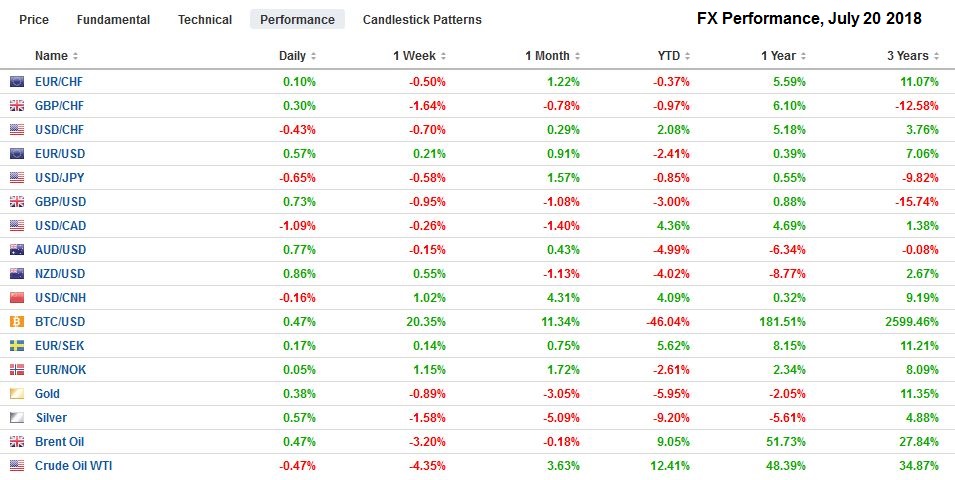

Swiss FrancThe Euro has risen by 0.19% to 1.1651 CHF. |

EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is little changed but mostly softer as the week draws to a close. The market is digesting the implications of yesterday’s comments by President Trump about interest rates and foreign exchange, and without fresh economic data, are content to go into the weekend. Since Trump’s comments yesterday, the euro has not been below $1.1625 nor above $1.1680. There is a $1.1700 option (~800 mln euros) and a $1.1600 option (699 mln euros) that expire today. On Monday, there is another 1.9 bln euro option struck at $1.17 that will be cut. At JPY112.40, the dollar is virtually flat on the week as it consolidates the previous week’s 1.7% gain. There is a $664 mln option struck at JPY112.50 that expires today. Sterling is largely flat, a little above $1.30, where a GBP440 mln option expires today. The loss for the week (@ $1.3020) of 1.5%, is the largest since late April. A soft batch of data this week encouraged the market to trim the likelihood of an August 2 rate hike to around 77% from 82% a week ago. The Australian dollar is slightly firmer, though is off about 0.6% for the week (@ $0.7380) is the largest in a month. It had approached a three-week low earlier today before recovering. There is a large A$1.3 bln option at $0.7400 that expires today. |

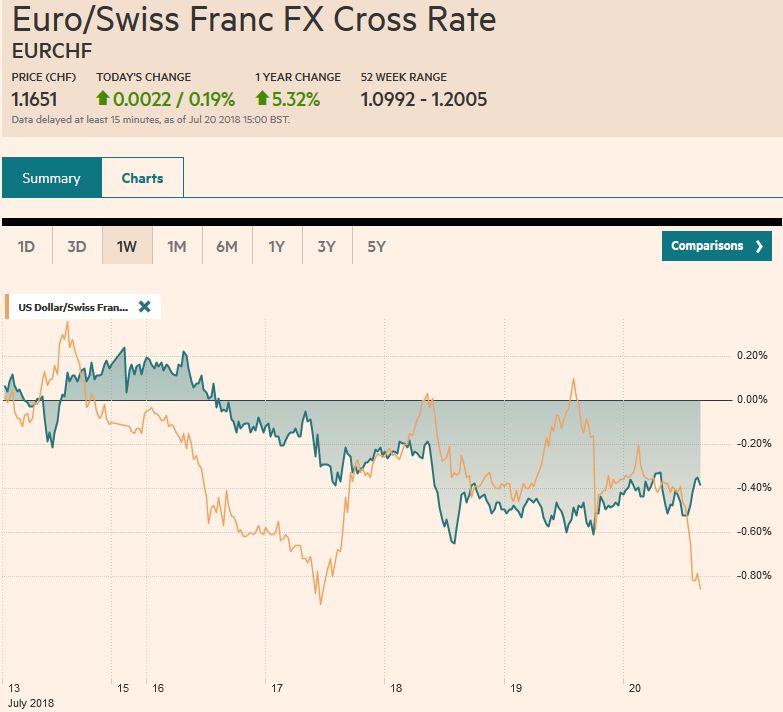

FX Performance, July 20 |

President Trump’s explicit displeasure with the Fed’s rate hikes sucked the wind from the dollar’s sails yesterday. The greenback extended this week’s gains to probe above JPY113 for the first since early January, and at its best level in 10-months against sterling, and was approaching the upper end of its two-month range against the euro. It sold off on Trump’s comments but managed to recover around half of the drop.

It is highly unusual for the President of the United States to be so explicit in public about monetary policy. The independence of the central bank is a pillar of modern practices. After crossing the line, Trump quickly scurried back by clearly stating that despite his misgiving “he was “letting [sic] them do what they felt best.” What is understood as the independence of the Federal Reserve, remains intact. Most investors and observers, we suspect, had already come to recognize over the past 18 months that the US President prefers low-interest rates and has little patience for informal practices that restrain him.

Although the dollar’s rally was halted, the impact on Fed expectations was marginal. The October Fed funds futures contract has more than twice the open interest of the September contract. Given that the September FOMC meeting is at the end of the month (Sept 26) there is not much juice in that month’s contract. The October contract is what is being used to position for the September rate hike. It closed unchanged on the day implying an average effective fed funds rate of 2.14%, which is a little above the middle of the expected ranges of 2.00% to 2.25%. That is 3.5 bp above where it was at the end of June and 2.5 bp higher than at the end of last week.

The January contract, which may offer a cleaner read of expectations for December and is also free of the year-end volatility. At 2.305%, the yield was one basis point higher on the day although two basis points higher than the end of last week and 5.5 bp higher than at the end of last month.

Trump also expressed concern about the weakness of the yuan. Given the pace of the yuan’s weakness, many participants argued that officials have weaponized it. The more than 7% depreciation over the past three months, making it the weakest Asian currency, is said to be blunt the impact of the US tariffs. The trade war is also becoming a currency war, goes the argument.

We find the claims unpersuasive. First, the recent decline follows the yuan’s out performance in Q1 18. Second, the PBOC is easing policy while it still trying to force some deleveraging. Third, given the structure of trade, the limited value-added actually incurred yuan-costs (think assembly work, especially for consumer electronics) means that the price of exports may not be particularly sensitive to movements in the yuan’s exchange rate. Fourth, the foreign exchange market is better characterized by a strong dollar than a weak yuan. Fifth, while typically central banks prefer their currency move in the same direction as monetary policy, currency depreciation is a blunt tool and could complicate other Chinese policy goals, including financial stability.

Chinese officials have used verbal intervention at different times during the yuan’s recent slide to stabilize the currency. The PBOC may have stepped into the fray today indirectly through the policy banks to support the yuan. Despite Trump’s comments, the yuan opened weaker, but then recovered. The dollar traded as high as almost CNY6.8150 and then slid to nearly CNY6.7655 before firming a little into the close. Although the yuan ended the mainland session slightly lower on the day, the weight on equities was lifted. Chinese shares recovered from initial losses to close 2% higher, and posted an outside up day reversal (traded on both sides of the previous day’s range and finished above its high). Activity early next week is needed to confirm the price action.

Asian shares more broadly recovered today from early declines. The MSCI Asia Pacific Index rose almost 0.5% to close on the session highs, and the loss for the week was pared to about 0.1%. Japanese stocks were a notable exception, slipping about 0.25%, to shave this week’s gains to a little more than 2%.

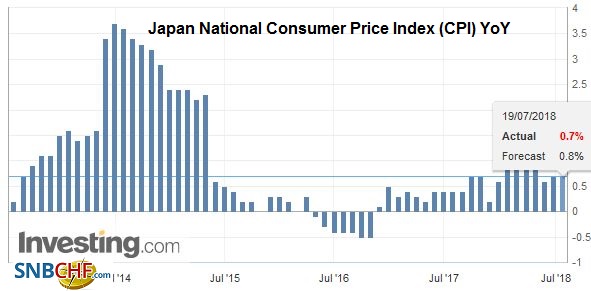

JapanJapan reported June inflation figures that were uninspiring. The headline rate was unchanged at 0.7%, |

Japan National Consumer Price Index (CPI) YoY, Jul 2013 - Jul 2018(see more posts on Japan National CPI, ) Source: investing.com - Click to enlarge |

| while the core rate, which excludes fresh food, ticked up to 0.8% from 0.7%. However, the reflects the rise in energy prices. Excluding fresh food and energy, the pace of inflation slipped to 0.2% from 0.3%. The BOJ reduced the amount of long-term JGBs it is buying, but with price pressures showing little progress toward the target, the exit from the extraordinary monetary policy seems as distant as ever. The BOJ meets at the end of the month, and there has been some speculation that it may cut its inflation target. |

Japan National Core Consumer Price Index (CPI) YoY, Jul 2013 - Jul 2018(see more posts on Japan National Core CPI, ) Source: investing.com - Click to enlarge |

European markets are mostly little changed. The Dow Jones Stoxx is straddling unchanged levels in late morning turnover on the Continent. Materials, financials, and real estate sectors are weaker, while consumer staples, healthcare, and utilities are leading on the upside. The benchmark is up about 0.3% for the week, which if it can hold onto through the local afternoon, it would be the third consecutive weekly advance.

Of note, Italy’s benchmark gapped lower, and although it has recovered, it is underperforming. It was nearly flat for the week coming into today. Italian bonds are also underperforming. The 10-year yield is up four basis points while other European benchmark yields are up less than one basis point. Italian bank shares are off by more than 1% for the second consecutive session. The weight on Italian assets today ostensibly is coming from a La Repubblica report that warns that Finance Minister Tria may be under pressure step down as the two deputy prime ministers (DiMaio and Salvini) insist on their candidate to head up the state lender CDP. Italy’s Treasury denies the reports that Tria may be ousted. Regardless of the particulars, it reflects in part the fact that the market’s anxiety about Italy has not been fully put at ease despite the soothing words of the Prime Minister that the euro was “irreversible.”

Canada reports May retail sales, which are expected to have bounced back after a 1.2% auto-led decline in April. June CPI is also on tap. While the headline may ease, the core rates are expected to be stead just below 2.0%. The Bank of Canada hiked rate July 11. Those, like ourselves that see the risk of another hike do not have it penciled in until later in the year. This may serve to reduce the market sensitivity to the near-term data. The Canadian dollar is recouping about a quarter of the week’s decline with the 0.25% advance today (@ CAD1.3240) but remains inside yesterday’s range.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,EUR/CHF,Federal Reserve,Japan National Core CPI,Japan National CPI,newslettersent,USD/CHF