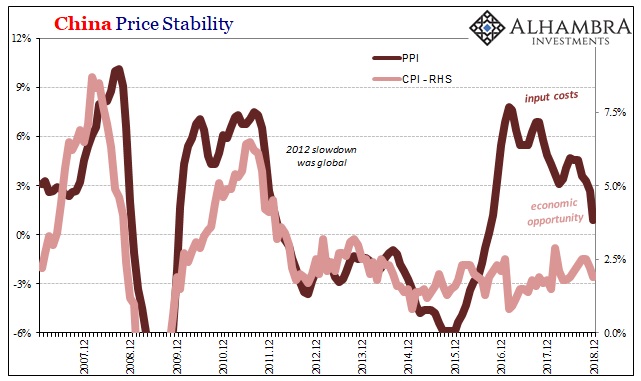

The bigger problem is factory pricing. China’s PPI rose by just 0.9% year-over-year in December. It’s down sharply from 2.7% in November and 4.6% as late as August. No one should ignore the gamma, the rate of change (this means not just how fast factory gate prices are decelerating, but also how quickly and substantially Federal Reserve officials change their tune). |

China Price Stability 1996-2018 |

| Raphael Bostic almost certainly doesn’t care about Chinese prices, but he should pay close attention to them. Everything we want to know about the global monetary system and therefore the direction, and strength of direction, for the global economy is contained in RMB. |

China Price Stability 2007-2018 |

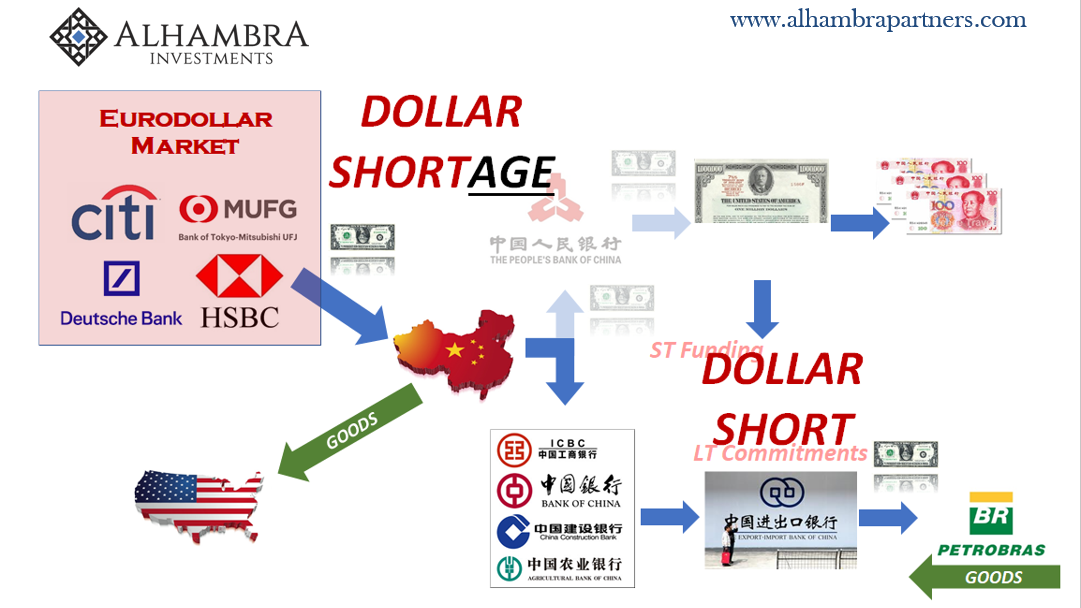

| Monetary constraint is the primary reason for the speed of the economic deceleration, a coincident occurrence with so much market disaster that just isn’t coincidence. Dollar short + dollar shortage = hawks becoming doves in the blink of an eye. |

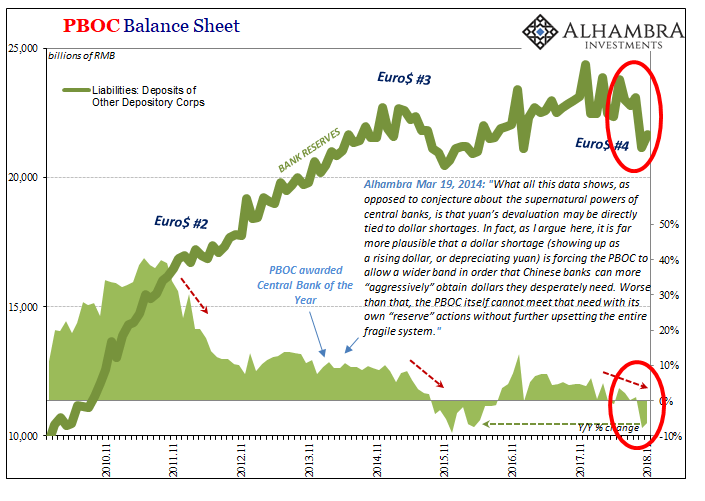

PBOC Balance Sheet 2010-2018 |

| The eurodollar market restricts the flow of “dollars” into China, therefore the central government through the central bank (and others) steps in to try and fill the gap. By doing so, the PBOC is constrained on its own money side. RMB money suffers. |

Dollar ShortAGE |

| These RRR cuts are a poor offset to the more basic deficiency, counting on banks to supply necessary liquidity (even plain money) during times of turmoil. In 2015, they understandably chose to hoard and the policy was foiled. How about 2018? Seems the same so far. |

China Price Stability 2007-2018 |

| Chinese missteps are global missteps because of the world’s reserve currency’s renewed dysfunction. What’s happening now is merely confirmation that economy is reacting as expected to textbook monetary restriction. Eurodollar #4 is more and more visible beyond currency prices or the alarming behavior of esoteric money statistics.

Unless something is done, what will happen next is what always happens next – four times so far. The economic confirmation proves the risks, which will lead to further monetary constraint and then further economic deceleration (or contraction). Mr. Bostic goes from “I struggled to come up with sufficient variations on the word strong” to “heightened uncertainty and concern” in less than three months and Eurodollar Bank #6 thinks it’s a good time to adjust (pare back) more than it already has. China’s PPI just confirms the wisdom of noticing the deterioration and not waiting for Bostic to catch up (assuming he ever does). |

Rational Ecpectations |

What can be done to stop this? This is, actually, China and the world’s grand predicament. The Chinese have tried to start the process of circumventing the eurodollar for years, almost exactly a decade since former PBOC Governor Zhou Xiaochuan first raised the issue of offshore, credit-based money in March 2009. The Chinese yuan just isn’t an acceptable alternative no matter how many times people keep saying it is happening (if it was, they would’ve done something long before 2014, avoiding suffering the grave consequences of the downturn that followed).

And they can’t even get the idea of a cooperative replacement off the ground because Economists. The latter are convinced the Federal Reserve is staffed with competent experts who know what they are talking about. There can’t be a global dollar problem because surely someone would’ve said something long before today. Who is Yi Gang going to negotiate with, Raphael Bostic?

That’s way too far off in the future, so we are left with what increasingly looks to be inevitable. We’ve had more than a year for any possible deviations from this course, and yet the global economy has been locked in this direction as if set by autopilot. The fact that central bankers are shocked by this development is an indictment of central bankers, not cause to doubt the development.

The only thing that is or has been truly strong is the eurodollar system’s intermittent drag, that which is now being captured by the rate of change in more and more places.

How do you spell eurodollar economy? L.

Tags: China,CPI,currencies,Deflation,dollar short,dollar shortage,economy,EuroDollar,Federal Reserve/Monetary Policy,inflation,Markets,newsletter,PPI