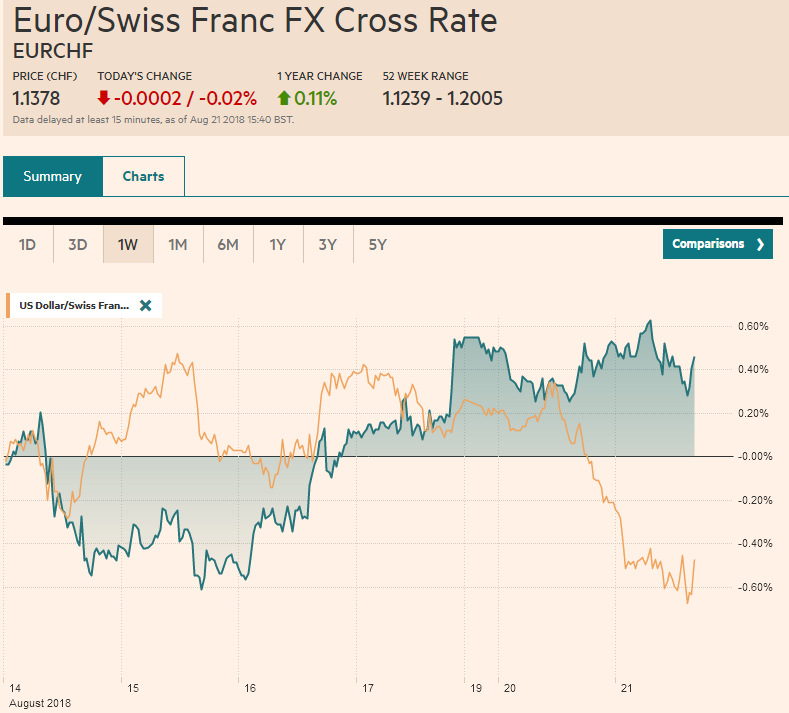

Swiss FrancThe Euro has risen by 0.02% to 1.1378. |

EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is broadly lower following President Trump’s comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week’s presidential tweet that identified strong capital inflows into the US may not have been written by President Trump. The qualification of a superlative was not his style. Trump did not talk the dollar down on Monday as much as criticize the Fed’s monetary policy, which in the mind of investors, is arguably even more sacrosanct than the strong dollar policy. The President did not seem to offer much of an explanation for his assertion that the Fed should be more accommodating. “I should be given some help by the Fed,” Reuters quoted him as saying. Trump also warned that he will continue to criticize the Fed if it continues to hike interest rates. While we do not think that Fed will raise rates as much as the dot plots suggest, we do expect a few moves over the next 12 months, and if we are right, then we should be prepared for additional criticism by the Administration. We do not expect investors outlook for Fed policy to change. It is convinced a September move is as done of a deal as these things get (~90%), and it leans toward a December hike but is not completely convinced (65%). Recall that the Fed’s median forecast increased to two hikes here in H2 because one member changed increased their forecast. The takeaway is that it is still seen as a close call. The January 2019 fed funds futures contract, a good proxy for where the market expects the effective fed funds rate to finish the year. The implied yield is 2.30%. It was 2.315% at the end of last week and 2.29% at the end of the previous week (August 10). |

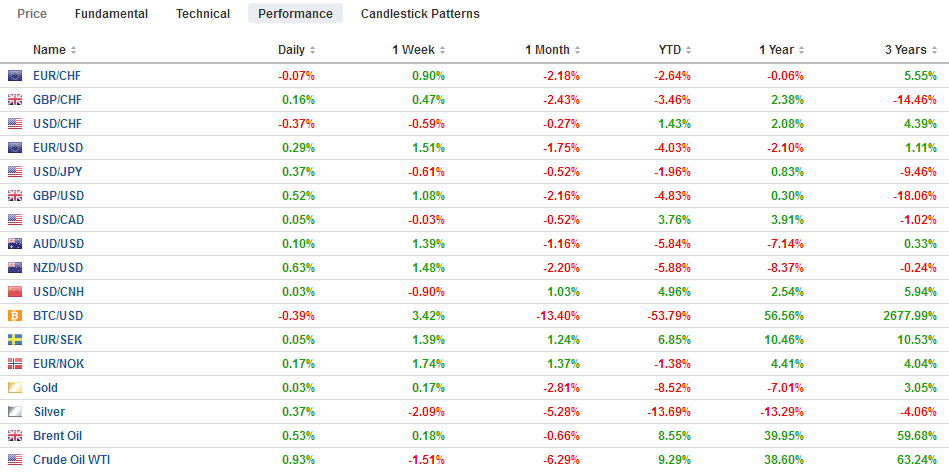

FX Performance, August 21 |

On the other hand, the dollar, which had been correcting lower since the middle of last week, sold-off further on the President’s comments and going forward may bear the brunt of investors’ angst over the verbal encroachment of the Fed’s independence. The interests of investors and the prerogatives of capital require a central bank that enjoys several degrees of freedom from the short-term desires of politicians. Many Wall Street veterans know the story of President Johnson manhandling William McChesney Martin, the Fed chair of the day trying to get him to pursue an easier monetary policy to fund the Great Society initiative and the war in Vietnam.

Investors do not mind if the Fed is criticized, just not by the President or the executive branch. Given the pace of growth and inflation, monetary policy is not tight, even though rates have risen. Typically this economic conditions would require higher interest rates. The fed funds target is below inflation. That means the real Fed funds rate is negative nine years into an economic recovery and expansion. The 10-year yield is also below inflation.

The euro’s gains extended to roughly $1.1540, a little beyond the 50% retracement of this month’s losses in Asia and made little headway in the European morning. The 20-day moving average, which the euro has not closed above here in August is found near $1.1545 today. A break back below $1.1500 would suggest the correction has run its course, though a loss of $1.1470 would be more convincing. Both levels see options rolling off today (~545 mln euros and 715 mln euros respectively). The 61.8% retracement is about $1.1575.

The dollar was sold through JPY110.00 for the first time since late June. It found new bids near JPY109.80 in early Asia and returned to JPY110.20 in the European morning, where is steadied. There are options struck at JPY110 (~$1.1 bln), JPY110.10 (~$460 mln), and JPY110.25 (~$795 mln) expiring today. A move above JPY110.40 would lift the technical tone.

The dollar’s softer tone helped underpin the Chinese yuan and extended its advance for a fourth session, which is the longest rally since March. The PBOC set the reference rate higher for the yuan for the fourth session. Three-month SIBOR rose for the sixth session (to ~2.856%). Chinese shares extended their rally, and the Shanghai Composite was 1.3% higher, and the two-day 2.4% rally is the largest in four weeks. More broadly, the MSCI Asia Pacific Index rose 0.40%, and after three days of gains, it has retraced half of its losses since the last bounced fizzled on August 9.

MSCI Emerging Markets Index is up a little more than 1% following yesterday’s gains of the same magnitude. It is the third day the market is rising. It bottomed last week near 1014. The 38.2% retracement of the last leg down was near 1041 and its surpassed it today. The 50% retracement is almost 1050, and the 61.8% retracement is near 1058.

European equities also are basking in the new risk-on mood spurred by the dollar’s retreat. All the sectors are moving higher in the Dow Jones Stoxx 600, which is up about 0.4% in late morning turnover. Italy is leading the pack with a 1.3% rise helped by a drop in interest rates. The 10-year yield is off seven basis points to ease back below 3% for the first time in a little more than a week. The yield peaked in the second half of last week near 3.20%. Italian bank shares flirted with the upside yesterday, but were unable to sustain the gains and today is up 2%.

Sterling is rising for a fourth session, and this may help explain the FTSE 100 underperformance today. It is flat to slightly lower, while the FTSE 250 is up about 0.4%, led by energy and the industrials. Real estate is underperforming. Sterling has approached the 38.2% retracement of the losses seen since the end of last month. It is found near $1.2855. Above there is the 50% retracement and the 20-day moving average around $1.2920.

The Australian dollar extended its gains for a fourth session as well. To do so it shrugged off a leadership challenge that Prime Minister Turnbull turned back, but the vote (48-35) was close enough to warn that other challengers may be emboldened. Ths Aussie also had to withstand a sharp fall in iron ore prices (Dalian ~-3%). With today’s gains, it has retraced a little more than 61.8% of the losses seen since the August 9 high near $0.7450. We suspect the Aussie gains may have largely run their course.

The US dollar is sitting on a trendline near CAD1.3030. Last week, the US dollar stalled near CAD1.3170. A band of support extends a little below CAD1.30. However, the intraday technicals warn that the move may be over. Initial resistance is seen near CAD!.3050, and a move back over it would help lift the tone.

From a larger perspective, we see President Trump’s comments as not impact US rate expectations, which means that investors do not think the Fed’s independence has truly been violated. The US dollar’s correction, after a strong run in the first 2.5 weeks of the month, had begun in the middle of last week and Trump’s comments accelerated this move that was already underway. We expect the Federal Reserve to largely ignore the President’s statements. However, it puts the US Treasury in a more difficult position. It has a different, legislative definition of manipulation. The October report will most likely not cite the EU and China for currency manipulation. This sends confusing signals and dilutes the importance of fx manipulation charges.

At the same time, the while verbal intervention can spur short-term movements in the currency market, the medium and long-term drivers are the macro fundamentals. The divergence of monetary policy, with the ECB on hold for another year, China moving back to a stimulus regime, the BOJ still pursuing extraordinary measures, and some doubting whether the UK economy can withstand one hike a year helps underpin the US dollar. The policy mix of accommodative fiscal policy and tighter monetary policy draws capital to the US. The TIC data shows that through June the US has imported the world’s savings needed to fund the entire year’s current account deficit.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$AUD,$CAD,$CAD $GBP,$CNY,$EUR,$JPY,$TLT,EUR/CHF,newsletter,USD/CHF