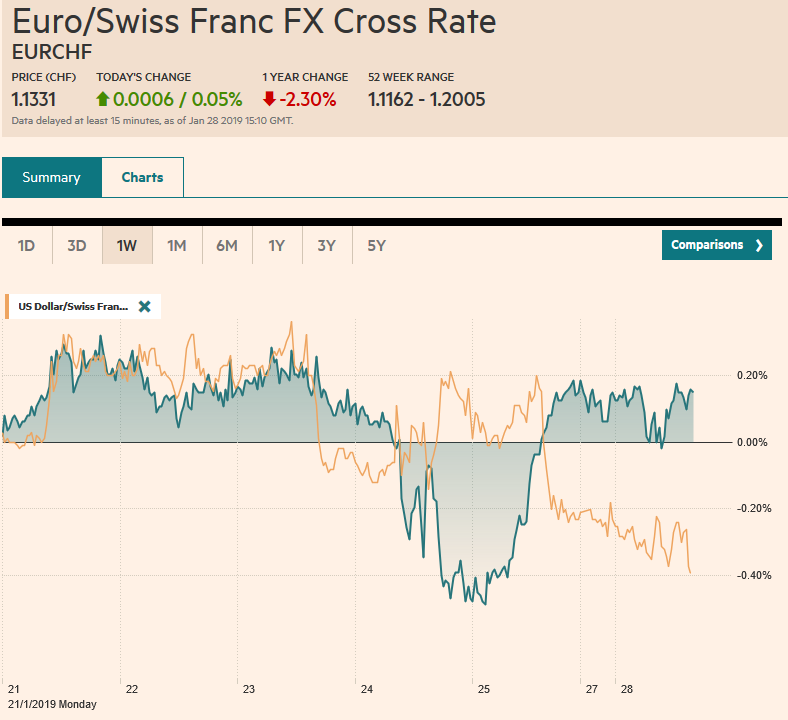

Swiss FrancThe Euro has risen by 0.05% at 1.1331 |

EUR/CHF and USD/CHF, January 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global capital markets are consolidating ahead of this week’s big events, which include the FOMC meeting, US jobs, an important Brexit vote in the UK parliament and the first look at Q4 EMU and US GDP. The US dollar is narrowly mixed. Equities are mostly lower. European benchmark 10-year yields have edged up, though the US 10-year yield is struggling to hold above 2.75%. The US government will re-open after the longest partial shutdown in history, but the agreement only covers through February 15, leaving open the possibility of another closure if a deal is not struck. Crude oil is trading heavily with the front-month Brent and WTI off nearly 2%. The March WTI contract has remained in a $50-$55 trading range for the past three weeks. Gold moved above $1300 an ounce for the first time since last June. It recorded an outside up week by trading on both sides of the previous week’s range and closing above that high. Technical considerations suggest that there may be upside near-term. |

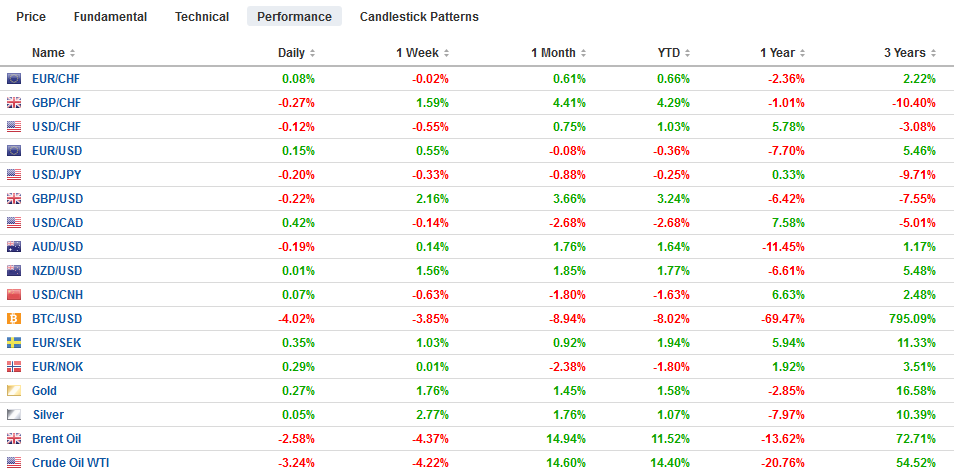

FX Performance, January 28 |

Asia Pacific

The week has begun slowly, and Australian markets were closed for a national holiday. Ahead of the trade talks in Washington starting later this week, the PBOC announced that it had approved S&P Global into China’s credit rating market. Other international credit rating companies hope China makes good on its pledge to allow additional foreign rating agencies to operate domestically. Separately, China reported that industrial profit fell (1.7% year-over-year in December). Last December, they had risen (10.8%) and is consistent with the economic slowdown and challenges the country faces.

After contracting in Q3, Japan’s economic recovery in Q4 appears spotty and uneven. This week Japan is expected to report that industrial output fell for the second month in December. On the other hand, household demand may have improved, and retail sales are expected to have bounced back after a sharp 1% decline in November. Australia reports Q4 CPI figures tomorrow, and softer price pressures may weaken the currency, as investors appear to have begun discounting a rate cut. China’s official PMI is expected later this week.

The dollar is trading within last week’s range (~JPY109.15-JPY110.00) against the Japanese yen. Two maturing options may be in play in the North American session. There is one for about $600 mln at JPY109.20 and another for around $535 mln at JPY109.55. The Australian dollar posted a potential upside reversal at the end of last week, but follow-through buying stalled near $0.7200. Resistance is seen in the $0.7220=$0.7235 area. The New Zealand dollar is seeing stronger buying that the Aussie after the pre-weekend gains. It reached new highs for the month near $0.6870. The dollar lurched lower against the Chinese yuan before the weekend and fell further during the mainland session today, after gapping lower. It reached almost CNY6.7225, its lowest level since last July. The greenback closed off its lows, and we suspect officials do not want to see it below CNY6.70.

Europe

Brexit developments are front and center. The House of Commons is set to vote tomorrow. There is a bill that will give more control to Parliament if there is government cannot find a majority to support its plan. May could be forced to seek an extension if no agreement is found by February 26. The government wants to renegotiate the backstop with the EC. This latter path looks blocked by the EC and Ireland.

One area that the UK seeks cooperation with Germany and France is over the US sanctions against Iran. There has been talk for a few months now that they could organize a special purpose vehicle that would facilitate trading with Iran ostensible without risking US sanctions as the SPV will not operate in the US. There are reports that an announcement could be made shortly. The US is unlikely to accept this end run around its embargo without a protest of some kind.

The ECB took unprecedented action last week in changing its risk assessment without the cover of new staff forecasts. The way in which Draghi has referred to Targeted Long-Term Refinancing Operations (TLTRO) suggest a consensus is emerging for a new round of long-term loans. However, today’s money supply data suggests the monetary conditions are stronger than the real sector, where German manufacturing PMI slipped below 50, and Italy is expected to report the economy contracted in Q4 for the second consecutive quarter. Money supply, M3 growth, accelerated to 4.1% from 3.1%, while lending to households and non-financial business remained firm.

The euro extended its pre-weekend gains, but the momentum faded in front of $1.1430, the 50% retracement of the decline from the spike higher earlier this month to $1.1575 to the Draghi-inspired lows last week, a little below $1.1300. The next retracement objective is near $1.1465. The 20-day moving average is found near $1.1415, and the single currency has not closed above it for two weeks. The session low, so far is $1.1390, just above the $1.1380 level were 745 mln euros are stuck in an option that expires today. Sterling has been unable to build on its pre-weekend gains, but it remains firm and continues to straddle the $1.32 level. That said, bids near $1.3150 appear sufficient, and another run at the highs looks likely.

North America

The re-opening of the US government should allow a resumption of economic data reports. However, today’s Chicago and Dallas Fed reports were not impacted by the partial government shutdown. Moreover, the key economic reports this week, the first look at Q4 GDP, a few hours before the conclusion of the FOMC meeting, and the January jobs data are also not impacted by the political theater. The FOMC will keep rates steady, and Powell may provide some more color on the Fed’s balance sheet, which had captured the market’s attention when the stocks cratered in December. The Fed’s rhetoric may have shifted (patient and flexible), but its actions have not changed. The balance sheet continues to shrink slowly, and the S&P 500 is up 6.3% this month, recouping 2/3 of the December decline. Economists expect that the US economy expanded around 2.5% in Q4, after 3.4% growth in Q3 and 4.2% in Q2. Trend growth is thought to be a little less than 2%.

US and China trade talks resume this week. The basis for an agreement has been well publicized. China agrees to buy more US goods, especially foodstuffs and energy, and agree to stop improper technology transfers, with some verification and enforcement mechanism. There is unlikely to be much progress on getting China to cut its aid to industry. Although many observers cry foul over the state’s involvement in the Chinese economy, the fact that the US housing sector, accounting for more than 10% of GDP, remains nationalized a decade after the financial crisis has ended, is seen as more acceptable. Both the US and China will likely have constructive things to say about the talks, but neither a breakthrough nor a collapse should be expected. The most that can be expected is an indication of future talks ahead of the early March deadline.

The US dollar has stabilized after falling sharply against the Canadian dollar at the end of last week. Initial support is holding near CAD1.3200. The low from earlier this month was near CAD1.3180. The greenback found support last week near MXN18.88. It has tested the MXN19.05 area today, and there is potential toward MXN19.15, but the high yields continue to draw funds. Meanwhile, the Dollar Index held support near 95.65. A move back above 96.00 is needed to lift the tone.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$CNY,$JPY,EUR/CHF,EUR/CHF and USD/CHF,FX Daily,MXN,newsletter,SPX,USD/CHF