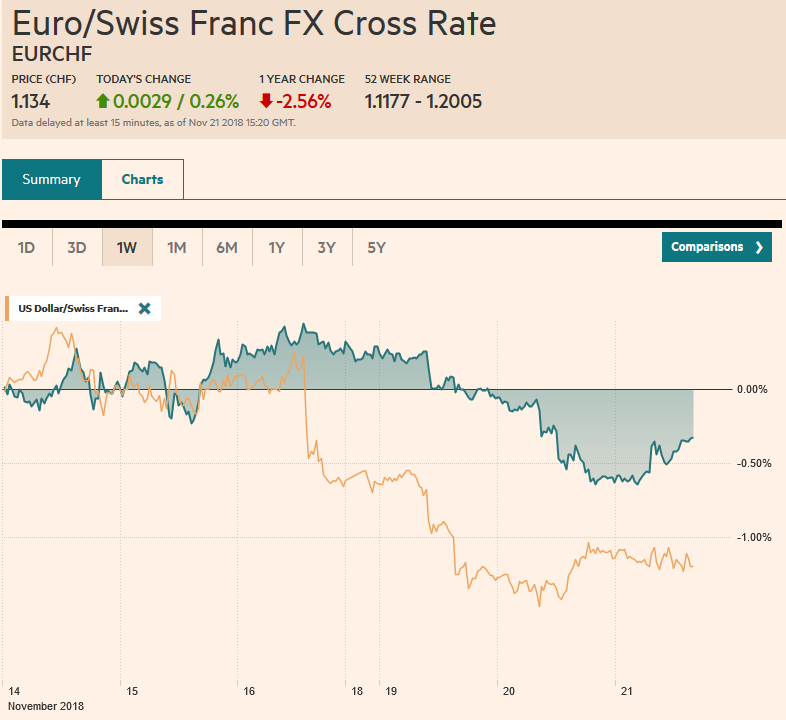

Swiss FrancThe Euro has risen by 0.26% at 1.134 |

EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Yesterday’s frenzy has burnt itself out for the moment. Equities began recovering in Asia after early losses. China, including Hong Kong, Singapore, and Thailand closed higher and European markets are recouping some of yesterday’s decline. The Dow Jones Stoxx is trying to snap a five-day decline and is up a little more than 0.5% near midday. Core bond markets have lost the safe haven bid, and yields are a couple basis points higher. Peripheral European bonds have been lifted not just by the better risk appetite today but also by a report (La Stampa) that suggests League leader and Deputy Prime Minister Salvini may be open to revision to the government’s spending proposals. Italian bonds and stocks are outperforming today, though the ongoing retail auction is struggling to raise a quarter the funds that it did back in May. The calmer capital markets are seeing yesterday’s dollar gains pared. It is heavier against the major currencies, save the yen, and most emerging market currencies. Oil prices are also recovering after yesterday’s dramatic fall. |

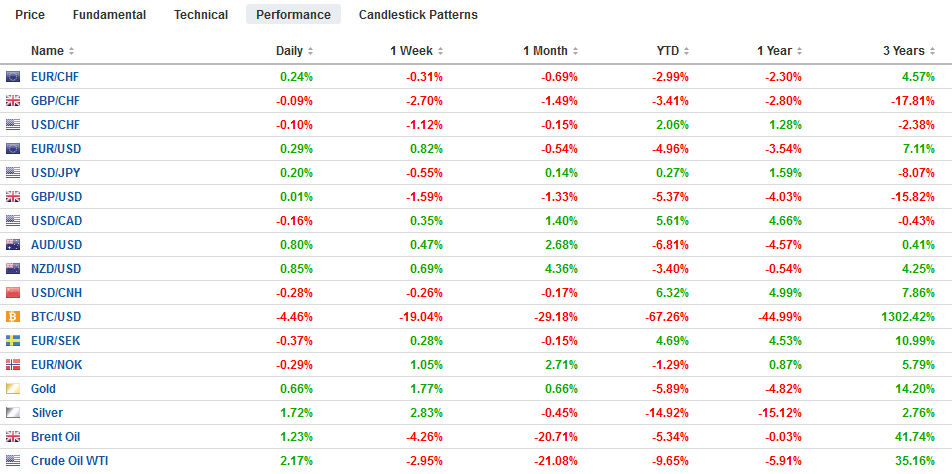

FX Performance, November 21 |

Asia Pacific

US Trade Representative Lighthizer issued a report yesterday, less than two weeks before Presidents Trump and Xi are to meet at the sidelines of the G20 meeting, accusing China of not altering its practices and continuing to steal American intellectual property rights. Following Vice President Pence’s rhetoric last weekend, the report makes it difficult to see how a deal can be struck between the US and China. This means that the most likely scenario remains for the US to begin the process that could lead to another round of tariffs on around $265 bln of Chinese goods and no deviation from the plan to increase the 10% tariff on $200 bln of goods to 25% at the start of next year.

The Australian dollar tested support near $0.7200 (also the 20-day moving average) and bounced higher. It and the New Zealand dollar are again leading the other currencies higher. A move above $0.7250 would help repair the technical damage inflicted yesterday. The Chinese yuan traded on both sides of yesterday’s range and closed slightly stronger to break a two-day decline. The PBOC appears not to be so accommodative its money market operations, and this may be helping to stabilize the yuan. The dollar recovered against the yen yesterday and bounced off the JPY112.30 area, the lowest level seen in nearly a month and closed near session highs (~JPY112.85). It is knocking on JPY113.00 where a $1.1 bln option is struck that expires today. There is another $500 mln option at JPY112.75 and $1.74 bln at JPY112.50-JPY112.55 that are rolling off today. Gains back above the 20-day moving average (~JPY113.15) would lift the tone.

Europe

The UK’s Brexit debate is impacting broader policy. Yesterday’s the government was forced to accept all of Labour’s amendments to the Finance Bill because it could not count on support from the DUP that is frustrated by the deal that has been negotiated by the UK and EC. Without the DUP, the Conservatives do not have a majority. Hence, the Tories may be in key offices, but they do not seem to be in power. Meanwhile, the EC shows little appetite to re-open the talks, and it is hoped that the deal can be signed at this weekend’s summit. May’s local opposition is thought to be regrouping ahead of the vote in Parliament next month. It is vaguely reminiscent of the US debate over health care early last year. There was widespread criticism of the Affordable Care Act, but there was no agreement an alternative. The status quo persists because the critics are divided.

The euro traded on both sides on Monday’s range yesterday and finished below Monday’s low. This bearish outside down day, however, has not been greeted with follow-through selling today. In fact, the euro has recouped nearly 50% of yesterday’s loss (~$1.1415). A roughly 960 mln euro option at $1.1400 is expiring today. There is another (~510 mln euro) option at $1.1450 that will be cut. On the downside, there are chunky options at $1.1350 (~575 mln euros) and $1.1375 (~670 mln euros) that are also expiring. Sterling is flat, pinned near yesterday’s lows. It has largely been confined to last Friday’s trading range this week (~$1.2760-$1.2880). The $1.2830 area marks the 50% retracement level of yesterday’s loss and a roughly GBP580 mln option at $1.2840 expires today.

North America

Recall that the price of WTI for January delivery fell for an unprecedented 12 consecutive sessions through November 13. It gained about 2.4% in the following four sessions (see dead cat bounce) before 6.5% yesterday. Several considerations are weighing on prices. There are some micro-market factors, like the fact that the banks appear to be in a position through the derivative market that makes that in effect increase their exposure as the price falls. This forces them to sell into the offered market and suggests that even if the macro picture were better, a contagion effect from falling equity prices could spur a cascade of selling. And to be sure, the macro considerations are poor.

Two major factors arise from the US. First, it is overproducing in the sense that inventories are accumulating. The EIA has reported oil stocks have risen for eight consecutive weeks ahead of today’s report. Another two-three million barrel build is expected. In the previous week, oil inventories rose 10.27 mln barrels. Until recently that would have been more than a day’s domestic output. Second, after refusing to make any concessions, the Trump Administration caught the market off-guard with its decision to grant 180-day exemptions to Iran’s largest oil customers. This means that there is more supply than many operators expected. There is a third factor, which seems more global and that is on top of the near-record supply, there is thought to be softer demand. Japan and Germany contracted in Q3. China is slowing. The US slowed from 4.2% in Q2 to 3.5% in Q3 and probably a 2-handle in Q4.

The shelf that had been built over the past week near $55 basis the January contract snapped like a twig yesterday. If the break is real and not to be quickly reversed, the next important area is in the $50-$51.50 area and then $45. The Federal Reserve is likely to see a sustained drop in oil prices as net stimulative, while some others it will be seen as deflationary.

The S&P 500 gapped lower yesterday, and this is an important price development. The gap lower opening on November 9 was the signal of this leg down. It is a small gap (less than $1), but size is not the issue. Yesterday’s gap (~2669/45-2681.10) is important. Short-term players could sell into gains as the gap is approached or closed. The S&P 500 has not closed below 2600 since April 2. The 2550 area may be more significant from a technical perspective.

A combination of the equity weakness and the drop in oil prices weighed on the Canadian dollar yesterday, sending it to the lowest level in five months. The US dollar poked above CAD1.3300, and while the upside momentum has faded, the greenback continues to straddle that level today. Initial support is seen near CAD1.3260.

The US economic calendar features October durable goods orders and existing home sales. Headline orders data may be weighed by a decline in orders for commercial aircraft, but the report’s internals should be more constructive. Existing home sales have fallen for the past six months, but economists forecast a small rise (1%).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,newsletter,SPX,USD/CHF