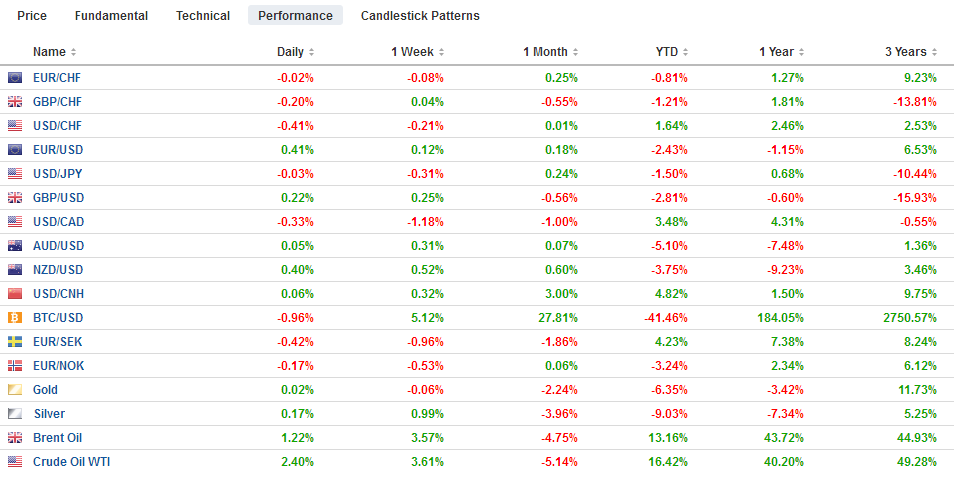

Swiss FrancThe Euro has fallen by 0.03% to 1.159 CHF. |

EUR/CHF and USD/CHF, July 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe week’s big events lie ahead. It is seen as the last important week before the dog days of summer when many participants will take holidays. The BOJ’s two-day meeting concludes tomorrow. Speculation that the BOJ is looking for ways to tweak its program continues to spur a small taper-lite tantrum in Tokyo. For the third session within a week, the BOJ defend the cap on the 10-year bond under its Yield Curve Control policy. And for the second of thee operations, it was actually forced to buy bonds. It bought JPY1.64 trillion today at 10 bp. Before the weekend it bought JPY94 bln of bonds. The 10-year yield finished slightly lower at 9.1 bp. The Nikkei lost nearly 0.75% while the Topix slipped less than 0.45%. There have been some reports suggesting the BOJ may shift its ETF buying from the Nikkei to the Topix to reduce it market impact, which is also consistent with our understanding that rather than tapering to take a step toward the exit, the BOJ is looking for ways to sustain the extraordinary measures for longer. The dollar is trading in less than a 20-tick range on either side of JPY111.00 so far today. It is consolidating within the pre-weekend range. There is a billion dollars option at JPY111.00 that expires today. The short-term speculative market is cautious ahead of BOJ meeting and Kuroda’s press conference. The PBOC set a lower (189 points) lower yuan at the fix today against the dollar to CNY6.8131. This put the greenback at its lowest level since late June last year. The pace has been steady. This month the rose three sessions each week. The move has been fairly orderly, and the spread between the onshore (CNY) and offshore (CNH) remains narrow. The decline in the yuan, the lower interest rates, and additional fiscal support have done little for Chinese stocks. The Shanghai Composite is fell for the fourth sessions. It is off 13.25% year-to-day, making it one of the worst performing markets. In comparison, the MSCI Asia Pacific Index snapped a four-day advance today (-0.35%) and is off 3.2% year-to-date. China’s official July PMI to be reported first thing Tuesday is expected to show minor slowing. The Swedish krona is the strongest of the majors today. It is up 0.85% (~SEK8.7670) on the back of a stronger than expected Q2 GDP report. The 1.0% quarter-over-quarter rate is twice as fast as the Reuters survey suggested. It is seen as bolstering the case for a rate cut later this year, though some Riksbank members still have to be convinced. |

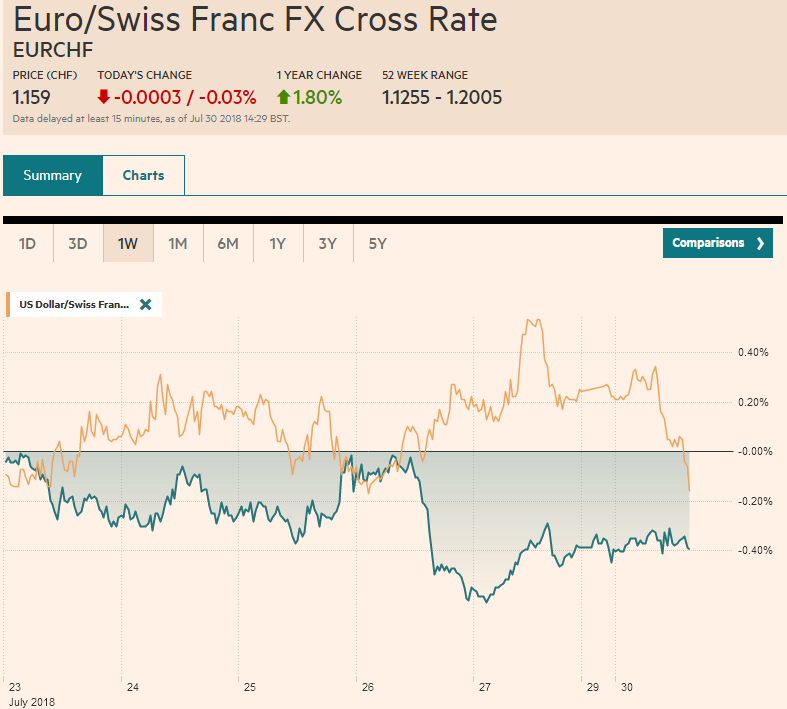

FX Performance, July 30 |

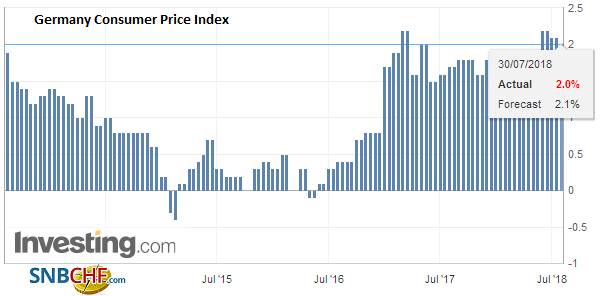

GermanySpain and Germany have reported mixed inflation data. Spain’s CPI was soft. Seasonal factors weighed on prices, which fell 1.2% on the month, leaving the year-over-year pace steady at 2.3% on the harmonized measures. Germany states’ CPI seemed to point to a 2.1% year-over-year harmonized pace, in line with forecasts. Tomorrow the EMU-wide estimate will be reported. The headline rate is expected to be steady at 2.0%, and the core rate may tick up to 1.0% from 0.9%. Also tomorrow, it is expected to be announced that June unemployment eased to 8.3% from 8.4%. |

Germany Consumer Price Index (CPI) YoY, July 2018(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

For the seventh consecutive week, the euro rose ahead of the weekend. On five of the following Monday’s, it also appreciated. The euro is about 0.25% higher (~$1.1680). The euro has not been above $1.17 since the ECB meeting last week. The euro has finished lower after each ECB meeting this year. There is a 576 mln euro option at $1.17 that expires today. This month, the euro has not closed below $1.16 and only once above $1.1750.

Sterling is slightly firmer, but largely confined to the pre-weekend range (~$1.3085-$1.3140). June credit and money supply data failed to inject fresh life into the quiet market. The Bank of England meets later in the week and is widely expected to raise rates. However, presently few see another opportunity to hike rates again before the end of next March when the UK leaves the EU. There is a $1.3100 option (~GBP382 mln) and $1.3160 option (GBP258 mln) that expire today.

The Australian dollar is little-changed smack in the middle of its $0.7300-$0.7500 trading range. The weekend byelection saw the governing Liberal-National government do worse than expected with Labour picking up four of five contested electorates. This likely ends talk of an early election, but it does not change the outlook for the Reserve Bank of Australia to remain on hold for some time.

The Canadian dollar is also little changed. Canada reports May GDP figures tomorrow (expect to rise around 0.3% for a 2.3% year-over-year pace). The US dollar continues to trade within last Thursday’s range of roughly CAD1.3025 and CAD1.3095).

The US calendar is light, though the earnings season continues. Tomorrow’s personal income and consumption report for June offer little fresh insight as they were incorporated into the Q2 GDP estimate. That said, the core PCE deflators is expected to be flat at 2.0%. The focus seems to be more on US jobs data (July) than the FOMC meeting, where only a statement will be issued, and nothing top dissuade the market from anticipating a September hike. A few hours before the Fed’s announcement, Treasury will announce its debt issuance plans for the August-September period. With revenue lagging behind spending, supply is set to rise to fund the larger deficit. Coupon issuance is expected to increase for the third consecutive quarter.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,EUR/CHF,Germany Consumer Price Index,newslettersent,SEK,USD/CHF